bankruptcy and business

Bankruptcy and Business: Introduction

As a licensed insolvency trustee, (previously referred to as a trustee in bankruptcy), my role involves assisting individuals and businesses in managing the complexities associated with entrepreneurship. The conclusion of a business often occurs without fanfare; it is not typically marked by formal announcements or celebratory farewells but rather unfolds quietly amidst the ongoing activity of the market. Despite rising bankruptcy and business failure through the recorded insolvency numbers, many businesses close without it showing up in the insolvency statistics, revealing a deeper truth about economic resilience.

For every corporate insolvency file that I administer, be it the legal process of a bankruptcy protection financial restructuring or a bankruptcy liquidation, there have been many more inquiries from entrepreneurs where the best advice I can give is rather than spending money on corporate bankruptcy, just shut down the business yourself.

In this Brandon’s Blog, which is aimed at Canadian entrepreneurs and their professional advisors, be they financial advisors, lawyers or accountants, I explore the complexities of bankruptcy and business failures, where one fact stands out: the numbers can be deceiving. The current rise in reported business insolvencies has raised eyebrows. But what’s behind these figures? Many businesses close their doors without formally declaring bankruptcy.

Bankruptcy and Business: Types of Business Structures Affected by Bankruptcy

It is essential to understand the different types of business structures that can be affected by or are eligible for bankruptcy. In this section, I’ll explore the impact of bankruptcy on sole proprietorships, partnerships, and incorporated companies.

Sole Proprietorships

A sole proprietorship is a business owned and operated by one individual personally. In the event of bankruptcy, the sole proprietor’s personal assets, including their home, savings, and other personal property, can be used to pay off business debts. This is because, from a legal perspective, the business and the individual are considered one and the same.

Partnerships

A partnership is a business owned and operated by two or more individuals. In the event of one or more partners filing for personal bankruptcy, the partnership’s assets are typically divided among the partners, and each partner is responsible for paying off their share of the debts. However, if one partner files for bankruptcy protection, then the partnership is automatically dissolved. If one partner is unable to pay their share, the other partners are responsible for paying off the remaining business debts.

Incorporated Companies

An incorporated company, also known as a corporation, is a separate legal entity from its shareholders. In the event of bankruptcy, as the corporation is a separate entity, the corporation’s assets are typically liquidated to pay off its debts, and the shareholders are not personally responsible for paying off the debts. However, if the corporation is insolvent, the shareholders may still be at risk of losing their investment.

Key Takeaways

- Sole proprietorships: The business and the individual are considered one and the same, and personal assets can be used to pay off business debts.

- Partnerships: Partners are responsible for paying off their share of the debts, or alternatively, each partner is responsible for paying off the entire amount of all debts. If one partner is unable to pay, and especially if one or more partners file for personal bankruptcy, the other partners are responsible for paying off the remaining business debts.

- Incorporated companies: The corporation’s assets are typically liquidated to pay off its debts, and shareholders are not personally responsible for paying off the debts, but may still be at risk of losing their investment.

Why Understanding Business Structure is Important

Understanding the type of business structure you have is essential in the event of insolvency, as it influences the appropriate debt relief solution that can be developed and executed. The relationship between bankruptcy and your business structure will affect how your assets are managed and how your debts are settled. For instance, if you operate as a sole proprietorship, you may be personally liable for the repayment of business debts. In contrast, if your business is incorporated, your personal assets are typically safeguarded from creditors.

Bankruptcy can impact any business structure; sole proprietorships, partnerships, and corporations. It is important to comprehend the specific business structure you operate under and the implications a bankruptcy protection filing may have on both you and your business. For Canadian entrepreneurs facing challenges with business debt, it is advisable to consult a licensed insolvency trustee to explore available options and make informed decisions regarding your financial situation.

Although parts of the balance of this article will focus on the corporate business structure, most will also be applicable to Canadian business regardless of the business structure.

