if parents declare bankruptcy what happens to the children

If Parents Declare Bankruptcy What Happens To The Children? How Bankruptcy Affects Family Dynamics

If parents declare bankruptcy what happens to the children? Imagine your world turning upside down when your parents tell you they’re facing serious money trouble. Bankruptcy isn’t just a grown-up problem—it can shake up an entire family, leaving teenagers worried about their home, their future, and what comes next.

How Bankruptcy Impacts Teens and Families

When parents declare bankruptcy, it’s more than just a financial setback. This challenging situation can touch nearly every aspect of a teenager’s life, from family relationships to future opportunities. Many young people find themselves navigating unexpected emotional and practical challenges during this time.

What Happens?

Bankruptcy doesn’t mean families are doomed. Instead, it’s a legal process that helps parents get a fresh start with their finances. For teens, this can mean:

- Potential changes in living arrangements

- Shifts in family financial planning

- Emotional stress and uncertainty about the future

- Possible impacts on university or career plans

Understanding the Bigger Picture

While bankruptcy sounds scary, it’s not the end of the world. Many families successfully rebuild after financial challenges. The key is understanding the process, supporting each other, and staying focused on long-term goals.

Key Takeaways for Teens

Your parents’ bankruptcy doesn’t define your future. Open communication with family is crucial. There are resources and support available. Financial challenges can be overcome with the right approach.

In this Brandon’s Blog post, we’ll unpack the multifaceted impacts of a parent’s bankruptcy on their children—financially, emotionally, and beyond. We’ll draw from recent data and expert opinions to help you understand and navigate this difficult family situation.

If Parents Declare Bankruptcy What Happens To The Children? Psychological Effects on Children: Inheritance and Legacy Loss

Bankruptcy is a challenging journey that can reshape a family’s financial landscape. For children, this process brings complex emotional and financial implications that extend far beyond simple monetary concerns. Let’s explore how a parent’s bankruptcy can impact a family’s future and what children need to understand.

Understanding Inheritance and Family Assets

When parents face financial difficulties, the potential inheritance children might have expected can change dramatically. This unexpected shift can create uncertainty and stress for the entire family.

Key Inheritance Considerations

- Bankruptcy prioritizes debt repayment over asset preservation

- Family assets like homes or savings could be eliminated

- Financial planning will require immediate reevaluation

If Parents Declare Bankruptcy What Happens To The Children? The Emotional Toll of Losing a Family Home

A family home represents more than just a physical space—it’s a symbol of stability, security, and cherished memories. Losing this anchor can profoundly impact children’s emotional well-being and sense of security.

Potential Impacts of Home Loss

- Disruption of established social networks

- Potential school changes

- Emotional stress from relocation

- Challenges in maintaining family continuity

Navigating Equity Rules in Bankruptcy

Bankruptcy proceedings involve complex equity rules that can determine the fate of family properties. Understanding these regulations is crucial for families experiencing financial challenges.

