Debt headlines: Introduction

There have been three recent debt headlines that have attracted a lot of people’s attention. In this Brandon’s Blog, I discuss all three.

Debt headlines: Bankruptcy statistics

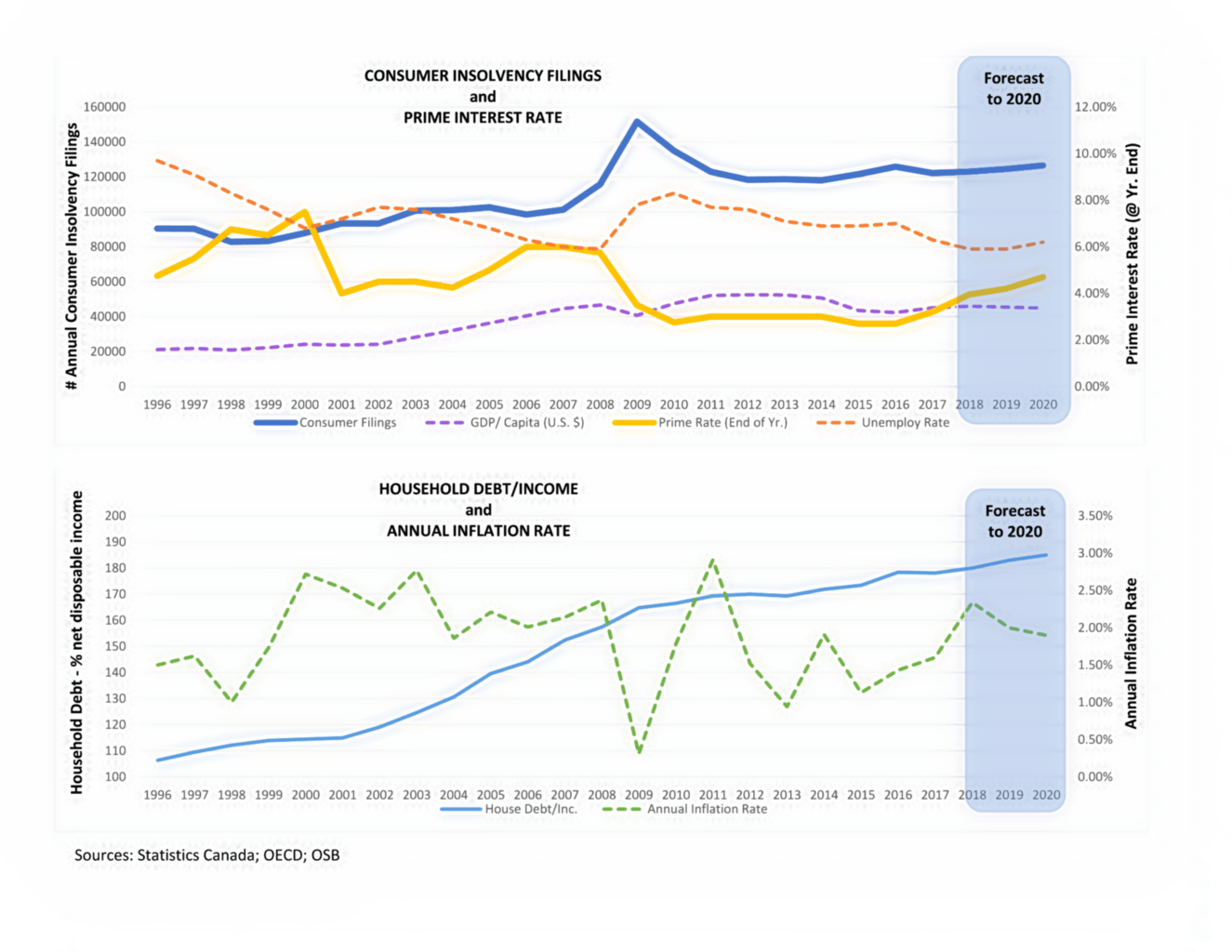

On January 4, 2019, the Office of the Superintendent of Bankruptcy Canada issued its bankruptcy statistics report “Insolvency Statistics in Canada—November 2018”. In my blog, BANKRUPTCY STATISTICS CANADA 2018: SCARED OF INSOLVENCIES IN CANADA OR DEBT?, I described the statistics. Many financial writers started to forecast doom and gloom. However, in my blog, I comment that I don’t see it that way. Insolvency filings in November 2018 were down from October 2018. The business writers quoted the statistic that there was a 5.2% increase in November 2018, compared to November 2017. However, insolvency filings have been unusually low for close to 10 years. So the increase really is not a big deal.