Understanding Bankruptcy and Business in Canada: A Guide for Businesses

As a Canadian entrepreneur, it is important to recognize that operating a business involves various risks and challenges. Even with diligent management, financial difficulties may arise that jeopardize the viability of your company. In these circumstances, it is essential to be well-informed about the options at your disposal. One widely recognized and effective solution in such situations is corporate bankruptcy.

What is Corporate Bankruptcy in Canada?

Corporate bankruptcy, arising from a corporate insolvency, occurs when a business is unable to pay its overwhelming debts as they become due – that is the definition of an insolvent company. This can happen due to a variety of reasons, including poor cash flow management, increased competition, unexpected expenses, or even a downturn in the economy. When a business becomes insolvent, it may be forced to cease operations, leading to financial losses for its creditors, employees, and shareholders.

Types of Bankruptcy For Corporations in Canada

There are two main types of corporate bankruptcy in Canada: proposal and bankruptcy.

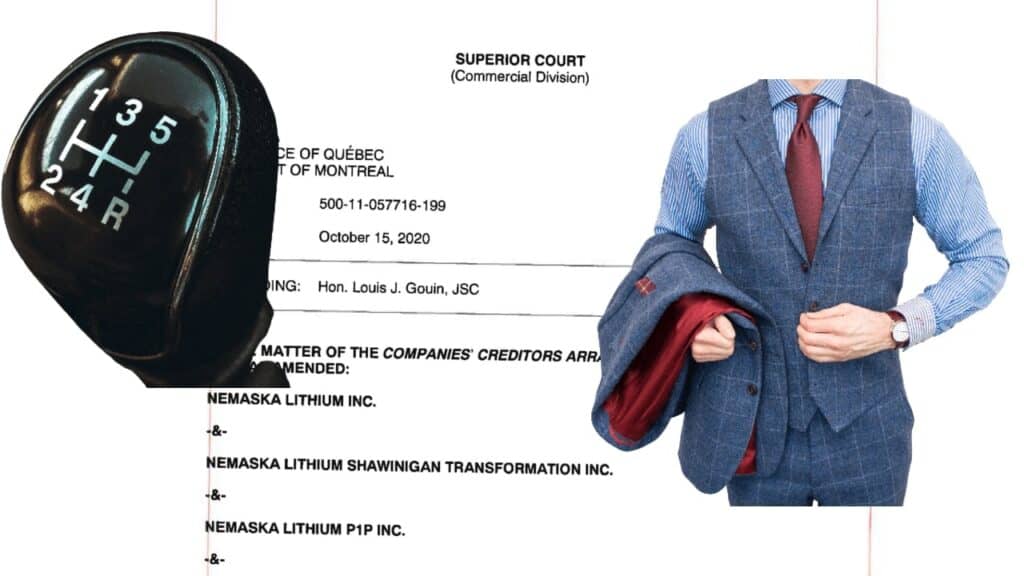

- Proposal: A corporate proposal is an alternative to bankruptcy. It is a formal payment plan under the Bankruptcy and Insolvency Act (Canada) BIA that allows a business a period of time to settle its debts with its creditors. The proposal is presented to the creditors, who then vote on whether to accept it. If accepted, the proposal then goes to court for approval. When the court approves the proposal, it then is binding on the debtor business and the creditors.

Once the proposal becomes binding, the business can restructure its debt and continue operating by making the monthly payments to the Trustee that it promised to make for the benefit of its creditors. This is otherwise known as a corporate restructuring plan.

- Bankruptcy: Bankruptcy is also a formal process under the BIA where the business assets are liquidated by selling off its assets. The Trustee then uses the net proceeds of sale to pay for the cost of the corporate bankruptcy process and then to distribute what remains to the unsecured creditors on a pro rata basis according to their claims.

Benefits of Corporate Bankruptcy in Canada

While bankruptcy protection may seem like a last resort, it can actually be a beneficial option for businesses facing financial difficulties. Some of the benefits of corporate bankruptcy in Canada include:

- Protection from Creditors: Bankruptcy provides a stay of proceedings, which means that creditors cannot take or continue legal action against the business or its assets.

