We hope that you and your family remain safe and healthy during this COVID-19 pandemic. The Ira Smith Team is fully operational. Both Ira and Brandon Smith are available to answer any questions you may have, for consultations or meetings. We are available by telephone, email or video meeting. Feel free to contact us.

what happens if you die without a will in ontario

What happens if you die without a will in Ontario introduction

I have been speaking to many lawyers to see what is happening in their marketplace since the onset of the COVID-19 pandemic. What they tell me is that many areas of their practice are quiet:

- Litigation and family law has slowed down because of the closure of the courts (other than for emergency matters).

- Both the courts being closed and people and companies obtaining government financial support through Canada’s COVID-19 Economic Response Plan have slowed insolvency matters right down.

- They also have said that there are not many large commercial real estate deals being done either, perhaps other than many lease amendments for mall landlords!

The one area though they say is very busy, due to the coronavirus pandemic, are the wills and estates lawyers. People are scared and this pandemic has made all of us face our own mortality. Therefore the wills and estate planning areas are quite busy.

Based on that discussion, I thought it would be timely to write Brandon’s Blog about what happens if you die in the province of Ontario without a will?

Composing will is commonly put-off because it is either expensive or troublesome. For sure it is not the most pleasant discussion to have.

The purpose of this Brandon’s Blog is to offer general details about what happens if you die without a will in Ontario. I am not a lawyer so this Brandon’s Blog is general in nature. It definitely is not meant to and must not be used as or to replace appropriate legal recommendations. So if you do not have a will or your will is terribly out of date, please consult with a wills and estates lawyer.

What happens if you die without a will in Ontario?

If you pass away without a will, the law states that you have passed away intestate. This means that you left no guidelines as to exactly how your property is to be divided and dispersed. In these circumstances, the Ontario Succession Law Reform Act regulates how your property will be dispersed to your surviving loved ones. Even if you desire your assets split according to Ontario legislation, you need to still have a will because it will certainly minimize hold-ups and the costs involved in dealing with your affairs.

So the Succession Law Reform Act, R.S.O. 1990, c. S.26 will dictate things and that is what happens if you die without a will in Ontario.

Dying intestate…who does that?

“Intestate” is a legal term that means “without a will.” According to the National Association of Estate Planners, approximately 1 in 50 people in the USA die without a will. And many of those people are famous, including modern movie stars and other famous people. The following list includes some famous people who died intestate:

- Jimi Hendrix

- Bob Marley

- Sonny Bono

- Stieg Larson

- Pablo Picasso

- Adam Goldstein aka DJ AM (who?)

- Michael Jackson

- Steve McNair

- Howard Hughes

- Abraham Lincoln

How is an estate is distributed If you die without a will in Ontario?

When an individual passes away without a valid will, it is called intestate. Ontario’s Succession Law Reform Act (the Act) lays out how the estate is dispersed.

According to the Act, unless someone who is financially dependent on the dead person makes a claim, the initial $200,000 of value is given to the departed individual’s spouse if she or he has chosen to claim his/her privilege. This is called the preferential share. The other possibility is to declare half of the net family property under the Family Law Act (Ontario). A lawyer will be very helpful in helping the spouse decide which is the better choice.

Anything over $200,000 is shared between the spouse and the descendants (e.g. children, grandchildren) according to specific policies. If there is no partner, the departed person’s kids will acquire the estate. If any one of them has died, that child’s descendants (e.g. the dead individual’s grandchildren) will inherit their share.

Assuming there are no legal challenges to rights to the property, this is what happens if you die without a will in Ontario. Where a spouse, children and grandchildren are involved, this is not a good place to leave them in.

What is a wife entitled to if her husband dies without a will?

Adding to what I just described, the Family Law Act defines a spouse as a married individual, and the term spouse in this family law legislation does not mean co-habiting parties or common-law spouses. Under this Act, a married spouse is entitled to get one-half of the amount through which the deceased person‘s net family assets exceed the net family assets of the surviving spouse.

This equalization payment makes certain that the spouse who is alive has the opportunity to share equally in any in the value of the assets that the couple made over their marriage. As I previously stated, the surviving spouse should elect to accept this payment OR to take what they are entitled to under the Act.

