Have you heard the radio advertising spots by a tax lawyer in Canada who is trying very hard to make you believe that he is The Rock Star in the world of tax problems and that he and only he can help you? One commercial ends with, “Don’t call a Trustee, call me”. Isn’t it amazing that without knowing anything about you and without a consultation, he knows exactly what your problems are and how to fix them? And, he has no way to know if a Trustee is all you require to solve your serious debt issues. However, fear based advertising must be working for him because he spends fortunes on it.

Have you heard the radio advertising spots by a tax lawyer in Canada who is trying very hard to make you believe that he is The Rock Star in the world of tax problems and that he and only he can help you? One commercial ends with, “Don’t call a Trustee, call me”. Isn’t it amazing that without knowing anything about you and without a consultation, he knows exactly what your problems are and how to fix them? And, he has no way to know if a Trustee is all you require to solve your serious debt issues. However, fear based advertising must be working for him because he spends fortunes on it.

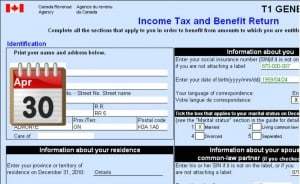

Don’t take advice from an advertisement. If you have legal issues, absolutely you need a lawyer in Canada. But, the reality is that Canadian bankruptcy law doesn’t differentiate between tax debts and other kinds of unsecured debt, therefore most people can declare bankruptcy on taxes owing. In fact, 50% of the people who file a consumer proposal or declare personal bankruptcy include some form of tax debt. If you are experiencing serious debt problems you must consult with a Trustee before declaring bankruptcy; no doubt you will have many questions about the bankruptcy process. The Trustee will evaluate your case and advise you on all of your alternatives – credit counselling, debt consolidation, consumer proposals, and bankruptcy. Bankruptcy and consumer proposals are administered by a Bankruptcy Trustee, not a lawyer. In fact you cannot declare bankruptcy through a lawyer unless the lawyer is also a Trustee in Bankruptcy.

There are cases in which you may need a lawyer:

- Tax debts are generally discharged in bankruptcy like other debts. However, if you have tax debts and the CRA (Canada Revenue Agency) is opposing your discharge, it is recommended that you seek legal assistance.

- In most cases Trustees do not act as your advocate. If you believe you need an advocate, you should consult a lawyer. Communication between you and your lawyer is confidential and privileged.

This is not an advertisement and we’re not telling you that we are Rock Stars. Ira Smith Trustee & Receiver Inc. is a full service insolvency and financial restructuring practice serving companies and individuals throughout the Greater Toronto Area (GTA) facing financial crisis or bankruptcy that need a plan for Starting Over, Starting Now. We approach every file with the attitude that corporate or personal financial problems can be solved given immediate action and the right plan. Our bankruptcy law is complicated. Canada (Superintendent of Bankruptcy) v. 407 ETR. Also check out our bankruptcy faqs. If you’re having serious debt issues, and yes, even tax debt, contact us today. We can provide you with realistic choices for practical decision-making.