We are trying something new. At the bottom is an audiogram of this Ontario pension plan Brandon’s blog. If you would prefer to listen to it, and not read it, scroll down to the bottom and press on the play button. Let us know what you think by sending us a message in the Question box below.

Ontario pension plan: Algoma Steel

Ontario’s Premier Doug Ford is promising his help for Ontario steelworkers as well as their Ontario pension plan following the United States’ federal government’s 25 percent tariff on Canadian steel.

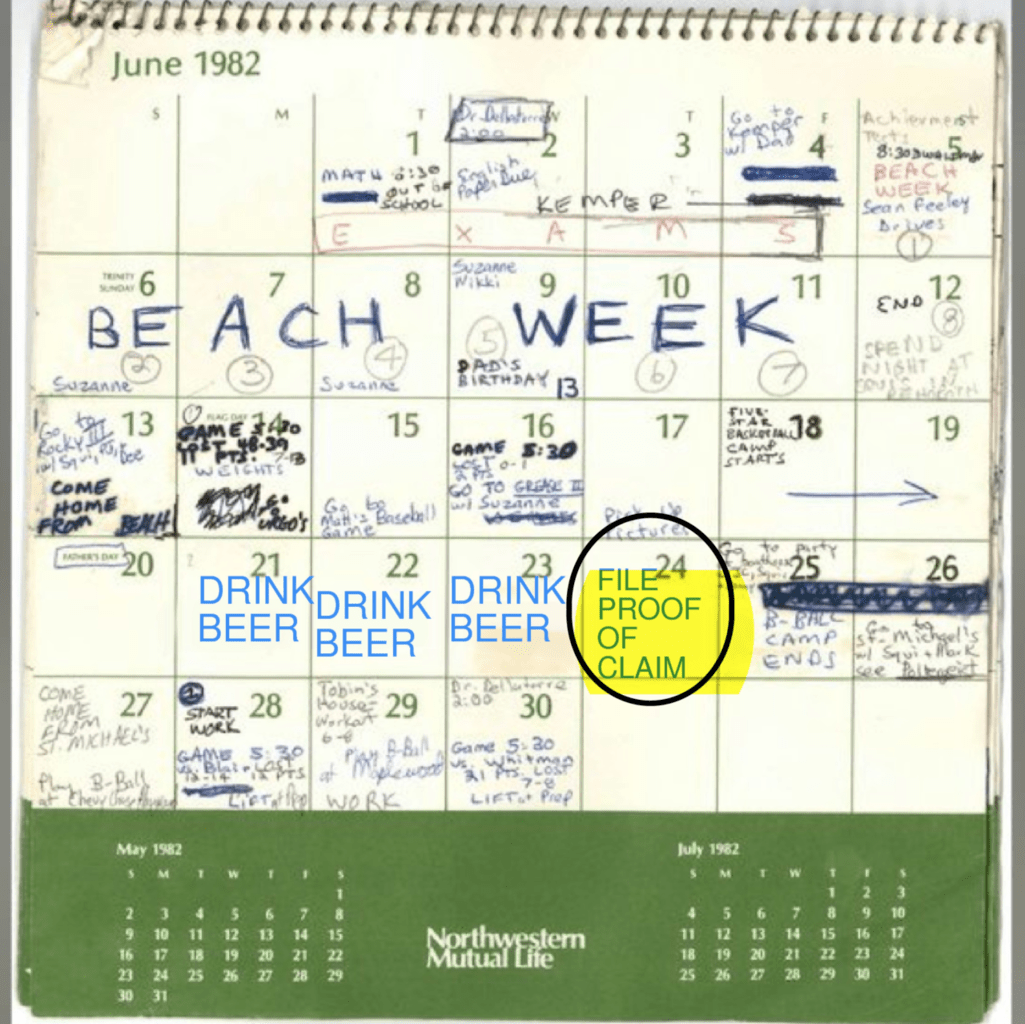

In news recently to Algoma Steel Inc. staff members in Sault Ste. Marie, Ont., Ford claimed the provincial government would assist in passing revisions under the Ontario Pension Benefits Act, R.S.O. 1990, c. P.8, along with insurance coverage from the Pension Benefits Guarantee Fund, subject to particular conditions.

