Financial literacy books: Introduction

The power of today’s technology enables one to discover ways to learn without needing to look very hard for it. The Internet has changed the ways we learn and in general, approach life. To gain financial literacy, financial literacy books are now merely one of many ways we can use to improve our financial acumen.

The academic system, for the most part, still uses classical teaching methods. As a standard, literacy is defined as the ability to write and read. Financial literacy is the ability of people to learn and understand basic financial concepts, strategies and information.

Unfortunately, financial literacy is not so common after all. With 21st century education, financial reading and financial writing can be used to make financial liberty. Financial literacy ought to not be a far-flung idea for people, starting at a very young age.

Financial literacy books: Think differently

In his best-selling book “What I Didn’t Learn in School however I Wish I Had“, author Jamie McIntyre talks about the relevance of financial literacy and 21st-century education. From the title of his book, he freely tells us that we are not discovering what could have been general information for success. The standard view forces the most people to be and follow a structure in a system before all the modern tools available to us today.

As a self-made millionaire, Jamie McIntyre advocates that to be a financial success, people need to be doing the opposite of what others have actually been doing for so long. By being financially literate, we can find reasons why people fail and discover ways to avoid these factors.

Financial literacy transcends the standard read-write approach. By having a different method or viewpoint to one’s life, financial literacy can be used to establish various monetary strategies with the hope of accomplishing financial flexibility.

Financial literacy books: There are many methods to increase financial literacy

To become financially literate, there are many ways people historically have learned about finance, with some new ones. I think some people would say that we can take financial courses or try to get the best financial advice from the best financial advisor. Others may suggest to read the best financial advice books of all time or go to the most popular money advice websites.

However, a research paper released in September 2018, may just give us a glimpse into a different way of gaining financial literacy.

Financial literacy books: What is financial literacy?

Financial literacy is the ability of people to get an understanding when it comes to standard monetary strategies and information. With 21st century education, financial reading and monetary writing can be used to obtain monetary flexibility. Financial literacy needs to not be a far-flung idea for individuals of any age.

