When to file bankruptcy to get a fresh start

Definition of Bankruptcy

Are you feeling overwhelmed by unmanageable debt? Then bankruptcy might be the perfect solution

for you. Bankruptcy can be defined as a legal process that can help people and businesses get out of their financial binds.

Though the thought of filing for bankruptcy may be daunting, it can be the best option when you’re facing unexpected expenses or other emergency situations.

To make sure you’re making the right decision, it’s important to understand when to file bankruptcy and what you can expect. Bankruptcy allows a person to get back on top of their finances and start fresh. Weighing the pros and cons of filing for bankruptcy can be an alarming task, but it can ultimately be the best when your back is against the wall with debt. This Brandon’s Blog lets you find out when to file bankruptcy, what you should expect and what the bankruptcy alternatives are.

What is Bankruptcy and How Does it Work?

Bankruptcy in Canada is a liberating process for those who have found themselves under a burden of debt. The Bankruptcy and Insolvency Act (Canada) (BIA) provides debtors with a discharge from most debts, allowing them to have a fresh start in their financial lives. The process is designed to help those who cannot pay their bills as they come due, and have no way of paying back their debt load. By taking advantage of the bankruptcy discharge, individuals can find themselves free from the chains of debt and start anew. On the other hand, unlike a person, a company that files for bankruptcy will not survive in the long run, and thus, there is no discharge process for a company.

When to File Bankruptcy?

Don’t let debt take the life out of you! Bankruptcy law can give you the fresh start you need. Although not to be taken lightly, a bankruptcy filing can be an absolute lifesaver when the debt becomes too much to bear.

Filing for bankruptcy is no small decision and has the potential to drastically alter your financial future. It’s essential to be informed on when to file bankruptcy and the process involved to ensure that your credit and ability to access money in the future are not adversely affected.

Start the legal process off right by filing for bankruptcy with the help of a licensed insolvency trustee (formerly called a bankruptcy trustee) (LIT or Trustee). The LIT will submit all the documents at once and get the ball rolling.

When an individual has too much consumer debt and files for bankruptcy, the LIT takes possession of their property and assets (subject to provincial government exemptions). The Trustee is the appointed authority in charge of liquidating the assets and depositing the proceeds into a trust account that will eventually be distributed among the creditors in the priority laid out in the BIA.

It is crucial to understand when to file bankruptcy and the process involved to make informed decisions about one’s financial future.

When to file bankruptcy: Identifying signs of financial distress

Here are 5 common signs of financial distress:

- Consistent inability to pay bills – Consistent inability to pay bills can be a difficult and stressful situation for individuals and companies. There are various options for managing late bill payments, however, missing bill payments can have negative financial impacts. It is important to be proactive in finding a solution, as missing bill payments may result in consequences such as eviction, cutting off of necessary supplies and financial penalties. Options for managing late bill payments vary, depending on the type of bill, such as rent or mortgages as opposed to suppliers of goods or services.

- Increased collection activity and legal threats – Balances in collections are the result of outstanding debts that have not been paid. The collection process and the behaviour of debt collection agencies and debt collectors are stressful. Provincial law dictates the rights of consumers when it comes to debt collection and debt collectors.The statute of limitations to collect a debt is also a matter of provincial jurisdiction. Debts are statute-barred after the period prescribed by the law for bringing legal action against the consumer to collect a debt. A debt is considered time-barred if the applicable statute of limitations has expired.

- Are you buried in debt and feeling overwhelmed? A hefty burden of financial obligations without a plan of attack can lead to a seemingly never-ending cycle of debt, with high-interest payments and a lack of hope. Alternatively, an overly ambitious plan can leave you feeling like freedom from debt is unattainable. The stress of debt can have a major toll on your mental health. It’s time to take control and devise a sensible debt repayment strategy to ultimately become debt-free and reduce the interest you pay.

- Tempted to use a credit card for all your needs? Be careful; it can be easy to go overboard and put yourself into financial hardship. When you use credit cards, you risk overspending, inflating your credit utilization ratio, and even opening yourself up to identity theft and credit card fraud. Don’t take the chance – think twice before swiping!

