We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic. Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

What does bankruptcy discharged mean: Restrictions placed on undischarged bankrupts

By enabling debtors to file an assignment in bankruptcy or consumer proposal, the Bankruptcy and Insolvency Act (BIA) provides relief to an honest but unfortunate debtor. Garnishment of wages (other than marital support) ceases, legal actions and collection calls cease, and the debtor receives some breathing space. If a bankrupt fails to fulfill his or her obligations, what happens? Can they receive a discharge from bankruptcy?

This Brandon Blog examines a recent case from Nova Scotia dealing with what does bankruptcy discharged mean for both a bankrupt person and for the licensed insolvency trustee. I also describe what does it mean for an undischarged bankrupt if the bankruptcy trustee gets its discharge when the bankrupt person does not have their bankruptcy discharge.

I will eventually get to the Court case, but there is first some background information that I will provide which sets the stage for a better understanding of the Court decision.

What does it mean to be an undischarged bankrupt?

In the event, you were unable to fulfill your obligations under your personal bankruptcy proceedings, your Trustee, and maybe a creditor or two would have opposed your discharge from bankruptcy. A bankrupt who has not been discharged poses many potential problems. Therefore, if you are an undischarged bankrupt, it is because you have failed to fulfill one or more of your obligations as a bankrupt.

What does bankruptcy discharged mean: Debts eliminated by bankruptcy discharge

A bankruptcy discharge means that you have completed your personal bankruptcy process and are no longer legally liable for any outstanding debt you included in the bankruptcy filing (with the exception of a few which I will describe soon). Upon receiving an absolute discharge from bankruptcy (we’ll get to that shortly), you are no longer responsible for any discharged debts.

The discharge in bankruptcy eliminates most of your debts, including unsecured debts such as credit card bills, medical bills, and payday loans. When you are discharged from bankruptcy, not the fact that you filed for bankruptcy, is what eliminates your debts. You need your discharge to get rid of your debts, which explains why it’s so important. That is what does bankruptcy discharged mean, really means.

What does bankruptcy discharged mean: Bankruptcy law can resolve tax debts

As well as the usual unsecured debts mentioned above, if you owe Canada Revenue Agency (CRA) money because you were not able to pay your whole personal income tax obligation when you filed your taxes, then a payment arrangement makes sense.

Collections officers from the CRA contact taxpayers regarding outstanding income tax debt arising from their tax filings and notices of assessment. They attempt to collect from delinquent taxpayers. When you say that you cannot pay the full amount at that time, they will offer you the option of a payment arrangement. The interviewer will ask you about your financial situation and may ask you to submit documents to support your income and expense claims.

They recommend a settlement plan after evaluating the information. Only if all attempts at collection have failed will legal action be taken. You must send the CRA postdated cheques to cover the agreed-upon monthly payment to participate in such a plan. Additional payments can be made if you have money to spare. The interest clock does not stop with a CRA payment plan. Be certain that all your cheques clear the bank as well. The entire payment plan can be cancelled if only one is returned NSF.

Should you enter into a payment plan? Yes. You should demonstrate to CRA that you want to work with them, and avoid tax debt collection activities that will disrupt your life. The most common enforcement activity involves freezing and taking money from your bank accounts, as well as garnishing your salary or wages if you’re employed. If you are a proprietor, they can notify your customers and claim your receivables. Furthermore, a federal judgment can be obtained without your knowledge to place a lien on your home.

You do not need to experience CRA’s more drastic collection methods. Be sure to pay your obligations on time. A tax garnishment, third-party assessment, or an asset lien is never pleasant. The consequences are severe and disruptive. In most cases, CRA only takes this step if you fail to comply with their efforts to enter into and maintain a CRA payment arrangement.

CRA tax debts can be discharged under bankruptcy law if no payment plan can be arranged. If bankruptcy is successfully discharged or a consumer proposal is fully completed, the income tax debt can be eliminated. We assume that CRA hasn’t already obtained a judgment against your interest in your home and registered it against it. Upon doing so, the CRA has successfully turned an unsecured debt into secured debt, and bankruptcy law no longer applies.

Several other things to keep in mind are:

- A bankrupt who owes more than $200,000 in personal income taxes and whose personal income tax debt represents at least 75% of their total unsecured proven claims is considered a high-tax debtor. In this situation, you cannot be automatically discharged. It is unavoidable that the Trustee will object to your discharge and there will be a discharge hearing before the Bankruptcy Registrar in the Bankruptcy Courts. Additionally, the CRA will oppose your discharge and will make submissions at your hearing. I am certain you will receive a conditional discharge, at least with the condition that you pay a portion of your income tax debt to the Trustee for distribution among your creditors.

