Investment fund introduction

Investment fund introduction

We have handled many insolvency cases of people and companies where an investment fund with negative returns, combined with a highly leveraged balance sheet, was a major reason for financial problems. This week we’re continuing our series on confusing financial terms that can cost you more than you bargained for. As trustees we see people in financial distress from a variety of reasons, but there seems to be a commonality – most people find financial lingo confusing.

This confusion magnifies when it relates to an investment fund they have bought, but don’t really understand. We have handled many cases where people having read articles about the tax and investment benefits of leverage, borrowing for investment purposes, do so by borrowing against the family home to invest in financial products they don’t understand!

Sometimes, if they have invested too heavily, not only is their investment at risk, but so is their family home! This series of blogs should clarify many confusing financial terms and with this knowledge help you to make more informed financial decisions. We’ve previously discussed Balloon Payments and APY – Annual Percentage Yield. Our current topic is expense ratios.

What is an investment fund expense ratio?

An expense ratio is a percentage of your investment fund or ETF that’s charged annually to cover its operating costs. These operating costs may include administrative charges, management fees, custody costs, legal expenses, marketing and transfer agent fees among others.

How can I find out what the expense ratio is on an investment fund that I’m interested in investing in?

Every investment fund has a prospectus (a legal document providing details about an investment offering for sale to the public) containing the expense ratio. The prospectus is sent to shareholders every year and shared with potential investors. And, since we live in the information age, a fund’s expense ratio can also be found on financial websites and in newspapers (both online and in print).

How can an expense ratio negatively impact my investment funds?

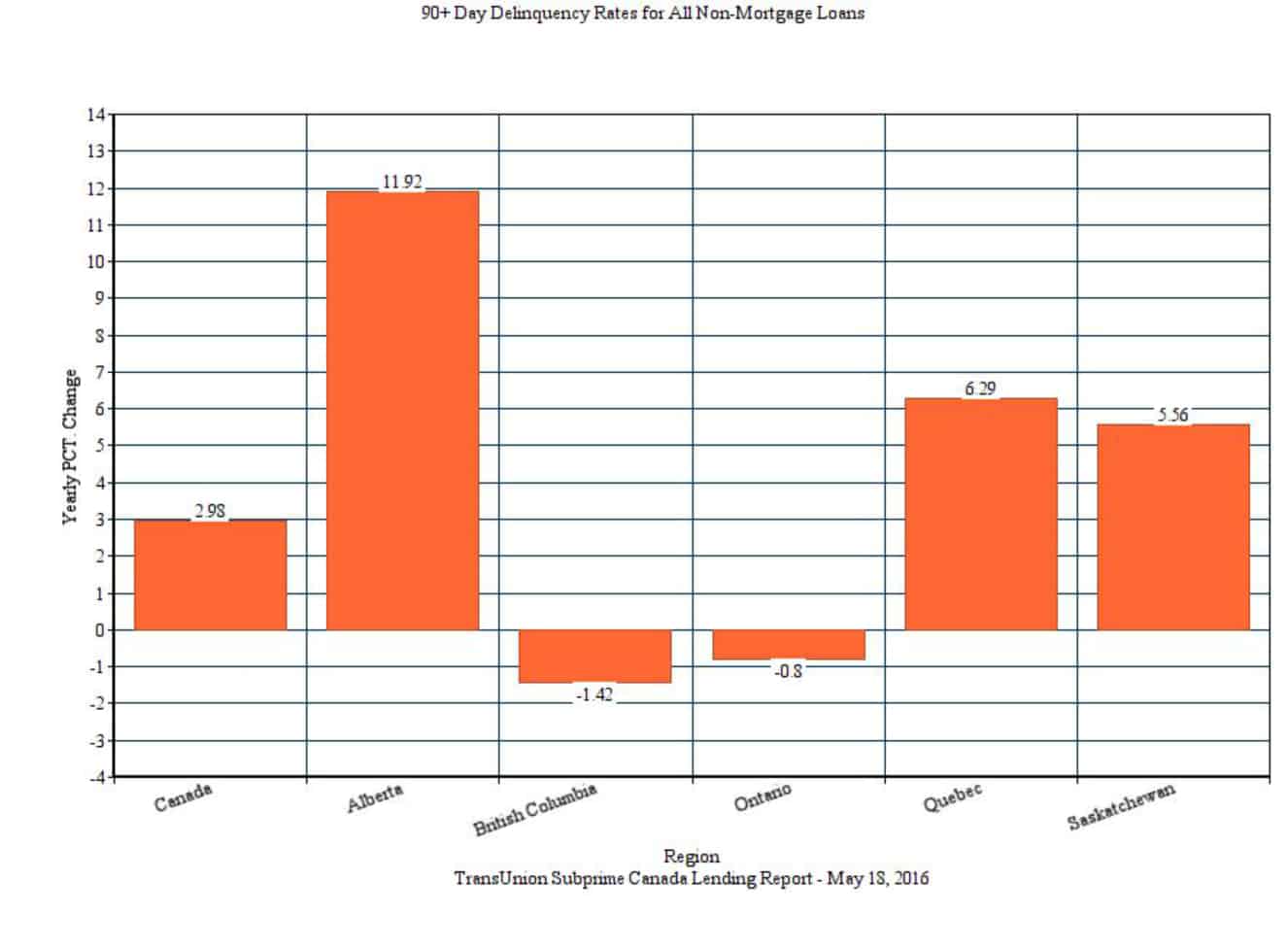

The expense ratio directly reduces an investment fund’s returns to its shareholders, which reduces the value of your investment. The lower your costs are the greater your investment’s return will be. Every dollar you pay in operating costs is one dollar less that’s earning money for you. Even small differences in fees can impact on your investment over time.

What if my investment fund heads south and I can no longer service my debts?

Making the right financial decisions is crucial to your financial health. Unfortunately many Canadians are now struggling with debt that seems insurmountable. The Ira Smith Team is here to tell you that we’re here to help, regardless of how dire your situation seems now. Make the right decision and give us a call today. Starting Over, Starting Now we can get you back on the road to financial health. Watch for future blogs when we’ll be discussing other confusing financial terms that can impact you financially.