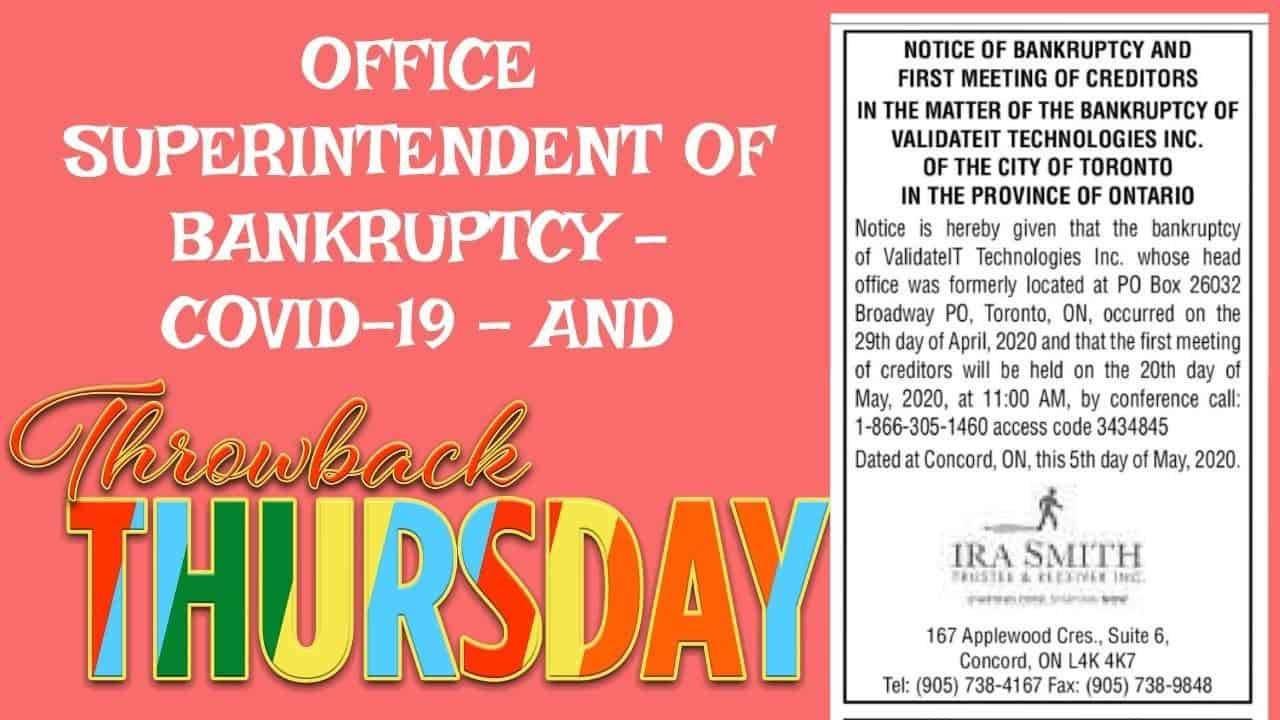

The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

[monkeytools msnip=”https://monkeyplayr.com/playr.php?u=5173&p=22327″]

Bankruptcy means introduction

From my perspective, bankruptcy means that a person or company has either filed an assignment in bankruptcy or the court has issued a bankruptcy order against the debtor. The debtor has taken the voluntary action to seek relief and the benefits obtained by doing so under the Bankruptcy and Insolvency Act (Canada) (BIA). Or a court, based on the application of one or more creditors, has ordered that the BIA applies and the debtor is adjudged bankrupt.

As I have written in the past, this is different from insolvency. Insolvency is the financial state where a company or person cannot meet their liabilities as they come due or whose assets, if sold at fair value, would not be enough to pay off all of the liabilities. Bankruptcy is a legal state.

I recently read an article about Mr. Stanley Frank Ostrowski aka Frank Ostrowski, who lives in Winnipeg, Manitoba. Mr. Ostrowski filed an assignment in bankruptcy on February 12, 2019. He listed his assets having a value of $250. He stated that his liabilities were $259,621. This is his second bankruptcy. His first was in 1983 and he received an absolute discharge in 1985.

The article states that Mr. Ostrowski has now made an application to the court to annul his bankruptcy. This Brandon’s Blog looks at: Is it possible to annul a bankruptcy and under what circumstances? Put another way, is it really the case that bankruptcy means you can file for bankruptcy and then say oops, I didn’t really want to file? I am not really sure that is how bankruptcies work.

The reasons why Mr. Ostrowski thinks bankruptcy means it can be annulled

In May 1987, a jury decided that Mr. Ostrowski was guilty of first-degree murder. In March 1992, he was found guilty of possession of cocaine for the purposes of trafficking. He was sentenced to 15 years in prison, concurrent with his life sentence for murder.

He served 23 years, 2 months and 24 days in prison. He got out of jail on December 18, 2009. In 2014, then federal justice minister Peter MacKay asked Manitoba’s Court of Appeal to review the case. Then justice minister MacKay believed that there was a miscarriage of justice with respect to the murder conviction.

