The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. We hope that you and your family are safe and healthy.

If you would prefer to listen to the audio version of this trustee bankruptcies Brandon’s Blog, please scroll to the bottom and click on the podcast.

Trustee bankruptcies introduction

Are trustee bankruptcies filings high right now?

Every day we read or hear in the media about the life-threatening health challenges faced daily by Canadians. We also hear sad stories about people who have lost their job because of businesses having to close down.

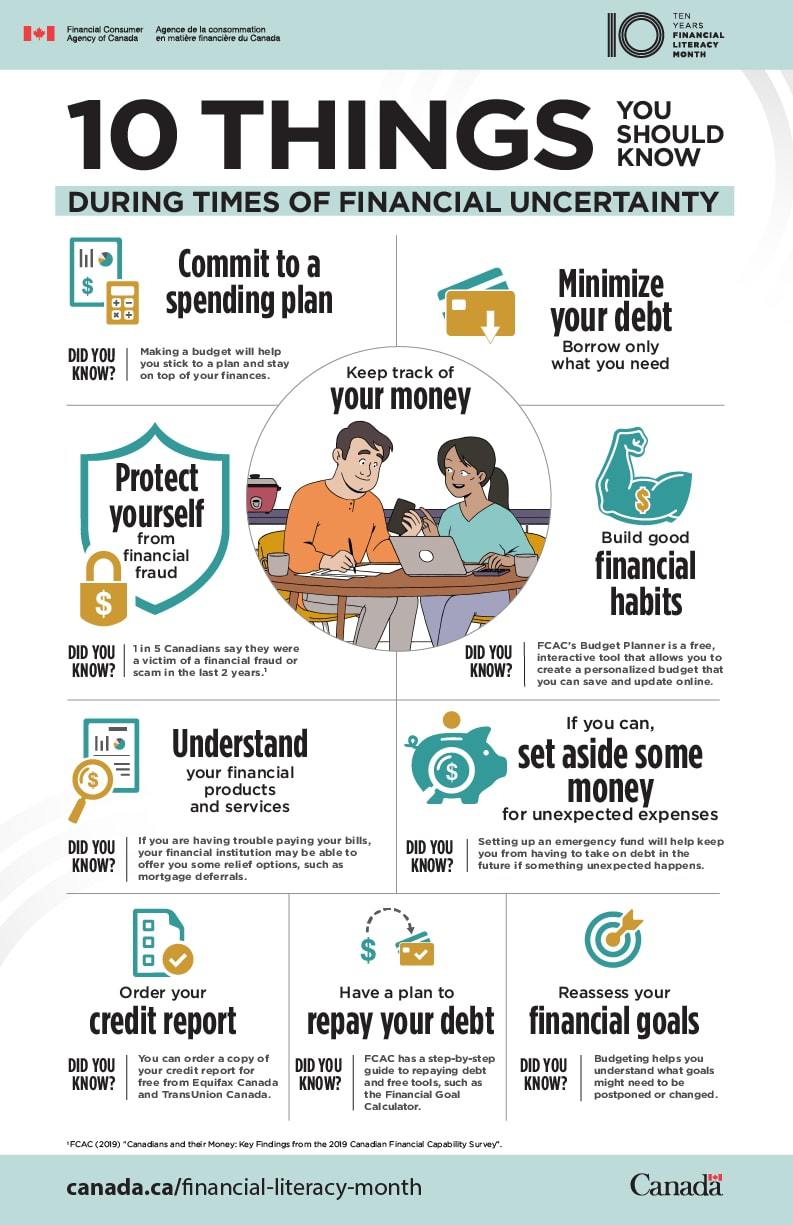

The general public thinks that right now there is a lot of personal bankruptcy and corporate bankruptcy filings. In actual fact, the numbers are low. The 2 main reasons are:

- Government support programs have helped support people and businesses. Most of the programs ended effective September 30, 2020.

- Creditors are not chasing or harassing borrowers right now. Given that we are about 5 weeks away from Christmas, that will not change until some time in 2021.

I am receiving a lot of inquiries from people and entrepreneurs about their personal and business debt situation. I am doing a lot of initial consultations by telephone or video meeting. That tells me that there should be an increase in insolvency filings in 2021.