Critical Equity Considerations

- Properties with significant equity will be sold to repay debts

- Legal frameworks prioritize creditor repayment

- Potential complete loss of family real estate assets is a possibility

Financial Stress: A Broader Perspective

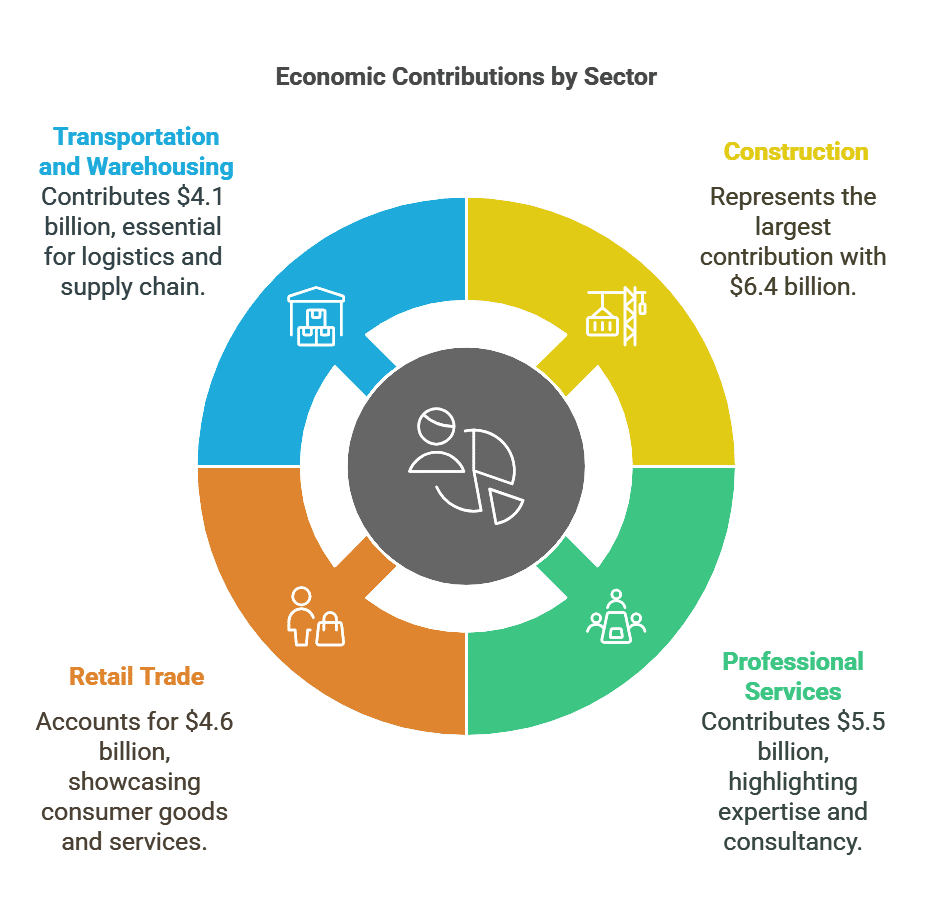

Research indicates that financial stress affects a significant number of families. According to recent studies, approximately 36% of parents experience substantial financial pressures that could potentially lead to bankruptcy.

Potential Silver Linings

- Bankruptcy can provide a financial reset

- Reduced parental financial stress

- Opportunity for improved financial management

- Potential for future financial stability

Emotional and Financial Recovery

While bankruptcy presents immediate challenges, it can also create opportunities for financial renewal and family growth. The process, though difficult, can lead to:

- Improved financial literacy

- Reduced debt burden

- A fresh start for family finances

- Enhanced long-term financial planning

“Bankruptcy isn’t the end of a financial journey—it’s a challenging but potentially transformative beginning.”

Empowering Families Through Understanding

Knowledge is the most powerful tool during financial traoe.

Remember, every financial challenge is an opportunity for growth, learning, and a more secure future.

If Parents Declare Bankruptcy What Happens To The Children? Child Support and Spousal Support Obligations: What Happens During Bankruptcy?

Navigating the complex financial obligations during bankruptcy can be challenging, especially when child support obligations and spousal support are involved. It is not that far-fetched to consider that the toll financial ruin takes on a family could lead to divorce. Understanding how these critical financial responsibilities intersect with bankruptcy is crucial for families facing financial difficulties.

The Unique Status of Family Support Obligations

Bankruptcy law treats child support payments and spousal support differently from other types of debt. These obligations are considered priority debts, which means they cannot be discharged or eliminated through bankruptcy proceedings.

Key Protections for Dependents

- Child support payments and spousal support are typically non-dischargeable

- Bankruptcy cannot stop existing support payment requirements

- Court-ordered support continues regardless of financial status

How Bankruptcy Impacts Support Payments

In short, the impact of bankruptcy on support payments is simple – in one word – NONE! When a parent files for bankruptcy, the impact on child support amounts and spousal support doesn’t vary.

Bankruptcy Liquidation

- Does not eliminate existing support obligations

- Child support arrears cannot be discharged

- Ongoing support payments must continue

Proposal Restructuring

- Provides a restructuring plan for debt repayment

- Allows parents to catch up on child support arrears

- Offers a structured approach to managing financial responsibilities

Protecting the Financial Interests of Children

The legal system prioritizes the financial well-being of children, ensuring that support obligations remain intact during bankruptcy proceedings.

Critical Considerations

- Support payments take precedence and must be made

- Failure to pay can result in severe legal consequences

- Courts have mechanisms to enforce support obligations

Navigating Support Obligations During Financial Stress

Bankruptcy doesn’t provide an escape from family support responsibilities. Parents must continue to meet their financial obligations to their children and former spouse.

