We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

Is CERB taxable? CERB is a taxable payment

Last weekend we set our clocks ahead 1-hour. This time of year always gets me thinking of doing my income tax return. So with taxes on my mind, I believed it would certainly be appropriate to discuss CERB, which is the short-hand for the Canada Emergency Response Benefit.

So, is CERB taxable? That is what I want to discuss with you today.

Since March 2020, I have written several blogs about different issues facing Canadians with Canada’s COVID-19 Economic Response Plan, including the Canada Emergency Response Benefit (CERB). My 3 previous blogs on CERB were:

- CERB Update: CERB Your Enthusiasm As Intense CERB CRA Audits Begin

- Consumer Proposal Ontario: The Only Post-CERB Guilt-Free Govt Approved Debt Elimination Plan

- CERB Requirements: Astonishing Mixup Understanding CERB Requirements Leads To A Bad Outcome

Now I look at is CERB taxable?

Is CERB taxable? What is the CERB?

Simply to freshen your memory, I think a summary of the CERB eligibility requirements will nicely establish the stage.

To be eligible for the $2,000 CERB payment by applying through the Canada Revenue Agency (CRA), you needed to have met specific CERB requirements for each of the CERB time periods you were making an application for. The Government of Canada specified the eligibility requirements to be:

- You didn’t obtain CERB or Employment Insurance (EI) from Service Canada for the CERB dates now being requested.

- You did not voluntarily give up your work.

- You live in Canada and are not younger than 15 years of age.

You earned at least $5,000 (before taxes) in the preceding 12 months, or in 2019, from 1 or even more of:

- job income;

- self-employment income;

- provincial benefits for maternity or parental leave;

- your job hours have been lowered as a result of COVID-19;

- you have actually quit or will give up work as a result of COVID-19;

- you are not able to work as a result of COVID-19, for example, because you are looking after an individual;

- you have been paid EI benefits for at least one week of qualifying after December 29, 2019, and your entitlement to such benefits have ended;

- this is your first application because:

- you have quit or will stop working, or you are working decreased hours, as a result of the coronavirus;

- you don’t expect to earn over $1,000 in gross work or self-employment earnings for at least 14 days right during the 4-week duration.

If you are getting a subsequent period: You are still not utilized or self-employed, or you are doing decreased hrs due to COVID-19. You do not prepare for transforming $1,000 in gross income; and - you expect this to continue throughout the whole 4-week period you are applying for.

The CERB emergency benefit: Our federal government started to attack the self-employed

The Canadian CERB program is completed. The CRA approved and paid retroactive applications until December 2, 2020. Currently, they are doing audits to see if individuals who received CERB did not really qualify.

As you may recall, this revealed a one-of-a-kind issue to the self-employed individual. CRA was inconsistent in their descriptions and definitions of the threshold to get CERB. The concern that was uncovered for self-employed people was in the computation of income. The qualification guidelines and eligibility standards concerning self-employed earnings had been misunderstood by both the public and CRA employees alike!

Self-employed Canadians have said that when they reviewed the federal government’s CERB site, they understood that their business had to have earned (before taxes) a minimum of $5,000. CRA stated that the $5,000 was net income, your business earnings after deducting all your expenses. Numerous people understood it to be gross earnings as meeting the income test requirement for obtaining CERB. The federal government originally stated that those that misunderstood this regulation would need to pay all the CERB back. Luckily for them, the government has withdrawn from that position and will just rely upon the income tax system to determine what those people will have to pay in income tax.

Now for is CERB taxable?

Is CERB taxable? Report T4E amounts on your tax return

Along with any other income you might have earned in 2020, if you got the CERB or other emergency benefits from Service Canada or any kind of EI payments, you will certainly be sent out a T4E tax slip showing the amount paid. So is CERB taxable? Sadly, yes.

These benefits are taxable. Any of this kind of payment you received prior to December 31, 2020, will certainly need to be reported on your 2020 tax return. You will receive a T4E slip at tax time or you may also get your T4E info from your My Service Canada Account.

Maximize your tax planning for CERB before our debt-ridden government comes looking for more

When I think of tax planning, I think of ways to avoid (but not evade) income tax. In the case of CERB and other such benefits, the planning is really making sure you actually have the money to pay your 2020 income tax liability. The reason for this was that, unlike employment income, no income tax was deducted at source for the CERB payments. The federal government wanted to get the money out as quickly as possible without extra bookkeeping.

How much tax will I have to pay on CERB is a question people ask. Given the duration that the benefits lasted for, the maximum CERB that Canadians might have obtained is $12,000 of revenue. Nevertheless, the amount of income tax obligation that you will owe cannot be calculated on this number alone. It will be calculated based on the full amount you made throughout the year.

Because the sum total of CERB paid to you is taxable income, it will be reported on line 11900 of the 2020 income tax return. That amount, in addition to any other sources of income, works through your income tax return to end up with your total taxable income and your total deductions. After that, you determine your income tax obligation, what taxes at source were subtracted or tax paid by you in instalments. The net amount is either tax payable or a tax refund. So the income tax payable on the CERB payments you obtained relies on what your marginal tax rate is.

Contributing to an RRSP may have been the only other way to reduce your total taxable income and therefore your total income tax. However, in a year where you had to rely on CERB, you may not have had surplus funds to contribute to an RRSP in 2020 or the first 60 days of 2021.

Is CERB taxable? When do I have to pay CERB taxes?

Unlike our 2019 income tax returns, there are no extensions being offered this year. The filing deadline for your 2020 income tax return is April 30, 2021, for most people. A self-employed person has until June 15, 2021, to file their income tax return. However, anyone who has a tax balance owing to CRA must pay it by April 30.

