The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. We hope that you and your family are safe and healthy.

Consumer proposal Ontario: Introduction

The Canada Emergency Response Benefit (CERB) has actually ended. Even more, people are calling me to ask about a consumer proposal Ontario. This is the only Canadian federal government licensed program for people to lower their consumer debt.

In this Brandon’s Blog, I answer the 11 most asked questions about consumer proposal Ontario.

1. What is a consumer proposal in Ontario?

A consumer proposal in Ontario is the same as anywhere else in Canada. It is a proceeding under the Bankruptcy and Insolvency Act (Canada) (BIA). However, it differs from bankruptcy. Such proposals are offered to people whose unsecured financial commitments do not exceed $250,000, not including debts secured by their primary residence.

Collaborating with a licensed insolvency trustee (Trustee) acting as the Administrator, you make it to:

- Pay your unsecured creditors a portion of what you owe them over a specific duration not surpassing 60 months.

- Raise the time you need to work it out and pay the amount you agreed to (less than 100% of what you owe)

- Or a mix of both.

Your payments are made to the Trustee, and the Trustee makes use of that cash to pay each of your creditors their pro-rata share. The consumer proposal Ontario shall end up within 5 years from the day of declaration. The full completion of your plan is what gets you the debt relief you are craving.

Also, the BIA says that it needs to give the insolvent individual’s unsecured creditors a better return than they would certainly obtain under the person’s bankruptcy.

The proposal is not made for a holder of secured debt. Assuming they have valid security against the asset and you are keeping it, like your house, then you just pay what you originally agreed to pay on that loan.

2. How much do you pay in a consumer proposal Ontario?

When I work with people in Ontario who want to file a consumer proposal Ontario, I need to determine what a reasonable deal to your creditors will be, based upon your financial situation.

I usually find that the minimum amount that creditors tend to accept is around 25% to 30% of what you currently owe all your unsecured creditors. You make the same monthly payment for the full time it takes to fully pay off your debt settlement plan.