Premier Ford didn’t provide any additional information on what specifically the help might be. However, he stated that negotiations are happening and extra info about just how Ontario is sustaining Algoma will certainly be introduced as quickly as possible.

Ontario pension plan: United Steelworkers

At the same time, the United Steelworkers union is prompting the federal government to enact regulations that would safeguard pension plans as well as benefits in situations of company bankruptcy, reorganization or liquidation. Union participants will be meeting legislators to check regulations focused on changing the Companies’ Creditors Arrangement Act (R.S.C., 1985, c. C-36) (CCAA) and the Bankruptcy and Insolvency Act (R.S.C., 1985, c. B-3) (BIA).

Ontario pension plan: Proposed federal legislation to date

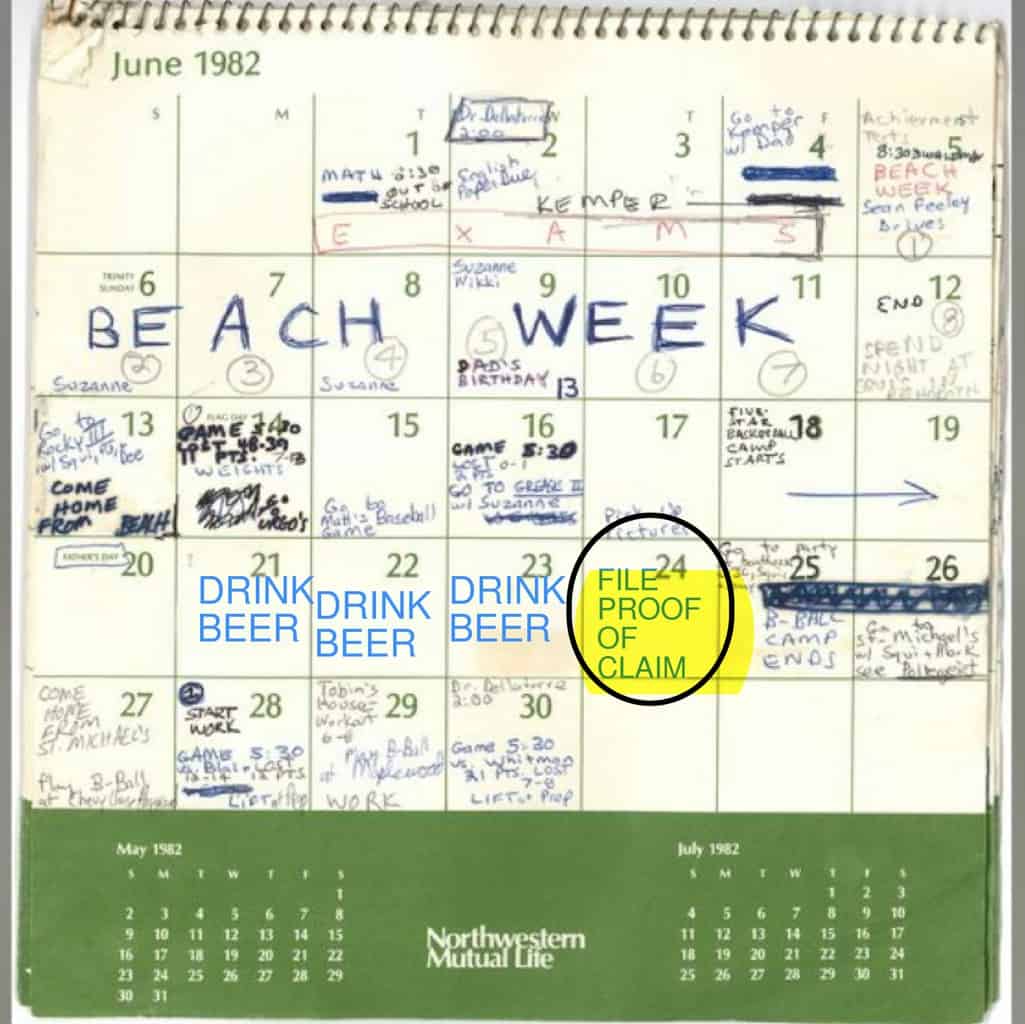

We previously described the efforts of Scott Duvall, MP for Hamilton MountainA, , MP for Manicouagan and Senator Art Eggleton:

- TORONTO BUSINESS BANKRUPTCY PROTECTION: NDP WANTS FEDERAL INSOLVENCY LAWS CHANGED SO THERE IS PENSION PLAN SECURITY WHEN FINANCIALLY TROUBLED BUSINESSES FAIL

Posted on September 27, 2017 - SEARS CANADA IS CLOSING: THE #1 REASON YOU HAVE TO RUN AND NOT JUST WALK TO REDEEM YOUR GIFT CARDS AND CREDITS

Posted on October 18, 2017 - SEARS CANADA CLOSING: POLITICIANS WANT NEW LAWS TO PROTECT PENSIONERS DUE TO SEARS CANADA CLOSING

Posted on November 1, 2017 - SEARS CANADA DEFINED BENEFIT PENSION PLAN SHORTFALL: MP SCOTT DUVALL COMES THROUGH ON HIS PROMISE IN CANADIAN PARLIAMENT

Posted on November 8, 2017 - CORPORATE BANKRUPTCIES CANADA: SENATOR EGGLETON PROPOSES NEW PENSION FUND CANADA LAW

Posted on October 22, 2018

Ontario pension plan: Canadian Association of Retired Persons

The Canadian Association of Retired Persons (CARP) is calling out the federal government, claiming it’s unreasonable that Sears Canada could pay out millions of dollars in shareholder dividends, a large part of which went to the US. At the same time, the pension plans of Sears Holding Corp.’s American staff members will be safeguarded by the U.S.’s Pension Benefit Guaranty Corp. while Canadian workers will certainly see benefits cuts.

“It’s time for the government to take decisive action to protect Canadian pensioners,” said Wanda Morris, chief advocacy and engagement officer at the CARP, in a press release.

Ontario pension plan: Private member’s Bill C-405

On October 17, 2018, Bill C-405 was presented by Conservative Erin O’Toole, MP for Durham. It is called “An Act to amend the Pension Benefits Standards Act, 1985 and the Companies’ Creditors Arrangement Act”.

The proposal is to change the Pension Benefits Standards Act, 1985 (R.S.C., 1985, c. 32 (2nd Supp.)), setting out what ought to take place if a business is under liquidation with the CCAA or Part III of the BIA.

His proposed changes lay out what should happen if a company is under liquidation through the CCAA or BIA. It proposes to allow, pending the permission of participants and beneficiaries, to transform the framework of the plan and/or move the pension’s assets to one more plans.

Granted this would probably be a necessary part of any global overhaul of pension plans. However, it is important to realize that it doesn’t do anything to safeguard the pensions or give the plan members and beneficiaries greater priority.

Ontario pension plan: Has a life event thrown you a curveball

Life has a way of throwing curve balls sometimes to good people. In the event of:

- Illness;

- addiction;

- divorce;

- family death; or

- job loss

unbearable financial pressures can occur.

The Ira Smith Team has generations and decades of experience in dealing with people or their companies fighting the pain, stress and suffering that comes with financial problems and too much debt.

Our method for each person is to develop an outcome where Starting Over, Starting Now occurs. This begins the minute you come through our door. You’re just one call far from taking the essential actions to return to leading a healthy and balanced life, moving forward pain-free.

Call us today for your cost-free consultation.

Recent bankruptcy cases: Introduction

Recent bankruptcy cases: Introduction

Transfer of property under s.160 of the Income Tax Act: Introduction

Transfer of property under s.160 of the Income Tax Act: Introduction