What if I didn’t set aside taxes for CERB? What happens when you can’t pay the tax on your CERB tax debt?

If you really did not reserve the right amount, or anything, to pay your taxes for CERB, and you find that you owe a substantial amount (possibly not hideous if CERB was your only earnings in 2020) then you’ll still have to figure out how to pay your taxes.

This situation resembles the majority of self-employed people whose taxes are not subtracted at source and need to be really attentive at reserving cash from their income to pay their income tax obligations. If they don’t have the funds readily available, they need to clamber to find the money for the CRA.

After your tax return is prepared, if you recognize you don’t have the cash to pay the tax owing, talk with your tax advisor. Perhaps they can establish a realistic timetable to offer CRA to pay your tax bill over some months using a current dated cheque and a few post-dated cheques to cover off the balance. This will give you the breathing room and financial help that you need.

However, the COVID-19 pandemic has left many Canadians in dire straits. They have barely enough money to pay for food and rent or mortgage payments, let alone income tax. If you find yourself in a situation where post-dated cheques are not even a possibility, contact a licensed insolvency trustee. We will provide you with a free consultation where we will go over your financial situation with you and make recommendations.

If you are working again and have a steady income, perhaps a consumer proposal is right for you. If you are not back at work or do not have full hours as you did before the pandemic, perhaps bankruptcy is your answer. Either way, contact a licensed insolvency trustee and find out what all your viable options are to settle your debts and eliminate that stress from your life.

Is CERB taxable summary

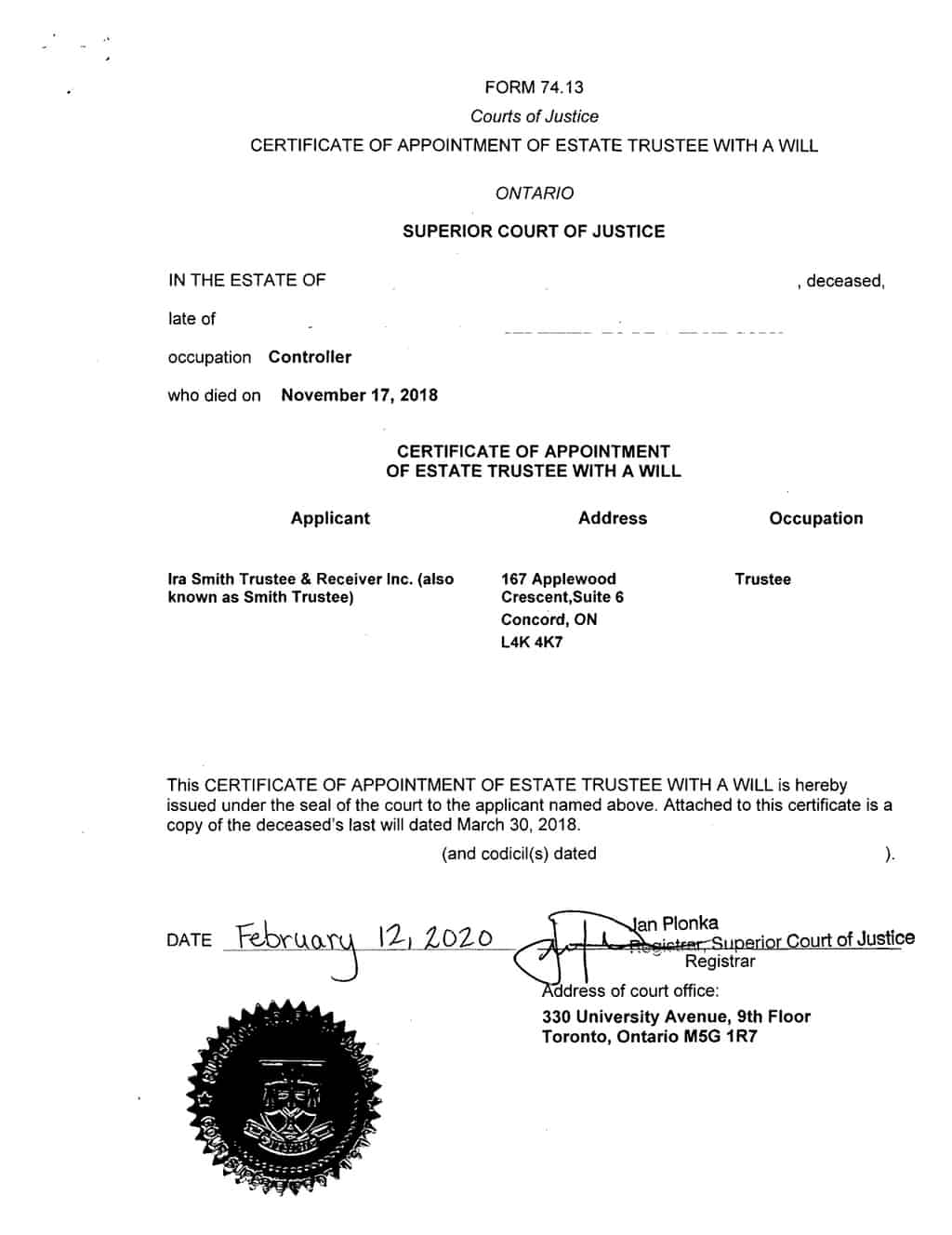

I hope you have enjoyed this is CERB taxable Brandon’s Blog. Do you or your company have too much debt? Are you or your company in need of financial restructuring? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or the person who has too much personal debt.

You are worried because you are facing significant financial challenges. It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding bankruptcy. We can get you debt relief freedom.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a debt settlement plan, we know that we can help you.

We know that people facing financial problems need a realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team That is why we can develop a restructuring process as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious about finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation.

We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.