As Brandon Smith, Senior Vice-President of Ira Smith Trustee & Receiver Inc., I understand the stress and confusion that comes with financial difficulty and legal proceedings. My goal is to provide clear, actionable, and compassionate advice to help you navigate these challenging times. This Brandon’s Blog post will demystify the complex world of seeking leave to appeal a receivership order in Ontario, using a real-world example to highlight the critical steps and why early professional guidance is essential.

Leave To Appeal Key Takeaways

- A receivership order means a third party takes control of a business’s assets, often leading to their sale. It’s a serious step, usually initiated by a creditor.

- Appealing a receivership order in Ontario is extremely difficult. You usually need “leave to appeal,” which is not automatically granted.

- Courts consider strict legal tests, including whether there’s a serious question to be tried, if irreparable harm would occur, and the balance of convenience.

- The case of Royal Bank of Canada v. 2339366 Ontario Inc., 2026 ONSC 327 (CanLII), shows just how challenging it is to successfully get leave to appeal.

- Strict deadlines apply, often as short as 10 days for insolvency-related appeals, making immediate action crucial.

- Proactive measures, like Bankruptcy and Insolvency Act Division I proposals or Companies’ Creditors Arrangement Act Plans of Arrangement, are often a better solution than waiting until receivership.

- Seeking expert advice from a Licensed Insolvency Trustee (LIT) like Ira Smith Trustee & Receiver Inc. early can help you explore options and avoid the receivership process entirely.

Leave to Appeal Introduction: When Control Slips Away

Imagine building a business from the ground up, pouring your heart, time, and money into it. Then, suddenly, financial pressures mount, and a powerful creditor, normally the senior secured lender, steps in, asking a court to appoint a licensed insolvency trustee as the “receiver.” This receiver takes control, manages the company’s assets, and sells them off. The feeling of losing control can be devastating. It’s a moment when everything you’ve worked for feels like it’s slipping away.

This is the harsh reality of a receivership order. It’s a powerful legal tool for creditors in Ontario. Many business owners, understandably, want to fight back, to appeal the decision. But what does that really mean, and what are your chances of success?

We’ll dive into the complexities of appealing an Ontario receivership order, using the important case of Royal Bank of Canada v. 2339366 Ontario Inc., 2026 ONSC 327 as a guide. This case highlights just how tough it is to get “leave to appeal” a receivership order. More importantly, we’ll discuss how to avoid reaching this point, and why expert advice from Ira Smith Trustee & Receiver Inc. is your best defence. We believe that understanding your options before a crisis hits is the key to protecting your financial future.

Understanding Receivership: What It Is and Why It Happens

A receivership is a legal process where a court appoints a neutral licensed insolvency trustee third party, called a receiver, to take control of a company’s assets or business operations. The receiver’s main job is to preserve the value of these assets and, usually, sell them to repay creditors. This is a serious step, often considered a last resort by a secured creditor seeking to recover their funds.

Why does it happen? Receiverships usually happen when a business is in severe financial trouble and can no longer pay its debts, especially to a secured creditor like a bank. This creditor will then ask the court to appoint a receiver to protect their interests. Common reasons include:

- Defaulting on loans: The business fails to make agreed-upon payments on its bank loans or other secured debts.

- Breaching loan agreements: Even if payments are being made, other terms of the loan agreement might be broken, such as not providing financial statements or selling key assets without permission.

- Mismanagement or fraud: If there are concerns about how the business is being run, or if there’s suspected fraud, a court might appoint a receiver to ensure assets are protected.

- Disputes among owners: Sometimes, conflicts between business partners or shareholders can threaten the company’s financial health, leading to a creditor seeking receivership.

- Risk of asset loss: If there’s a risk that valuable assets might be wasted, sold off improperly, or disappear, a receiver can step in to secure them.

The impact on a business is immediate and severe. Once a receiver is appointed, the original owners lose all control over daily operations and decision-making. The receiver steps in to manage everything – from selling inventory and equipment, to collecting money owed to the business, to dealing with employees and suppliers. They make all decisions that affect the business and its assets. The goal is liquidation and repayment, not usually continued operation or rehabilitation.

