The Ira Smith Team is absolutely operational and both Ira, as well as Brandon Smith, are right here for a telephone appointment, conference calls and also virtual meetings.

The Ira Smith Team is absolutely operational and both Ira, as well as Brandon Smith, are right here for a telephone appointment, conference calls and also virtual meetings.

Stay healthy and safe everybody.

If you would rather listen to an audio version of this Brandon’s Blog, please scroll to the bottom and click on the podcast.

Introduction

As issues about COVID-19 in Canada grows, insolvency practitioners are doing their part by having determined it is needed to take steps to reduce in-person contact. The Office Superintendent Bankruptcy Canada has helped Licensed Insolvency Trustees (formerly called bankruptcy trustees) (Trustee) in these initiatives while keeping all aspects of Canada’s insolvency system running.

In my April 29 Brandon’s Blog, CONSUMER PROPOSALS IN ONTARIO TEST POSITIVE FOR COVID-19, I described how the Superintendent of Bankruptcy went to Court in Ontario. They made a motion to have the Court direct how certain procedures would change during the state of emergency lockdown. Part of that will be how the government wants to have Trustees resurrect an old methodology in personal debt settlement plans and corporate restructuring plans not really been used in the last 25 years.

Since then the government has come out with additional information and clarifications on how they see the bankruptcy Canada process continuing to work during the coronavirus shutdown. In Brandon’s Blog, I talk about these issues.

Office Superintendent Bankruptcy Canada approves social distancing

There are many ways that the Office Superintendent Bankruptcy Canada has approved social distancing for Trustees.

Initial free strategy session – Most if not all Trustees will provide a no-cost consultation for a personal or corporate insolvency discussion. In the pre-coronavirus era, most of these were done in a face to face meeting. Trustees can and do use methods aside from in-person assessments. These methods were always reserved for extraordinary circumstances. Boy, are we in one now!

So, the Office Superintendent Bankruptcy Canada has reminded Trustees that the COVID-19 pandemic is such a phenomenal circumstance and Trustees can conduct assessments making use of approaches other than face to face. Where video-conferencing is not viable, assessments may be done using a mix of telephone conversations and e-mail.

Credit counselling in personal debt settlement or bankruptcy cases – Trustees can offer counselling through telephone conversations or videoconference. The government is updating its software to allow for Trustees to file confirmation of credit counselling done this way as before it was not available. I am finding that our “customers” like this way of being able to deal with credit counselling. They don’t need to travel to our office and appreciate that we are still checking in with them.

