We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

If you would prefer to listen to the audio version of this Brandon’s Blog, please scroll to the bottom and click on the podcast.

The Rachel Uchitel story

Rachel Uchitel was an American night club manager. She gained popularity for her involvement in the Tiger Woods sex scandal. Currently, she is making news for a different reason – bankruptcy. Her father died when she was only 15 years old. She lost her fiance in the 9/11 tragedy.

She has been quoted as saying that her dad’s fatality had a big impact on her life. Maybe that can describe her as “looking for love in all the wrong places“. But a lot more on that particular later.

In reading about her background, you could reach the conclusion that she was just a pillow-lipped party girl. It may feel like she has actually committed her adult life to arrive on the social scene and in show business. Nonetheless, she does have a college degree in communications. In 2002, Rachel Uchitel was a Bloomberg television producer. But it is clear that she turned away from Bloomberg news to seek her fame and fortune as a star celebrity.

I think you will find this Brandon Blog is very different from most of the others. I tell a bit of the Rachel Uchitel story. I tell her story not to be salacious, but to highlight how real addictions can lead to a person’s downfall. Even a famous celebrity type and how their troubles can lead to bankruptcy.

Rachel Uchitel and the Bottle Girls

Starting in 2008 in Las Vegas, a team of young women called the “Bottle Girls” began to appear on the scene. It wasn’t long before these ladies were creating a great deal of enthusiasm from the public as well as the financial investment community. Before the coronavirus pandemic, Bottle Girls were a typical sight at some of the most preferred clubs and bars in Las Vegas. They are young, gorgeous women that stand outside of the bar or casino and try to people to go into the establishment to partake in all that it has to offer.

While they may be scantily clad to stand out, they are the friendly girl next door type. Rachel Uchitel was a bottle girl.

Nightclub hostess and NHL Rangers good luck charm

Rachel Uchitel was one of the most famous people hosting in New York, and her links with nightclub managers had been invaluable to the New York Rangers. Soon after she started dating then-Ranger Sean Avery, the team started winning. So it’s reasonable that the Ranger players and then-coach Tom Renney held her in high regard.

Her grandparents owned the Manhattan El Morocco supper club in the 1960s. Famous people like President John F. Kennedy and Cary Grant frequented the place on a regular basis. She held on to her family’s memorabilia, and her dream has always been to one day re-create a contemporary version to be a nightclub owner.

What Rachel Uchitel is most famous for

As the story has it, Rachel Uchitel and Tiger Woods first met at the Griffin, a former club in New York’s Meatpacking District. The American nightclub manager was the director of VIP services. In interviews, she would often stress that it was her duty to greet important patrons such as Tiger and also ensure that they were having fun. After that, she met Tiger a number of times more before they hooked up with each other.

When the news came out concerning Tiger’s extramarital relations, Rachel Uchitel was caught up in the media storm and the face of one of the greatest celebrity cheating scandals. She was called an “alleged mistress” and dealt with public scrutiny over this.

When Tiger Woods drove his vehicle into a fire hydrant in November 2009, the headlines weren’t regarding the accident itself. They were about Rachel Uchitel, the American model and one of the most notorious women connected to the pro golfer. She came to be the face of his affairs regardless of dozens of allegations from women of sexual affairs with Tiger that appeared shortly thereafter.

As you may remember, the fling notoriously finished when Woods’ angered his better half Elin Nordegren who chased him from their Florida home brandishing a golf club after discovering saucy messages from Rachel Uchitel on his phone. Horrified Woods then banged up his car backing up into a fire hydrant and his neighbour’s tree. Nordegren later got an estimated $100 million in their divorce. It was not a pretty picture.

Rachel Uchitel was paid $10 million in 2010 after signing a non-disclosure contract meant to acquire her silence over the affair. Yet a year later, she was forced to hand most of the money back by her then-lawyer Gloria Allred after discussing her fling with Tiger when she appeared on Celebrity Rehab.

The Rachel Uchitel Addiction

Nowadays, it feels like lots of people are addicted to something. The one-way ticket to dependency seems to be love. The love of money, love of sex, love of liquor, even the love of food. Addiction has actually brought about a lot of issues in our society. The concern is, what’s the dividing line between addiction and a healthy and balanced relationship?

