Sears Canada news today: Introduction

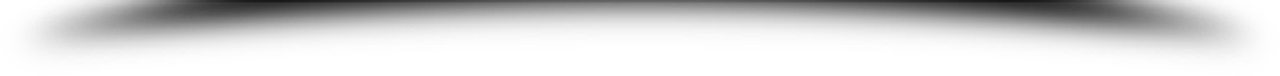

“I will certainly not invest one red cent in your shop … no severance, no sale,”

A (typical comment) posted on the Sears Canada Facebook page before the company blocked new comments and made old ones vanish.

Well there has been a lot of Sears Canada News today and in the last month. The company sought bankruptcy protection only last June 22, 2017. It has been only a little over 1 month, but there has been so much media attention it seems a lot longer.

Sears Canada news today: Social media backlash

We’ve seen on social media that Sears Canada is facing a backlash when it comes to how they’re handling this liquidation. Notice that I am using the word liquidation, as opposed to restructuring. This is in spite of they are currently operating under the Companies’ Creditors Arrangement Act (Canada) (CCAA). This statute is designed as a restructuring statute.

Sears Canada news today: Why KVETCH about a KERP?

It comes just as the company began its liquidation sales at those fifty-nine stores they’re looking to close. There is a boycott in Canada that is gaining some traction on social media. People are upset with Sears Canada’s senior management. They obtained on the first Court application, approval from the Court on their plan to pay themselves retention bonuses. These bonuses would be paid under the terms of what is commonly called in complex corporate restructurings a “Key Employee Retention Plan” (KERP).

The retailer introduced that, as part of a Court-supervised restructuring procedure. It is shutting 59 of its 255 shops and letting go 2,900 workers. None of them will get severance pay. Sears also will stop payments to the employees’ defined benefit pension plan. The retailer recently accepted to delay that pension plan payment issue till September 30th.

Sears also accepted the compromise with the former employees to maintain paying health benefits for an extra 3 months until the end of September. This is so the people could have that time to get alternate coverage. It is still not great though. The employee pension plan will remain underfunded. The employees will have to look for a new health plan. To date, there is no provision for former staff to receive any sort of package.

Sears Canada news today: What exactly is a KERP?

It is normal in complex corporate restructurings to set up a KERP. The concept of a KERP began in US corporate restructurings in the 1990’s. The theory is that to have a successful restructuring, senior management have specific knowledge and ability. If they walked away from the company in bankruptcy protection, such as to accept a senior position elsewhere, the company would have a much more difficult and costly time in restructuring. Hence the idea was born that those essential managers should be promised a bonus to create the most value possible in the restructuring for the stakeholders. This is in addition to their normal compensation.

Often KERPs are now viewed as either:

- a standard item that senior management expects to receive; or,

- a greedy money grab negatively affecting other stakeholders.

I have not yet read any material to show why the Sears Canada bankruptcy protection case is so complex. I have not read how Sears Canada could not liquidate without existing senior management. It is earlier and current senior management who have not created a retail vision niche for Sears Canada for years.

Sears Canada news today: Time to “come back”

Thankfully, all CCAA protection orders have a standard “come back” clause. The reason for this is that not every stakeholder receives notice of the company applying for the bankruptcy protection order. Any stakeholder can come back to Court to oppose any part of the original order they did not receive notice of. They could not tell the Court of their position, and now want to come to Court with their complaints.

The Court appointed a law firm to represent the interests of the employees and former employees. As part of their motion material filed with the Court, they are asking the Court to amend the Sears Canada KERP. They state:

- the amounts are excessive under the circumstances; and

- the KERP does not incentivize senior management to enhance the value of Sears Canada.

It will be very interesting to follow this.

Sears Canada news today: It didn’t have to be this way

You may recall that Target Canada took a slightly different route towards its former employees when it decided to liquidate and leave Canada. It also liquidated under the CCAA. In our blog “TARGET CANADA CLOSING: $5.4 BILLION AND COUNTING”, we told you about the liquidation and that Target US established a trust fund for payment of the Target Canada obligations to its employees. For sure personal hardships occurred. At least they tried to soften the blow.

So now, while Sears Canada wants customers to come and buy at the liquidation sale, they have a PR nightmare on their hands.

Sears Canada news today: No comments please

It is so bad, that Sears Canada is not permitting public messages on its Facebook page. Most the messages from the public so far are negative against the company. CBC News recently noted that Sears Canada’s Facebook page was riddled with remarks from Canadians objecting exactly to what was happening to the company’s employees. Sears Canada has removed those comments from its Facebook page as well as blocking new comments.

Sears Canada news today: Certainly a funny way to stay in business

You must wonder if Sears Canada really wants to restructure, or if they are just liquidating their inventory. They are also trying to sell whatever other assets they can. If it was a true restructuring, you would think that senior management would want to see more customers who would be loyal to (the new) Sears Canada when it would exit bankruptcy protection.

So instead of growing a loyal customer base, Sears Canada’s actions have spawned a strong and growing “Boycott Sears” momentum. They’re going to have to deal with that. It’s going to be interesting to see exactly how this plays out while Sears Canada currently is shopping for a buyer.

According to Sears Canada, the unhappy remarks did not motivate it to close the public articles or to remove many of the bitter statements. Regardless, the former employees are still faced with now with the question “how do you collect salary owed to you from an employer that goes out of business”.

Sears Canada news today: What to do if you or your company have too much debt

If your company or you are experiencing financial problems, contact Ira Smith Trustee & Receiver Inc. We’re here to tell you on your restructuring and other options to avoid bankruptcy. If necessary, we can also talk to you about your bankruptcy options.

We can help you put your financial house back in order and set you on a path to debt free-living. You’ll be amazed at the difference one phone call to Ira Smith Trustee & Receiver Inc. can make.

Contact us today. We are a licensed insolvency trustee and will listen to your issues and offer compassionate, professional assistance to aid you to avoid bankruptcy.

With our help, you can regain control of your life, Starting Over, Starting Now.

UPDATE: CHECK OUT OUR NEW VLOG BY CLICKING ON:

CREDIT SCORES ONTARIO

CREDIT SCORES ONTARIO