It may surprise you to hear that even a licensed insolvency trustee (formerly called a bankruptcy trustee or trustee in bankruptcy) business could be having cash-flow problems. A recent court decision out of Ottawa highlights this issue. The purpose of this Brandon’s Blog is to discuss the court case and what it means for a trustee bankruptcies fee collection.

What are the fees of a licensed insolvency trustee?

This question is quite relevant, but the answer depends on what role the licensed insolvency trustee takes on.

A trustee in bankruptcy performs a wide variety of services, such as:

- administrator in a consumer proposal;

- the monitor under a Companies’ Creditors Arrangement Act (CCAA) corporate restructuring;

- licensed insolvency trustee in either a summary administration or ordinary personal bankruptcy;

- receiver over a company’s assets, either by private appointment or court appointment;

- the licensed insolvency trustee in a corporate restructuring under the proposal provisions of the Bankruptcy and Insolvency Act (Canada) (BIA);

- as the licensed insolvency trustee in a corporate bankruptcy; or

- act as a consultant in either a corporate or personal insolvency situation, advising either a creditor or the debtor.

The fee will certainly differ depending on what duty is played. Keep in mind that the costs of trustee bankruptcies are established under the BIA itself for all insolvency administrations under the BIA.

Personal bankruptcy administration where the non-exempt assets are estimated to be worth less than $15,000 is called a summary administration bankruptcy. Rule 128 of the BIA General Rules dictates the cost and disbursements in such trustee bankruptcies. This kind of fee is called a tariff. A tariff also exists in a consumer proposal file.

A bankruptcy is called an “ordinary” bankruptcy when the realizable assets are estimated at $15,000 or greater in personal bankruptcy. Every corporate bankruptcy is an ordinary administration. The BIA also regulates the trustee bankruptcies fee and disbursements.

With this information as background, I will now discuss the recent case out of the court in Ottawa.

A bankruptcy trustee needs cash flow too

The case involves a court application by an Ottawa bankruptcy trustee on 3 separate ordinary administration personal bankruptcy files. Normally, when a bankruptcy trustee wishes to get an interim draw towards its fees and disbursements in an ordinary administration, they either get the approval of the creditors at a meeting of creditors or, approval of the inspectors appointed in the bankruptcy administration.

The First Meeting of Creditors has to take place within 21 days of the date of bankruptcy. It is rare to have to call another meeting of creditors. So if the Trustee does not get approval for an interim draw at the outset from the creditors present at the First Meeting, that chance is gone quickly. If no inspectors are appointed, or a long time has passed and the Trustee has trouble finding the inspectors, getting inspector approval may also prove difficult.

But there is one more way for a Trustee to get approval to get an interim draw for its cash flow.

Office of the Superintendent of Bankruptcy (OSB) Directive no. 27R

The OSB publishes Directives from time to time. Trustees are bound by and obliged to follow all regulations provided by the OSB. This is so there will be consistency in the insolvency process across Canada. Directive 27R is titled “Advance of Trustee’s Remuneration for Bankruptcies Under Ordinary Administration.”. It was issued on February 10, 2010. The purpose of this Directive is to set out the correct procedure the Trustee should comply with when making an interim withdrawal or taking out an advance on remuneration for ordinary trustee bankruptcies.

To withdraw an advance on its compensation, the Trustee needs to obtain consent in the form of:

- a resolution of a duly comprised meeting of creditors;

- the resolution of a majority of the inspectors at a properly convened meeting of inspectors; or

- make an application to the Court for an order approving such interim advance.

This is what this Ottawa Trustee did for 3 of its trustee bankruptcies.

The OSB did not like the court application

The OSB did not like the fact that the Trustee made this application. The OSB actually opposed the application, notwithstanding the Trustee was properly following all the requirements of Directive 27R. The Trustee brought to the court’s attention that it would still take some time to prepare its Final Statement of Receipts and Disbursements, submit it to the OSB to receive their comment letter and then apply to the court for taxation. The process would take many months.

The Trustee also highlighted for the court that these are not normal times. Due to the coronavirus pandemic, government and court staff were not working at their normal pace. The Trustee also pointed out that its own business had to lay off staff and its own cash flow was suffering. Therefore, the Trustee was making an application to the court for approval for an interim draw, as allowed. The Trustee highlighted what has gone on to date in each bankruptcy estate. The Trustee also provided proof of proper service on the OSB of this motion.