Rachel Uchitel says she had a love addiction. Looking back on her affair with Tiger Woods, she says that she didn’t think she was a love addict. Rather, she said the affair with such a famous person wanting to have sex with her was her way of validating her own self-worth. She did not lump herself in with drug and alcohol addicts. Yet her striving to prove her own self-worth was through a love addiction.

She may not be alone. According to an American survey, one in 10 Americans claims to be head over heels in love with someone who does not love them back. This is a statistic that appears to support the claim that love dependency is an actual, diagnosable condition. The study, conducted by the American Psychiatric Association, also discovered that 7% of Americans made love with a person they understood had not been helpful for them, just because they felt they could not quit the relationship.

Rachel Uchitel really did not include herself in with drug addicts, alcoholics and those with gambling issues. However ultimately, she did come to the realization that she did need to go to rehab. She got assistance to understand and overcome her sex addiction.

Rachel Uchitel is now bankrupt

Rachel Uchitel has recently been making more headlines not in a good way. The 45-year-old-woman at the time filed for Chapter 7 bankruptcy protection last July. She has since turned 46. She listed her main creditors like American Express and Deutsche Bank, both of whom are owed more than $595,000.

She additionally owed more than $10,000 in an unsettled lease on her Manhattan home and racked up a bill of $164,770 on a 2nd Manhattan residence. Rachel Uchitel says she has not worked since her children’s clothing shop closed in 2019.

She described herself as jobless in her Chapter 7 bankruptcy filing. She is likewise on the hook for another $17,339 in tax debt in addition to $23,694 due to a New York law firm.

Rachel Uchitel on the HBO documentary talks about Tiger, boyfriends and marriage

Rachel Uchitel is currently showing up in the HBO documentary Tiger, where she discusses her affair with him in detail for the very first time. It is unknown whether she was paid to be on the program.

Ms. Uchitel asserts that the huge majority of her financial obligations to be discharged were directly related to her kids’ clothes shop business which proved to be not financially viable. She stated she had directly guaranteed debts of the business, leaving her no choice but to go into bankruptcy.

When asked if her connection with Woods was to blame for her financial troubles, Rachel Uchitel reacted saying, “No, I don’t think so. There’s no correlation between golf and bankruptcy.“

Is Chapter 7 one of the types of bankruptcies in Canada?

No. Chapter 7 bankruptcy is one of the bankruptcy Chapters under the US Bankruptcy Code. It is the most common type of bankruptcy in the United States. This chapter of the Bankruptcy Code is for the liquidation of the debtor’s non-exempt property and then distributing the funds realized to the creditors in priority. It is not meant as a restructuring tool or to implement a debt settlement plan.

