[monkeytools msnip=”http://monkeyplayr.com/playr.php?u=5173&p=20148″]

Gambling debts: Introduction

The Canadian insolvency process is geared to deal with gambling debts or any debt resulting from addiction. It does not only deal with the debts caused by borrowing money to feed an addiction. The insolvency process is uniquely positioned to deal with the person’s total rehabilitation. When the person hits rock bottom with debts they cannot repay and no more credit to keep borrowing to feed the addiction, a licensed insolvency trustee (LIT or Trustee) (formerly called a bankruptcy trustee) is positioned to help not only with the debt issues but also the rehabilitation issues. Let me explain.

My firm has been involved in helping people out of their debt problems arising from addiction issues. The most common are gambling, alcohol and drug addictions. Professionals have referred us their family members suffering because of an addiction. In my January 31, 2018 blog, GAMBLING DEBT BANKRUPTCY: CAN GAMBLING DEBT BE DISCHARGED IN BANKRUPTCY?, I discussed from a procedural view the issue of gambling debts and bankruptcy. In this blog, I want to focus on how the insolvency process, especially bankruptcy, can deal with overall rehabilitation.

I will draw on my own personal case studies and specifically refer to a recent decision of the Supreme Court of Nova Scotia in Bankruptcy and Insolvency in Donaldson (Re), 2019 NSSC 33.

Gambling debts: What the LIT is expected to do

The free consultation provided by a LIT to an insolvent person pre-filing is where a LIT would find the addiction issues. It will also be noted on the person’s initial filing documents in filing either a consumer proposal or for bankruptcy. The Canadian insolvency system is geared towards giving the honest but unfortunate consumer a fresh start.

In cases of addiction, the LIT must also point the person to community resources to aid in healing the person with the addiction to lead a sober life. This must be a pre-condition for any LIT to support the addicted person’s consumer proposal or discharge from bankruptcy. This is how my practice works. It is also the view of the Court in the Donaldson case.

Gambling debts: The Donaldson facts

Gloria Donaldson and Wayne Donaldson are fourth-time bankrupts. This is their 5th experience with the Canadian insolvency process as one of their filings was a consumer proposal. They made separate filings. The Court found that it really should have been a joint filing.

Gloria and Wayne were 65 and 73, respectively. The Court holding their discharge hearing found both Gloria and Wayne to be forthright, honest and trustworthy. Yet, this is the 4th bankruptcy and the 5th use the Bankruptcy and Insolvency Act, RSC 1985, c. B-3, as modified (BIA).

They declared the source of this bankruptcy as an overextension of credit on real house improvements. They did not list gambling. However, Registrar Balmanoukian found that there is no doubt on the evidence before him that gambling was a significant factor to at least speed up driving the Donaldson’s to this 5th insolvency filing.

The Donaldson’s filings spanned a duration of nearly 40 years. They are seniors. Their future income is restricted, by age and health.

Gambling debts: The bankruptcy discharge will not be easy

A 4th bankruptcy is a really major issue. Without a doubt, also for applications including third-time bankrupts the Courts have revealed an unwillingness in providing the bankrupt’s discharge. At the very least not without an extensive suspension or similar burdensome terms.

Coming to Court for a discharge as a 3rd-time bankrupt is a serious matter. The Court must be satisfied that the insolvent understands and has made enough adjustments in his/her life. The Court wants to know it won’t be possible that an additional bankruptcy will take place.

By the time a person has actually gotten in a 3rd bankruptcy, the objective, as well as the intent of the Act, changes from its restorative function of helping sympathetic yet unfortunate debtors to a shielding culture, and protecting innocent possible creditors. The most effective intents and hopes of such bankrupts is no longer the main issue. The main issue is that creditors be shielded from the insolvent’s shown economic inexperience, carelessness and negligence.

In a 4th bankruptcy, the Court has to pay cautious interest in creating a suitable yet custom treatment when determining what is right in the bankrupt’s application for discharge. The Bankruptcy Court is not just there to be a financial car wash. The truth is that these bankrupts are not rogues. That, however, is not enough of a reason to approve a discharge.

A 4th bankruptcy is a clarion call to the Court and its officers that these people should never come before the Bankruptcy Court again. The issues need to be fixed.

Gambling debts: The bankruptcy discharge must serve a purpose

The proof is clear that Mr. and Mrs. Donaldson did not have the possibility of having sources with which to pay any kind of meaningful amount on their much debt. The passage of time and their health and wellness have actually prevented this. Nevertheless, that does not imply that the Court can only enforce a token wag of the finger and a reprimand “do not do it ever again”.

What the Registrar decided is frankly, something that the LIT should have already done. When I am faced with potential bankrupts whose debt has arisen as a result of spending money they did not have on their addiction, this is what I tell them. I say that if they wish to have any chance of having a discharge from bankruptcy, then they need to get themselves into a rehab program immediately. Gamblers Anonymous and AA are two that we regularly refer clients to. We also tell them that for discharge purposes, they will need to have their sponsor verify to us, in writing, that they have regularly attended and continue to attend meetings to help themselves.

This way, by the time we come to Court, we can prove rehabilitation has already begun. Real rehabilitation helps the person get back on to a clean, healthy life. We have many examples of people we have helped overcome drug, alcohol and gambling addictions, as part of cleaning up their financial debts. In some cases, these people have even become leaders and sponsors themselves in the rehabilitation program that helped them so much. I have great pride in hearing years later from such former addicts I have helped when they tell me that they have saved up enough to buy a home, now have a better job and their family is in a better place because of my help.

The Donaldsons need to get themselves resolved to live within their earnings. They also must learn to stop gambling if they wish to have a chance of surviving this bankruptcy.