Under Ontario family law, assuming the surviving spouse does not own the matrimonial home outright or as a joint tenant with the deceased spouse, the family law statute in Ontario gives the surviving spouse certain rights. In that case, that spouse also has the right to continue to be in the matrimonial home for a period of 60 days following the death of their spouse, on a rent-free basis.

So as you can tell, there will be a lot of pain and uncertainty to the surviving spouse and that is what happens if you die without a will in Ontario.

Who will be in charge of my Estate?

Someone, such as a close loved one, will need to apply the court to be designated as the estate trustee without a will (Estate Trustee). The Estate Trustee has the exact same tasks as an executor, the only difference is that the Estate Trustee can’t start to act until the court gives permission. This can take a while, such as a busy court in the city of Toronto. As well as if nobody steps up, then the court will certainly have to designate a public trustee.

Once the Estate Trustee is appointed, they can then apply for probate in Ontario. Probate is a process to ask the court to:

- Provide a person with the authority to serve as the Estate Trustee of an estate.

- Or validate the authority of a person called the Estate Trustee in the deceased’s will.

- Formally accept that the deceased’s will as their legitimate last will

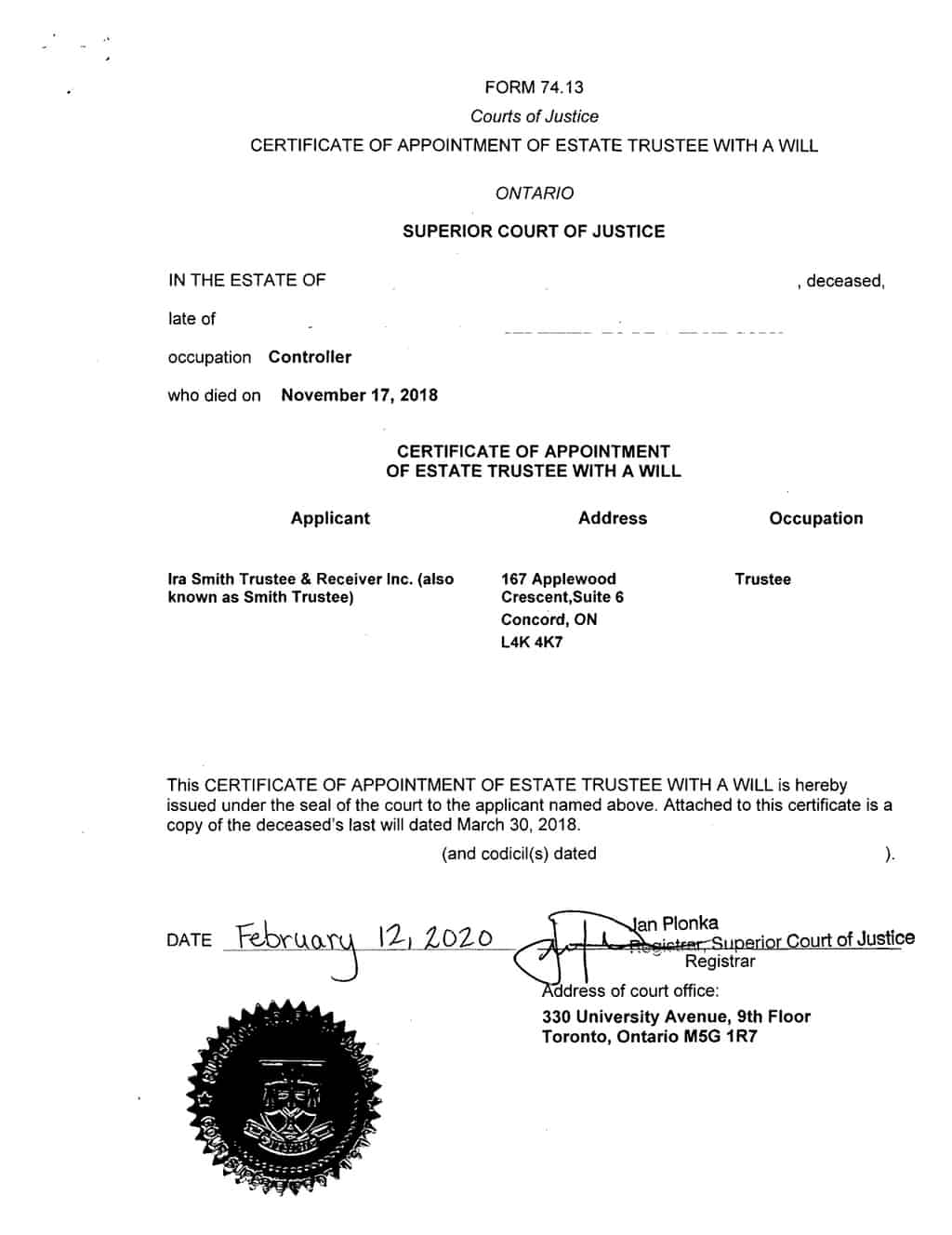

The court then issues a Certificate of Appointment of Estate Trustee With A Will when there is a will. As I mentioned above, if the person dies intestate, then the court issues the Certificate of Appointment of Estate Trustee Without A Will.

Here is a picture of what a Certificate looks like. It is redacted from one of our Estate Trustee files where the original Estate Trustees named in the will renounced their role:

With the Certificate, the Estate Trustee can prove to anyone of his or her authority. This is especially important because that is the document all banks look for before handing over money from the deceased’s bank accounts to the Estate Trustee. In the case of someone dying intestate, the appointing court order will serve as proof until the court then issues the Certificate.

Ira Smith Trustee & Receiver Inc. accepts assignments in acting as an Estate Trustee. The skills needed are very similar to ones we already have in acting as a licensed insolvency trustee. We do our Estate Trustee assignments under the name Smith Estate Trustee Ontario.

Having a will certainly enables a person to start acting on your behalf instantly after you pass away. If not, this is what happens when you die without a will in Ontario.

Duties of the Estate Trustee