It’s important to understand that only a Licensed Insolvency Trustee (LIT) can be appointed as a receiver. While a LIT is a Canadian insolvency professional experienced in all insolvency processes, including receivership, their primary role in other insolvency processes, like corporate financial restructuring or corporate bankruptcies, is different. In those cases, LITs focus more on helping debtors restructure or liquidate in an orderly, debtor-focused manner. Receivership, by contrast, is often a creditor-driven process, putting the secured creditor’s interests first, but not exclusively, without regard to the interests of all other stakeholders.

Royal Bank of Canada v. 2339366 Ontario Inc., 2026 ONSC 327 Case: A Closer Look At Leave To Appeal

This Ontario Superior Court of Justice decision, released January 16, 2026, Royal Bank of Canada v. 2339366 Ontario Inc., is a clear example of the challenges involved in trying to stall or overturn a receivership order. It demonstrates the high legal hurdle faced by debtors seeking to appeal such a decision.

What Happened in the Case? In this specific case, Royal Bank of Canada (RBC) had successfully obtained a receivership order against 2339366 Ontario Inc. and other related parties. The statutes relied upon to gain the appointment were the Ontario Courts of Justice Act and the Bankruptcy and Insolvency Act. This meant the court had agreed with RBC that a receiver was needed to take control of the assets of the debtor company and its related parties. The debtor, understandably wanting to retain control, challenged this decision by seeking “leave to appeal” that receivership order. They were asking for permission from the Court of Appeal for Ontario to challenge the original decision that put their business into receivership.

What is “Leave to Appeal”? In many legal matters, especially those involving the Bankruptcy and Insolvency Act (BIA), including the appointment of court-appointed receivers, you don’t have an automatic right to appeal a court’s decision. This is a critical distinction. Instead, you must first ask a judge of the Court of Appeal for Ontario for leave to appeal, which means asking for permission to bring the appeal forward. It’s a vital first hurdle, a gate that must be passed before the actual appeal can even be heard. The court looks at whether there’s enough merit or public importance to justify the time and resources of a higher Ontario Court of Appeal.

The Legal Threshold: Criteria for Granting Leave to Appeal

To get leave to appeal, the court typically looks at several strict factors. In insolvency cases, and specifically when trying to appeal a receivership order, these often include:

- Is there a serious question to be tried? This isn’t just about disagreeing with the decision. It means, is there a real, important legal issue that needs to be addressed by a higher court, not just a minor disagreement about facts or a desire to re-argue the case? The potential appellant must show that their appeal has “arguable merit” and a reasonable chance of success.

- Will the applicant suffer irreparable harm if the leave is refused? Would they face damage that cannot be fixed later, even if they were to eventually win the appeal? For example, if assets are being sold off by a receiver, the “harm” of losing those assets is often already happening, making it hard to argue future irreparable harm.

- Does the balance of convenience favour granting the leave? The court weighs who would be more negatively affected by granting or refusing the leave – the party wanting to appeal (the debtor), or the other parties (like the creditors and the Canadian insolvency professional receiver who is working to recover funds)? In receivership, delaying the receiver’s work can cause more harm to creditors, who are trying to recover their money and mitigate further losses.

- Is there an error in principle? Receivership orders are often considered “discretionary.” This means the original judge had some choice in making the order, based on the specific facts and legal principles. To successfully appeal a discretionary order, you usually need to show that the judge made a mistake in applying a legal principle, rather than just disagreeing with how they used their discretion.

In the RBC case, the debtors argued that since appealing an insolvency order invokes the stay of proceedings, applying for leave to appeal the receivership order must also stay the actions and activities of the receiver. They further argued that therefore, they did not have to cooperate with the receiver, including delivering the books and records and the assets of the company.