In a November 2018 decision, the Court of Appeal set aside the conviction after it discovered a miscarriage of justice took place when two vital details were not revealed to the defence or the court. While the court set aside his conviction, it did not acquit him. In their decision, the three-judge panel said they thought there was enough proof against the accused, which the court could have found him guilty even if full disclosure had been made.

The court also held that it would be unfair to have another trial given that it had been 32 years since the shooting. The court also entered a judicial finding that the charge is stayed from further prosecution.

In June 2020, Mr. Ostrowski retained legal counsel to commence an action for damages because of his wrongful conviction. His lawyers have not yet launched the claim but they plan to. The article said that he will be seeking $16 million in compensation.

Now he wants to have his 2019 bankruptcy annulled. He believes he has a realistic chance of receiving sufficient compensation to be able to settle all his debts. So with all this background information, do I think his bankruptcy means that he can get his bankruptcy annulled?

Bankruptcy means: what happens if I declare bankruptcy?

I have written before about what happens when a person or company declares bankruptcy. There is a responsibility to make full disclosure to the licensed insolvency trustee (formerly called a bankruptcy trustee) (Trustee) all of your assets, liabilities, income and expenses. The debtor also must give to the Trustee all provincially non-exempt assets so that the Trustee can sell them for the benefit of the creditors.

In his bankruptcy filing documents, Mr. Ostrowski did not make mention of this potential lawsuit that had not yet been launched. He also did not indicate that he had the right to such an asset. If he had, there would be two realistic options.

He could have taken the position that the amount of recovery in a lawsuit not yet launched is unknown and speculative. So, the action should only be valued at $1 as a placeholder. By doing so, he would have made full disclosure to his creditors and to his Trustee as to the existence of this potential asset.

If Mr. Ostrowski had disclosed this asset and valued it at more than $259,371, then he would not have met the asset test for being insolvent and potentially would not have been able to file for bankruptcy. I say potentially because, in his affidavit, Mr. Ostrowski makes no mention of what his income and expenses were at the time of filing for bankruptcy or now. Mr. Ostrowski does not disclose in his affidavit whether or not he has to pay any surplus income to his Trustee for the benefit of his creditors.

Can bankruptcy be annulled?

Annulling a bankruptcy is more than just cancelling a bankruptcy. It is erasing it to the point as if it never happened. It is a complete elimination of the bankruptcy. If it was the person’s first bankruptcy, and it was annulled, they could honestly say they never were bankrupt.

To figure out what are the odds that Mr. Ostrowski will be successful in his application to annul his bankruptcy, we need to look at several factors. First, what reasons does Mr. Ostrowski say are the basis as to why his bankruptcy should be annulled?

In his affidavit sworn June 8, 2020, the reasons he gives are:

- “I have a realistic chance of receiving sufficient compensation to be able to settle my debts with my creditors in a manner that would be more advantageous to the creditors than if I pursue bankruptcy.”

- “I am advised by…” my lawyer “…that when he advised…” my Trustee, “… of my intention to seek an order annulling my assignment in bankruptcy…” my Trustee “…did not object to it.”.

That is it. No other reasons. To Mr. Ostrowski, his bankruptcy means that maybe perhaps he can do better for his creditors than they would get in his bankruptcy and his Trustee doesn’t object to his trying to annul his bankruptcy.

With all due respect to his legal counsel on this bankruptcy annulment application who only has what he has to work with, I rate those reasons somewhere between weak and lame! The bankruptcy annulment process was not designed for the convenience of the bankrupt.

Bankruptcy means when will a court annul a bankruptcy?

First, Section 181(1) of the BIA gives the court the authority to annul a bankruptcy. It says:

“181 (1) If, in the opinion of the court, a bankruptcy order ought not to have been made or an assignment ought not to have been filed, the court may by order annul the bankruptcy.”

This authority is discretionary. Generally, the court will only annul an assignment if it is shown that:

- The debtor was not insolvent at the time of filing.

- It was an abuse of process of the court

- The debtor was trying to commit a fraud on his or her creditors.

If Mr. Ostrowski’s affidavit is the only evidence submitted in his application to annul his bankruptcy, he has not shown that the bankruptcy assignment “ought not to have been filed”.

Second, there have been cases where an assignment in bankruptcy has been annulled. The list of general reasons why the court found that a bankruptcy order ought not to have been made or an assignment ought not to have been filed are:

- An assignment in bankruptcy was completed and was to be held in escrow while the debtor negotiated with his creditors. The assignment was only to be filed if a resolution could not be worked out. A deal was reached but the assignment was filed in error. In other words, a verifiable mistake.

- The bankruptcy was of no benefit to the creditors. The creditors would receive a distribution but would bear all the costs of the bankruptcy administration.

- The debtor was restrained by court order from dealing with all of his assets without giving his estranged wife seven clear days’ notice and he filed an assignment in bankruptcy with no notice given.

- Joint assignment by a husband and wife where it was evident that a large amount of debt was from the husband’s unincorporated business and the wife was not in partnership with him.

