If you would prefer to listen to the audio of this financial new year’s resolutions 2019 version of this Brandon’s Blog (with an introduction from a celebrity guest), please scroll to the bottom and click on the podcast.

Financial New Year’s resolutions 2019: Introduction

The New Year has arrived. I wish all of my readers a healthy, happy and prosperous New Year. By now, many people have made themselves promises on how they will improve in 2019. Many people make New Year’s resolutions, including financial new year’s resolutions 2019. In this Brandon’s Blog, I explore what are many of the common resolutions people make and what the chances are on people actually carrying them out.

Financial New Year’s resolutions 2019: The 8 most common resolutions

Other than the first one, in no particular order, the 8 most common New Year’s resolutions are:

Lose Weight. The Number 1 New Year’s Resolution is to drop weight. We’ve all seen it, or become aware of it. Many resolve to lose weight, but few truly complete it in the long-term. That is why January every year is when the weight loss programs, gyms and workout products advertise heavily.

Do Better Than Last Year. Often, life is simply hard. In between family members, good friends, your work, and all the various other stress and anxieties that life can toss at you, it simply appears sometimes that absolutely nothing can go right. And also some years are simply a plain draw. So, after a year of grinding via the days, weeks, and months, you’re prepared for a do-over. You’re prepared to do anything to make sure that the following year begins the very best way it can. So, this resolution is to merely attempt to have a better year than the last one.

Exercise. One of the most usual New Year’s resolutions has to do with ones very own health and wellness. Among the many health and wellness promises, is working out. When you consider it, it’s not just wishing to slim down (which is the number 1 resolution), it’s in fact about wishing to be more powerful, quicker and generally in better shape.

When your body is in peak condition, it does do far better. An in shape body functions far better, provides you with much more power, boosts your mind’s abilities and a lot more. DON’T try to push your body in the beginning to do more than it can handle. Any personal trainer will tell you to begin slowly and work yourself up from there. Set realistic goals for yourself.

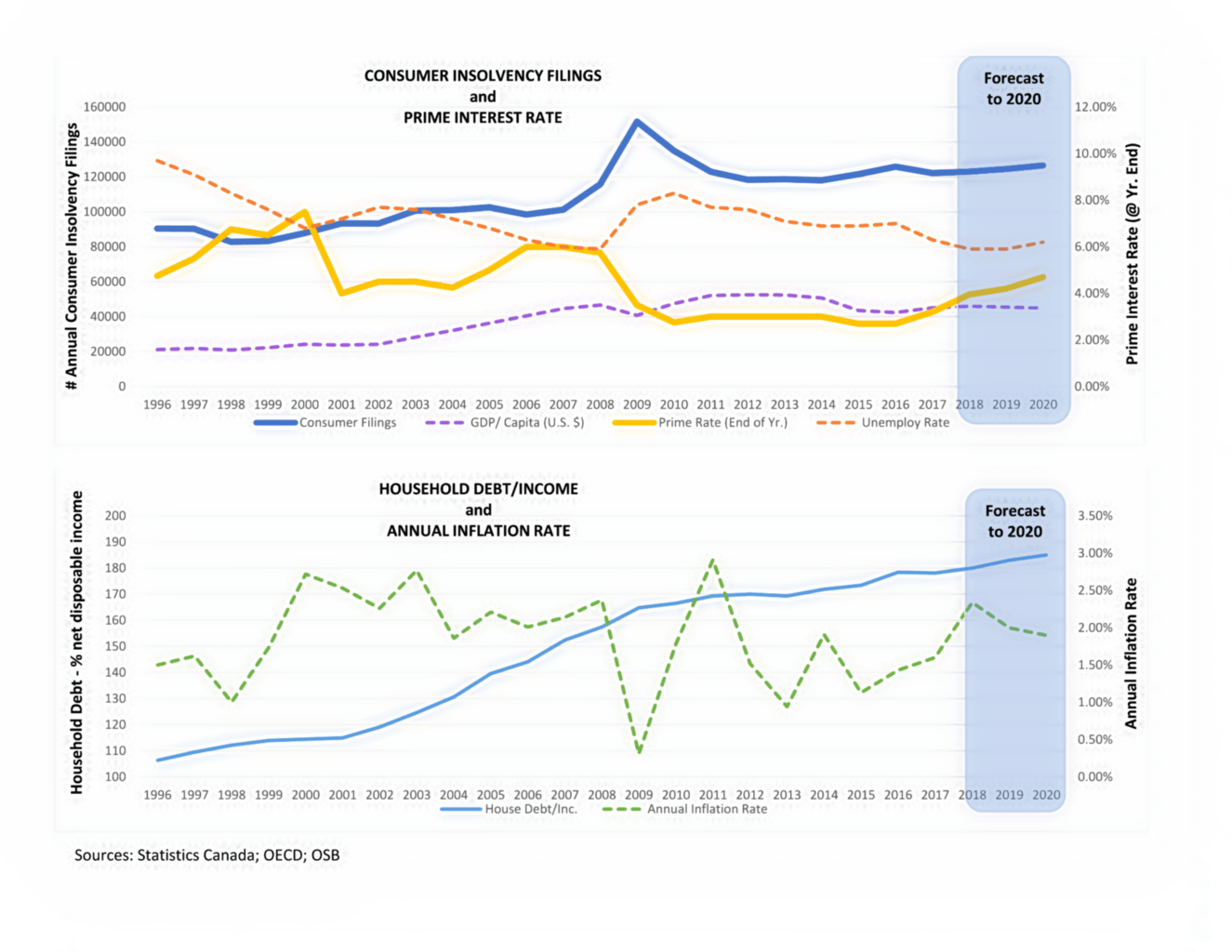

Save More/Spend Less. Cash is what people need and the most common of all the financial New Year’s resolutions 2019 is to make sure that we have more of it in the New Year. This is especially true for most Canadians, who are living paycheque to paycheque.