Gambling debts: The Registrar’s decision

So the Registrar ordered that the Donaldsons:

- Shall attend such counselling for gambling abuse and/or addiction for such period as is necessary to get an opinion from a qualified counsellor or medical professional that both of the Donaldson’s are able to conduct themselves without going back to gambling in any way.

- Refrain from gambling in any form, and further that they enrol and stay enrolled in the voluntary exclusion program with Casino Nova Scotia;

- Absolutely stop obtaining credit from any lender in any form, except as approved in advance and in writing by the Trustee.

- Disclose and subject to any provincial exemptions, turn over to the Trustee any property of either or both that comprises “property of the bankrupt” within the meaning of the BIA between the date of the Donaldson’s’ bankruptcies and their discharge.

- Upon compliance with the foregoing for a period of at least five years from the date of the decision, the Donaldson’s may make a further application for discharge.

The Registrar’s decision is right. The Donaldsons will finally get the help they need to fight their gambling addiction. They will come clean with their LIT about handing over any non-exempt assets. They will not be able to borrow money for gambling again. Once they have been “clean” for 5 years, they may reapply to their discharge from bankruptcy. Hopefully, by then, they will be able to live a healthier life without the stress of gambling debts.

Gambling debts: Do you have too much debt?

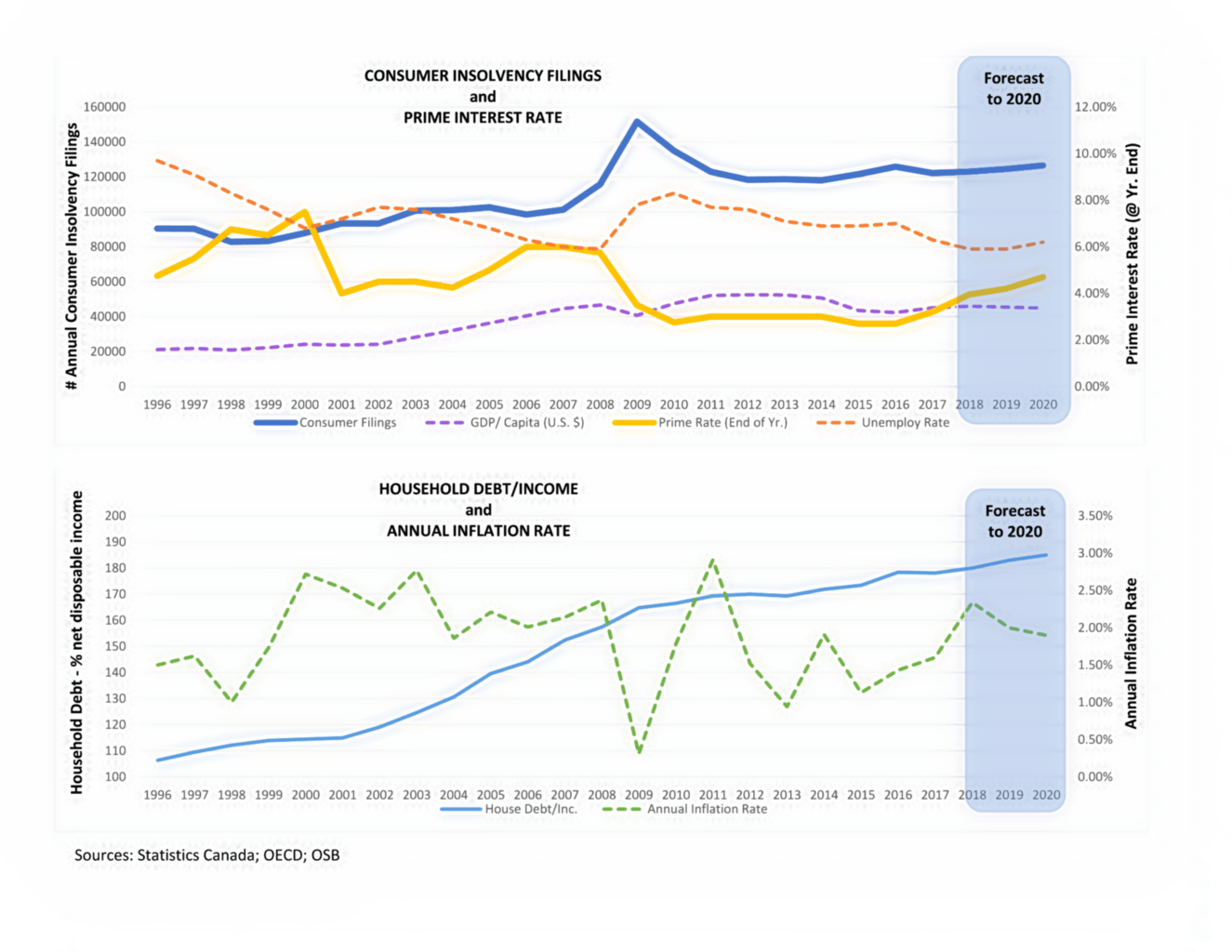

Do you have too much debt because of an addiction or otherwise? Are you worried that the future interest rate hikes will make presently affordable commitments entirely unmanageable? Is the discomfort, tension and anxiousness presently detrimentally affecting your health and wellness as well as health?

If so, speak to the Ira Smith Team today. We have decades and generations of helping people and companies looking for financial restructuring. As a licensed insolvency trustee (formerly called a bankruptcy trustee), we are the only experts licensed and supervised by the Federal government to provide insolvency services.

Call the Ira Smith Team today for your free consultation and to make sure that we can begin assisting you to return right into a healthy, balanced, hassle-free life.

Income tax debt relief: Introduction

Income tax debt relief: Introduction