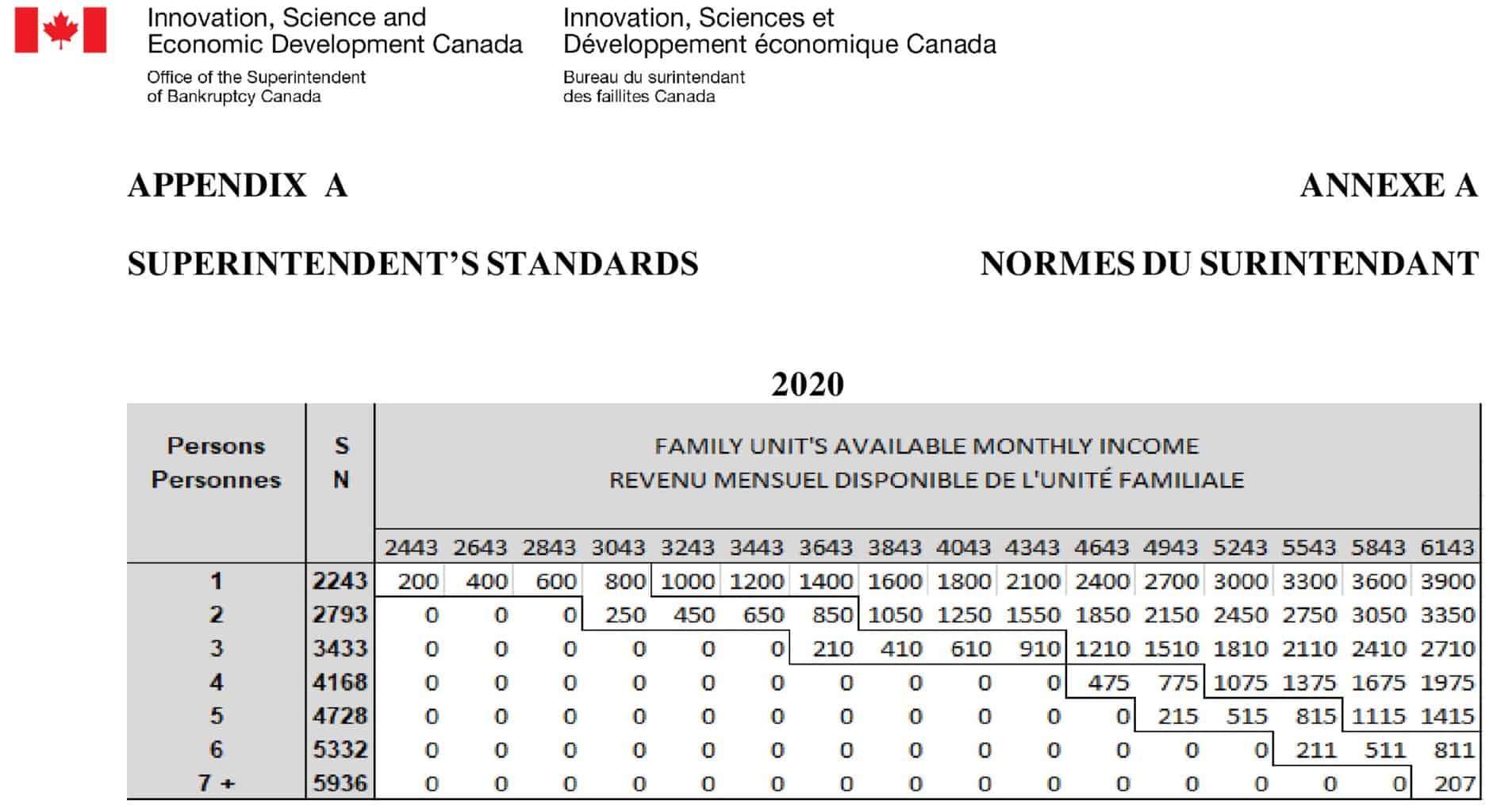

As I mentioned above, the BIA says that the offer in a proposal must be a better alternative for your creditors than your bankruptcy. So first, I do a calculation of what your creditors can expect to receive in your bankruptcy. That calculation involves two pars:

- the liquidation value of your non-exempt assets; and

- the amount of surplus income, if any, you would need to pay in a bankruptcy.

The starting point of what to offer your creditors is something slightly better than the result of your bankruptcy calculation.

3. Can I keep my credit card if I file a consumer proposal Ontario?

I have both good news and bad news. The good news is that there is no requirement for the licensed insolvency trustee to collect your credit cards from you when you file a consumer proposal Ontario. However, every unsecured creditor at the time of your filing, including credit card issuers, receive a notice of your filing and a form 31 proof of claim form to complete.

So now for the bad news. Every credit card issuer you owe money to and therefore gets notice that you filed a proposal, will certainly cut you off. They will not let you keep using the card while not paying them in full.

So, you will be able to keep your credit card, but it won’t work anymore. If you need a credit card, you will have to get a new secured credit card.

4. Can I pay off my consumer proposal early?

A consumer proposal Ontario is like an interest-free loan at an amount much less than you originally owed your unsecured creditors. So it may be helpful to you not to pay it off early to get the full benefit of it.

However, we write all of ours in a way that gives you flexibility. You can take the full 5 years if you need to. If you are able to pay it off early and you have good reasons for wanting to do so, then you can. We word our proposals to say that you promise to pay the total amount in no more than 60 months. So you can take all 60 months or not. The choice is yours.

By wording it this way, we don’t need to go back to the creditors or the court to vary anything. It is built right in. Also, unlike other loans, there is no penalty for paying it off early.

5. How much does a consumer proposal cost in Ontario?

The expense is established by the federal government and is laid out in the proposal rules section of the BIA. The Trustee’s fee is a fixed amount called a tariff.

How much an individual pays in their debt settlement plan is entirely unassociated with the allowable federal government tariff. I explained the calculation the Trustee goes through in determining the amount of your consumer proposal Ontario so that it is a better return than in your bankruptcy.

The Trustee is allowed to take the fee from the amount you agreed to pay right into your financial obligation debt restructuring plan.

So, how much does a proposal cost? My cost is FREE!

6. Consumer proposal Ontario: Is a consumer proposal worth it?

There are benefits for you to file such a financial debt settlement strategy. Initially, you do not give up your assets. Next off, an authorized proposal binds all creditors to the arrangement.

We start with having you complete the standard intake form that we call, the Debt Relief Worksheet. When totally filled out, it gives us a listing of your assets, liabilities, earnings and expenses. Using that details, I have the ability to formulate a proposal based upon your capability to pay.