- Reorganization: Bankruptcy allows businesses to restructure their debt and reorganize their operations to become more sustainable.

- Fresh Start: Bankruptcy can provide a fresh start for businesses, allowing them to emerge from insolvency and start anew.

When to Consider Corporate Bankruptcy in Canada

If your business is experiencing financial difficulties, it’s essential to seek professional advice from a licensed insolvency trustee. Here are some signs that may indicate it’s time to consider corporate bankruptcy:

- Cash Flow Problems: Cash flow problems can indicate underlying financial issues within a business. If a company is consistently struggling to pay its bills on time, it is essential to investigate the root causes of this cash flow challenge, as it may reflect broader financial health concerns.

- High Debt Levels: When a business is burdened with significant debt and faces challenges in meeting its repayment obligations, considering bankruptcy may be a viable option to explore.

- Loss of Key Customers or Suppliers: Loss of key customers or suppliers can indicate underlying issues within a business that require attention. It is important to analyze the reasons behind this loss, as it may reflect broader challenges affecting the organization’s performance and stability. Addressing these issues promptly can help mitigate potential negative impacts on operations and profitability.

Corporate bankruptcy in Canada is a multifaceted process that can present challenges for businesses in financial distress. However, it can serve as an effective mechanism for companies to address their financial challenges and restructure. By familiarizing themselves with the available options and consulting with qualified professionals, businesses can effectively navigate the bankruptcy process, potentially emerging in a more resilient and sustainable position. Entrepreneurs in Canada facing significant business debt are encouraged to reach out to a licensed insolvency trustee to explore their available options.

Bankruptcy and Business: The Overlooked Landscape of Business Closures

Understanding Bankruptcy and Business Insolvency Filing vs. Closure

Have you ever wondered the difference between a business going bankrupt and closing its doors? It’s important. Business insolvency is the financial condition that the business cannot pay all of its debts as they come due. Business bankruptcy is a legal process where a business files for bankruptcy in order to deal with the distribution of its assets among its creditors in a fair and orderly fashion, as far as the money can go. On the other hand, closure can happen for many reasons, like poor management or market changes. Bankruptcy and business failure many times go hand in hand, but just as often, they don’t.

Reasons For Bankruptcy and Business Failure

Understanding the Common Causes

As a licensed insolvency trustee, I’ve seen firsthand the devastating impact of business bankruptcy on entrepreneurs, employees, and the economy as a whole. While no business is immune to financial difficulties, understanding the common reasons for business bankruptcy can help entrepreneurs take proactive steps to mitigate risks and avoid insolvency.

In this section, we’ll explore the three main categories of reasons for business bankruptcy: Financial Challenges, Operational Issues, and External Factors.

Financial Challenges

Financial challenges are often the most obvious reason for business bankruptcy. Some common financial challenges that can lead to insolvency include:

- Cash flow management issues: Inability to manage cash flow can lead to delayed payments, missed deadlines, and ultimately, insolvency.

- High debt levels: Carrying too much debt can put a significant strain on a business’s finances, making it difficult to meet financial obligations.

- Inadequate funding: Insufficient startup capital or ongoing funding can hinder a business’s ability to grow and operate successfully.

- Poor budgeting: Failing to create a realistic budget or failing to stick to it can lead to financial difficulties.

Operational Issues

Operational issues can also contribute to business bankruptcy. Some common operational issues that can lead to insolvency include:

- Inefficient operations: Poorly managed operations can lead to wasted resources, increased costs, and decreased productivity.

- Lack of scalability: Failing to adapt to growth or changes in the market can lead to operational inefficiencies and financial difficulties.

- Poor management: Ineffective leadership or management can lead to poor decision-making, which can ultimately result in insolvency.

- Failure to innovate: Failing to innovate or adapt to changes in the market can lead to stagnation and financial difficulties.