The court determined that the debtor’s and the other moving parties’ argument was without merit. The court said that seeking leave to appeal is not the same as an active appeal and did not impose an automatic stay. This meant their attempt to challenge the validity of the receivership order was stopped before it could even begin. The original decision to appoint a receiver under Canadian insolvency law stood at that time. This case highlights how robust the initial evidence for a receivership must be, and why it is in force until a higher court says it was stayed or is no longer valid.

Navigating An Appeal: What “Leave to Appeal” Really Means in Ontario

The RBC v. 2339366 Ontario Inc., 2026 ONSC 327 case underscores a crucial point for anyone facing such a situation: simply disagreeing with a receivership order is not enough to have it stayed (or get an appeal heard). The bar for getting leave to appeal in Ontario, especially for insolvency matters under the Bankruptcy and Insolvency Act (BIA), is very high. It’s designed to prevent endless litigation and allow the insolvency process to move forward efficiently.

Why is it so difficult to obtain leave to appeal an Ontario receivership order?

It’s difficult because courts want to ensure that appeals don’t unduly delay the administration of an insolvent estate, which can cause further losses for creditors. The legal system aims for finality and efficiency in insolvency proceedings. For a receivership order, this means letting the receiver do their job of securing and selling assets as quickly and effectively as possible.

The Strict Legal Tests Courts Apply:

When deciding whether to grant leave to appeal, courts apply several strict legal tests. These are not easy to meet:

- Arguable Merit (Serious Question to be Tried):

- You must show that your proposed appeal is not frivolous or simply a delay tactic. It must raise a genuine insolvency law legal issue that has a reasonable chance of success if fully argued.

- This often means identifying a clear error of insolvency law or otherwise by the original judge, a misinterpretation of a statute, or a significant factual error that led to an incorrect legal conclusion. It’s not enough to say the judge “got it wrong”; you need to show how they got it wrong according to legal principles.

- For example, you might argue that the original judge did not properly apply the specific conditions required under insolvency law for a receivership under the BIA, or that there was insufficient evidence to prove the debt existed.

- Irreparable Harm:

- You need to convince the court that if the appeal isn’t allowed to proceed, you will suffer harm that cannot be fixed later, even if you eventually win the appeal.

- This is incredibly challenging in a receivership case because the core “harm” – losing control of your assets and having them sold – is usually already in motion by the receiver. Once assets are sold, reversing that is often impossible. The court will question whether the harm is truly “irreparable” if it could be compensated with money if you were to win the appeal. In many cases, the harm is financial, and the court may see that as reparable by damages, even if that’s a difficult outcome for the debtor.

- Balance of Convenience:

- The court weighs the potential negative impact on you if leave to appeal is denied against the potential negative impact on the other parties (primarily the creditors and the receiver) if leave is granted.

- In insolvency law, courts often prioritize the interests of creditors and the efficient administration of the estate. Delaying a receivership through an appeal can increase costs, devalue assets, and frustrate creditors’ efforts to recover their money.

- The court asks: Who will suffer more if the process is stalled? Often, the creditors’ need for timely recovery outweighs the debtor’s desire to appeal a decision already made.

- Public Importance (Less Common for Individual Cases):

- Sometimes, the court will consider whether the case raises a novel or important question of law that has significance beyond the parties involved. This is less common for typical receivership orders, which usually hinge on the specific facts of a debt.

- Unless your case sets a new legal precedent or clarifies a significant area of insolvency law, this factor is unlikely to swing the decision in your favour.

Tight Deadlines: An Unforgiving Reality One of the most unforgiving aspects of insolvency appeals, especially those related to receivership orders, is the strict timeline. Under the Bankruptcy and Insolvency Act (BIA) Rules, you often have only 10 days from the date of the order to file your notice of appeal or your application for leave to appeal. Missing this deadline can be fatal to your appeal, regardless of how strong your arguments might otherwise be. The courts are very reluctant to extend these short deadlines in insolvency matters, especially if the appeal lacks general importance in insolvency law, as noted by legal experts.

This highlights why time is truly of the essence and why professional guidance is not just helpful, but essential from the very first sign of financial trouble. Delaying action to address debt issues can close doors to crucial legal avenues, making a difficult situation even harder to resolve.

