We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

probate ontario

Afer reading this blog, also check out our Brandon Blog

What is Probate Ontario?

Yes, you just found a blog site on the topic of wills and probate Ontario. It is a complex legal treatment that is typically not totally comprehended by lots of people. It is usually a requirement of the passing away of an individual. It is the start of certain actions to ensure the deceased’s wishes are performed.

In July 2019, we set up a companion business to our insolvency Firm. This new business is acting as an Estate Trustee. It is called Smith Estate Trustee Ontario. As we are asked many times about the intersection of death and debts and have acted as the licensed insolvency trustee in the bankruptcy of an insolvent deceased estate, I thought it would be a chance to write about deceased estate matters, including probate Ontario.

It is important to understand that the choice of and the actions of the Estate Trustee (previously known as the executor or executrix) will certainly make all the difference in exactly how the probate process will go. An excellent Estate Trustee will be able to help you comprehend the entire process. The Estate Trustee is the person in charge of seeing to it that whatever needs to be done pertaining to the estate, its property, and the distribution to the estate beneficiaries are all done properly.

Probate is a legal process that comes after the death of an individual that has left a legitimate will. It is used to accomplish the directions laid out in the will. It starts with the death of the testator and finishes when the Estate Trustee of the will certainly disperse the estate to the beneficiaries as stipulated in the will. If there is no will, various rules apply. If a person dies without a will, it is said that they have died “intestate“.

In this Brandon Blog, I go over many of the matters involved in taking the estate to probate Ontario.

What assets are subject to probate Ontario?

Property that is bequeathed to people in a will may have to go through the application for probate Ontario. It normally includes cash, land, as well as other physical possessions. The probate process involves the Estate Trustee named in the will, seeking the court to:

- give that person (or group of individuals) the authority to act as the Estate Trustee of an estate; or

- validate the authority of an individual named as the Estate Trustee in the deceased’s will;

- officially authorize that the deceased’s will is their legitimate last will.

This individual, or group of people if greater than one is named in the will, is accountable for administering the estate as well as ensuring that the wishes and directions that are written in the will are accomplished as the dead person meant them to be.