- Communicate openly with support recipients

- Seek legal advice to understand your specific obligations

- Explore payment modification options if financial circumstances change

- Maintain transparency with family court systems

“Bankruptcy is a financial tool, not an excuse to abandon family responsibilities. Child support and alimony remain critical obligations that must be honored.”

Proactive Steps for Parents

If you’re facing bankruptcy and have support obligations:

- Communicate with both your Licensed Insolvency Trustee and family law lawyer to make sure that you understand your responsibilities

- Develop a comprehensive financial plan

- Maintain open communication with all parties involved

While bankruptcy presents significant financial challenges, it does not absolve parents of their support responsibilities. By understanding the legal framework and maintaining a commitment to family obligations, parents can navigate this difficult process while protecting their children’s financial interests.

Remember, your children’s well-being should always be the top priority, even during challenging financial times.

If Parents Declare Bankruptcy, What Happens to the Children? Emotional Repercussions -Understanding a Child’s Perspective During Family Bankruptcy

Bankruptcy isn’t just about numbers on a page—it’s a deeply personal journey that can shake a family to its core. As a licensed insolvency trustee, I’ve seen firsthand how financial challenges impact not just bank accounts, but the emotional world of children.

Understanding the Emotional Rollercoaster

When a family faces bankruptcy, children experience a whirlwind of feelings that go far beyond financial spreadsheets. Imagine your entire world feeling uncertain—that’s what kids go through during this challenging time.

What Children Feel

Kids don’t just see bankruptcy as a money problem. They experience:

- A deep sense of vulnerability

- Worry about their family’s future

- Fear of losing their home

- Anxiety about changing relationships

The Invisible Challenges Children Face

Your family home is more than just walls and a roof. It’s a sanctuary of memories, safety, and belonging. When financial stress threatens this sanctuary, children feel like their entire world is shifting.

The Real Impact on Kids

Bankruptcy can trigger some serious emotional responses in children:

- Increased anxiety and mood swings

- Potential feelings of shame

- Disruption to their sense of identity

- Concerns about social connections

Supporting Your Children Through Financial Stress

As a parent, you have the power to help your children navigate this challenging time. Here are practical strategies to support your family:

Communication is Key

- Have open, honest conversations using age-appropriate language

- Reassure your children about family love and unity

- Maintain consistent daily routines

- Create new family traditions that build stability

School and Social Life: What to Expect

Moving or financial changes can disrupt your child’s school and social world. Potential challenges include:

- Academic performance gaps

- Feeling isolated from friends

- Increased anxiety about changes

Long-Term Emotional Considerations

The psychological impact of bankruptcy can affect children during critical developmental stages. Parents should watch for:

- Behavioural changes

- Emotional withdrawal

- Potential long-term stress management challenges

Professional Support Matters

Don’t hesitate to seek professional counselling if you notice significant emotional changes in your child. Therapists can provide valuable coping strategies.

The Silver Lining: Positive Transformation

While bankruptcy feels overwhelming, it can also be a pathway to financial healing. Reducing financial strain can create a more stable emotional environment at home.

Remember: Your family’s strength isn’t measured by your bank account, but by how you support each other through life’s challenges.

Final Thoughts for Parents

Bankruptcy is a process, not a permanent state. With compassion, communication, and strategic planning, your family can emerge stronger and more resilient.

If Parents Declare Bankruptcy, What Happens to the Children? Financial Impact on Children

When parents declare bankruptcy in Canada, children naturally worry about how this will affect their daily lives. Understanding these impacts can help families navigate this challenging time together.

Seizure of Children’s Personal Belongings

Many children and teens worry that their items might be taken when their parents declare bankruptcy. The good news is that in most cases, children’s belongings are protected.

In Canada, bankruptcy trustees (now officially called Licensed Insolvency Trustees) generally do not seize items that belong to a child. This includes:

- Clothing, toys, and personal electronics

- Sports equipment and musical instruments

- Educational materials and school supplies

- Items purchased with a child’s own money

However, certain situations can create complications. If parents purchased expensive items for their children shortly before filing for bankruptcy, these may be scrutinized. For example, an expensive jewelry item bought just before filing could potentially be viewed as an attempt to hide assets.

To protect children’s belongings, it helps to have documentation showing when and how these items were acquired, especially for valuable possessions.