The Proactive Path: Alternatives to Receivership for Businesses and Individuals

The challenging reality of appealing a receivership order emphasizes one critical truth: prevention is far better than reaction. Waiting until a creditor has obtained a receivership order, and then trying to appeal it is often too late to truly save your business or regain control of your assets. By that point, the legal and financial damage is usually significant.

Instead, businesses and individuals facing financial distress should explore proactive restructuring options. This is where the expertise of a Licensed Insolvency Trustee (LIT) like the Ira Smith Team becomes invaluable. We can help you understand and navigate solutions designed to avoid the drastic measures of receivership or bankruptcy. We offer guidance that allows you to take control before others step in.

Key Alternatives to Avoid Receivership:

Consumer Proposals: A Lifeline for Individuals and Small Proprietorships

- What it is: A Consumer Proposal is a formal, legally binding offer that an individual (or a small business owner with personal guarantees) makes to their unsecured creditors. You propose to pay back a portion of what you owe, over a period of up to five years, without interest. It’s a structured debt settlement overseen by a Licensed Insolvency Trustee.

- How it helps:

- Stops collection calls and legal actions: Once filed, a “stay of proceedings” comes into effect. This means creditors cannot call you, garnish your wages, or pursue other legal actions.

- Reduces debt: You often end up paying back only a fraction of your original unsecured debt.

- No interest: All interest charges are frozen once the proposal is filed.

- You keep your assets: Unlike receivership or bankruptcy, you generally keep all your assets, including your home, car, and business property.

- Avoids bankruptcy: It’s a powerful alternative to personal bankruptcy, allowing you to settle your debts while protecting your credit rating more quickly than bankruptcy.

- Who it’s for: Individuals with debts of up to $250,000 (not counting a mortgage on a principal residence). It’s an excellent option for consumers and small business owners whose personal guarantees are a significant burden.

Division I Proposals: Restructuring for Larger Consumer Debts and Corporations

- What it is: Similar to a Consumer Proposal but designed for larger debts, corporations, or individuals with debts over $250,000 (excluding a mortgage on a principal residence). A Division I Proposal allows a company (or a high-debt individual) to propose a restructuring plan to all of its creditors (generally only those who are unsecured). This plan is administered by the LIT, who acts as the Proposal Trustee.

- How it helps:

- Business continuity: If accepted, the business can often continue operating, avoid bankruptcy, and repay its debts under new, manageable terms. This is a crucial difference from receivership, which usually means the end of the business.

- Stops creditor actions: Like a Consumer Proposal, it imposes a “stay of proceedings,” stopping all legal actions, including potential receivership requests, from creditors.

- Comprehensive restructuring: It can be tailored to address various types of debt and allow for more complex negotiations with creditors, including secured creditors.

- Preserves value: It allows for the orderly winding down or sale of parts of a business, or the full rehabilitation of a viable business, often preserving more value than a receivership.

- Who it’s for: Corporations struggling with significant debt, or individuals whose unsecured debt exceeds the Consumer Proposal limit. It’s a powerful tool for business rescue.

Understanding Bankruptcy: When It’s the Right Option

- What it is: While often seen as a last resort, bankruptcy is a formal legal process that can provide a fresh financial start by clearing most unsecured debts. For businesses, it involves the orderly liquidation of assets to pay creditors. An LIT oversees this process, ensuring all legal requirements are met. It is governed by federal law, specifically the Bankruptcy and Insolvency Act.

- How it helps:

- Debt discharge: For individuals, it legally eliminates most unsecured debts, offering a true fresh start. Corporate bankruptcy does not give the company a fresh start.

- Stops creditor action: Immediately stops all collection calls, lawsuits, and wage garnishments.

- Orderly asset liquidation: For businesses, it provides a structured way to close down, sell assets, and distribute funds to creditors fairly, rather than a chaotic dismantling.

- No more interest: All interest on unsecured debts stops.

