consumer proposal student loans

As the COVID-19 pandemic continues, we hope that you, your family, and your friends are safe, healthy, and secure. Ira Smith Trustee & Receiver Inc. is fully operational, and both Ira and Brandon Smith are readily available for phone or video consultations.

Consumer proposal student loans: Student Loans and Consumer Proposals

In the event of student loan debt, you may be able to eliminate certain student loans through a bankruptcy or consumer proposals. Student loans are given special treatment under the Bankruptcy and Insolvency Act (Canada) (BIA). The seven-year waiting period is a requirement for consumer proposals related to student loans (by the way, the concept is similar in personal bankruptcy).

Throughout this Brandon Blog, when I refer to student loans, I am referring to loans issued under the Canada Student Loans Act, the Canada Student Financial Assistance Act, or any provincial act that provides loans or guarantees for student loans.

I am not talking about any loan debt not meeting this definition. A private loan or a loan from a financial institution that is not covered by the above-noted legislation would be examples, including other loans taken out for professional training.

Consumer proposal student loans: Filing a consumer proposal for student loan debt

In previous posts, I discussed consumer proposals and how they can be used as an alternative to bankruptcy and as a means to negotiate repayment terms of your entire debt with creditors. Canada’s only federally authorized debt settlement program is the consumer proposal. Only licensed insolvency trustees (formerly called bankruptcy trustee) can administer consumer proposal student loans or for any other kind of debt. By using consumer proposals, you can negotiate away the majority or all of your debt in return for making monthly payments for a fraction of that amount and over an extended period of time, not exceeding five years, without incurring any interest. The seven-year rule affects consumer proposal student loans under the student loan legislation.

When you submit a consumer proposal, one of the major benefits is a stay of proceedings, just as in bankruptcy. You will no longer be subject to collection efforts including collection calls, legal action and wage garnishments. Private or financial institution loans taken out while you were a student, not covered by student loan legislation, may be eliminated under the BIA without regard to the seven-year rule. Private student loan debt such as a line of credit or credit card debt incurred while you were a student would be examples.

Consumer proposal student loans: Think of insolvency waiting periods like a clock with a start date and an end date

In either personal bankruptcy or consumer proposals, student debt is treated differently under government student loan legislation than normal ordinary unsecured consumer debt. The 7-year waiting period is a mandatory waiting period set by the BIA. This is why it is so important.

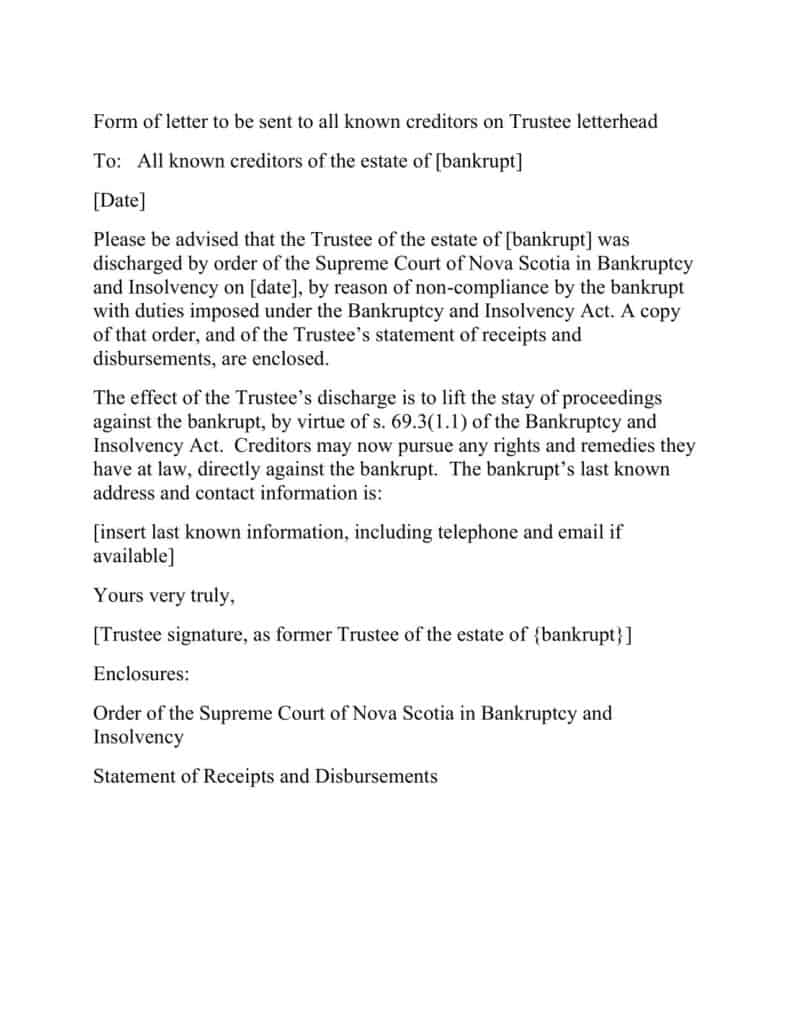

Student loan debt relief under section 178(1)(g) of the BIA is not available to people who have filed for bankruptcy or a consumer proposal and have not yet ceased to be a full-time or part-time student or who are within 7 years of ceasing to be a full- or part-time student.