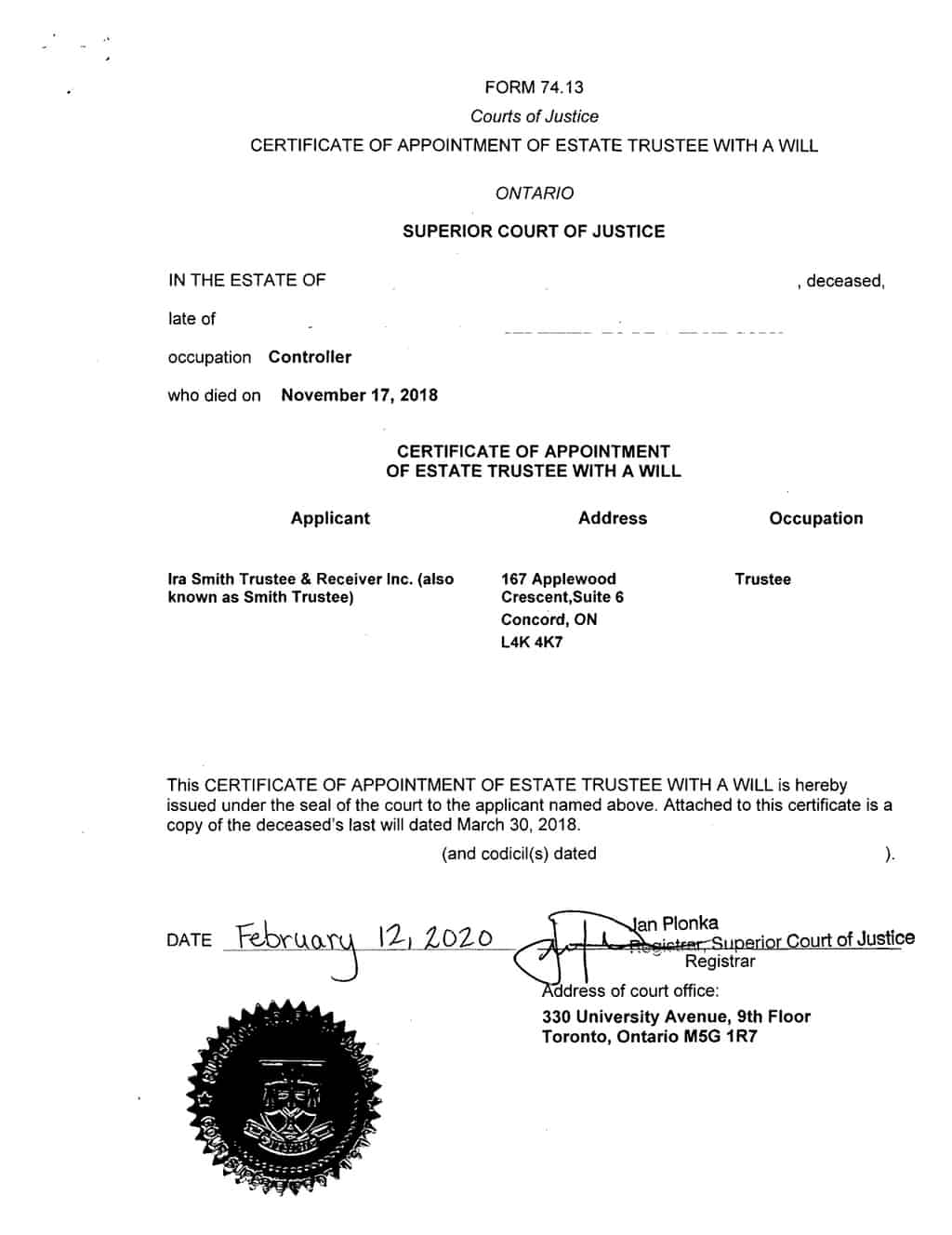

Probate Ontario: What is a Certificate of Appointment of Estate Trustee?

If you’ve ever read the official documents of a deceased’s estate, you’ve probably heard the phrase “Certificate of Appointment of Estate Trustee“. As well if you’re like most people, the term may have appeared a little mystical and confusing. However, for those of us who are managing an estate as an executor or administrator, a Certificate of Appointment of Estate Trustee is a necessary part of the probate process.

A Certificate of Appointment of Estate Trustee is a paper that is issued by the Government of Ontario and provided to the assigned Estate Trustee to prove that the individual has actually been selected to the function of the Estate Trustee. It shows that he or she has the legal authority to deal on behalf of the estate.

The certificate is not a legal necessity in the province; it’s simply a document provided by the government that verifies that the individual called the Estate Trustee has actually been assigned. It makes things a great deal easier when verifying to financial institutions and also other third parties that you have the authority to act concerning the estate property. To acquire the certificate, you need to provide the provincial government with a certified copy of the death certificate as well as a duplicate copy of the will.

If there is no will, the court will issue an order upon the probate application of an interested party approving the choice of Estate Trustee. This would certainly be in addition to any other death court forms the province needs the Estate Trustee to submit for probate Ontario.

Probate Ontario: What does an estate trustee have to disclose to beneficiaries?

A well-written will is the cornerstone of proper estate administration. The Estate Trustee is the one who oversees the distribution of the estate. In his/her function, the person in charge of the estate must manage a number of legal and financial issues. The Estate Trustee should be neutral and act in an impartial way to all stakeholders, especially the beneficiaries.

The Estate Trustee is well advised to report on a regular basis, preferably in writing, to the beneficiaries to ensure that they will be up to date on all issues of significance. For instance, beneficiaries need to understand the extent of the estate’s debts. They also must be told of any kind of litigation the estate is or might about to be associated with. This is specifically so if that implies a loss of value of the assets to reduce the estate’s worth. Nothing good will come from surprising the beneficiaries. Especially if it is bad news about a reduction of value in what they expected from the estate.

Probate Ontario: What is this Estate Information Return?

Typically, any individual who gets a Certificate of Appointment of Estate Trustee (likewise referred to as an Estate Certificate or Probate) after January 1, 2015, is required to file an estate information return.