- Who it’s for: Individuals or corporations who cannot meet their financial obligations, and for whom a proposal is not feasible or desirable. It’s a powerful tool when other options are exhausted, and a complete reset (consumer) or shut down (corporate) is needed.

These alternatives empower you to take control of your financial situation, often preserving assets, stopping legal actions, and offering a clear path forward. This is incredibly difficult to achieve once a receivership order has been imposed by the court and a receiver is already at work. By speaking with a Licensed Insolvency Trustee early, you gain the knowledge and support to make informed decisions that protect your future. Ira Smith Trustee & Receiver Inc. is here to help you explore these options with dignity and professionalism.

The Real-World Impact: What This Means for You

The lessons from cases like Royal Bank of Canada v. 2339366 Ontario Inc., 2026 ONSC 327 are clear and profound. They highlight the significant consequences of delaying action when facing financial distress.

- For Business Owners: If your business is struggling, waiting until a secured creditor initiates receivership proceedings means:

- You have not recognized the danger signals early enough.

- Therefore, you did not have the time where you could have taken remedial action.

- Your options are severely limited.

Once a receiver is appointed, you lose control of your operations, your assets, and often your entire business. This can lead to a complete loss of the value you’ve built, damage to your reputation, and immense personal stress. Proactive engagement with a Licensed Insolvency Trustee can open doors to solutions that keep you in control and your business viable, or at least allow for an orderly wind-down on your terms, not a creditor’s.

- For Individuals with Personal Guarantees: Many small and medium-sized business debts, especially to a secured lender, are backed by personal guarantees from the owner. Further, corporate directors are liable for unpaid salary, wages and vacation pay, unremitted source deductions and unremitted HST.

If your company goes into receivership, those personal guarantees don’t disappear. They can lead to personal financial ruin, putting your home, savings, and future at risk. Understanding options like consumer proposals for your personal debts, or a Division I Proposal for you or your business, is crucial to protect your personal finances.

- For Creditors: While receivership is a powerful tool to recover debt, it can be costly and time-consuming. The receiver’s fees and legal costs can eat into the recovered funds, sometimes leaving less for creditors than expected. Understanding the alternatives and how a debtor might proactively offer a proposal can sometimes lead to a quicker, more efficient recovery of funds and a less adversarial process.

The stress and emotional toll of financial uncertainty cannot be overstated. I’ve witnessed it countless times. Knowing your options and having a clear plan of action provides not just practical solutions but also immense peace of mind. Taking early action with expert guidance can transform a seemingly hopeless situation into a manageable path forward.