- A bankruptcy assignment purportedly filed by an infant!

- The second assignment filed before the bankrupt received a discharge from the 1st bankruptcy.

- The husband filing an assignment in bankruptcy in an attempt to disgorge himself of his assets while embroiled in bitter family law proceedings.

- Directors of a company whose assets were already being administered under a court-appointed receiver having filed an assignment in bankruptcy for the company.

In all the above situations, the court DID annul the bankruptcy. The court did not agree that bankruptcy means it was the right choice in those situations.

Bankruptcy means when will a court NOT annul a bankruptcy?

Third, there have been cases where an assignment in bankruptcy was NOT annulled. The list of general reasons why the court found refusing the annulment request was appropriate are:

- The sole purpose of the bankruptcy was to rearrange the priorities of certain creditors.

- A bankruptcy to defeat the enforcement attempts of a judgment creditor.

- The sworn statement of affairs failed to show the name and amount of a creditor.

- The debtor had no assets.

- Debtor was insolvent and did not bring an application to annul the bankruptcy until 4 months after filing an assignment in bankruptcy. The court decided that an application to annul a bankruptcy only because the debtor did not wish to continue with the bankruptcy process should be brought immediately after the filing of the assignment in bankruptcy.

The last reason why the court did not annul a bankruptcy, is pretty much the reason Mr. Ostrowski says he wants his bankruptcy annulled. Only in his case, he is bringing the application some 18 months after becoming a bankrupt.

Interestingly enough, that last reason was a Manitoba case, Baker (Bankrupt), Re, 1997 CanLII 23100 (MB QB). In that case, the bankrupt contended that the Trustee filed the bankruptcy documents with the Office of the Superintendent of Bankruptcy in error. However, she waited for 4 months and the court was not persuaded that the filing was an error!

In Mr. Ostrowski’s case, his reasons boil down to it will be more convenient for him! As you can probably tell by now, I don’t place a high probability of his chances of success in persuading the court to annul his bankruptcy. But then I am not the judge.

Bankruptcy means what should Mr. Ostrowski do?

The answer as to what his bankruptcy means and what Frank Ostrowski should do lies within the BIA. Mr. Ostrowski has two choices and I believe it will be what the court decides.

First, the BIA allows for a bankrupt, with the permission of the inspectors in his bankruptcy, if any, to file a restructuring proposal. He could get that started right now without any court application.

If his debts are truly over $250,000, based on the claims filed to date, then he can file a proposal under part III division I proposal under the BIA. If the claims filed are a total under $250,000, then he could file a consumer proposal. Either way, the administration would continue under the BIA.

His proposal would be a very simple one. It would essentially say that he has a claim against several parties for what his lawyer believes is $16 million. He knows he will get at least enough to pay all of his creditors in full. So, if you vote in favour of my proposal, if I win, enough money will be paid to the Trustee to pay all the creditors in full. If I don’t win, or there isn’t enough money to pay everyone in full, all creditors will share in whatever is available.

Once the restructuring proposal is accepted by his creditors and approved by the court, his bankruptcy is annulled. He will get exactly what he is asking for. His creditors will get paid presumably in full. They will not just get the chance to have their debts settled as Mr. Ostrowski states in his affidavit.

Second, section 144 of the BIA says that the bankrupt is entitled to any surplus remaining after payment of all creditor claims in full, with interest, and the cost of the bankruptcy administration. So, if Mr. Ostrowski is successful and gets $16 million, that money would go to his Trustee, after the legal costs of winning that award. The Trustee would keep what is necessary to pay all the claims in full, with interest, and the costs of the bankruptcy administration. Mr. Ostrowski would keep the rest.

I recommend the first way, the restructuring proposal route because that could get Mr. Ostrowski’s bankruptcy annulled fairly quickly, which is what he is asking for.

It will be interesting to see what the court decides. I will let you know when I find out.

Bankruptcy means summary

I hope you found this bankruptcy means Brandon’s Blog informative and interesting.

The Ira Smith Team family hopes that you and your family members are remaining secure, healthy and well-balanced. Our hearts go out to every person that has been affected either via misfortune or inconvenience.

We all must help each other to stop the spread of the coronavirus. Social distancing and self-quarantining are sacrifices that are not optional. Families are literally separated from each other. We look forward to the time when life can return to something near to typical and we can all be together once again.

Ira Smith Trustee & Receiver Inc. has constantly used clean, safe and secure ways in our professional firm and we continue to do so.

Income, revenue and cash flow shortages are critical issues facing entrepreneurs, their companies and individual Canadians. This is especially true these days. Some people think that bankruptcy means the end of their life. Bankruptcy should be a last resort for anyone. We strive to help people and companies avoid bankruptcy. But if bankruptcy is necessary, do not think of it as the end of life. It really is a fresh new beginning. That is what bankruptcy means.

If anyone needs our assistance for debt relief Canada COVID-19, or you just need some answers for questions that are bothering you, feel confident that Ira or Brandon can still assist you. Telephone consultations and/or virtual conferences are readily available for anyone feeling the need to discuss their personal or company situation.

The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.