As Estate Trustee we determine and locate all of the assets of the deceased. We must also identify all of his or her liabilities also. We need to make sure that funeral arrangements have been made and that the funeral costs and any other funeral expenses have been paid. We must understand the true nature of the assets and their market value. The administration of wills and estates (unless otherwise directed in a will) dictates that we must then sell them.

The Estate Trustee also needs to prepare all necessary income tax returns, pay all taxes owing as well as other debts. If there need to be any investigations, or if the estate is involved in litigation, the Estate Trustee must complete and manage those processes also.

The balance of funds left over after settlement of the liabilities and payment of all expenses, including those of the Estate Trustee and its legal counsel, creates the assets readily available for distribution from the estate. The Estate Trustee is a fiduciary and must perform the duties impartially. The Estate Trustee is also personally liable if any mistakes are made which causes one or more parties to suffer damages.

The duties and responsibilities of the Estate Trustee do not change whether or not there is a will. Without a will, what happens if you die without a will in Ontario is that you have lost the choice to appoint who you think will do the best job for your estate.

What happens to your property if you die without a will in Ontario?

Lots of people erroneously believe that the government takes the property from the deceased’s estate if you die without a will. Relax, that is not what happens if you die without a will in Ontario.

While of course, it is always better to have a will to direct what ought to take place to your assets after death, the law attempts to equitably distribute the assets of the deceased amongst the deceased’s spouse, children or grandchildren, as I have already described and further described below.

Who will get my Estate?

Without a will, you cannot pick who you’d like to receive the benefit of your estate. You can’t leave money to a charity you appreciate, you cannot leave any gifts to close friends and also you cannot allot money to cover the expense of taking care of your furry relative. Your estate will be dispersed using the provincial regulations that I already described. They have really little versatility and this is exactly what happens when you die without a will in Ontario.

What do children get when a parent dies without a will?

As already gone over, the Act sets up a scheme to divide the estate of a person who passes away without a will. If the deceased had assets worth less than $200,000 at the time of their death, their spouse will be entitled to the entire estate.

If the assets of the deceased are worth more than $200,000, after that preferred share amount (and the payment of all expenses of the estate), the remainder of the estate will be split as shown in the following examples:

- The deceased had a spouse and an only child. They each will get 50% of the rest of the estate.