- Unremitted employee source deductions owed by a proprietor or partner of an unincorporated business will not be helped by bankruptcy law. Generally, bankruptcy will eliminate HST obligations. For now, CRA ranks the debt as unsecured in a consumer proposal, but as CRA provides the accommodation, it is not a part of bankruptcy law. If the outstanding HST is extremely large, the CRA may argue that since you held the HST in trust for them, it still remains a claim even if you declare bankruptcy. Under Canadian bankruptcy law, they can do this, but I have not seen them do it yet.

- Director liability for unremitted employee source deductions or HST is an unsecured claim against you for your personal liability as a Director. Bankruptcy and a properly worded Proposal will both eliminate that debt.

what does bankruptcy discharged mean

What does bankruptcy discharged mean: Debts never discharged in bankruptcy

In personal bankruptcy, there are certain types of debts that are not discharged. Section 178(1) of the BIA outlines the following debts that are nondischargeable debt:

- Any type of fine, penalty, restitution order, or other order similar to a fine, penalty or restitution order, imposed by a court for an offence, or any kind of debt arising from a recognizance or bond;

- Damages awarded by a court in a civil case for:

- bodily injury intentionally caused, or sexual assault, or

- wrongful death as a result of these acts;

- the payment of spousal support or an alimentary pension;

- any financial obligation or liability arising under a judgment establishing an association or regarding support, maintenance, or an agreement for maintenance and support of a spouse, former spouse, previous common-law partner, or child who is not living with the bankrupt;

- a financial obligation or liability that results from fraud, embezzlement, misappropriation or defalcation in a fiduciary capacity or, in the Province of Quebec, while acting as a trustee or administrator;

- apart from debts and responsibilities arising from equity claims, any debt or liability resulting from getting property or services by false pretenses or fraudulent misrepresentation;

- unless a creditor had notification or understanding of the bankruptcy and didn’t take reasonable action to prove a claim, the liability for the dividend that a creditor would have received on any provable claim not disclosed to the trustee; or

- student loans if the bankruptcy occurred before the bankrupt stopped being a full- or part-time student or within seven years of the date the bankrupt stopped being a full- or part-time student.

What does bankruptcy discharged mean: Absolute discharge vs. conditional discharge and so on and so forth

In order to obtain a discharge, a bankrupt person must have fulfilled all of their bankruptcy duties. These personal bankruptcy duties include:

- providing all books, records or documents to the Trustee that identify the assets and liabilities of the debtor;

- prepare and submit to the Trustee within 5 days after filing for personal bankruptcy, unless the Office of the Superintendent of Bankruptcy Canada extends the time, a sworn statement of affairs detailing the person’s assets and liabilities, and for each of the bankrupt’s creditors, their respective names, addresses and the amount owing;

- disclose to the Trustee complete details of all dispositions of property within 1 year before the date of the bankruptcy;

- make a disclosure to the Trustee of all the details of property disposed of by gift or settlement without adequate valuable consideration within a 5 year time period before the date of bankruptcy;

- if a creditors’ meeting is called, attending it;

- making any required surplus income payments to the Trustee;

- participating in two mandatory financial counselling sessions; and

- offering whatever assistance is requested by the Trustee.

If the bankrupt fulfill all of their duties, then the Trustee will not have a reason to oppose the discharge. If no creditor opposes, then the bankrupt is entitled to an absolute discharge. As already stated, the discharge is what eliminates unsecured debts.

In addition to an absolute discharge, there are other types of discharge under bankruptcy law available to a bankrupt person upon having a discharge hearing:

- conditional discharge;

- suspended discharge; and

- refused discharge.

To read more on the different kinds of discharges available to be applied to a bankrupt person, and for what does bankruptcy discharged mean, take a look at my August 2021 Brandon Blog “A BANKRUPTCY DISCHARGED IS THE KEY TO HEARTWARMING DEBT ELIMINAT1ON“.

What does bankruptcy discharged mean: At long last, the Nova Scotia case

The Nova Scotia bankruptcy case deals with the discharge of the Trustee in a personal bankruptcy matter. Once the Trustee brings on the bankrupt’s application for discharge and a discharge Order is made by the Court, and the Trustee completes the rest of the administration of the bankruptcy estate, the Trustee is entitled to a discharge. If the bankrupt did not receive an absolute discharge and has not completed his or her duties, including complying with a conditional discharge order, eventually, the Trustee can still apply for its discharge. Upon the Trustee’s discharge two things occur:

The bankrupt goes into bankruptcy purgatory. No discharge occurs. The Trustee has fulfilled its obligation to present the bankrupt’s discharge request to the court and the court has issued an Order. Whenever the bankrupt wants to prove they have fulfilled all their obligations, obeyed the discharge order, and now deserve an absolute discharge, he or she will need to retain a bankruptcy lawyer and apply to the Bankruptcy Courts.