A consumer proposal or personal bankruptcy can be filed by insolvents after they stop being full-time or part-time students more than seven years after ceasing to be students. In that case, the student loans debt can either be discharged by bankruptcy or by consumer proposals.

Counting the 7 years may also not be as straightforward as it sounds. In most cases, students take out a series of loans for each year of college or university. Do the 7-year counts take place on a loan-by-loan basis individually, or is it treated collectively? If in doubt, group them together.

The person must consider all three aspects of the calculation in order to do the calculation correctly:

- the date the personal bankruptcy or consumer proposal was filed;

- When the insolvent person ceased to be a student;

- After ceasing to be a full-time student or part-time student, the length of time the person must wait before a consumer proposal student loan compromises the debt or the loan is discharged through an absolute discharge from bankruptcy.

Consumer proposal student loans: Potential “Court-Ordered Discharge” under hardship provision where 5-year waiting period satisfied

Under section 178(1.1) of the BIA, there is a provision that only applies in bankruptcy. It does not apply for consumer proposal student loans. Since we are discussing student loan debt, I would be remiss if I did not mention it.

Under this section, the court can order that the 7-year waiting period does not apply to a bankrupt who has student loan debt under federal or provincial student loan legislation 5 years after ceasing to be a full-time or part-time student. It would then actually be only a five-year waiting period.

Only a five-year waiting period can be allowed by the court if these conditions are met:

- the bankrupt acted in good faith in connection with its student loan debt; and

- it is likely that the bankrupt will continue to face financial difficulties to such an extent that it is impossible for them to repay their student loan debts.

What does the compulsory waiting period entail? When should we choose between a 7-year and 5-year waiting period? The 7-year waiting period has already been discussed. In determining whether a bankrupt is entitled to the hardship reduction for the lower 5-Year waiting period, the court considers the following factors:

- How was the money used? For the purpose, it was borrowed for?

- Was the bankrupt honest in his or her attempt to complete the educational program?

- Has the bankrupt gained employment in an area directly related to his or her education?

- Did the bankrupt make reasonable efforts to make monthly payments or otherwise make student loan payments against the loan or did the bankrupt make an immediate assignment into bankruptcy?

- Are there any repayment assistance programs options for student loan debt relief that the bankrupt can take advantage of concerning the outstanding student loans, such as interest relief or loan forgiveness and has the bankrupt applied for such repayment assistance programs?

- Did the bankrupt overspend or behave irresponsibly with personal or family finances?

- When the loan applications were made, was the person’s disclosure about his or her circumstances fair and accurate?

The court decisions on obtaining financial hardship relief show that it is not easily obtained. A bankrupt normally have to show that they have exhausted all efforts, their financial hardship is not a result of their actions or inaction and that their financial situation cannot reasonably be expected to improve without the undue hardship relief.

Consumer proposal student loans: Paying Student Loans During Your Bankruptcy or Consumer Proposal

What if:

- Your financial circumstances are you have too many unsecured debts and your unsecured creditors are taking legal action against you?

- You have a history of rolling over payday loans and are deep in financial trouble.

- You have to go see one of the licensed insolvency trustees in your area and ultimately use one of the debt-relief tactics of bankruptcy or consumer proposal.

If you stopped being a student:

- 5 or 6 years ago but you know that you could not qualify for the financial hardship provision relief; or

- the last time you went to school was less than 5 years ago; and

- you need to start repaying your student loans.

To rebuild a solid foundation for a good financial future in such a situation, either bankruptcy or a consumer proposal would have to be filed. Despite the fact that you would not be able to eliminate or compromise your student loans, you would be able to escape the clutches of your otherwise crushing other unsecured debts.

In such a case, it may make sense to file for an insolvency process, even though you would be paying student loans during your bankruptcy or consumer proposal.

Consumer proposal student loans summary

I hope you found this consumer proposal student loans Brandon Blog informative. Are you or your company in financial distress and a debt crisis? Are you embroiled in costly litigation or a crushing debt load and need a time out in order to restructure? Do you not have adequate funds to pay your financial obligations as they come due? Are you worried about what will happen to you in retirement? Do you need to find out what your debt relief options and realistic debt relief solutions for your family debt are? Is your company in financial hot water?

Call the Ira Smith Team today. We have decades and generations of experience assisting people looking for life-changing debt solutions through a debt settlement plan and AVOID the bankruptcy process.

As licensed insolvency professionals, we are the only people accredited, acknowledged and supervised by the federal government to provide insolvency advice and to implement approaches to help you remain out of personal bankruptcy while eliminating your debts. A consumer proposal is a government-approved debt settlement plan to do that. It is an alternative to bankruptcy. We will help you decide on what is best for you between a consumer proposal vs bankruptcy.

Call the Ira Smith Team today so you can eliminate the stress, anxiety, and pain from your life that your financial problems have caused. With the one-of-a-kind roadmap, we develop just for you, we will immediately return you right into a healthy and balanced problem-free life.

You can have a no-cost analysis so we can help you fix your troubles.

Call the Ira Smith Team today. This will allow you to go back to a new healthy and balanced life, Starting Over Starting Now.

As the COVID-19 pandemic continues, we hope that you, your family, and your friends are safe, healthy, and secure. Ira Smith Trustee & Receiver Inc. is fully operational, and both Ira and Brandon Smith are readily available for phone or video consultations.