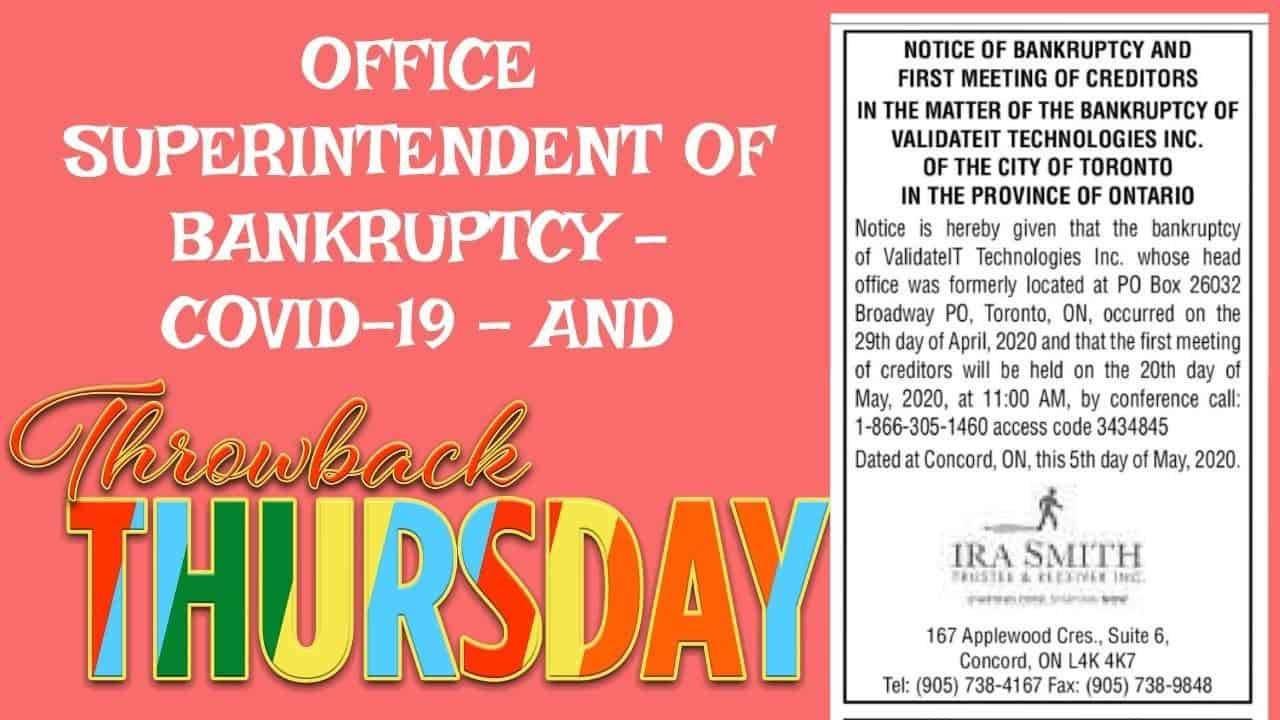

Meetings of Creditors – The Office Superintendent Bankruptcy Canada is encouraging Trustees as the Chair of the creditors’ meeting to hold the meetings on time using either telephone conference call or video methods. Trustees can rely on the oral representation from everyone on the call as proof of attendance. The notice and legal ad calling the meeting of creditors looks a bit different than we are normally used to seeing because of this change. At the top of this Brandon’s Blog is an image of the legal notice I ran in a local newspaper.

Signatures/Oaths – I am now circulating papers that call for signature by means of e-mail. I then supply debtors the necessary support to explain the papers via videoconference. I then ask the debtor over the Zoom meeting if they swear or affirm that what is in the document is true. When they respond affirmatively, I then ask them to sign in the space provided. I then commission the document on my end, ask them to email me a copy of the signed document and put the original signed paper in the mail to me. So far it has been working smoothly.

Closure of non-essential businesses

The provinces have ordered the closure of non-essential businesses. So far, the businesses of lawyers and accountants have been deemed essential. The Office Superintendent Bankruptcy Canada has confirmed to Trustees that it wants the Canadian insolvency system to continue operating smoothly. So, the Trustee business is considered to fall under these same categories as being essential.

As you are aware, creditors right now seem to be choosing to either explicitly or implicitly forbear on amounts owing to them. They are trying to be supportive of people by recognizing that with reduced or no income, they need some breathing room. Although there are media reports to the contrary, as of now, debtors seem to be getting a break. Trustees are also encouraged to do the same if someone is having trouble making a surplus income payment in their bankruptcy right now. In fact, Trustees will probably be held to a very high standard when their conduct is reviewed by the Court.

In my April 29 Brandon’s Blog, I spoke about the whole issue of a debtor in a consumer proposal who misses three payments. If that happens, the consumer proposal is considered annulled. In this case, the Order the Ontario Court issued essentially gives debtors up to the end of 2020, and in some cases, beyond that date, to make up the missed payments.

COVID-19 insolvency frequently asked questions

There are some frequently asked questions that are coming up. So, I want to give the questions and answers to help people better understand what is going on right now in the Canadian insolvency system.

Q: Do consumer proposal debtors need to make up all missed payments by December 2020?

Response: This was not previously well explained. The answer is No. As much as an extra three monthly payments can be missed between March 13, 2020, and December 31, 2020, before a consumer proposal is considered annulled. Missed payments will need to be made up by the end of the proposal or a modified proposal will certainly need to be authorized by creditors. I am advising debtors to carefully think about whether it is necessary to miss making payments. There is no guarantee that later on, debtors will be able to make up the missed payments. So I am telling debtors that if they can still afford to make the payments, they should. Don’t choose to miss payments you otherwise can afford to. What if you can’t catch up? Do you really want your consumer proposal to be annulled later on after potentially you have paid everything except a few payments? That would be terrible..

Q: If a proposal was deemed annulled before April 27, 2020, when does it need to be revitalized to be covered by the order?

Response: A proposal that is revived by the steps taken under the Bankruptcy and Insolvency Act (BIA) on or prior to June 30, 2020, will certainly be covered by the order.

Q: If three payments were missed on or before April 27, 2020, but the Trustee did not send notices of deemed annulment, does anything require to be done to be covered by the order?

Response: Yes. When three payments prior to April 27, 2020, are missed out on the BIA states that a consumer proposal is regarded annulled despite administrative actions that may or might not have been taken. Thus, where the equivalent of three or even more payments has been missed out on, the consumer proposal will certainly need to be revived according to the BIA on or before June 30, 2020, in order to be active under the order.

Q: Is the duration under which a consumer proposal can be automatically revived likewise extended?

Response: No. The order allows the equivalent of as much as three extra payment defaults or an added three months time during the March 13 to December 31, 2020 timeline, prior to a deemed annulment of a consumer proposal. After this happens, a notice of revival has to still be filed within 30 days of the deemed annulment.

Q: Will the five-year restriction on consumer proposals be lengthened in order to offer debtors the time required to make up the missed out on payments?

Response: The BIA says that a consumer proposal needs to say that it will be completed within 5 years. Consequently, all payments, including missed repayments, have to be made during this same timeline. The only thing that will change that is if an amended proposal is filed and approved. After saying that, the BIA does not offer instant repercussions for defaults that lead to non-performance during this 5 year time period. If a consumer proposal has exceeded the five-year period but has actually not been annulled, it remains in force and therefore, in my view, can be completed.