Child Income and Its Role in Bankruptcy

Children’s earnings and income are generally separate from their parents’ bankruptcy proceedings, but there are important considerations:

For teenagers with part-time jobs, their income remains their own and is not considered part of the parent’s bankruptcy estate surplus income calculation. This means:

- Wages from after-school or summer jobs belong to the teen

- Money in bank accounts in the child’s name remains protected (subject to understanding the source of any recent deposits)

- Scholarships and educational grants directed to the child stay secure

However, parents should be aware of certain situations that could affect children’s finances:

- If parents have been depositing large sums into children’s accounts before filing, these transfers will be reviewed as potential preferences that a Trustee could successfully attack

- Joint accounts between parents and children might be temporarily frozen during the bankruptcy assessment until the source of funds is fully understood

- Regular large gifts of money from parents to children shortly before bankruptcy will be questioned

The key factor is timing and intent. Regular deposits to a child’s education fund over many years are viewed differently than sudden transfers made just before filing for bankruptcy.

For families facing financial difficulties, being transparent with the Licensed Insolvency Trustee about children’s assets and income helps ensure appropriate protections remain in place.

If Parents Declare Bankruptcy, What Happens to the Children? Transforming Financial Futures and Finding Hope After Bankruptcy

Breaking Free from the Debt Cycle

Picture the moment when a tremendous weight lifts from your shoulders—that’s the profound relief many families experience after filing for bankruptcy. This isn’t a story of failure, but a strategic reset for your financial life. As a licensed insolvency trustee, I always get excited when I see this happening to families that I am able to help.

The True Meaning of Financial Liberation

Bankruptcy isn’t the end of your financial journey. It’s a new beginning that offers:

- A fresh start away from overwhelming debt

- An opportunity to rebuild financial foundations

- A chance to develop healthier money habits

- Renewed hope for economic stability

Understanding the Financial and Emotional Landscape

Before bankruptcy, many families felt trapped in a relentless cycle of financial stress. Imagine endless bill payments, sleepless nights, and the constant anxiety of making ends meet. These challenges drain both emotional and financial resources, creating a seemingly impossible situation.

The Transformative Power of a Financial Reset

Bankruptcy provides a powerful opportunity to:

- Break free from cyclical debt

- Gain mental and emotional clarity

- Refocus on meaningful financial goals

- Create a strategic path forward

Rebuilding Your Financial Future

After bankruptcy, families discover an unexpected freedom. The elimination of crushing debt opens doors to:

- Building emergency savings

- Exploring strategic investment opportunities

- Setting long-term financial goals

- Improving overall financial literacy

More Than Just Numbers: The Emotional Impact

Financial stress doesn’t just affect bank accounts—it impacts entire family dynamics. Bankruptcy can be the first step toward creating a more stable, nurturing home environment.

Unexpected Benefits

- Reduced household tension

- Improved family communication

- Enhanced emotional well-being

- Opportunity for collective financial education

Before vs. After: A Comparative Snapshot

Before Bankruptcy

- Constant financial anxiety

- Limited financial flexibility

- Overwhelming debt burden

- Restricted economic opportunities

After Bankruptcy

- Reduced financial stress

- Increased budgeting capabilities

- Clear financial planning

- Potential for economic recovery

“Bankruptcy isn’t an end—it’s a strategic financial reset that offers families a second chance at economic stability,” Dr. Emma Reynolds.

Developing Financial Resilience

The journey after bankruptcy is about more than just numbers. It’s an opportunity to:

- Learn from past financial challenges

- Develop robust budgeting skills

- Create sustainable financial habits

- Build a more secure future

As financial expert Ashley Morgan wisely states, “Bankruptcy can be a legitimate strategy to regain control of your finances and future.”

If Parents Declare Bankruptcy, What Happens to the Children? Frequently Asked Questions: Children and Parental Bankruptcy

Will We Lose Our Home and Have to Move?

Bankruptcy doesn’t automatically mean losing your family home. The outcome depends on:

- How much equity (value minus mortgage) exists in the home

- Your province’s exemption rules

- The specific type of bankruptcy filing

Many families can keep their homes during bankruptcy, especially if there isn’t significant equity or if they can make arrangements with the trustee. If moving becomes necessary, we help families plan this transition carefully to minimize disruption to children’s schooling and social connections.

