Introduction

On November 16, 2018, the Canadian Association of Insolvency and Restructuring Professionals (CAIRP) issued a press release on the state of consumer insolvencies in Canada. Hidden in the information was data which leads me to believe that debt consolidation may be tougher in 2019 and certainly in 2020.

A perfect storm is brewing

A historically low rate of interest and accessibility to credit have enabled some Canadians to stay up to date with debt and debt payments that would otherwise have gone into default. Interest rates are now rising and it is expected that the Bank of Canada will continue to raise its benchmark rate into 2019. Canadian household debt is on average at its highest level ever and is forecast to continue to rise. Rising household debt combined with rising interest rates is not a good combination.

Until now, Canadian real estate values have continued to rise, so consumers have been able to combine unsecured credit card and other debt into new mortgage or home equity line of credit debt secured by Canadian real estate. However, times have changed. Effective January 1, 2018, a new mortgage stress test came into effect. We described it in our blog “CANADA MORTGAGE STRESS TEST: WE EXPOSE THE SECRET TO TURN YOU FROM ZERO TO HERO”.

The mortgage stress test has resulted in one of its prime goals; a noticeable downturn in new mortgage loans. The second result is a slowing down of the runaway real estate markets in Vancouver and Toronto. If Canadian household debt continues to rise, interest rates keep rising making debt payments tougher and Canadians can no longer combine their unsecured debts by taking out a new loan by borrowing against their homes, debt defaults are going to rise.

That is why I say that debt consolidation loans may start playing hard to get.

The important relationships to consider

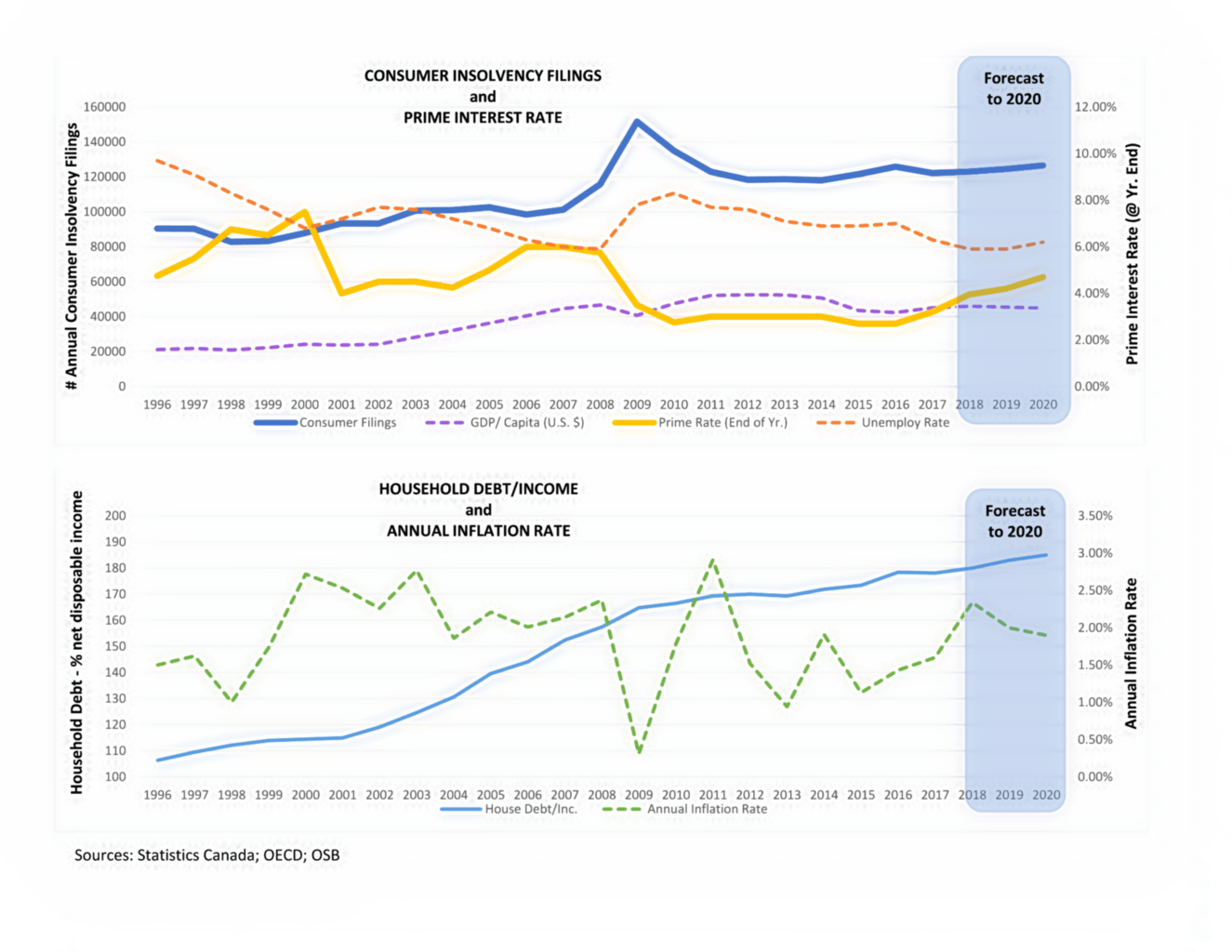

Below is a chart displayed in the CAIRP press release which I have reproduced here.