External Factors

External factors can also play a significant role in business bankruptcy. Some common external factors that can lead to insolvency include:

- Economic downturns: Economic recessions or downturns can lead to reduced consumer spending, decreased demand, and financial difficulties.

- Competition: Increased competition can lead to reduced market share, decreased revenue, and financial difficulties.

- Regulatory changes: Changes in regulations or laws can lead to increased costs, decreased revenue, and financial difficulties.

- Natural disasters: Natural disasters or other external events can lead to significant financial losses and insolvency.

By understanding the common reasons for business bankruptcy, entrepreneurs can take proactive steps to mitigate risks and avoid insolvency. This includes creating a solid business plan, managing cash flow effectively, and staying adaptable to changes in the market. As a licensed insolvency trustee, I’ve seen firsthand the devastating impact of business bankruptcy on entrepreneurs and the economy. By being aware of the common causes of business bankruptcy, entrepreneurs can take steps to avoid insolvency and achieve long-term success.

Statistical Insights

Recent statistics highlight an important trend that merits our attention. Following the 2008 financial crisis, we saw a notable rise in business closures, with many not opting to file for bankruptcy. This is quite surprising, isn’t it?

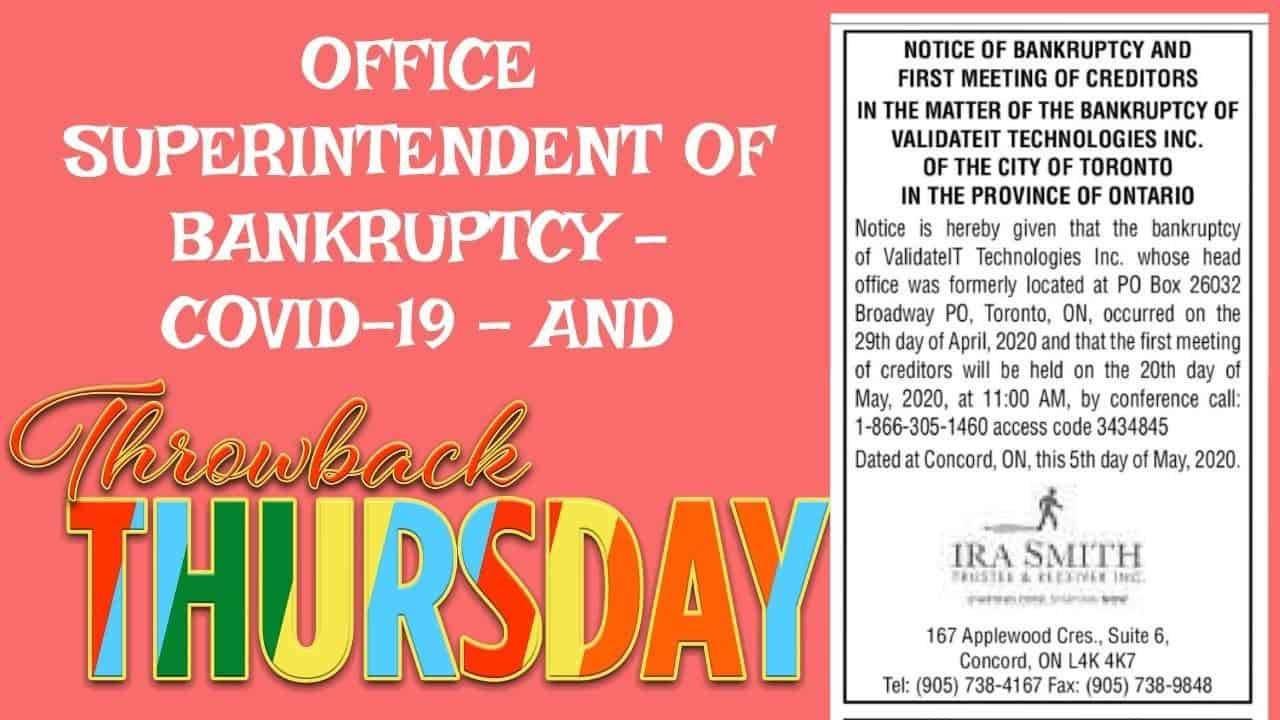

In the first quarter of this year, Canada experienced 2,003 insolvencies, which included 1,599 bankruptcies and 404 proposals. This marks an 87 percent increase compared to the same quarter last year and represents the highest number of insolvencies in the first three months since early 2008.

