licensed insolvency trustee for bankruptcy

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic. Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

Licensed Insolvency Trustee for bankruptcy on why businesses go bankrupt

In my last Brandon Blog, Business Bankruptcy In Canada: Discover The Causes Of Business Insolvency And Bankruptcy, I described the causes of business insolvency, the types of business entities normally found in Canada and tips on how to pull your business around back from insolvency.

Numerous businesses are battling to survive today, not to mention stay lucrative. They are scaling down or just closing their doors. They are accessing the available government support money for a business. Most entrepreneurs hesitate to seek the advice of a licensed insolvency trustee due to the fact that they are afraid all the licensed insolvency trustee (formerly called a bankruptcy trustee or a trustee in bankruptcy) wants to do is be a trustee for bankruptcy.

In this Brandon blog post, I want to continue from the suggestions from my last blog, to show you exactly how that the last point I push for is to be a trustee for bankruptcy. I first look to reorganize your business. If your business or company remains in danger because of the effect of the COVID-19 pandemic, it will certainly be advantageous for you and also your organization to do so.

I will also show how sometimes, a trustee for bankruptcy or receivership, can actually help save parts of your business. The only other alternative could be to let all the business parts fail, which is the worst possible outcome.

The role of a debtor in bankruptcy or insolvency

Remember, I previously defined insolvency as a financial condition, where bankruptcy is a legal condition and a legal process. You will also recall that in my last Brandon Blog, I described the three common types of business structures in Canada; proprietorship, partnership and corporation. Just as these three business structures are different in form, they are also treated differently in insolvency vs bankruptcy. Here is how I differentiate the role of each debtor.

Proprietorship – Sole proprietorships are a type of business structure in which one individual is the sole owner of the business, which gives that person control over everything related to the business. This includes the business’ name, structure, accounting, legal obligations and tax responsibilities.

As I described last week, in Canada, the person, the sole proprietor, is carrying on business in their personal name, operating as the business name. You can register a sole proprietorship with the provincial government by completing an application form.

A sole proprietorship is the simplest kind of business structure. It permits an individual to sell goods or run a service with complete control of it on their own. Nonetheless, a sole proprietorship is not considered a separate legal entity from the owner. This means that any liabilities incurred by the business are also personal financial obligations of the owner.

So in an insolvency situation, all of the sole proprietor’s assets come into play as do all of his or her debts. It is not just the business assets and business liabilities. It is everything. This is the worst-case scenario for an entrepreneur.

So if the business is viable, and the personal assets and liabilities lead to the sole proprietor being in the situation where they can do a debt settlement plan, they can choose one of two options to restructure their entire personal financial situation. This assumes they cannot resolve their financial issues informally to bring their financial situation back to being solvent.

Partnership – A terrific way to begin a new business is teaming up with one or more people. All of you should enhance the group’s abilities as well as energy. Nonetheless, you also wish to be with people that are trustworthy, industrious and have a certain expertise that will help the business grow. Just like the way a proprietorship is one person, a partnership is made up of two or more people.

A partnership agreement is crucial. This is an agreement between the partners, describing the rights as well as obligations of each partner in the business. The same way a sole proprietor is personally responsible for the debts of the business and is putting all of their personal and business assets at risk, the same is true for partners in a business partnership. The partners are each liable for 100% of the business debts in case of insolvency. The partners cannot limit their liability to only their partnership share of the business.

Corporation – When you incorporate a business, it is a corporation. The company is a different legal entity from its owner shareholders. Shareholders are not responsible for the unpaid debts owed to financial institutions (normally a secured creditor), suppliers to the firm (normally an unsecured creditor) or the government. There are only two exceptions: (i) certain government liabilities that are a personal liability of a Director; and (ii) if the entrepreneur directly guarantees a financial debt of the company, such as a company loan, then that individual will have a liability with respect to such debt.

If the company’s financial future becomes bleak because it is insolvent, there are options. In my last blog, I talked about self-help remedies senior management of a company whose business is viable can try to informally bring the company back to a healthy financial state. You can re-read that blog to see the options available. If the self-help remedies do not work yet then we must look at more formal proceedings.

