Business debt advice Canada: Introduction

When it involves money, timing is everything. Your business is getting closer to the top of its banking line and your banker is asking for more information than usual. This is where your heart starts pounding faster and your stress level increases. This is the moment you can seize to right size your business or else it very well may fail. The purpose of my blog is to give you business debt advice Canada.

Business debt advice Canada: Relationships can become strained

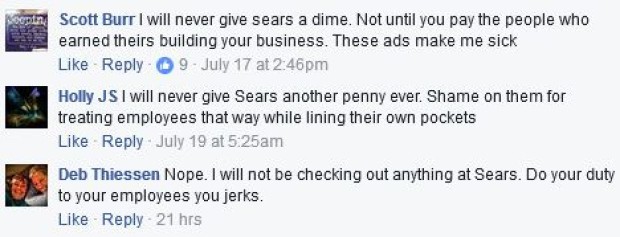

Relationships can become strained with your lender and suppliers when business debts are mounting and your company is facing a cash crisis. However, there are actions a borrower can take to prevent calamity. Reassuringly, most of the time, lenders would rather support you if you have a viable business plan to correct the situation going forward, and not putting you out of business.

I hope the suggestions below shows you that you should look at this as an opportunity to fix your business. I have found that in trying times when a company has mounting debts and insufficient cash, there is no replacement for good management.

A solid business plan showing how the company will turn itself around is what your lender wants to see. Communication with your lender and your suppliers is key. Do not hide from the problem. Face it head on. If your business plan shows you can turn things around, you will feel like you are dealing from a sound platform and not just running scared.

Business debt advice Canada: Take emotion out of the equation

These situations generally become more tense before they become better. You, your lender and your unpaid suppliers all want the same thing. You all want the company to be successful and profitable, and to be able to pay all of its bills in full when due. Your lender and suppliers are not out to get you. However, if they do not: (i) know that you have solid business turnaround plan; and (ii) receive ongoing information to show what steps you are taking to fix the problems, they will have no choice but to turn off the tap.

I have unfortunately seen too many companies fail in their business restructuring efforts due to lack of communication. The turnaround plan may have been sound, but nobody knew. This only creates ill will among the stakeholders and a result that nobody wants.

Business debt advice Canada: Informal and formal turnaround options

I must preface this section by saying do not be afraid to consult with a licensed insolvency trustee (LIT) for business debt advisory services. Trustees’ training makes them expert in assessing troubled business situations and implementing turnaround steps. A LIT does a lot more than just bankruptcy.

You will find it helpful to have a professional trustee assist you in developing your turnaround business plan, implementing it and keeping management focussed and accountable. You will also find it very helpful to have a LIT go with you for meetings with your banker; there will be many of those!

Business debt advice Canada: Troubleshooting

Fully understanding the full current status of the company showing signs of financial trouble is key. Things that I focus on early on when looking at troubled companies are:

- What are all the different assets of the company and where are they located?

- Are all the assets properly insured?

- What is the going-concern value and the estimated liquidation value of the assets?

- What is the full extent of all liabilities and business debt levels? This includes amounts owing to the government for:

- unremitted source deductions

- outstanding HST

- amounts owing to lender(s) and other secured creditors

- amounts owing to employees; and

- amounts owing to unsecured trade suppliers

- What is the status of premises lease(s) for both remaining term and cost?

- Is the cost of the leased premises above or below current market value?

- Has anyone personally guaranteed bank debt, the landlord or any other creditor that would affect turnaround decisions to be taken?

- Has a current crisis cash-flow statement and turnaround business plan been developed and tested for reasonableness?

- What are the causes of the company’s current financial problems and how likely are those causes to recur?

This list is not meant to be exhaustive. No doubt other questions will arise as answers are found for these first questions. However, this is the information I first want to get before embarking on developing a restructuring plan.

Business debt advice Canada: Informal restructuring and turnaround

If the business problems have been identified early and have not been allowed to fester, then an informal restructuring may very well work. Perhaps all that will be needed is some accommodation from the lender both in time and money. Banks are quite willing to enter into a forbearance agreement with their corporate client allowing the time (and sometimes more money) to see if the turnaround plan will work.

The bank would rather have a successful turnaround than shut you down. The bank needs to know that management has the bench strength to pull off the restructuring. If not, they will expect you to have a lawyer experienced in turnarounds and a LIT active on your team.

Companies that have relatively few trade suppliers may also be able to work out a restructuring of their unsecured debt. The fewer people you have to talk to and get onside, the higher the likelihood of success. Of course, the trust developed from earlier dealings is very important. If there is no trust, or if there are just too many suppliers, an informal restructuring will not work with them.

Business debt advice Canada: Formal restructuring

The Bankruptcy and Insolvency Act (R.S.C., 1985, c. B-3) (BIA) and the Companies’ Creditors Arrangement Act (R.S.C., 1985, c. C-36) (CCAA) are the two primary Federal statutes that govern corporate restructuring in Canada. The requirements of each statute and the exact processes themselves are weighty enough to deserve their own blog. However, the takeaways from this blog on formal restructuring are:

- In a formal restructuring, I still go through the checklist I have identified above of issues to look into.

- Under the BIA, the restructuring section is Part I Division III of the BIA

- If a restructuring under the BIA does not receive the necessary creditor AND court approval, the company will automatically be bankrupt

- In a formal restructuring, the company stays in control of its assets and business operations

- A formal restructuring invokes a stay of proceedings so no party can begin or continue litigation or enforcement action against the company

- A company needs to have at least $5 million in debt to restructure under the CCAA

- A BIA restructuring will be less costly than a CCAA restructuring because the company does not have to go to Court for approval every time it wishes to do something

- The term “bankruptcy protection” in Canada, refers to a formal restructuring under either the BIA or CCAA.

Business debt advice Canada: What to do if your company has too much debt

Is your business facing financial problems? Perhaps your company is in need of a restructuring. The Ira Smith Team can develop a restructuring plan which may or may not include the need to file for bankruptcy protection.

The Ira Smith Trustee & Receiver Inc. Team understands the pain you are going through trying to keep your company alive while trying to negotiate with potential purchasers. We understand that you are playing beat the clock, and the pain and stress you are feeling thinking that you may just run out of time. The bankruptcy protection process can ease this stress and provide a level playing field so that no potential purchaser takes advantage of you.

The Ira Smith Team has a great deal of experience in running a stalking horse stalking horse asset purchase agreement. The stress placed upon you due to your company’s financial challenges is enormous. We understand your pain points. Call the Ira Smith Team today for your free consultation. We can end your pain and put your company back on a healthy profitable path, Starting Over, Starting Now.