- If the deceased had a spouse and more than one child, then you need to add up the total number of people. So, if there were three children, then, including the spouse, there are 4 people. The spouse and each child will get a 1/4 equal share of the remainder of the estate.

Under an intestacy, children have rights to both property and if applicable, support under the Act. However what occurs if an estate is worth $200,000.00 or much less and the children are entitled to support? The legislation of intestacy recommends that all the money goes to the spouse of the deceased to go towards the preferential share.

If required, the minor children, or their guardian, can bring a court application against the estate for assistance due to the fact that the children are specified as dependants under the Act. The child or children are primarily claiming, my deceased mom or dad had a legal commitment to support me at the time of his/her fatality. I still require to be supported. The court under those instances may access the assets of the estate, and various other assets such as insurance coverage or assets owned jointly with the deceased’s spouse, to fund an order for the support of those dependent children.

As you can see, what happens if you die without a will in Ontario can be very troubling for your loved ones, especially dependent children who do not deserve those problems. This alone should be a great reason for you to not hold of any longer in having an up to date will.

Who will take care of your dependent children?

If the dependent children don’t have another parent, the court will select a guardian for them. The guardian acquires all of the legal rights as well as the responsibilities of a mom or dad. There is no guarantee that the guardian will be the individual you think will certainly do it the best. The kids’ inheritance will be kept in trust until they reach the age of majority. This is what happens if you die without a will in Ontario.

What About Other Relatives?

If the deceased that died intestate leaves no spouse or kids living at the date of their death, then their estate is split between their parents. If they have no parents, it is then split among their brothers and sisters. If they have no brothers or sisters surviving them, it is shared amongst their nieces and nephews who are blood-related. If they have no blood-related nieces or nephews, after that it is dispersed amongst their next closest blood relative.

When an individual dies having no will and no blood relatives surviving them, only then will their net property end up being the property of the government. This is what happens if you die without a will in Ontario.

What happens to debt if you die?

I am regularly asked what happens to debt if you die, in addition to what happens if you die without a will in Ontario. I have written several blogs on the topic.

They are:

- WHAT HAPPENS TO DEBT WHEN YOU DIE CANADA: ARE YOU FREE OF DEBT

- WHAT HAPPENS TO MORTGAGE WHEN YOU DIE CANADA: DEBT PHILOSOPHY EXPLAINED

- CREDIT CARD DEBT AFTER DEATH IN CANADA: WHO IS RESPONSIBLE?

What happens if you die without a will in Ontario summary

I don’t know if the word “enjoyed” is appropriate for this topic. So, I will say that I hope you found this what happens if you die without a will in Ontario Brandon’s blog informative.

Our mix of empathy, experience and impartiality provides us with a distinct viewpoint and the capability to appropriately administer the estate, minimize problems and accomplish outcomes for all stakeholders in an economical way.

Professional and impartial Officer of the Court

- Acting as estate trustee

- Obtain probate in Ontario

- Asset management

- Investigation and valuation

- Monetization of assets

- Trust accounting

- Beneficiary reporting and distribution

- Taking care of what happens if you die without a will in Ontario

Estate Trustee Under Litigation

- Professional and impartial Officer of the Court

- Asset investigation, valuation and safeguarding

- Trust accounting

- Reporting to the Court and all stakeholders

- Protecting assets

- Experienced as Officer of the Court if estate trustee has conflict – perceived or real

- Minimize costs

- Stakeholder strategies

Insolvency

- Planning and strategy to safeguard assets

- Restructuring and Turnaround

- Acting as Trustee of an insolvent estate

We provide a full range of services to provide solutions for the complex Estate issues to end the pain and frustration the stakeholders are experiencing. We apply our expertise and creative thinking to take care of all details to end your pain and achieve the goals of the beneficiaries and other stakeholders. Contact Smith Estate Trustee Ontario today for your free consultation.

Get our free full-scale analysis of your issues and our recommended options to solve your problems allowing you to move forward confidently. Check out our website by clicking here. All our details are there.

We hope that you and your family remain safe and healthy during this COVID-19 pandemic. The Ira Smith Team is fully operational. Both Ira and Brandon Smith are available to answer any questions you may have, for consultations or meetings. We are available by telephone, email or video meeting. Feel free to contact us.