- Increasingly relying on personal loans from friends and family – The dangers of relying on loans from friends and family include broken promises or agreements. There may be confused assumptions about the loan, which can lead to misunderstandings.Additionally, not setting up clear and defined terms for repayment could lead to problematic personal relationships. A loan from friends and family could also provide tax problems depending on how it is set up and how interest payments, principal repayments and/or loan forgiveness are treated on tax returns, or not, as the case may be.

when to file bankruptcy

When to file bankruptcy: The process of filing for bankruptcy

The process of filing for bankruptcy in Canada is handled by a Trustee under the supervision of the Office of the Superintendent of Bankruptcy Canada (OSB) under the BIA. The time to complete the bankruptcy process for a 1st time bankrupt with no surplus income, where neither the Trustee nor any creditor opposes the individual bankrupt’s discharge is 9 months. If a first-time bankrupt gets a discharge at the 9-month point, then they have received an automatic discharge from the LIT. During bankruptcy, the creditors can no longer harass the bankrupt person or carry out legal proceedings or wage garnishments.

The LIT provides an information form for the person to complete, and uses that information to prepare and then file the bankruptcy paperwork. The LIT needs personal information (name, address, birth date), a list of creditors and a list of assets. The LIT then files the bankruptcy documents electronically with the OSB and then they will issue a Certificate confirming the acceptance of the bankruptcy filing. It is the day and time of the issuance of the OSB’s certificate that marks the beginning of the bankruptcy process.

When to file bankruptcy: What is the impact of filing for bankruptcy?

Once your bankruptcy is filed, there is an immediate stay of proceedings. This means that unsecured creditors cannot begin or continue lawsuits, wage garnishees, or even contact you to request payment. Within five days of the bankruptcy starting, the LIT will send a copy of the bankruptcy paperwork to creditors so they can file a claim.

Overview of the bankruptcy process

Can I keep my assets when I file for bankruptcy? In most cases, yes. However, the trustee may sell some assets to pay off your creditors. The assets you can keep will depend on your province’s exemptions. The Trustee’s job is to manage the sale of the bankrupt’s assets and place the proceeds into a trust, safeguarding them for the creditors. In other words, the Trustee is a guardian of funds, making sure everything is handled properly.

Are you worried that filing for bankruptcy will destroy your credit? Don’t fret – while bankruptcy will certainly leave its mark on your credit report, it’s far from a death sentence. Once your bankruptcy is approved, you can start taking steps toward restoring your financial health. A fresh start is waiting – be smart and make decisions that will get you back on the right track!