Additionally, Statistics Canada provides insights into active businesses by tracking their monthly payroll filings with the Canada Revenue Agency (CRA). Due to a slight delay in data reporting and analysis, the latest figures are from January, showing there were 936,327 active businesses in Canada. However, there were also 43,121 closures, being companies that reported employees to the CRA in December 2023 but did not in January 2024.

“The real tragedy of business closures hides in the shadows of insolvency statistics.”

In light of all this, understanding that a business can disappear without ever declaring bankruptcy is crucial. It paints a clearer picture of our economy. Whether due to management issues or other challenges affecting the viability and solvency of the business, this is a landscape that deserves attention. What are your thoughts on this?

Bankruptcy and Business: The Hidden Truth Behind Business Closures

Understanding the Landscape of Business Failures

Did you know that the actual number of business closures is likely much higher than what insolvency figures reveal? It’s a shocking reality. Business insolvencies are soaring to heights we haven’t seen since the financial crisis of 2008. But here’s the catch: these numbers only represent a fraction of the businesses that are truly shutting down each year.

Why Do Businesses Fail?

Let’s dig into some reasons why businesses fail:

- Lack of Cash Flow: Many businesses struggle with cash management. Without enough cash coming in, they can’t pay bills.

- Poor Decision-Making: Sometimes, choosing the wrong direction can lead to disaster. It’s like sailing without a compass.

- Competition: It’s a wild world out there. If you can’t keep up with your competitors, you may find yourself left behind.

The Significance of Measuring Failures

When you think about it, why are these insolvency numbers so important? They give us a glimpse into the broader economic conditions. However, they don’t paint the full picture. Countless businesses fold without ever going through the insolvency process. This raises the question: how can we better support these struggling businesses?

What Can Be Done?

We need to think creatively. Here are some strategies to consider:

- Strong Cash Flow Management: Maintaining robust financial practices can prevent major setbacks.

- Seek Guidance: Consulting with business mentors can provide invaluable insights.

- Flexibility is Key: Being adaptable to changing market demands can keep a business afloat.

A detailed examination of these factors reveals that each statistic embodies a narrative. Gaining insight into these dynamics enhances our understanding of the current business environment and facilitates the development of more effective solutions.

Bankruptcy and Business: Understanding Business Failures vs. Insolvency Rates

The current trend of rising bankruptcy and business failures can be alarming. We’re seeing numbers that remind us of the financial crisis back in 2008. But here’s the kicker: the official insolvency figures don’t tell the whole story. They only reflect a fraction of the businesses that close each year. So, what’s going on?

The Hidden Truth Behind Business Closures

When a business shuts down, sometimes bankruptcy and business do not go together. The business is insolvent, but as I stated in the introduction to this bankruptcy and business Brandon’s Blog, sometimes the wisest choice for owners is simply to close their doors rather than declare bankruptcy. Of course, in doing so, the business must treat its employees fairly in making sure that all wages and vacation pay are paid up in full, the books and records should be finalized, any leased equipment or consignment goods returned to their owners and all final government returns are filed.

A voluntary business closure raises a few questions:

- Are entrepreneurs running away from the stigma of bankruptcy and business failure?

- Do businesses fear the legal complexities of bankruptcy?

The Reality of Business Closures

Many businesses succumb to market pressures, competition, or changing consumer preferences. So even if a business doesn’t file for bankruptcy, it’s still part of a broader trend of bankruptcy and business failure.

Here are some factors contributing to these closures:

- Economic downturns: A slowdown can hit sales hard.

- Shifts in consumer behaviour: Staying relevant is crucial.