This return is to be completed in addition to an application for a Certificate of Appointment of Estate Trustee submitted to the Courthouse (Ministry of the Attorney General). It will be used by the Ministry of Finance to impose compliance with the Ontario Estate Administration Tax Act, 1998. This return should be filed with the Ministry of Finance within 180 calendar days after the appointment certificate is issued to deal with the provincial estate tax owing.

If not all the estate tax issues are solved within the 180 day period, an amended return can always be filed later. The estate trustee would either pay any additional tax owing or request a refund of any overpayment. The estate administration tax estate administration matters must be taken care of in the administration of any estate.

What are the ways to avoid probate Ontario for an estate?

To avoid probate Ontario, you need to ensure for your assets that can avoid probate, are either owned jointly with the person or individuals you wish to inherit them, or are named as a designated beneficiary.

The most reliable preparation strategy to employ prior to death to minimize probate tax is making use of “twin wills“. This is where assets that require probate pass under one will, and other property that regularly do not call for probate (such as the shares of a family-owned private company) pass under a separate will.

Properties that can be omitted from probate Ontario are:

- Jointly held assets with a right of survivorship.

- RRSPs, RRIFs, TFSAs with a named beneficiary apart from ‘Estate’.

- The life insurance policy proceeds paid to a named recipient besides ‘Estate’.

- Real property owned outside of Ontario.

- Gifts to people made throughout your life.

How long does probate take in Ontario?

How long probate will take for probate Ontario varies depending on where in the province the departed person lived and exactly how complex the will and the estate is. In Ontario, and specifically in the Toronto area as a result of how backed up the courts are, it can take numerous months just to obtain the Certificate of Appointment. The procedure starts after the Estate Trustee files the request for probate with the court in Ontario.

Probate Ontario: How does my estate (assets) get transferred after I die?

As you age it’s essential to prepare for what will certainly take place in your estate after you die. When you have children and grandchildren, it is specifically important to set up a will or living trust. Without one, your assets (residence, automobile, and also financial savings) will require to pass through the court system, which might be costly and also take a long time. The court system is likewise raging with possible issues, such as opposed wills, family arguments, and unintentional disinheritance.

If you have a will, your assets will get distributed to your beneficiaries by the Estate Trustee according to your wishes, barring any type of court challenge.

What happens if someone dies without a will in Ontario

When an individual dies without a legitimate will, it is called intestate. Ontario’s Succession Law Reform Act (the Act) lays out exactly how the estate assets are distributed.

According to the Act, unless a person that is financially dependent on the dead individual makes a claim, the first $200,000 of value is given to the departed individual’s spouse if she or he has chosen to claim his/her entitlement. This is called the preferential share. The other possibility is to claim half of the net family assets under the Family Law Act (Ontario). Lawyers will be really handy in helping the spouse choose which is the better selection.

Anything over $200,000 is shared between the spouse and the offspring (e.g. children, grandchildren) according to particular policies. If there is no partner, the departed individual’s children will certainly acquire the estate. If any among them has actually died, that youngster’s offspring (e.g. the dead individual’s grandchildren) will inherit their share.

Assuming there are no lawful challenges to rights to the property, this is what occurs if you pass away without a will in Ontario. Where there are a spouse, children, and grandchildren, this is not a good place to leave them in.

Probate Ontario: Do I have to file taxes for the deceased?

We are often asked the question, “Do I have to file taxes for the deceased?” Your loved one has passed away and now you are trying to settle their estate, and you wonder about the taxes. Let’s start with the basics of what taxes you may owe for the estate of your loved one.

When a person dies, the estate has to pay several types of taxes. The first is the amount of estate administration taxes calculated on the Estate Information Return. The Estate Administration Tax is billed on the value of the estate of a departed person if an estate certificate is requested and is provided. The estate tax obligation is paid as a deposit when looking for an estate certificate from the Ontario Superior Court of Justice. Once the estate certificate is released, that deposit comes to be the estate administration tax.

The estate administration tax is paid on the value of the assets in the estate. The return provides for an estate administration tax calculator on the form. So, it is a pretty easy thing to calculate. If an estate certificate is neither gotten nor issued, no Estate Administration Tax applies.