The proposal is submitted to the Office of the Superintendent of Bankruptcy (OSB). As soon as submitted, you can quit paying your unsecured creditors. If creditors are garnishing your earnings or suing you, those are stopped.

Your credit score will be negatively affected. If you are considering a consumer proposal vs. bankruptcy vs. doing nothing, given all the positives, I say it is worth it.

7. Consumer proposal Ontario: How bad is a consumer proposal?

Given all the relief you can get with a consumer proposal Ontario, I would say that it is not bad at all.

As soon as the appropriate files are eFiled with the OSB, I after that send out the proposal to every one of your unsecured creditors. The creditors then have 45 days to accept or reject the offer. If creditors are dissatisfied with the proposal, as the Trustee I can work out adjustments. Nevertheless, everything is based upon what you can still take care of to securely pay.

As soon as we get approval, you are then accountable for making regular payments to the licensed insolvency trustee. The Trustee will absolutely use that cash to pay your creditors as well as the tariff.

As part of the consumer proposal procedure, you will be required to meet with me for 2 counselling sessions. Once you totally finish your payment plan, you will be legitimately released from all of your unsecured debt responsibilities that existed at the date of filing.

There is always an emotional element to filing a consumer proposal Ontario. However, given all of its benefits, including fixing your credit rating over time and allowing you to eliminate your consumer debt, that is why I say that it is not bad at all.

8. How long does a consumer proposal stay on your credit report in Ontario?

A notation that you filed a consumer proposal Ontario, or elsewhere in Canada usually stays on your credit report for 3 to 4 years after you have successfully completed it. It does negatively affect your credit rating. It obviously shows up on your credit history.

However, as part of the counselling sessions, I hold with my clients, I do explain to them ways in which they can start improving their credit rating right away.

9. How long does it take to rebuild credit after a consumer proposal Ontario?

As mentioned above, I counsel my clients on how they can start rebuilding their credit right away after filing a consumer proposal Ontario. No one needs to wait until after they have successfully completed their plan to start rebuilding credit.

Good habits like paying your monthly bills on time, or taking out a small RRSP loan and repaying it within 1 year, all go to rebuilding your credit. Another way is getting a secured credit card and paying it off in full each month.

By doing these small things, your credit rating will start rebuilding sooner than you expected. Soon, your negative credit history will be a thing of the past.

10. Can I buy a house after consumer proposal Ontario?

There are no prohibitions to buying a house after you successfully complete a proposal. There is no law that says you cannot buy a house. As with any major financial purchase, you will probably need to apply for a mortgage. Your ability to buy the house will depend on your ability to get a mortgage.

Being able to qualify for a mortgage depends on many factors. The value of the home, the amount of your down payment that you have saved up, how large a mortgage you need, your credit score, your credit report, can you afford the proposed monthly payment, are there any co-signers or guarantors of your mortgage debt?

It is possible to achieve your dream of home ownership after your CP is over. The chance of qualifying before you successfully complete it is of course much less.

People go through insolvency proceedings for many different factors yet the goal of obtaining a fresh start is the same for everyone. If part of your objectives for the future includes home ownership, we will talk about it in your 2 mandatory counselling sessions. There are steps that you will need to take. It might not be quick or easy, but it is feasible to buy a home after successfully completing a consumer proposal Ontario.

11. How many consumer proposals can you file?

Once you successfully complete your first consumer proposal, there is no law that stops you from filing another sometime in the future. However, you should know that creditors are quite likely to excuse you and let you get a fresh start your first time. Each subsequent time means that you didn’t learn anything from the first one. You were not financially rehabilitated, which is one of the goals of the Canadian insolvency system. So creditors are not so forgiving the second time around.

So, although you can file a new one after successfully completing your first one, it will mean that something went wrong. I would not recommend getting into financial trouble a second time.

Consumer proposal Ontario summary

I hope you have enjoyed this Brandon’s Blog.

Do you or your company have too much debt? Are you or your company in need of financial restructuring? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or the person who has too much personal debt.

You are worried because you are facing significant financial challenges. It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding bankruptcy. We can get you debt relief freedom.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a debt settlement plan, we know that we can help you.

We know that people facing financial problems need a realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team.

That is why we can develop a restructuring process as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious about finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation.

We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. We hope that you and your family are safe and healthy.

The

The