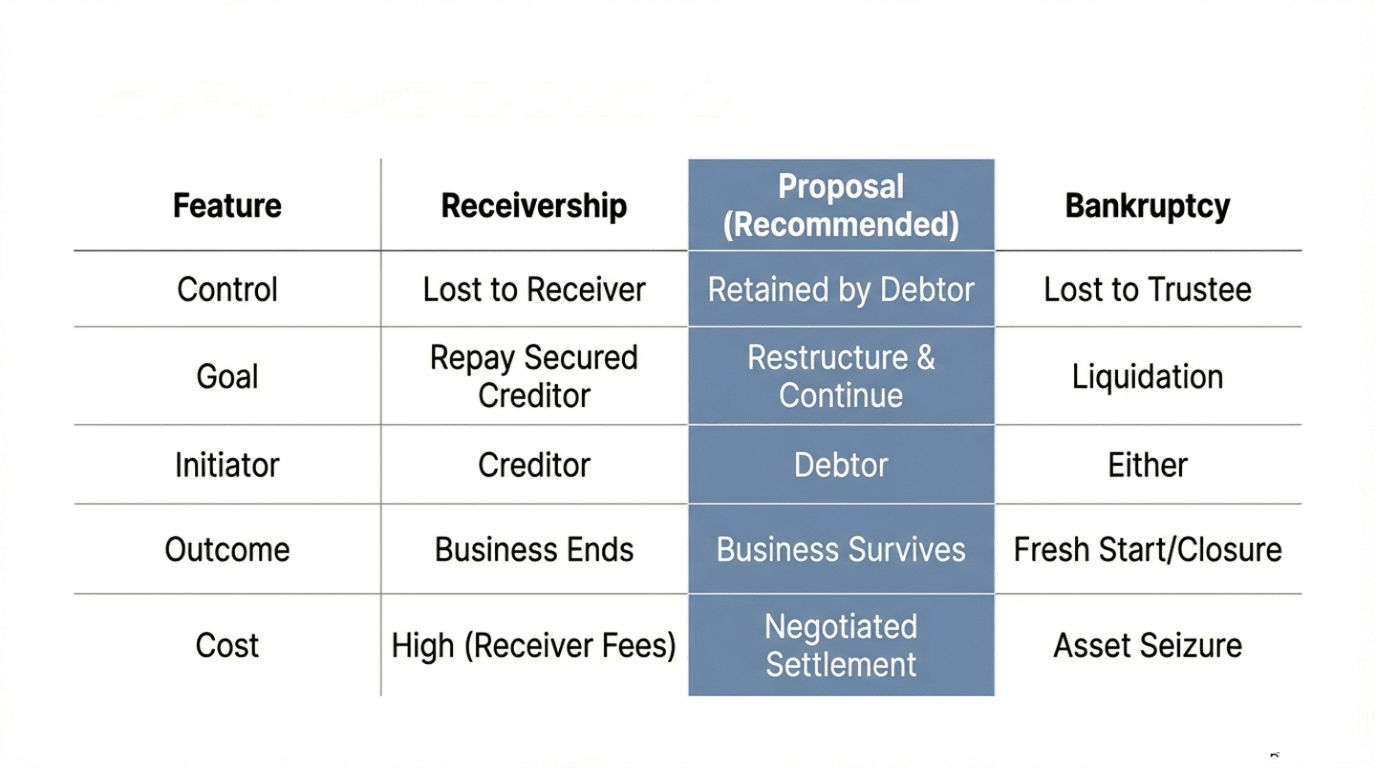

Comparison Table: Receivership vs. Proposal vs. Bankruptcy

Understanding the differences between these insolvency processes is key to making an informed decision. Here’s a quick comparison:

Leave To Appeal FAQ Section

Q1: What does “leave to appeal an Ontario receivership order” mean, and why is it so difficult to obtain?

A: “Leave to appeal” means you must ask the court for permission to bring an appeal; it’s not an automatic right. It’s difficult to obtain because courts want to prevent delays in insolvency proceedings and require you to meet strict criteria. You must show there’s a serious legal question, that you’d suffer irreparable harm, and that the balance of convenience favours hearing the appeal.

Q2: What are the specific legal tests courts apply when deciding whether to grant leave to appeal a receivership order in Ontario?

A: Courts typically apply a three-part test: (1) Is there a serious question to be tried (meaning your appeal has arguable merit)? (2) Will you suffer irreparable harm if leave is refused? (3) Does the balance of convenience favour granting leave? For a discretionary order like receivership, you often also need to show an error in legal principle by the original judge.

Q3: How is a receivership different from bankruptcy?

A: A receivership is usually initiated by a secured creditor to seize and sell specific assets to recover a debt; the business owner loses control. Bankruptcy, on the other hand, is a broader insolvency process. For individuals, it aims to discharge most debts and provide a fresh start. For corporations, it involves the liquidation of all assets to pay creditors, in priority, leading to the company’s cessation. A Licensed Insolvency Trustee (LIT) administers both personal and corporate bankruptcies.

Q4: What should I do if my business is facing financial trouble?

A: Act immediately. The most crucial step is to seek professional advice from a Licensed Insolvency Trustee (LIT) as early as possible. An LIT can assess your situation, explain all your options (like consumer proposals or Division I proposals), and help you develop a strategy to avoid receivership or bankruptcy.

Q5: How can Ira Smith Trustee & Receiver Inc. help me?