On the day the Trustee is discharged, the stay of proceedings that had protected the bankrupt from any enforcement action by creditors whose debts were owed at the date of bankruptcy no longer applies. As a result, creditors can now pursue the bankrupt person since the debts have not been eliminated and the stay of proceedings is no longer in place.

It is interesting to examine how far the Registrar in Bankruptcy directed the Trustee in this Nova Scotia bankruptcy case to ensure that all creditors understood that they still had the right to pursue the bankrupt.

The decision in Frost (Re), 2021 NSSC 296 can be boiled down to the following facts:

- Mr. Frost went bankrupt.

- He failed to fulfill his duties and moved to the UK permanently.

- He didn’t inform the Trustee of his new address and telephone number.

- His actions left his Trustee and other stakeholders to fend for themselves, explicitly telling the Trustee he wasn’t going to fulfill those duties and didn’t intend to do so.

- A hearing was held for the bankrupt’s discharge and Mr. Frost was refused discharge.

- The Court previously directed the Trustee to appear before it to be heard on the Trustee’s application for discharge.

The Court concluded that the Trustee completed the administration of the bankruptcy estate and gave the Trustee its discharge. However, the reason why the Registrar in Bankruptcy wanted the Trustee to attend such a hearing was so the Registrar could take things one step further. In the normal course, the Trustee sends out a notice to all those whose proof of claim was admitted of the results of the bankruptcy administration and of the Trustee’s discharge. However, the Registrar wanted to make sure that it was crystal clear to all creditors.

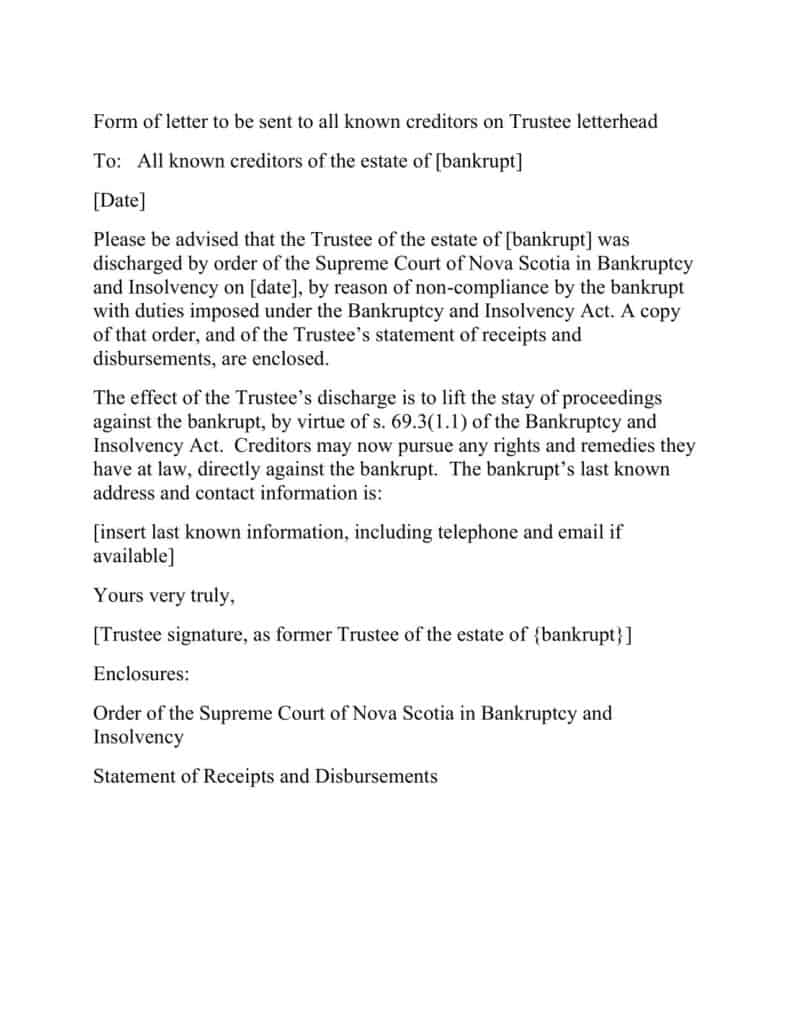

The Registrar wrote a cover letter for the Trustee and directed the Trustee to send it along with the normal statutory notice to creditors (or their debt collectors of record). Here is a copy of that letter:

What does bankruptcy discharged mean summary

I hope you found this what does bankruptcy discharged mean Brandon Blog post informative. Are you worried because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option? If it is too much debt for any reason, call me. It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties while avoiding bankruptcy. We can get you the relief you need and so deserve.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost consultation.

We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic. Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.