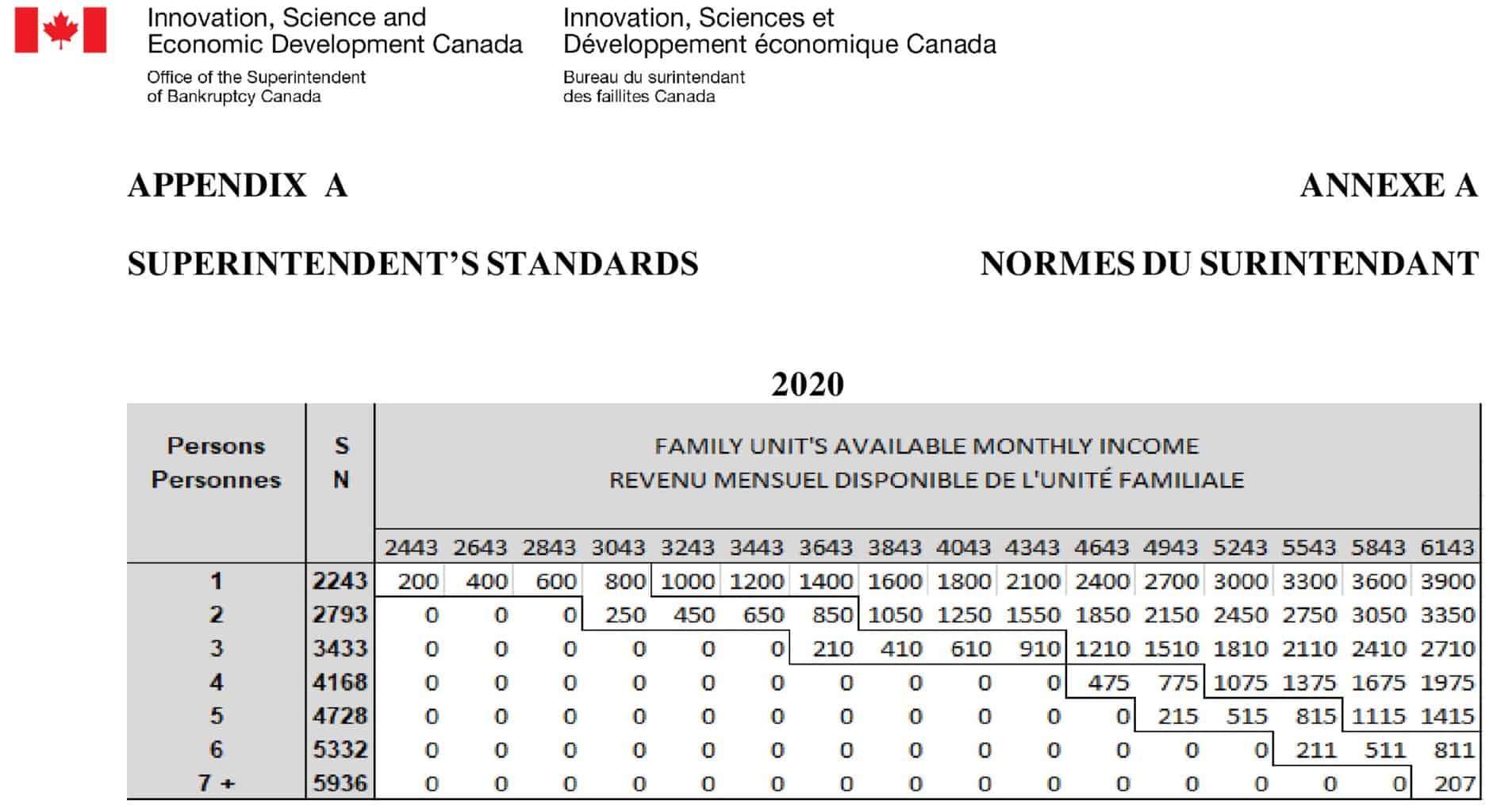

Wondering just how long you’ll be in bankruptcy? That all depends! If it’s your first-time bankruptcy filing with no surplus income, it should only last nine months. But if you’ve filed for bankruptcy more than once and don’t have surplus income, it will take 21 months. For those who have surplus income, this process will take longer.

2 financial counselling sessions. In a consumer restructuring or bankruptcy administration under the BIA, the debtor is required to go through two financial counselling sessions with the LIT. The reason is that one of the objectives of the BIA is financial rehabilitation. Financial education and teaching financial literacy tips are important parts of that rehabilitation.

Requirements for filing bankruptcy

To be eligible to file for bankruptcy in Canada, you must meet certain requirements. You must owe at least $1,000 in unsecured debt and be unable to pay your debts as they come due. You must also be insolvent, meaning you owe more than the value of the assets you own. Additionally, you must either reside, do business or have property in Canada. There are other acts of bankruptcy contained in the BIA, but the normal requirement is as I just described.

Role of Trustees in the bankruptcy process

The role of a LIT in Canada is to assist individuals or companies in the bankruptcy process as laid out by the BIA. They help to explain to the debtor the various options in dealing with their debt and provide advice on the best course of action. The Trustee also prepares the necessary paperwork, including reviewing the debt and completes the process from start to finish. One of the key responsibilities of the Trustee is to take possession of the property not exempt under provincial law, or subject to a trust or secured claim. The LIT then does this by selling the available assets and depositing the funds in trust for the creditors in the bankruptcy administration.