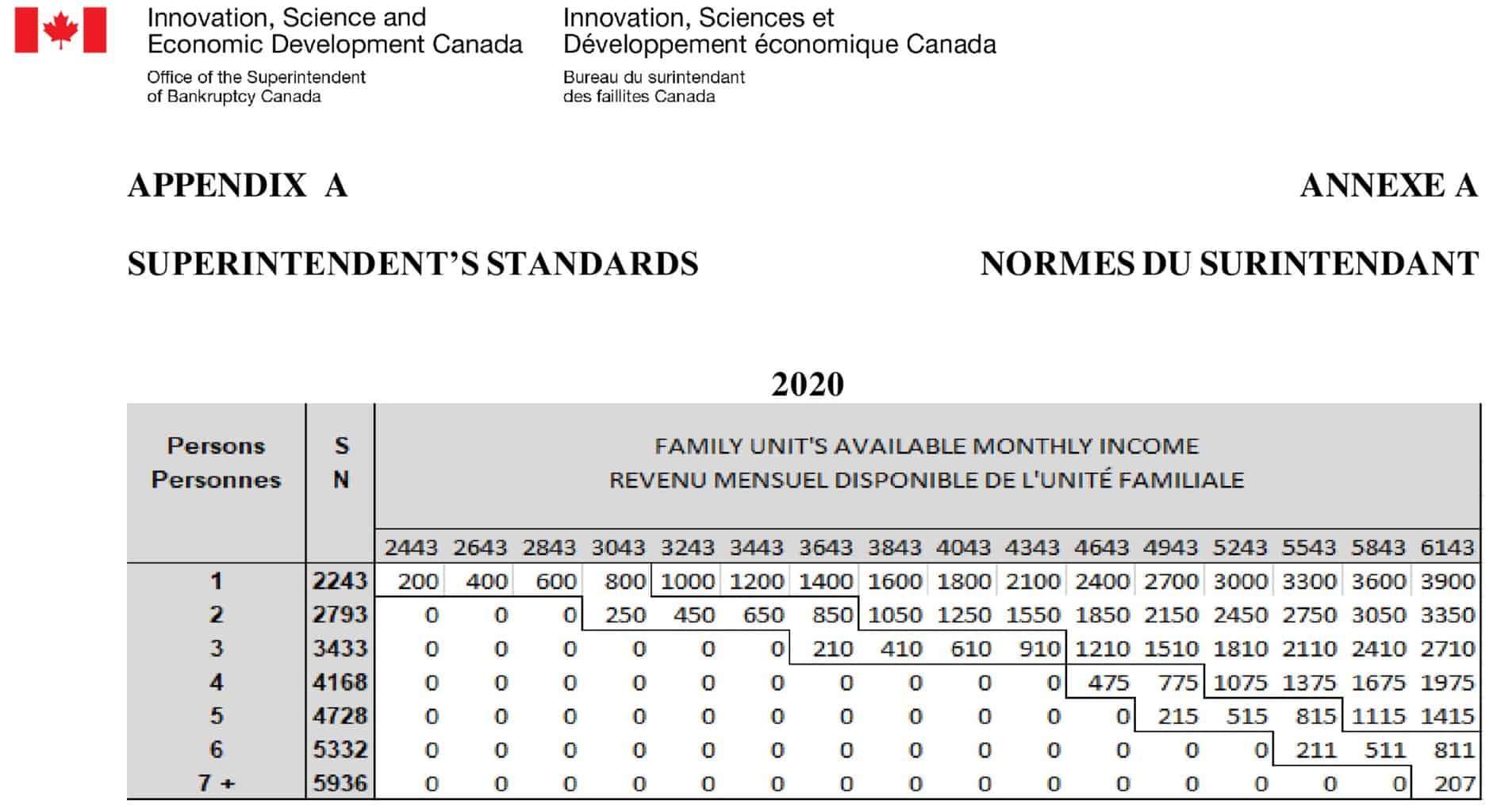

In Canada, there is no such thing as Chapter 7. Here in Canada, it is just called either personal bankruptcy or consumer bankruptcy. As in the US, this is not one of the types of bankruptcies in Canada that would be used to do a restructuring to implement a debt settlement plan. Rather, personal bankruptcy in Canada is also for the liquidation of the debtor’s non-exempt property so that funds can be distributed to the creditors. In Canada, the bankruptcy system is operated under the provisions of the Bankruptcy and Insolvency Act (Canada) (BIA).

Bankruptcy and addictions

The Canadian insolvency process is geared to deal with debts resulting from any kind of addiction. It does not only deal with the debts caused by borrowing money to feed an addiction. The insolvency process is uniquely positioned to deal with the person’s total rehabilitation. When the person hits rock bottom with debts they cannot repay and no more credit to keep borrowing to feed the addiction, a licensed insolvency trustee (formerly called a bankruptcy trustee) is positioned to help not only with the debt issues but also the rehabilitation issues.

My firm has been involved in helping many people out of their debt problems arising from addiction issues. The most common are gambling, alcohol and drug addictions. But a love addiction can be just as troublesome. Professionals have referred their family members suffering because of an addiction to me.

In my January 31, 2018 blog, GAMBLING DEBT BANKRUPTCY: CAN GAMBLING DEBT BE DISCHARGED IN BANKRUPTCY?, I discussed from a procedural view the issue of gambling debts and bankruptcy. In my January 30, 2019 GAMBLING DEBTS HELP blog, I focussed on how the insolvency process, especially bankruptcy, can deal with overall rehabilitation.

The addict is not an awful person but they do have an awful problem. They need the support of their family, family friends and medical professionals. If addiction has led to unmanageable debt, that is where a licensed insolvency trustee fits in to be part of the team helping the honest but unfortunate person. If Rachel Uchitel was living in Canada, a proceeding under the BIA would help her get rid of her debts.

The Rachel Uchitel story summary

I hope you enjoyed the Rachel Uchitel Brandon Blog post. If you are concerned because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option, call me. It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties while avoiding bankruptcy. We can get you the relief you need and so deserve.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost consultation.

We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now.

We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.