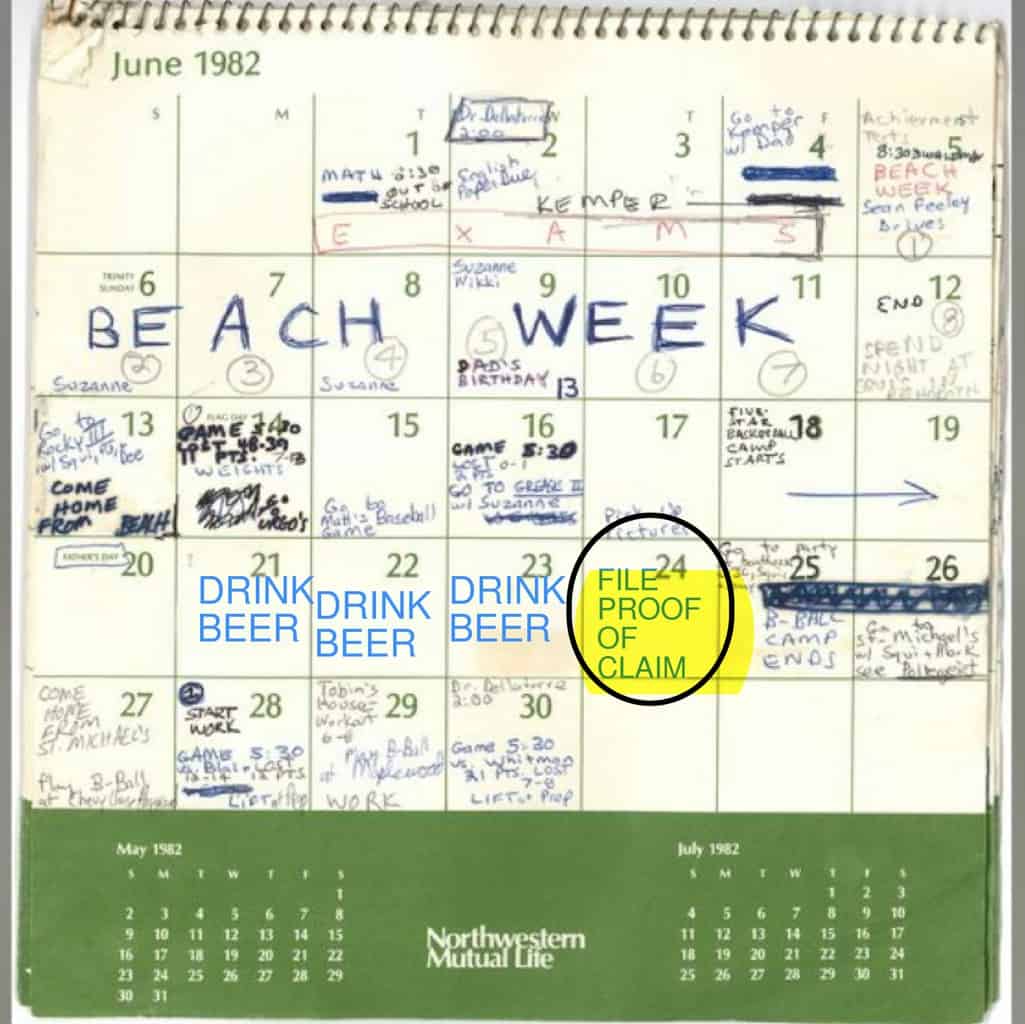

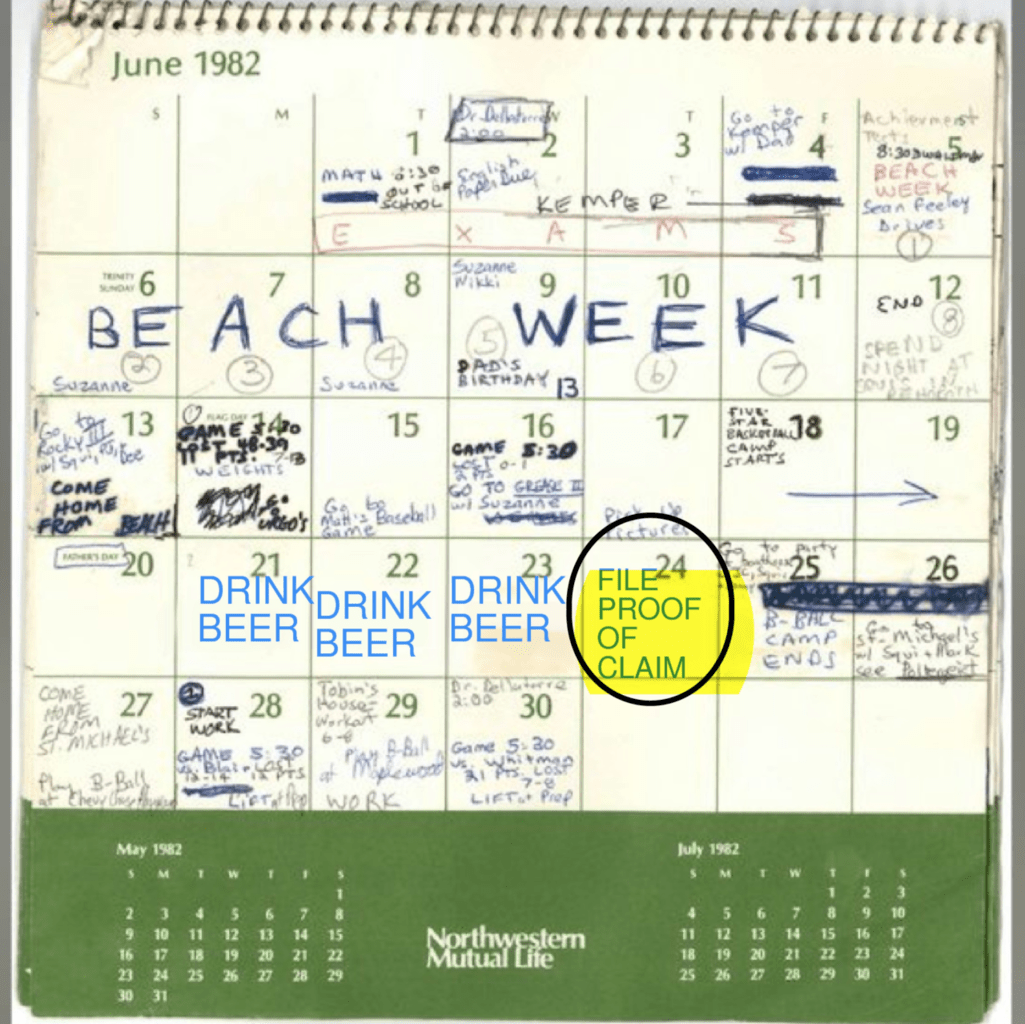

Financial literacy books: A new research study

A brand-new research study discovered that people with reduced financial knowledge have a tendency to find out more and make far better choices about money if they are helped by peers that have comparable degrees of financial expertise. This is the case more than if they read financial literacy books or got financial advice from people with much more financial experience and knowledge.

The study, Peer Advice on Financial Decisions: A case of the blind leading the blind?, was released in September 2018. The research showed that the majority of university undergrads with little financial acumen learned better after looking for help from a peer that was in a similar way unenlightened and not somebody having a lot more financial savviness.

While this may strike you as being strange, the study described why it makes good sense. Learning was better between people who can understand and had the patience for each other’s learning gaps stated Professor Sandro Ambuehl, a co-author of the research and an assistant prof at the University of Toronto’s Rotman School of Management. His fellow researchers are B. Douglas Bernheim of Stanford University, Fulya Ersoy of Loyola Marymount University and Donna Harris of the University of Oxford.

Financial literacy books: A new way of learning

What this suggests to me is that one of the best ways to teach financial literacy is to start in the elementary schools and continue it throughout high school. Let groups of students interact with their peers to learn together on age proper financial and investment definitions, terms, subjects and strategies. The study suggests that and not leaving it up to people to try to learn it for themselves, promoting learning in peer groups, may be the easiest and most efficient way for learning financial literacy.

Our provincial governments should be taking the lead in encouraging our teachers to start teaching financial literacy to children at a very young age. The study indicates that by having peers work in groups to learn about financial matters, may just be the way for us to have more financially literate adults and a society that has great financial literacy. Peer groups working together to increase their financial knowledge may just be the best resource.

Financial literacy books: Do you have too much debt?

Do you feel that you don’t have sufficient financial literacy? Do you believe that the lack of knowledge has led to you making financial mistakes? Have these mistakes caused you to now have too much debt? Is the pain and stress of too much debt now negatively affecting your health?

If so, contact the Ira Smith Team today. We have decades and generations of helping people and companies in need of financial restructuring and counselling. As a licensed insolvency trustee (formerly known as a bankruptcy trustee), we are the only professionals licensed and supervised by the Federal government to provide debt settlement and financial restructuring services.

We offer a free consultation to help you solve your problems. We understand your pain that debt causes. We can also end it right away from your life. This will allow you to begin a fresh start, Starting Over Starting Now. Call the Ira Smith Team today so that we can begin helping you and get you back into a healthy, stress-free life.