The actual problem is not these stats. Instead, it is the historically high degree of Canadian house debt collected when rates of interest went to near almost 0%. Since we stay in a slowly boosting rates of interest environment for the near future, not every person or business will be able to carry their high debt. This will lead to more insolvency filings.

Debt headlines: 46% of Canadians on the verge of bankruptcy as rates increase: Study

I have written before about Canadians and their debt load. Personal debt loads are of some worry. There’s brand-new information that casts a brand-new alarming light on the state of Canadians’ personal balance sheets.

A current study reveals that 46% of Canadians are on the verge of bankruptcy as interest rates increase. I begin by stating a word of caution. The survey size was a small pool so I don’t want to generalize. Canadians have a great deal of debt. What does that tell us about what these people are saying?

This really did not occur overnight. These are long-lasting financial obligations that have been gathered over a long time. The weight of them is actually having an influence. These are individuals that live paycheque to paycheque.

Well, these people are claiming that 46% who answered the survey would not have enough cash or are within $200 or much less to manage their debts and expenses at the end of the month. If something shows up that can interfere with that whether its rates of interest going higher, they might lose their job, or they might have unanticipated emergency costs. So what this informs us is that practically half of Canadians that were surveyed are truly living really near to the margin.

Numerous people do live in this way. Having debt repayments that stay in the mix since that is something that is non-negotiable, will certainly increase in time if you do not resolve it. Rates of interest will certainly increase. Do we understand what percentage of these individuals is facing that? I’m going say a fair number.

The reason I say this is due to the fact that if you return to the start of the monetary crisis in 2008, the Bank of Canada decreased rates of interest in an initiative to boost the economic climate. Ten years actually. I recognize rates of interest have actually begun to go higher however when you’re in this low-interest atmosphere you can carry a lot of debt.

People have. I’m not speaking about the tiny expenses placed on a charge card. I am speaking about paying an astronomically high price for a house in a rising real estate market, not having the ability to manage those home mortgage repayments, tackling that costly debt using your charge card.

43% of those surveyed stated they are sorry for some of the debt that they incurred. They would certainly enjoy a getaway today however if you cannot pay for it that vacation credit card debt is still there.

Just how concerned do you get when you hear that rates of interest are increasing? You are most likely to need to be getting ready to get your affairs in order.

Debt headlines: Canadian financial institutions might drop by ‘a minimum of’ 50% says a US Hedge Fund

Canadians following our markets look to see what’s happening with the Canadian financial institutions. There is one short seller following the Canadian banks. Denver-based Crest Capital believes the Canadian real estate market will lead Canada into an economic downturn. Nonetheless, the huge 6 financial institutions have actually taken care of proving the cynics incorrect in the past.

Kevin Smith is the founder and CEO of Crest Capital, a hedge fund with $53 million in assets under administration. Crest Capital also has an excellent track record. He is shorting the Canadian financial institutions and thinks now is the moment. He thinks it actually boils down to China.

Kevin Smith thinks that:

- there is a real estate bubble in Canada;

- housing debt to GDP has been blown up and been trouble for a time;

- house prices have increased for a very long time; and

- the cash streaming in from China that has actually pushed up housing prices and

- compelled Canadians themselves to extend to purchase real estate.

He believes the China credit bubble is ultimately going to break. China has this credit bubble which has actually been taking place for years. The cash has actually been spilling around the globe yet he believes the funding streams currently from China are truly beginning to run out and perhaps also turn around. There has actually been a lot of cash leaving China right into Canada. This is what has aided the Canadian real estate market and the economic climate.

He said that we are 10 years right into a worldwide financial cycle. He thinks Canada’s personal high debt to GDP ratio will leave the financial institutions holding the bag on this debt trouble. I do not know if he is right, yet that is what he is banking on.

Debt headlines: Can you afford your debt payments with a higher interest rate?

Do you have too much debt? Are you worried that the future interest rate hikes will make presently affordable commitments entirely unmanageable? Is the discomfort, tension and anxiousness presently detrimentally affecting your health and wellness as well as health?

If so, speak to the Ira Smith Team today. We have decades and generations of helping people and companies looking for financial restructuring. As a licensed insolvency trustee (formerly called a bankruptcy trustee), we are the only experts licensed and supervised by the Federal government to provide insolvency services.

Call the Ira Smith Team today for your free consultation and to make sure that we can begin assisting you to return right into a healthy, balanced, hassle-free life.