We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

If you would prefer to listen to the audio version of this Brandon Blog, please scroll to the very bottom and click play on the podcast

What is insolvency def?

The insolvency definition (insolvency def) is a state of financial distress in which a person or company is unable to pay its debts. The definition of insolvency can be displayed in an insolvent person or the insolvent debtor company which arises from:

- poor cash management;

- a reduction in cash inflow;

- an increase in expenses;

- inadequate accounting controls and reporting;

- a lack of proper human resources management; or

- all of the above.

The purpose of this insolvency def Brandon Blog is twofold. First I will give a simple primer on what insolvency def is. Next, I will explain how a person can analyze their situation to determine if an insolvency process is for them and if so, which one.

I will use a real-life example that appeared earlier this week in the Toronto Star.

Factors contributing to insolvency

The above reasons can lead to different types of insolvency. The insolvency def can be looked at in a few different ways when considering factors and symptoms.

Balance Sheet insolvency def –

Balance sheet insolvency is when a person or company does not have enough assets, if fully collected or liquidated to pay off all of their debts.

Cash flow insolvency def –

Cash-flow insolvency is when an individual or company has enough assets, if fully collected or liquidated, to pay what is owed. Nevertheless, they do not have enough cash to pay their creditors in full.

What is the difference between technical insolvency and actual insolvency def?

While insolvency def in the technical sense is a basic synonym for balance sheet insolvency, cash-flow insolvency is not the same as insolvency under the Bankruptcy and Insolvency Act (Canada) (BIA).

What Is an insolvent person according to the BIA?

“Insolvent person” according to the BIA insolvency def is a person or company that is not bankrupt and is resident, carries on business or has property in Canada, whose liabilities to creditors provable as claims under the BIA amount to $1,000 or more and which for any reason they are not able to pay those obligations as they typically come to be due.

Further, if the insolvent person or the insolvent company liquidated all of their assets, there would still not be enough money to pay off all of the amounts owing to creditors; both secured creditors and unsecured creditors.

What does the insolvent def mean financially?

Now that I have given you the textbook insolvency def, let us look at a real-life example. Every Monday in the Toronto Star there is a column called Millenial Money. This past Monday, Evelyn Kwong wrote about a 34-year-old named Chele. Chele earns $45,000 per year gross.

As I understand it, she borrowed $100,000 to pay for medical expenses back home in the Philippines for a family member. Also, her ex-husband racked up an amount of debt that she is also responsible for. It is unclear from the article if the two sets of debt obligations total $100,000 or something greater.

They presented Chele’s situation to a financial expert to give advice. After looking at Chele’s debt situation, he advised that she speak with a licensed insolvency trustee to determine if a consumer proposal or a bankruptcy proceeding would be best to alleviate Chele of her outstanding debts.

What If I Am Insolvent?

What is Chele’s situation? First, let us look at her monthly statement of income and expenses:

| Monthly take-home pay | $2,200 |

| Recurring monthly expenses: | |

| Rent | 700 |

| Transportation | 810 |

| Food | 250 |

| Sports and hobbies | 50 |

| Cell and internet | 100 |

| Personal | 300 |

| Monthly total expenses | $2,210 |

So Chele is able to essentially balance her cash-flow budget. Her take-home pay is presumably after income tax and other deductions. We can assume that she either receives a small refund on her tax return or at least does not owe any income tax.

As she rents, she does not own a home. Her transportation costs are for her car which is financed. Let us assume that the equity she has in her car fits into her provincial exemption so that a licensed insolvency trustee would have no interest in her car.

So Chele has no assets other than her car and she owes at least $100,000. Now we can look at the consumer proposal as an alternative to bankruptcy vs her doing an assignment in bankruptcy filing.

Consumer proposal vs bankruptcy proceeding

As I have written before, a consumer proposal is an insolvency process under the BIA for any person who owes $250,000 or less, not including any debts secured by their personal residence. It is a debt settlement arrangement to pay your unsecured creditors less than the total you owe in order to relieve yourself of all of your debt obligations.

A person can take up to 5 years to make the regular monthly payments to the licensed insolvency trustee acting as the Administrator in the consumer proposal. The insolvency trustee then distributes the total amount agreed to by the creditors and paid by the insolvent debtor as a dividend distribution. Once the insolvent debtor fully completes the consumer proposal, they are relieved of all of their unsecured debt balances (other than a few minor exceptions laid out in the BIA).

Canadian bankruptcy law says that any offer to the creditors in a consumer proposal has to be a better alternative for the creditors than they would get from the person’s bankruptcy estate. So first we need to calculate what the creditors could expect from Chele’s bankruptcy.