CAIRP came to some interesting conclusions about interest rates and consumer insolvencies, based on the trends shown in these charts. However, I believe they overlooked what I think is the central issue.

In the top chart, it shows that insolvency filings increased in the 2009-2010 years. CAIRP surmised that there was a lag between the time interest rates rose in the years 2006 through 2008 and the increased filings. This is true. However, the increase in filings mirrors the increase in unemployment in the 2009-2010 period. My personal view is that the more important finding is that the unemployment rate lagged the interest rate increase and it is the increase in the unemployment rate that produced a higher level of insolvencies.

With higher interest rates, corporations are paying more on their debt. Corporations want to show a steady increase in their profits year over year. If debt costs rise, companies have to find other costs to save. One cost that can be reduced in the short-term is labour costs. The forecast shows that as employees are terminated, the unemployment rate rises. Not everyone can find new work in the same time frame. This leads to increased consumer insolvency filings. In my view, the unemployment rate is a more important relationship to consumer insolvency filings.

Looking at 2019 and 2020

The bottom chart shows the relationship between household debt to income and the inflation rate. As you can see, the household debt to income ratio has kept a steady climb in 1996 through 2017 years. This steady climb has continued in 2018 and is forecast to rise even more in 2019 and 2020. The forecast also shows that inflation will nudge up to the 3% rate in 2020. So prices are expected to rise with inflation, and the household debt to income ratio is expected to rise also. This will put more pressure on Canadians trying to keep up with their debt payments.

The upper chart shows us that in 2019-2020, the forecast is that GDP stays flat, while interest rates continue to rise. In the same time frame, the downward trend in the unemployment rate bottoms out and begins to rise. Again, more unemployment and higher interest rates lead to problems for people trying to pay off debts. If you agree with my hypothesis that Canadians won’t be able to merge debt by borrowing more against their homes, this will lead to more financial problems and presumably an increase in consumer insolvency filings.

What you can do now

All is not doom and gloom. There are many things a person with a lot of debt can do now before things get out of control. There are many things that you can do right now to avoid a disaster down the road. My 5 steps for anyone who wants to resolve debt issues now are:

- Review your household budget now and cut spending on “wants” vs. “needs”. If you don’t have a household budget, develop a realistic one NOW!

- Rework the budget so that you spend less each month than you are currently spending. Look for ways to economize. Use that extra cash to paying down debt.

- Start paying more than the minimum monthly payment on your credit card and other unsecured debt. The more you can pay, the faster you can pay it off.

- Pay down the debt with the highest interest rate first. The less you pay in interest the better. That means more is going to pay down the principal debt.

- Perhaps you need to consider taking on a part-time extra gig to bring in more income.

What if I can’t pay off my debts?

For Canadians that discover themselves not able to handle their debt on their own, there is a range of alternatives to take into consideration:

- striking a deal with each of your major unsecured creditors through an informal debt settlement negotiation;

- don’t give up on trying to combine all unsecured financial debts into one regular monthly payment;

- a more formal debt settlement strategy with a consumer proposal; or

- bankruptcy.

Identifying which choice is most appropriate depends upon a person’s scenarios as well as their unique asset and liability structure.

Debt consolidation: How we can help you

Licensed Insolvency Trustees (formerly called bankruptcy trustees) are the only experts accredited, licensed and supervised by the federal government to handle debt restructuring. As a licensed insolvency trustee, our personalized strategy will assist you to recognize all of your alternatives. The alternative you pick based on our recommendations will take away the stress and pain you are feeling because of your debt problems.

The Ira Smith Team has decades and generations of experience people and companies in financial trouble. Whether it is a consumer proposal debt settlement plan, a larger personal or corporate restructuring proposal debt settlement plan, or as a last resort, bankruptcy, we have the experience.

Our approach for each file is to create an end result where Starting Over, Starting Now takes place. This starts the minute you are at our front door. You’re simply one phone call away from taking the necessary steps to get back to leading a healthy, balanced hassle-free life. Call us today for your free consultation.