How Will This Affect Our Family Finances and My Future?

When parents declare bankruptcy, the family budget typically changes. This might mean:

- Less spending on non-essential items

- More careful planning for expenses

- Possible changes to vacation or entertainment plans

However, a parent’s bankruptcy doesn’t define a child’s future opportunities. Many financial aid programs, scholarships, and grants for education look at the student’s situation, not the parents’ bankruptcy history. Open family discussions about these changes help everyone adapt and plan together.

What Happens to My Potential Inheritance?

Bankruptcy may reduce or eliminate assets that parents might have passed down. Family savings and investments might be used to pay creditors. However, rebuilding financial stability after bankruptcy is possible, and many parents create new financial plans that include future provisions for their children.

Will My Personal Belongings Be Taken?

In Canada, belongings that belong to children are generally not affected by a parent’s bankruptcy. These protected items typically include:

- Clothing and personal items

- Toys and games

- Electronics for school or personal use

- Sports equipment

- Musical instruments

- Items purchased with a child’s own money

Trustees are concerned with adult assets, not children’s possessions.

Is My Part-Time Job Money Protected?

The money you earn from your part-time job and keep in your bank account is generally separate from your parents’ financial situation. This includes:

- Your wages and savings

- Scholarships and grants in your name

- Money given specifically to you as gifts

Just be careful about large deposits from parents right before they file for bankruptcy, as these might be questioned.

How Might This Affect Me Emotionally?

Financial stress affects the whole family. Children might experience:

- Worry about the future

- Anxiety about potential changes

- Concern about social standing with friends

- Confusion about what bankruptcy means

It’s important to maintain open communication, stick to familiar routines, and sometimes seek additional support from school counsellors or family therapists if needed.

What About Child Support and Alimony?

Bankruptcy does not eliminate a parent’s responsibility to pay child support or alimony (spousal support). These are considered priority debts that continue regardless of bankruptcy status. Courts still expect these payments to be made on time.

Can Bankruptcy Help Our Family?

Despite the initial challenges, bankruptcy often provides families with:

- Relief from overwhelming debt stress

- A fresh financial start

- The improved household atmosphere once financial pressure decreases

- Opportunities to develop better money management skills

- Protection from collection calls and creditor actions

Many families emerge from bankruptcy with improved financial habits and a more secure future.

If Parents Declare Bankruptcy, What Happens to the Children? Getting Professional Support

If your family is considering bankruptcy, speaking with a Licensed Insolvency Trustee can help clarify how it might affect everyone involved. We provide confidential consultations to explain the process and answer questions from all family members.

Remember that bankruptcy is a financial tool for recovery—not a reflection of personal worth or parenting ability. Many successful families have used bankruptcy to overcome temporary financial setbacks and build stronger futures.

If Parents Declare Bankruptcy, What Happens to the Children? Conclusion

While bankruptcy may initially seem like a setback, it can catalyze positive change. The relief from debt opens doors to better financial management. Parents can redirect their focus toward savings and investments, creating a more stable home environment. Understanding the potential benefits of bankruptcy can help you navigate this challenging situation. It’s essential to recognize that this process can lead to improved budgeting and planning, ultimately transforming your financial future. Embrace this opportunity for growth and renewal.

I hope you’ve found this if parents declare bankruptcy what happens to the children helpful. If you or someone you know is struggling with too much debt, remember that the financial restructuring process, while complex, offers viable solutions with the right guidance.

At the Ira Smith Team, we understand both the financial and emotional components of debt struggles. We’ve seen how traditional approaches often fall short in today’s economic environment, which is why we focus on modern debt relief options that can help you avoid bankruptcy while still achieving financial freedom.

The stress of financial challenges can be overwhelming. We take the time to understand your unique situation and develop customized strategies that address both your financial needs and emotional wellbeing. There’s no “one-size-fits-all” approach here—your financial solution should be as unique as the challenges you’re facing.

If any of this sounds familiar and you’re serious about finding a solution, reach out to the Ira Smith Trustee & Receiver Inc. team today for a free consultation. We’re committed to helping you or your company get back on the road to healthy, stress-free operations and recover from financial difficulties. Starting Over, Starting Now.

The information provided in this blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc., and any contributors do not assume any liability for any loss or damage.