The decision does not indicate why the Trustee did not just go for inspector approval. Nevertheless, its position was that it was within its rights to make this application to the court and for the court to approve it.

The OSB’s basis for opposing this motion can be summarized as:

- Interim draws approved by a court under Directive 27R are just to be made in special circumstances.

- While COVID-19 is an exceptional situation, it is insufficient to call for the orders asked for by the Trustee.

- The OSB additionally argues that the motion was not on notice to the creditors in the respective trustee bankruptcies estates concerned, who might actually object to the amount being claimed by the Trustee.

- The OSB is worried that, if the motion is granted and the court order made, it could cause more need on the court’s time as more Trustees will seek similar orders in other trustee bankruptcies estates.

- Finally, the OSB says that this matter is not urgent and therefore ought to not be dealt with right now. The Trustee should just go for final taxation in the normal course.

The OSB also provided two earlier court decisions where interim draws were not approved in support of its opposition.

The court sees COVID-19 creating urgencies, even for trustee bankruptcies

The court considered the OSB’s submissions and the cases it relied upon. The court distinguished those cases from the current motion for these trustee bankruptcies. Due to COVID-19, the Court found that it is not practical for the Trustee to need to wait on the receipt of the OSB Letter of Comment and then proceed to final taxation.

The court stated these are not normal times. The timelines for any of the steps involved in the final taxation process could be much longer, taking into consideration the stay-at-home orders that have been issued, even including the OSB team.

The judge stated that the court must deal with the situation as it presently exists and as it advances each day, and also make appropriate decisions as necessary. He stated that businesses in all industries have been laying workers off. This includes the insolvency industry. A lot of the businesses that are still operating are doing so with minimized staff. Those businesses are attempting to make the most out of their limited cash flow to sustain operations.

The court stated that it understands that the choice it makes on this motion might bring about an influx of cases for interim draws in trustee bankruptcies. If that becomes the case, the court will deal with it. In addition, the court recognized that, because of coronavirus, interim draws are a practical method of managing the liquidity crunch presently being experienced by Trustees. Even if there had been no coronavirus pandemic, Directive 27R still allows for such an application to the court in the trustee bankruptcies.

The Court was also conscious that accounting firms, and consequently licensed insolvency trustee businesses, have been proclaimed essential services in the Province of Ontario.

The court’s decision on the trustee bankruptices motion

As a result of all these findings, the court decided that licensed insolvency trustees must have the tools essential to maintain their operations and to permit people and companies to get access to the Canadian insolvency system. Therefore, the court held that Trustees need to be able to access the funds in their trust accounts that they have actually earned as fees, inclusive of HST.

Taking all this into account, the court exercised its discretion and ordered that the Trustee is approved to withdraw 75% of the fee that has been earned in the three trustee bankruptcies, including HST. The Trustee should then move to final taxation. There are already safeguards built into the final taxation process where creditors in each of the trustee bankruptcies estates can object to the taxation and the total fees if they wish to.

If the total final fees are approved, then the Trustee can withdraw the remaining 25%. If final taxation results in any fees less than the 75% interim draw approved in any of the trustee bankruptcies, then the Trustee will have to repay into the bankruptcy estate the specific amount(s).

The court ordered that any costs incurred on the motion was an overhead cost of the Trustee and was not recoverable from the trustee bankruptcies. Costs were neither sought nor awarded. My understanding is that the OSB is not appealing this decision.

Trustee bankruptcies summary

I hope you have enjoyed this trustee bankruptcies Brandon’s Blog. It is the first decision I am aware of that deals with the reality that like any other entrepreneur, a licensed insolvency trustee is running a business too.

Do you or your company have too much debt? Are you or your company in need of financial restructuring? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or the person who has too much personal debt.

You are worried because you are facing significant financial challenges. It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding bankruptcy. We can get you debt relief freedom.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a debt settlement plan, we know that we can help you.

We know that people facing financial problems need realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team.

That is why we can develop a restructuring process as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious in finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation.

We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

The Ira Smith Trustee Team is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting. We hope that you and your family are safe and healthy.