Licensed InsolvencyTrustee for bankruptcy: Settle with creditors and debt collectors without bankruptcy

In a proprietorship or partnership, if the underlying business is viable, then there are a variety of options to try to turn the business around yourself. You would use the self-help methods I described in my last blog. If the self-help options do not work, there are debt settlement options available to the individual(s) under the Bankruptcy and Insolvency Act (Canada) (BIA). They would be the only government-sanctioned debt settlement plan available in Canada. Either a consumer proposal or a Division I Proposal. You can read about how each one works by clicking on the following links:

- CONSUMER PROPOSAL FAQ – You owe $250K or less, not including any debts registered against your personal residence

- DIVISION I PROPOSAL – You owe more than $250K

In a successfully completed debt settlement program, the bankruptcy trustee would not be a trustee for bankruptcy. Rather, the trustee in bankruptcy would be an Administrator under a consumer proposal or a Proposal Trustee in the Division I Proposal.

If the business is not viable or the circumstances are such that a debt settlement plan is not feasible, then personal bankruptcy would be the only other option. You can read about how personal bankruptcy works by looking at our top 20 bankruptcy FAQs section. Upon the bankruptcy of the person, the sole proprietorship is automatically terminated.

Since a partnership is a way of carrying on business personally, then the same insolvency options available to the partners to the business debtor are also available. A restructuring is always preferred over a bankruptcy when the partnership is in financial difficulty.

For a debt settlement insolvency filing, the licensed trustee is not a trustee for bankruptcy. That is the case only if there is an actual bankruptcy assignment. Under provincial law, if a partner goes bankrupt, the partnership is automatically dissolved.

Licensed Insolvency Trustee for bankruptcy: Ask creditors to help you avoid bankruptcy of the corporation

Without wanting to sound like a broken record, you can review my prior blog to go over the self-help remedies for turning a business around, even if it is a corporation. A self-help remedy is always a great alternative to bankruptcy. If that isn’t appropriate, or just plain does not work, then you must get in touch with an insolvency trustee.