A: The Ira Smith Team specializes in helping individuals and businesses facing financial distress in Ontario. We are Licensed Insolvency Trustees, which means we are licensed by the federal government to administer all insolvency processes. We offer a free, confidential consultation to evaluate your specific situation, explain all your options in plain language, and guide you toward the best solution to gain control of your financial future. We focus on providing clear, actionable, and empathetic advice.

Brandon’s Take On Leave To Appeal

As a Senior Vice-President at Ira Smith Trustee & Receiver Inc., I’ve seen firsthand the stress and heartache that financial problems can cause. The Royal Bank of Canada v. 2339366 Ontario Inc., 2026 ONSC 327 case is a stark reminder that once a receivership order is in place, your options become severely limited. Trying to get leave to appeal is often a long, costly, and very difficult battle with a low chance of success. It’s a fight most people can and should avoid.

My experience tells me that most companies that end up in receivership could have found a better, less disruptive solution if they had sought help sooner. The emotional toll of waiting, hoping the problem will just go away, is immense. But financial problems rarely resolve themselves; they usually get worse, piling on more stress, more debt, and fewer options.

That’s why I strongly advocate for proactive measures. Don’t wait until a creditor is at your door, or a receiver is being appointed. Explore alternatives like consumer proposals or Division I proposals. These options allow you to take charge, protect your assets where possible, and restructure your debts in a way that provides real relief. We are here to listen without judgment and guide you through every step of that journey. Our goal is to empower you to make informed decisions and find the best path to financial recovery.

Leave To Appeal Conclusion: Don’t Face Financial Challenges Alone – Take Control Today

The legal landscape surrounding receivership orders and appeals in Ontario is complex and unforgiving. The lessons from cases like Royal Bank of Canada v. 2339366 Ontario Inc., 2026 ONSC 327 clearly demonstrate that appealing a receivership order is an uphill battle, fraught with strict legal tests and tight deadlines. By the time you’re considering an appeal, a significant amount of control and potential value has likely already been lost.

Your best strategy against financial distress is not to fight a receivership order after it’s been granted, but to prevent it from happening in the first place. Early intervention, comprehensive understanding of your options, and expert guidance are your most powerful tools. With the right information and professional support, you can explore viable alternatives that allow you to regain control, manage your debts, and secure a more stable financial future.

Don’t let financial uncertainty dictate your future. If you or your business is struggling with debt, losing sleep, or facing the possibility of legal action, contact Ira Smith Trustee & Receiver Inc. today. We offer a free, confidential consultation to discuss your situation, explain your options in plain language, and help you develop a clear, actionable plan. Our team of Licensed Insolvency Trustees is dedicated to providing the compassionate, professional support you need to regain control and achieve a debt-free life. Take the first step towards a brighter financial future – call us now.

Ira Smith Trustee & Receiver Inc. is licensed by the Office of the Superintendent of Bankruptcy and is a member of the Canadian Association of Insolvency and Restructuring Professionals.

- Phone: 905.738.4167

- Toronto line: 647.799.3312

- Website: https://irasmithinc.com/

- Email: brandon@irasmithinc.com

——————————————————————————–

Disclaimer: This analysis is for educational purposes only and is based on the cited sources and my professional expertise as a licensed insolvency trustee. The information provided does not constitute legal or financial advice for your specific circumstances.

Every situation is unique and involves complex legal and factual considerations. The outcomes discussed in this article may not apply to your particular situation. Situations are fact-specific and depend on the particular circumstances of each case.

Please contact Ira Smith Trustee & Receiver Inc. or consult with qualified legal or financial professionals regarding your specific matter before making any decisions.

About the Author:

Brandon Smith is a Senior Vice-President at Ira Smith Trustee & Receiver Inc. and a licensed insolvency trustee serving clients across Ontario. With extensive experience in complex court-ordered receivership administration and corporate insolvency & restructuring proceedings, Brandon helps businesses, creditors, and professionals navigate challenging financial situations to achieve optimal outcomes.

Brandon stays current with landmark developments in Canadian insolvency law. He brings this cutting-edge knowledge to every client engagement, ensuring his clients benefit from the most current understanding of their rights and options.