- Operational inefficiencies: Sometimes, a business just can’t keep up.

The data presented reflects not merely statistics, but real stories of individuals whose dreams and aspirations have faced significant challenges. Recognizing this broader context is crucial for comprehending the current realities of the business landscape.

Bankruptcy and Business: Understanding Business Failures Beyond Insolvency Numbers

Every year, countless businesses close their doors. But did you know most failures don’t make it to the insolvency list? It’s a striking fact. There’s a lot more happening beneath the surface.

The Real Picture of Business Failures

Business insolvencies are currently rising, reaching levels reminiscent of the 2008 financial crisis. However, these numbers only tell part of the story.

- Insolvency counts are just the tip of the iceberg. Many businesses close without ever filing for bankruptcy.

- They might choose to liquidate assets instead, avoiding formal insolvency procedures.

- Some simply shutter their operation quietly, leaving no trail that stats can follow.

Why Do They Close?

Now, let’s dig deeper. Why do businesses close? Here are a few key reasons:

- Market changes: Trends shift rapidly. A product that sells today may be yesterday’s news tomorrow.

- Lack of funds: Often, owners run out of cash. It’s not always about being in debt.

- Poor planning: Without a solid business plan, success becomes a game of chance.

It’s critical to understand these points. When we consider the broader picture, it becomes clear that the narrative of bankruptcy and business failure encompasses much more than insolvency figures. So, when you hear those numbers, remember: behind every statistic, there’s a unique story. It’s worth exploring.

Bankruptcy and Business Behind the Scenes: A Personal Journey with Business Failure

Let me describe to you, with no names of course, about an entrepreneur who recently consulted with me. He truly believed in his retail business. It was welcoming, colourful, and brimming with potential. He had dreams of providing the best customer service in town. But, not long after the grand opening, he saw that it wasn’t working out. The foot traffic was lower than he anticipated, and the expenses kept piling up. He had to close the doors within a year of opening. It felt like a hard punch to his gut.

Lessons Learned

From this experience, he learned a few invaluable lessons:

- Resilience is Key: Every setback can teach us something. We just need to be open to those lessons.

- Adaptability Matters: The ability to pivot quickly can save a business. If he had been more flexible and had some staying power, perhaps he could have found a way to make it work.

- Not All Bankruptcy and Business Failures Reflect Capability: Just because a venture doesn’t succeed it doesn’t mean that the person is not capable as an entrepreneur.

The Emotional Toll

Closing his store was not just a business decision; it hit him hard on a personal level. There’s a saying:

“Failure isn’t the opposite of success; it’s part of success.”

This resonated with him throughout the process. He felt a profound sense of loss—not just for his dream, but for his team and the community, albeit small, that had begun to form around his business. It’s important to recognize that every business closure affects many lives.

He will cherish the memories, good and bad. We often think of success as the ultimate goal. However, failures

can be just as important. After all, they prepare us for the next big opportunity.

Bankruptcy and Business: The Economic Ripple Effect of Silent Failures

Have you ever stopped to think about the impact of a business closing its doors quietly? It’s alarming. Each silent closure sends ripples through our communities. But how exactly does this happen?

Understanding the Broader Economy

When a business goes unnoticed, its effects are profound. For small towns and cities, local businesses are often the lifeblood of the economy. They provide jobs and foster a sense of community. But when they fail, a series of consequences unfold.

- Potential job losses: Every unnoticed closure often results in job losses. It’s estimated that thousands of jobs are impacted as small businesses close each year.

- Supply chain impacts: Smaller firms are interwoven into larger supply chains. When they disappear, disruptions occur, affecting many others reliant on their goods or services.

A Community Heartbreak

The silence surrounding these closures can be deafening.

“Every business closure is a community heartbreak.”

This isn’t just a catchy phrase; it’s the reality for many.

Large corporations may withstand economic struggles, but small businesses often can’t. Imagine a local diner you frequently visit, or a beloved independent bookstore. If these establishments close, the repercussions extend beyond just lost revenue. They can alter job security and change local culture.