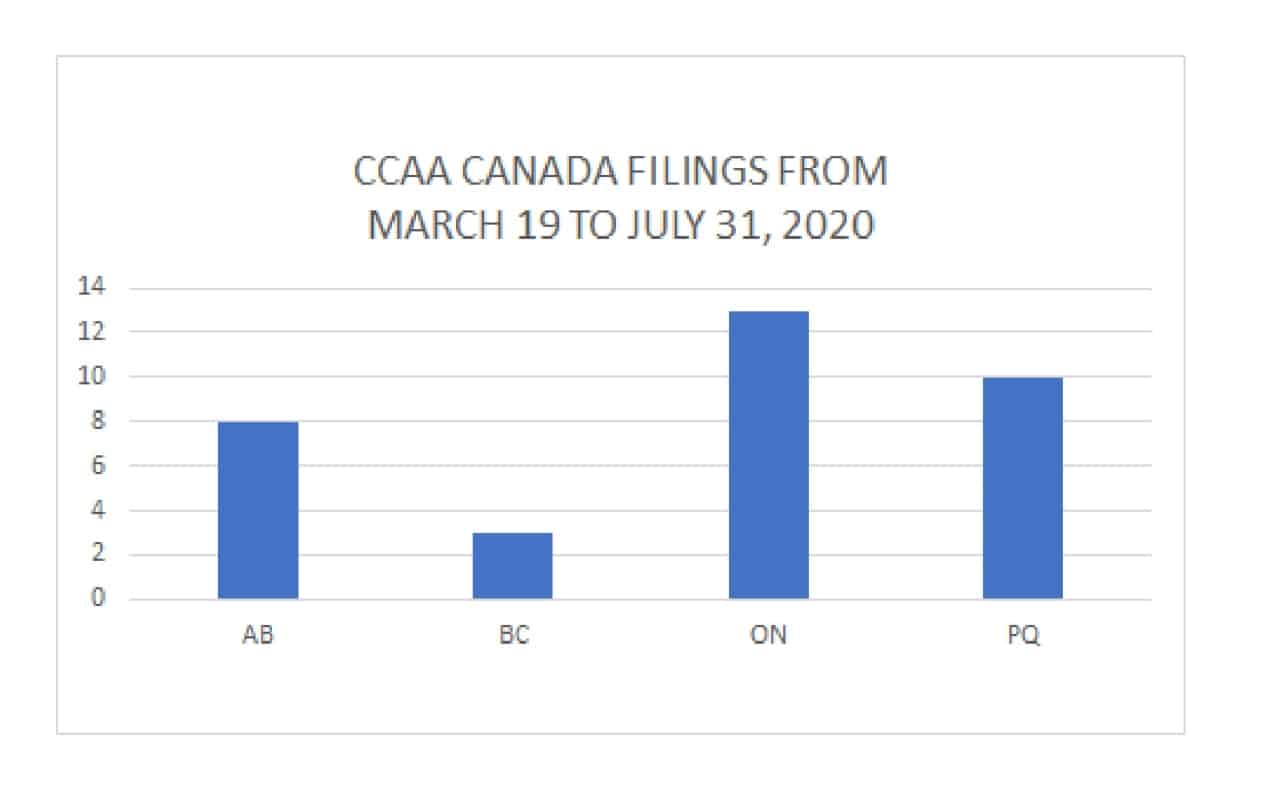

Again, if the company’s business is viable, then there are financial restructuring alternatives. these alternatives will be within a government-regulated insolvency proceeding. There are two formal restructuring statutes in Canada:

- Division I Proposal under the BIA.

- A restructuring Plan of Arrangement under the Companies’ Creditors Arrangement Act (CCAA).

In both cases, a company should retain the services of both a licensed trustee for bankrutpcy and a bankruptcy lawyer. The lawyer acts as legal counsel to the company. The licensed trustee will be both a financial advisor and steer the company through the restructuring process. The CCAA option is for companies with $5 million or more of debt. A BIA Proposal is for a company with any amount of debt. The main difference between the two processes are:

- In a failed BIA Proposal, the debtor is immediately deemed to have filed an assignment in bankruptcy. This is not the case in a failed CCAA Plan of Arrangement.

- A CCAA proceeding is more costly as there are many more court appearances in that forum than in a BIA restructuring.

Using one of these two statutes to gain what is called in the media “bankruptcy protection” in order to work out a successful restructuring with your unsecured creditors is always preferable. The company will pay less than it owes while keeping its viable but insolvent business alive. Don’t underestimate the power of preserving jobs in the eyes of a court. A bankruptcy trustee can be very helpful in obtaining great results.

Licensed Insolvency Trustee for bankruptcy: When to consider an Assignment for the Benefit of Creditors

If the business is not viable and is insolvent, then the only thing left to consider is an assignment in bankruptcy filing. It is definitely a last resort if everything I have already spoken about in this Brandon Blog just won’t work and you have run out of options. Trustees in bankruptcy always consider the alternatives to bankruptcy, but sometimes filing bankruptcy is the only option available.

In the case of a proprietorship or partnership, it is the individual sole proprietor and one or more of the partners who will be meeting with a trustee in bankruptcy and filing for a personal type of bankruptcy. the personal bankruptcy trustee will administer the personal bankruptcy estate. Again, you can read up on personal bankruptcy by looking at our top 20 personal bankruptcy FAQs section.

In personal bankruptcies, it will be either a streamlined system called a Summary Administration and if not, it is then an ordinary administration bankruptcy. Unlike a company, a person is ultimately entitled to a bankruptcy discharge.

When it comes to the administration of bankruptcy for a corporation, it is always an ordinary administration bankruptcy. The purpose of this Brandon Blog is not to run through all the steps in a personal or corporate bankruptcy process. Above I have provided some links to read up on debt settlement restructuring and personal bankruptcy. For corporate bankruptcy, I recommend that you read our corporate website page on corporate bankruptcy.

Alternatively, you can also read my previous Brandon Blog Bankrupting a Limited Company: Canadian Corporate Bankruptcy Process.

A trustee for bankruptcy administers the bankruptcy process for the benefit of unsecured creditors. Sometimes, it is a secured creditor who needs to enforce their security. They do not necessarily need the company to meet with a trustee for bankruptcy. Rather, the secured creditor needs the appointment of trustee to act not in a bankruptcy administration, but rather, to act as a receiver or receiver-manager to enforce the secured creditor’s position by taking control of the assets subject to the security and ultimately selling them. To read the receivership process, you can read the receivership section of our corporate website.

You can also read my Brandon Blog titled What Is A Receivership? Our Complete Guide To Receivership Solutions.

Licensed Insolvency Trustee for bankruptcy: How to avoid bankruptcy and save your business from closing

I hope you enjoyed the licensed insolvency trustee for bankruptcy Brandon Blog post. Are you worried because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option? Call me. It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties while avoiding bankruptcy. We can get you the relief you need and so deserve. As you can see from this blog, we are not just a trustee for bankruptcy. We believe every person and business should first explore debt settlement to avoid bankruptcy.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost consultation.

We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic. Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.