This assumes no interested party goes to Court to ask for a court-ordered annulment. The Office Superintendent Bankruptcy Canada has formally stated that where hold-up in completion is due to COVID-19 reasons, they will not be seeking an annulment.

Everything old is new again or “Throwback Thursday”

There is one area that has not yet been covered off by the Order obtained by the Office Superintendent Bankruptcy Canada. When a person who does not fit under the $250,000 debt limit of consumer proposals, and for all companies, debt settlement restructuring plans under the BIA are done under Part III Division I Proposal section.

If a restructuring proposal cannot be filed straight away, the BIA allows for the filing of a Notice of Intention To Make A Proposal (NOI). The BIA statute says that unless extended by the Court, a Proposal needs to be filed within 30 days after the filing of the NOI. The Court can extend the timeline for a period not exceeding 45 days for any individual extension. In total, extensions cannot be more than 5 months. So in total, a debtor who has filed an NOI can be operating under the NOI for a maximum of 5 months and 30 days.

The Court has to order the extension prior to the expiry of the earlier time period trying to be extended. But the Courts are currently closed. They are only hearing emergency applications via telephone conference call or videoconference. Are a bunch of businesspeople fighting over money with the debtor asking for more time to file a Proposal an emergency? I can’t answer that right now. So if they can’t get into Court, what is the answer?

The Office Superintendent Bankruptcy Canada has recommended an old method. In the “old days”, before 1992, there was no NOI provision. So what did a person or company who needed more time to formulate and file a Part III Division I Proposal debt settlement plan, but needed to hold off creditors right now, do? They filed what was called a “holding proposal”. A holding proposal is no more than a proposal that says I promise to file a debt settlement plan that will clearly say how I plan to settle my debts either by a certain date or when a specific set of events happen.

The benefit was that the debtor got help from the immediate stay of proceedings. If the debtor could, he, she or it filed an amended proposal at the meeting of creditors which really said how the debts would be settled and then paid. If not, the creditors could consider the issues holding up the filing of the real proposal. If they felt it was in their best interests, they voted in favour to give the debtor the necessary time. If not, they voted it down and the debtor was immediately deemed to have filed an assignment in bankruptcy.

Where the creditors gave the debtor more time under the holding proposal, the Court approved them as long as the requirements the Court had to review were met. It was ultimately the creation of the NOI that was made to make it easier for debtors who were not ready to file a definitive proposal but needed relief from creditors to get it.

So now, the Office Superintendent Bankruptcy Canada is recommending for those cases where you just can’t get into Court, file a holding proposal. I am glad that Ira has kept a copy of a holding proposal in our document template file!!

Summary

I hope you found this case review helpful. It should be of particular interest to contractors, developers and builders in Ontario.

The Ira Smith Team family hopes that you and your family members are remaining secure, healthy and well-balanced. Our hearts go out to every person that has been affected either via misfortune or inconvenience.

We all must help each other to stop the spread of the coronavirus. Social distancing and self-quarantining are sacrifices that are not optional. Families are literally separated from each other. We look forward to the time when life can return to something near to typical and we can all be together once again.

Ira Smith Trustee & Receiver Inc. has constantly used clean, safe and secure ways in our professional firm and we continue to do so.

Revenue and cash flow shortages are critical issues facing entrepreneurs and their companies and businesses. This is especially true these days.

If anyone needs our assistance, or you just need some answers for questions that are bothering you, feel confident that Ira or Brandon can still assist you. Telephone consultations and/or virtual conferences are readily available for anyone feeling the need to discuss their personal or company situation.

Are you now worried just how you or your business are going to survive? Those concerns are obviously on your mind. This pandemic situation has made everyone scared.

The Ira Smith Team understands these concerns. More significantly, we know the requirements of the business owner or the individual that has way too much financial debt. You are trying to manage these difficult financial problems and you are understandably anxious.

It is not your fault you can’t fix this problem on your own. The pandemic has thrown everyone a curveball. We have not been trained to deal with this. You have only been taught the old ways. The old ways do not work anymore. The Ira Smith Team makes use of new contemporary ways to get you out of your debt problems while avoiding bankruptcy. We can get you debt relief now.

We look at your whole circumstance and design a strategy that is as distinct as you are. We take the load off of your shoulders as part of the debt settlement strategy we will draft just for you.

We understand that people facing money problems require a lifeline. That is why we can establish a restructuring procedure for you and end the discomfort you feel.

Call us now for a no-cost consultation. We will listen to the unique issues facing you and provide you with practical and actionable ideas you can implement right away to end the pain points in your life, Starting Over, Starting Now.

The Ira Smith Team is absolutely operational and both Ira, as well as Brandon Smith, are right here for a telephone appointment, conference calls and also virtual meetings.

Stay healthy and safe everybody.

[monkeytools msnip=”http://monkeyplayr.com/playr.php?u=5173&p=22219″]