When to file bankruptcy: Alternatives to Bankruptcy

There are several alternative solutions that a LIT can recommend to a debtor in solving their debt problems. Bankruptcy is always the last resort and is to be avoided if at all possible. The main alternative solutions are:

Debt consolidation and debt management plans

In Canada, consolidation loans are available to assist individuals in reducing their high-cost debt payments. If you qualify for such a loan, it is an advantageous solution. These debts may include credit cards, payday loans, and unpaid tax obligations. By consolidating higher-interest-rate debts into one lower-interest-rate loan, it is possible to make affordable monthly payments and work toward eliminating debt.

If you’re in need of financial help, a Debt Management Plan (DMP) may be the answer. A DMP is an effective way to repay credit card debt, and with the help of a non-profit, no-cost credit counselling agency, you can get the support to make it work. The agency will assess your situation to ensure that a DMP is the best option for you. Put your debt worries to rest and take the first step towards a sound financial future with a DMP.

Both debt consolidation and debt management plans aim to help individuals in Canada manage their debt effectively.

Credit counselling and financial planning

Credit counselling and financial planning can help someone who has many debts. The services are provided by accredited credit counsellors working for non-profit credit counselling organizations. A credit counsellor will assess the financial situation of an individual and provide tips on dealing with debt. Financial planning and budgeting will be an important part of the process.

If the individual decides to sign up for a DMP, the counsellor will contact creditors on their behalf to request reducing or eliminating the interest rate or fees on their debts. In some cases, the creditors may agree to these requests.

Debt settlement, restructuring and negotiation with creditors

Debt restructuring, also known as debt negotiation, is the process of negotiating the terms and conditions of debt repayment with creditors. This process can be carried out by the consumer or company themselves seeking alternative repayment options. The goal is to reach a mutually agreed-upon arrangement that is more manageable for the consumer or company to repay their debt. It can involve the forgiveness of interest, stopping the interest clock and even the forgiveness of principal. If the company or consumer handles the discussions themselves, or with the help of their accountant, it is called an informal restructuring.

When a consumer or company restructures their debt with the help of a LIT under the BIA, they would file either a consumer proposal or a Division I proposal restructuring. A large company could also restructure under the Companies’ Creditors Arrangement Act.

When to file bankruptcy: Conclusion

Personal bankruptcy or corporate bankruptcy, and when to file bankruptcy, is a big decision, but it can be the right one when you’re overwhelmed with debt. You can make an informed decision by understanding the basics of bankruptcy, including when to file and what to expect. If you’re struggling with debt and considering bankruptcy, it’s important to speak with a professional who can help you assess your options. Bankruptcy can be a fresh start for your financial future, but it’s important to understand the consequences and work with a professional to determine if it’s the right choice for you.

I hope you enjoyed this when to file bankruptcy Brandon’s Blog.

Revenue and cash flow shortages are critical issues facing entrepreneurs and their companies and businesses. Are you now worried about just how you or your business are going to survive? Those concerns are obviously on your mind. Coming out of the pandemic, we are now worried about its economic effects of inflation and a potential recession.

The Ira Smith Team understands these concerns. More significantly, we know the requirements of the business owner or the individual that has way too much financial debt. You are trying to manage these difficult financial problems and you are understandably anxious.

It is not your fault you can’t fix this problem on your own. The pandemic has thrown everyone a curveball. We have not been trained to deal with this. You have only been taught the old ways. The old ways do not work anymore. The Ira Smith Team makes use of new contemporary ways to get you out of your debt problems while avoiding bankruptcy. We can get you debt relief now.

We have helped many entrepreneurs and their insolvent companies who thought that consulting with a trustee and receiver meant their company would go bankrupt. On the contrary. We helped turn their companies around through financial restructuring.

We look at your whole circumstance and design a strategy that is as distinct as you are. We take the load off of your shoulders as part of the debt settlement strategy we will draft just for you.

We understand that people facing money problems require a lifeline. That is why we can establish a restructuring procedure for you and end the discomfort you feel.

Call us now for a no-cost consultation. We will listen to the unique issues facing you and provide you with practical and actionable ideas you can implement right away to end the pain points in your life, Starting Over, Starting Now.