The second is income taxes. If the deceased has any years for which an income tax return was not filed, the Estate Trustee must gather up the pertinent information and file those returns from prior years. Then, there is the income tax return for the year of death. That is called the terminal return. Finally, the Estate Trustee has to make sure that any tax arising out of the sale of assets of the estate are also accounted for and any income tax paid.

The Estate Trustee must make sure that all outstanding amounts, be it to the Province of Ontario or to Canada Revenue Agency are fully paid. Ideally, the Estate Trustee should also request and receive from Canada Revenue Agency a clearance certificate. This certificate shows that all amounts owing have been paid. It is important for both the personal liability of the Estate Trustee and for the estate to have this clearance.

In Ontario, there is no such thing as a death tax.

Probate Ontario: If your parents die with debt who pays it in Canada?

Generally, nobody can inherit debt. But there are exceptions.

In general, what happens to debt when you die in Canada is that the Estate Trustee needs to understand all of the deceased’s assets and liabilities. The Estate Trustee needs to make sure that all debts are paid off before making any distribution to the beneficiaries. Unless you have co-signed for or guaranteed someone else’s loan, you are not responsible for your spouse’s or parent’s debts upon their death. There are generally three exceptions.

The first is credit card debt where usually a spouse has a supplementary credit card on the same account. In that case, you need to look at the credit card agreement because the supplementary cardholder might be responsible for the debt. So if there are insufficient assets in the estate to pay off the credit card debt, the supplementary cardholder is liable.

The second way is through being entitled to inherit an asset, such as real property or a vehicle. That asset may have financing registered against it; a mortgage or a vehicle financing loan. If you accept the asset, then you must also be responsible to make the payments for interest and principal. If the secured loan is not kept current, the lender has the ability to seize the asset and sell it as part of their enforcement rights.

The third example is Canada Revenue Agency for unpaid income tax. Section 160(1) of the Income Tax Act (R.S.C., 1985, c. 1 (5th Supp.)) (Income Tax Act), and its equivalent, S. 325 of the Excise Tax Act (Canada), can be utilized by Canada Revenue Agency to assess a tax obligation liability to those who received a transfer of property from persons with tax obligations at the time of the transfer.

This deals with if a person offers you something of value (virtually anything), while they have a tax debt, Canada Revenue Agency can and will certainly pursue you. Their view is that the original tax obligation debtor ought to have sold whatever was transferred, and the funds used to pay off the tax debt.

This section of the Income Tax Act (or Excise Tax Act) especially comes into play during the administration of a deceased Estate or in an insolvency filing. As a matter of fact, if a deceased estate is insolvent, the Estate Trustee has the ability to get an order from the court allowing the Estate Trustee to place the deceased estate into bankruptcy. Then the licensed insolvency trustee will deal with selling assets and distributing the funds in priority of ranking, as established under the Bankruptcy and Insolvency Act (Canada).

My other probate Ontario blogs you might find interesting

I have written on a variety of matters regarding a deceased estate, debt and probate that you may find interesting. They are:

WILLS AND ESTATES: SELLING DECEASED ESTATE PROPERTY

FREE E-BOOK – TRUSTEE OF DECEASED ESTATE – WHAT A TORONTO BANKRUPTCY TRUSTEE KNOWS

TRUSTEE OF DECEASED ESTATE: WHAT A TORONTO BANKRUPTCY TRUSTEE KNOWS

WHAT HAPPENS IF YOU DIE WITHOUT A WILL IN ONTARIO? READ OUR INTENSE ANALYSIS

WHAT HAPPENS TO MORTGAGE WHEN YOU DIE CANADA: DEBT PHILOSOPHY EXPLAINED

WHAT HAPPENS TO DEBT WHEN YOU DIE CANADA: ARE YOU FREE OF DEBT

CREDIT CARD DEBT AFTER DEATH IN CANADA: WHO IS RESPONSIBLE?

DO YOU INHERIT DEBT IN CANADA: CRA SAYS YES TO PROPERTY TRANSFERS

TRUSTEE OF PARENTS ESTATE: DO I REALLY HAVE TO?

Probate Ontario summary

I hope you enjoyed the probate Ontario Brandon Blog post. If you are concerned because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option, call me. It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties while avoiding bankruptcy. We can get you the relief you need and so deserve.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost consultation.

We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now.

We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.