The best way to start your financial plan for the New Year is to first look at what happened in the year that just ended. Reflect on your year. I’m certain you’ll realize some things about your immediate past financial behaviour. Some items that you wish you had not purchased or lost money on. Or, if you understood then what you currently know, you would certainly have done things in a different way and saved yourself a couple of bucks in the process.

In other words, look at your income and expenses carefully and budget properly for the New Year. Your proper budget must include saving a certain amount from each paycheque to put away in an emergency savings fund for when there is an unexpected, well, emergency. Your budget will also hopefully allow for other savings to be able to invest for the longer term.

Use the start of the brand-new year to begin preparing just how you could invest your new savings. In your personal financial plan or budget, concentrate on things you NEED versus the many things you WANT. By doing this one simple thing, you will find you will have more in your savings account. This is the best way to stay on track to meet your financial New Year’s resolutions 2019.

Get More Sleep. Depending upon the researcher you listen to, the body requires between 6-8 hours of rest. Our bodies can work on much less, yes, yet it’s not something that a lot of medical professionals advise. This is another one of the resolutions fitting into the health and wellness category.

Get A New Hobby/Skill. Whether we intend to confess or otherwise, most of us wish to be our best selves. We do not simply intend to be the individual that undergoes the movements, we intend to have something we can expect each week, and even take pride in.

So, with a brand-new year, comes a chance to learn new skills or do something different in our lives than just the “same old, same old”. For some, it, in fact, implies attempting to get new skills for getting a better paying job. For others, they see it as a possibility to handle a new pastime or discover something that they’ve always intended to do or learn.

Quit Smoking/Drinking. Humans are animals of routine, yet in some cases, those behaviours are actually, REALLY negative for you. Two of the ones that cover the “negative for you” checklist is alcohol consumption to such an excess that it is an addiction and smoking cigarettes. Like any addiction, this is very tough to do and many times requires the help of trained professionals.

Volunteer. While practically every one of these resolutions is created to aid oneself in one fashion or another, this one helps both the self and others. One of the best ways to help others is to volunteer your time. Volunteer to what? To help any place you can certainly. In some cases, it’s at a homeless shelter, or to assist a close friend in need. There are many opportunities to help the less fortunate. However the crucial point is that you place yourself 2nd, and the needs of others first. Spreading a little happiness can go a long way for a person. Therefore if you wish to assist others, do not hesitate to ask, “What do you need?”. You may be amazed by simply just how much you can help somebody.

Financial New Year’s resolutions 2019: Why do we do it?

We cannot forecast the future. In some cases, it’s tough to anticipate what will take place in the following couple of hours, not to mention the following 12 months. Why do we do it? Well, it’s mainly since we intend to think that we have some power over the future. If we can state to ourselves, “This year will certainly be different, this will certainly be the year I will make changes for me”, it’ll place us in the best attitude to get down to business and do things. The feeling that we have control over our lives is exceptional.

Financial New Year’s resolutions 2019: Will we keep our resolutions?

It begins straightforward. We look in the mirror, see what we don’t like and resolve to make the changes that probably should have been made a long time ago. We will establish worthy ventures to do simply that thing or things. However, most people will drop off the wagon within a short period of time. What? I’m not being mean, I’m being genuine. Making significant changes in your life is hard.

We are hyped for the New Year. We are. so tired of what occurred in the previous year that we are ready to make the changes we promised ourselves we would make. We may also have invested a lot of time informing other people what changes we will make in the New Year. But then life gets in the way and we fall short.

Financial New Year’s resolutions 2019: Falling short is OK

It does not matter that I fell short all my resolutions actually. I need to so that I can ensure that I can improve further! Of course, I should not try to fail them, but it is normal to fall short. No one is perfect. As long as you see that you have made improvements in the right direction, that is what really counts.

So, make sure that your goals are realistic. Even if you fall short, you have improved immensely and that will be your new starting point for the next New Year’s resolutions. I hope all of you improve your life in some area this year, and that will be your new starting point when 2019 comes to an end. This includes your financial New Year’s resolutions.

Do you need professional help to meet your financial goals?

As I stated above, sometimes professional help is required to meet a New Year’s resolution. We may not have all the skills required. Improving your financial situation may be one of those areas where professional help is required. Maybe you only need a coach to keep you focussed on performing your financial new year’s resolutions 2019. Perhaps on a personal level, you might require only some credit counselling or debt consolidation. On a more formal basis, you may need a debt restructuring plan in the form of a consumer proposal in order to eliminate your debts and get back on the right financial path. In some extreme cases, personal bankruptcy may be what is needed.

Perhaps your company is in need of financial restructuring. Perhaps your lender is threatening receivership or bankruptcy so you are in need of a financial advisor skilled in insolvency matters. A licensed insolvency trustee (formerly called a bankruptcy trustee) is the only professional licensed and supervised by the Canadian Federal government skilled in both personal and corporate insolvency matters If you or your company have too much debt, call the Ira Smith Team for your free consultation. We understand your pain, and we have the prescription to end your pain forever. Call the Ira Smith Team today, so that you can begin your improved life for this New Year 2019, Starting Over, Starting Now!

[monkeytools msnip=”http://memochimp.com/memo.php?u=4931&p=3613″]