We often overlook just how many jobs depend on these small firms. Have you considered what happens to job seekers when they vanish?

Bankruptcy and Business: Preventing the Silent Nightmare of Business Closure

We all know that running a business can feel like navigating through a storm. Sometimes, even the most resilient enterprises can face economic downturns that threaten their very existence. So, how do we ensure survivability? Here are some strategies to consider:

1. Embrace Innovation

- Adapt to Market Trends: Staying ahead means constantly evaluating what’s working and what’s not. Are your customers shifting their preferences? Innovate to meet their needs.

- Leverage Technology: Digital tools can streamline operations and reach wider markets. Tools like social media and e-commerce platforms can significantly boost visibility.

2. Cultivate Adaptability

We must understand that adaptability is key. If we don’t learn and pivot, we risk stagnation. Have you ever noticed how quickly the business landscape shifts? Continuous learning is not just a phrase; it’s a necessity. Training programs and workshops can enhance our expertise.

3. Build Community Support

One of the most effective strategies is building a strong support system. Entrepreneurs often feel isolated—this needn’t be the case. Engaging in community networks or mentorship programs can provide valuable guidance.

Imagine a gardener tending to a plant. It needs nurturing, sunlight, and sometimes a bit of pruning. Similarly, businesses thrive in supportive environments where they can learn and adapt. We need to reinforce this sense of community, where sharing experiences can lead to encouragement and growth.

Finally, I want to acknowledge that the journey is indeed tough. Yet, it is essential to focus on personal resilience. Everyone faces challenges. But through understanding and support, we can not only overcome but also flourish!

I urge you to seek out success stories, too. Businesses that have pivoted successfully often serve as a beacon of hope. They illuminate paths we never considered. By sharing our experiences and challenges, we help each other to thrive.

Bankruptcy and Business: Shining a Light on Shadows

As we’ve explored the complexities of business failures, one fact stands out: the numbers can be deceiving. The current rise in business insolvencies has raised eyebrows. But what’s behind these figures? Many businesses close their doors without formally declaring bankruptcy. This distinction is critical for understanding the health of our economy. Not all failures are recorded in official statistics. Every year, countless ventures close down quietly, leaving little trace. Each shuttered business represents dreams, investments, and hard work.

As we wrap up our discussion, it’s clear that *business failures* are more common than we often admit. Many business owners might feel isolated, and that’s understandable. But recognizing the reality of these failures is essential. It reminds us that every entrepreneur’s journey is difficult yet filled with opportunities to learn and grow.

Here are some key points we’ve explored:

- The numerous factors that contribute to business closures.

- The impact of community support on a business’s survival.

- How understanding failures can lead to future successes.

Bankruptcy and Business in Canada: FAQ

1. What is the difference between a business closing and a business going bankrupt?

Business closure and bankruptcy are distinct concepts in the realm of business operations.

Business closure refers to the termination of a business’s operations for various reasons. These reasons may include factors such as ineffective management, shifts in market conditions, or a deliberate choice by the owner to cease operations.

On the other hand, business bankruptcy is a legal process defined by the BIA in Canada. This occurs when a business officially declares its inability to meet its financial obligations. The bankruptcy process typically involves either restructuring debts through a formal proposal or liquidating business assets to repay creditors.

It is important to note that while bankruptcy often results in the closure of a business, not all closures are accompanied by bankruptcy proceedings. A business can close without filing for bankruptcy, opting instead to liquidate its assets and settle any outstanding debts on its own.

2. What are the main types of corporate bankruptcy in Canada?

Canada provides two main avenues for corporations encountering bankruptcy:

- Proposal: This option involves submitting a formal payment plan to creditors for their approval. If the proposal is accepted and subsequently sanctioned by the court, the business can restructure its debts, continue its operations, and repay creditors over an extended period.

