The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. We hope that you and your family are safe and healthy.

Bankruptcy surplus income introduction

I have written many blogs about personal bankruptcy and consumer proposal insolvency matters over the recent past. I notice though that it has been many years since I have written about bankruptcy surplus income. I refer to it in many of my Brandon’s Blogs but have not described it in detail in quite a while.

In order to correct that situation, here I discuss the concept and application of bankruptcy surplus income in personal bankruptcy filings.

What is bankruptcy surplus income?

Surplus income is perhaps an inadequately worded expression. Very few individuals would certainly really feel that they have surplus income, especially when dealing with financial debt. Nonetheless, in the bankruptcy context, surplus income describes a calculation that figures out just how much cash monthly an individual must be paying into their bankruptcy estate for the benefit of their creditors.

When you file for personal bankruptcy in Canada you are able to retain most of the income that you make monthly. In order to have a practical level of living during the bankruptcy period, the Office of the Superintendent of Bankruptcy Canada (OSB) establishes a net month-to-month earnings standard.

These earnings criteria take into consideration annual inflation and are derived from information collected by Statistics Canada annually. What you pay to your licensed insolvency trustee (Trustee) into your bankruptcy estate every month is determined by these standards. They are used to decide if a bankrupt has any bankruptcy surplus income.

I have to warn you though. The practical standard of living that the OSB permits is actually the Canadian poverty line. It matters not if you reside in one of Canada’s most pricey cities or in a rural area. There are no regional modifications made. The OSB lays out the meaning and calculation in its Directive No. 11R2. Every year the OSB updates the exemption limitations.

Click on this link for the up to date bankruptcy surplus income 2020 Directive No. 11R2-2020.

What happens to a person’s wages during bankruptcy?

You are still allowed to earn money and collect your wage or salary when you apply for bankruptcy under the Bankruptcy & Insolvency Act (Canada) (BIA). As a matter of fact, lots of people apply for bankruptcy because their wages, salary, or bank account are being garnisheed or frozen either by Canada Revenue Agency (CRA) or a judgment creditor. As I have written in several Brandon’s Blogs, the filing of an assignment in bankruptcy knocks out the garnishee against your wages or salary and/or the freeze on your bank account.

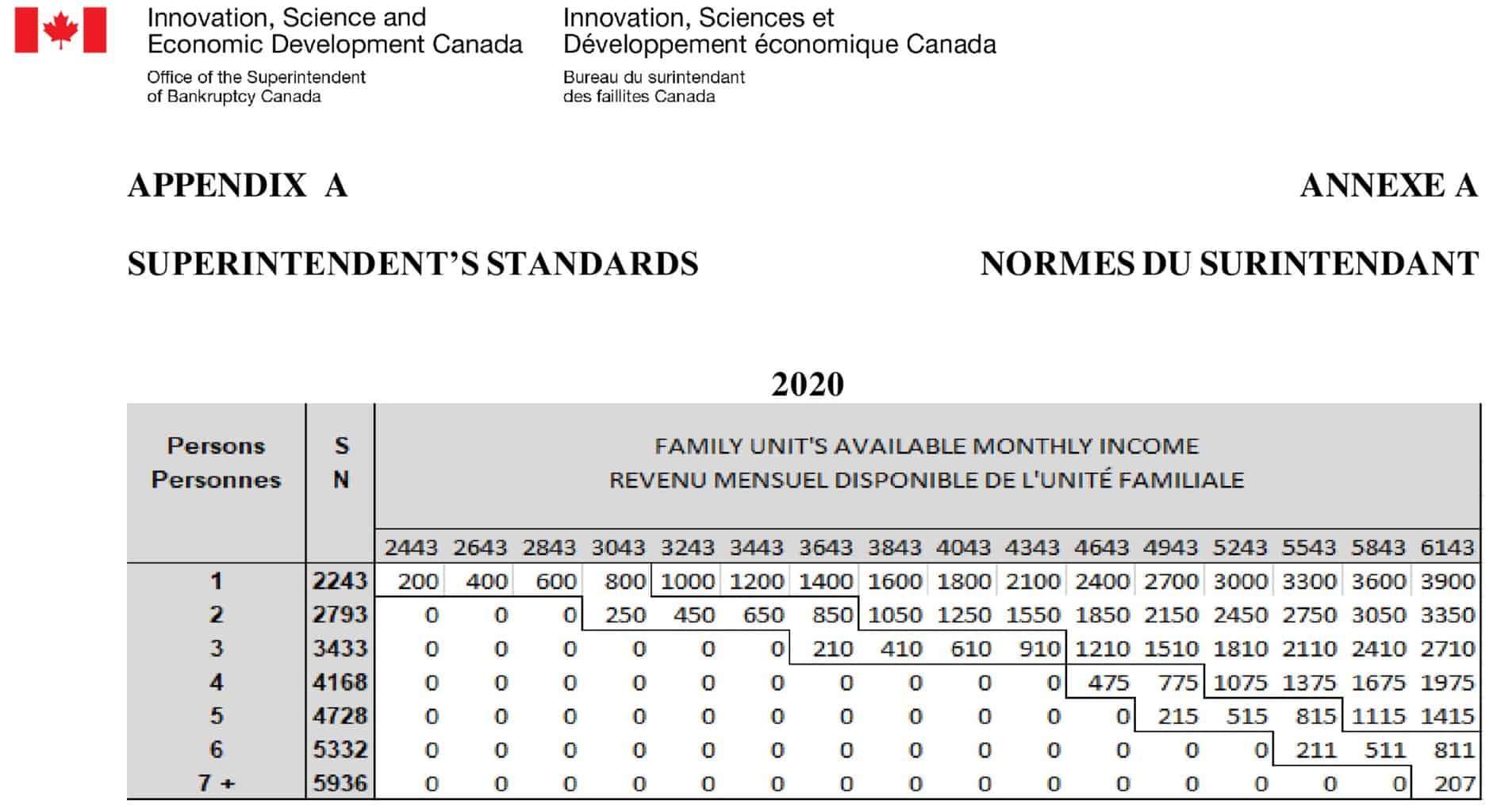

Now that there is no longer a garnishee, your earnings on an after-tax basis are readily available to you. The Canadian bankruptcy process, which strives for fairness, states that your after-tax income is now available for contribution to bankruptcy surplus income. To provide you a feel for the personal exemptions permitted, on an after-tax basis, as established by the OSB, here is the 2020 table the Trustee needs to work off of:

Superintendent’s Standards – 2020

How it works is that you look at the table and pick first how many persons are in your household. The next column marked “S” and “N”, is the exemption that the OSB standard that it gives your family. You can then do one of two things: (1) go across the top of the table that resembles the closest your household after-tax income (the household’s, not just yours); or (2) if you know the calculation, do the exact calculation.

Bankruptcy surplus income limits for 2020 Canada

To have bankruptcy surplus income payable, your after-tax regular monthly earnings need to be $200 or greater than the limit established by the OSB. The exact computation is to add the bankrupt’s after-tax monthly earnings to the bankrupt spouse’s after-tax month-to-month revenue, and the same for anyone else in the family that is contributing their income for household expenditures.

Take that sum and deduct your allowed exemption. Then subtract the reasonably few unique extra exemptions, if appropriate:

- medical expenses;

- support payments

- child care expenses

- court-imposed fines or penalties

- expenses as a condition of employment.

After that take the bankrupt’s percent of the complete household income bankruptcy surplus income which you just computed. Split that number in half which is the month-to-month surplus income that the bankrupt must pay.

So for example, take a look at the calculation below for an imaginary family of two where both spouses work and there are no extra special deductions:

| Family Situation (Family unit of two) | |

| Bankrupt’s available monthly income | $2,800 |

| Add: Other family unit member’s available monthly income | 1,000 |

| Family unit’s available monthly income | $3,800 |

| Minus: Superintendent’s standard for a family unit of two | 2,793 |

| Total monthly surplus income | $1,007 |

| Family Situation Adjustment (2800 ÷ 3,800 = 73.68% $1007 × 73.68% = $741.96) | $741.96 |

| Payment required from bankrupt ($741.95 × 50% = $370.98) | $370.98 |

Bankruptcy surplus income calculator

To help you better understand everything that goes into the calculation, I want to share with you a tool I use to calculate bankruptcy surplus income. I am providing you with the link to the same spreadsheet that I use to do the calculation.

Here is the link:

Bankruptcy surplus income calculator

Your income is checked by the Trustee on a month-to-month basis and is balanced out over the entire period of your bankruptcy. If you have a short-term boost in earnings, such as from a bonus or commissions, or a short-term reduction, such as a temporary layoff, this will be factored in.

When do bankruptcy surplus income payments end?

For a 1st time bankrupt, without surplus income, you are entitled to get an automatic discharge after 9 months. This requires that neither the Trustee nor a creditor has opposed your bankruptcy discharge. If you are a 1st time bankrupt yet you do have surplus income, then you need to make monthly bankruptcy surplus income payments for 21 months. You are then entitled to an automatic discharge if all your surplus income payments are made and there is no opposition to your discharge.

If you have actually been bankrupt before and this is your 2nd (or more) bankruptcy, you will not have the ability to obtain a discharge in 9 months. Your bankruptcy will certainly be lengthened. A 2nd + bankruptcy lasts for a minimum of 24 months. If you have surplus income, a second-time bankrupt will certainly not have the capacity to obtain a bankruptcy discharge for 36 months. The monthly bankruptcy surplus income payments must be made for the very same 36 months.

Can I file bankruptcy if I make too much money?

The test to file for bankruptcy is not how much money do you make. The test is:

- are you insolvent; and

- have you committed one or more acts of bankruptcy within the six months preceding the filing of an assignment in bankruptcy or the launching of an application for a bankruptcy order.

But if you do make a lot of money, and go into bankruptcy, then no doubt you will have a large bankruptcy surplus income obligation to pay to the Trustee every month. That large amount may not fit into your monthly budget. You may not be able to afford that monthly bankruptcy surplus income payment.

So what can you do? You should speak to a Trustee about filing either a consumer proposal or a Division I Part III proposal. Both are filed under the BIA. Why? Depending on your assets, a proposal may work better for you. Although your proposal would have to be a better alternative for your creditors than your bankruptcy, it gives you the advantage of terming out the monthly payments.

It may work out that for a little more, you can get up to 60 months to pay. So rather than having only 24 or 36 months to make your total payment, as the case may be, you could get 60 months to pay only a bit more. Obviously, the proposal is more gentle on your budget than a bankruptcy. It is also easier on your credit score and credit report.

Bankruptcy surplus income summary – Are you in financial trouble?

To declare personal bankruptcy is a major life event. However, it is a necessary thing to rid yourself of crippling debt. Most people who declare bankruptcy have been faced with a major life event. The main examples are illness, pay cuts, job loss, or divorce. It is not your fault. I hope this bankruptcy surplus income Brandon’s Blog has given you helpful information.

Do you have too much debt? Are you in need of financial restructuring? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or the person who has too much personal debt.

You are worried because you are facing significant financial challenges.

It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding bankruptcy. We can get you debt relief freedom.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a debt settlement plan, we know that we can help you.

We know that people facing financial problems need realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team. That is why we can develop a restructuring process as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious about finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation.

We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. We hope that you and your family are safe and healthy.