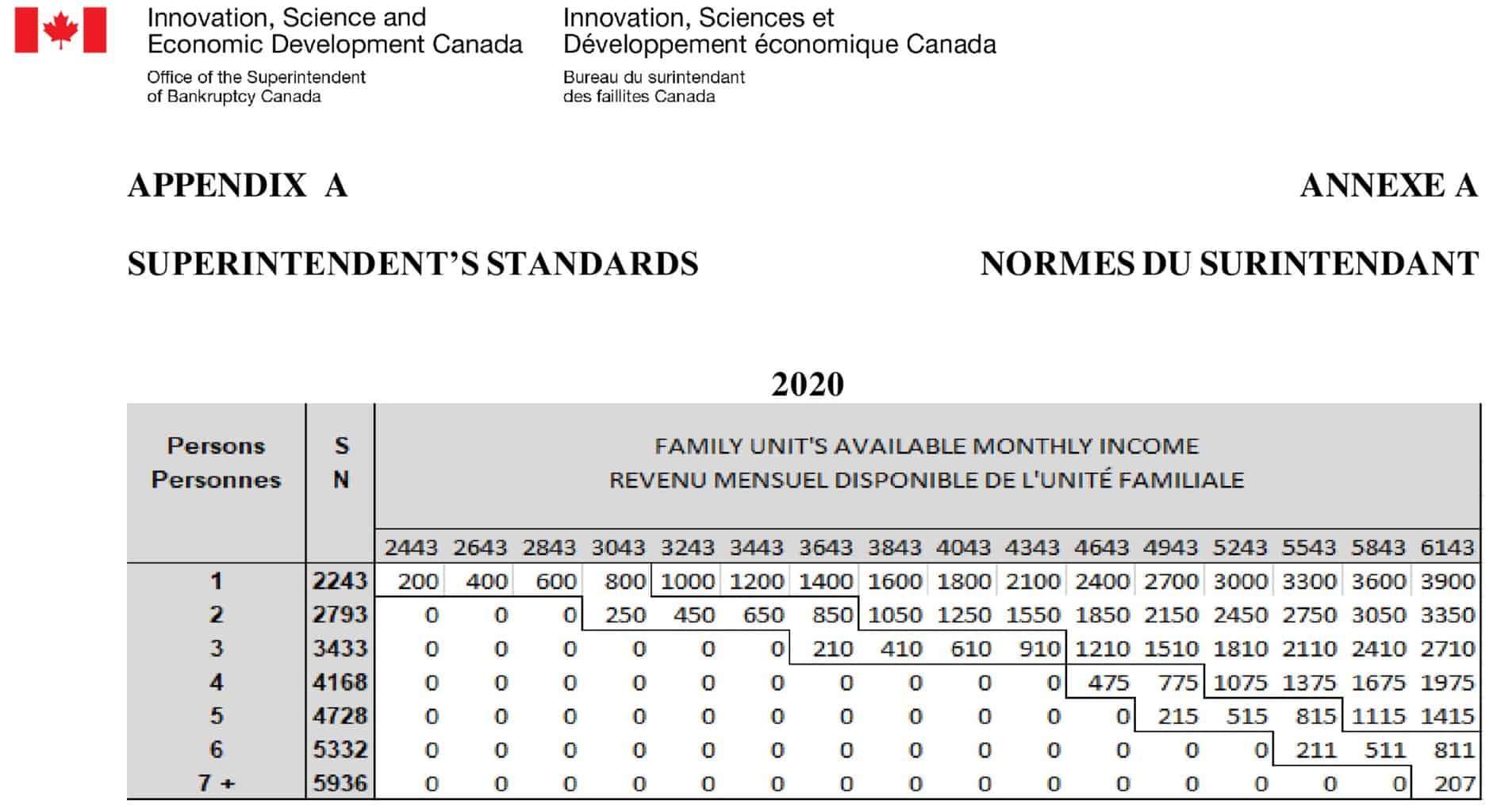

Chele has no assets available to her creditors. Her equity in her only asset, her car, is protected by her personal exemption for a vehicle in Ontario. There are no other known assets. All bankruptcy trustees are required to perform a surplus income calculation. In Chele’s case, she earns $2,200 per month net of tax, and she is allowed to earn as a single person in 2021 $2,400 per month before she is subject to any surplus income. So she also does not need to contribute any surplus income.

Assuming Chele has never been bankrupt before if she performs all of her duties in bankruptcy, she is entitled to a discharge from bankruptcy 9 months after the date of bankruptcy, unless a creditor opposes it. All she will be required to pay is the fee to the licensed insolvency trustee to administer her bankruptcy.

In a consumer proposal, in this case, she could offer anything because that would meet the requirement of being a better alternative than her bankruptcy. However, creditors generally expect to receive no less than 20% to 25% on their outstanding debt. So if Chele owes $100,000, at the midpoint of 22.5%, she would have to offer to pay her creditors $22,500 payable in monthly payments over no more than 5 years or 60 months. That works out to a monthly payment of $375. Chele does not have room in her budget right now to afford that monthly payment.

So in her case, unless she can figure out how to reduce her spending so that she can afford a monthly payment for the next 60 months, my advice to her would be to choose the bankruptcy option and file an assignment in bankruptcy. If all goes well, she can start to rebuild her life, free from all her unsecured debt, in 9 months’ time.

Insolvency def summary

I hope that you found this insolvency def Brandon Blog interesting. If you are concerned because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option, call me.

It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties while avoiding bankruptcy. We can get you the relief you need and so deserve. Our professional advice will create for you a personalized debt-free plan for you or your company during our no-cost initial consultation.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need to become debt-free, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost consultation.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.