- Bankruptcy: In this scenario, the corporation liquidates its assets to settle debts with creditors. The proceeds from the asset sales are allocated to creditors, starting with secured creditors, followed by a proportional distribution of any remaining funds to unsecured creditors.

3. What are some common reasons for business failure?

Business failure can result from various issues that can be categorized into three main areas:

Financial Challenges:

- Poor cash flow management

- High levels of debt

- Insufficient funding

- Ineffective budgeting practices

Operational Issues:

- Inefficient operational processes

- Inability to scale operations

- Subpar management practices

- Lack of innovation

External Factors:

- Economic downturns

- Heightened competition

- Changes in regulations

- Natural disasters

4. Why is the number of business closures likely higher than official insolvency statistics suggest?

Many businesses choose to close their doors without formally filing for bankruptcy. This could be due to several reasons:

- Avoiding the stigma of bankruptcy: Some entrepreneurs may perceive bankruptcy as a personal failure and opt for a quiet closure.

- Complexity and cost of bankruptcy proceedings: The legal processes involved in bankruptcy can be daunting and expensive, deterring some businesses.

- Strategic decision to liquidate independently: Owners may decide to manage the closure process themselves, selling assets to settle debts outside of formal insolvency proceedings.

5. What are the economic consequences of unrecorded business closures?

Unrecorded closures have a significant impact on the economy:

- Job losses: Closures, whether reported or not, often lead to job losses, impacting individuals, families, and communities.

- Supply chain disruptions: Small businesses are often integral to larger supply chains. Their closures can disrupt these networks, impacting other businesses reliant on their goods or services.

- Reduced economic activity: Closures reduce overall economic activity in communities, impacting local spending, tax revenue, and overall economic health.

6. What are some strategies to help businesses avoid closure?

- Embrace innovation: Adapting to market trends, leveraging technology, and developing new products or services can help businesses remain competitive.

- Cultivate adaptability: Continuous learning, training, and willingness to adjust strategies can improve resilience in the face of change.

- Build community support: Engaging with local networks, seeking mentorship, and fostering collaboration can provide valuable resources and guidance.

- Prioritize financial management: Strong cash flow management, responsible budgeting, and careful debt management are crucial for business stability.

7. How can we better understand the true landscape of business closures?

- Improved data collection: Implementing better tracking mechanisms to capture closures beyond formal insolvency filings could provide a more accurate picture of business failure rates.

- Research and analysis: Studying the reasons behind unrecorded closures can offer insights into common challenges and potential solutions.

- Open dialogue and awareness: Encouraging entrepreneurs to share their experiences, both successes and failures, can normalize conversations about business closure and facilitate learning.

8. What is the key takeaway from understanding the difference between business closures and bankruptcy?

Recognizing that business closures are more prevalent than official insolvency statistics indicate is crucial. It highlights the challenges faced by entrepreneurs and emphasizes the need for support systems, innovation, adaptability, and sound financial management to foster business success and resilience. Acknowledging the silent failures allows for a more accurate understanding of the economic landscape and can help policymakers and support organizations develop strategies to address these challenges and better support businesses.

Bankruptcy and Business: Conclusion

So, why is it important to acknowledge these failures? It’s simple. They are not just numbers on a report; they are the culmination of hard work, dreams, and sometimes missteps. When a business fails, it can feel like a dark cloud, but it can also be the start of something new.

I hope you enjoyed this bankruptcy and business Brandon’s Blog. Do you or your company have too much debt? Are you or your company in need of financial restructuring due to distressed real estate or other reasons? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or someone with too much personal debt.

You are worried because you are facing significant financial challenges. It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding the bankruptcy process. We can get you debt relief freedom using processes that are a bankruptcy alternative.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a plan, we know that we can help you.

We know that people facing financial problems need a realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team.

That is why we can develop a restructuring process as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious about finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation. We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

The information provided in this Brandon’s Blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content of this Brandon’s Blog should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc. as well as any contributors to this Brandon’s Blog, do not assume any liability for any loss or damage resulting from reliance on the information provided herein.