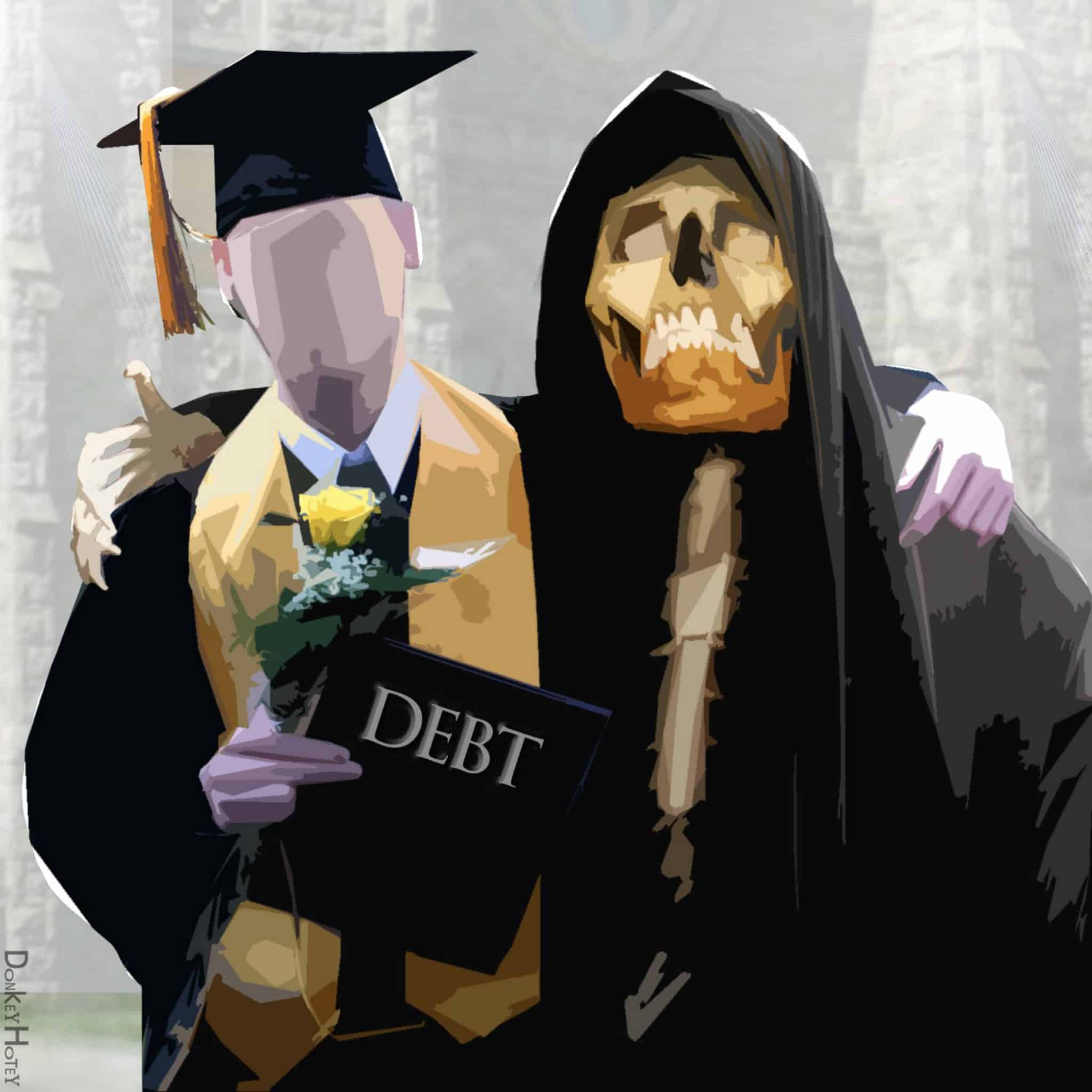

An interesting American case about student loans debt

Student loans debt is nearly impossible to get rid of in bankruptcy. A case winding its way through the US court system has piqued our intellectual interest. A father, who is a discharged bankrupt, is taking the lender who HE borrowed funds from for his child’s education to Court. The lender is continuing to pursue collection efforts against the father on the basis that the provisions of the Bankruptcy Reform Act of 1978, as amended, codified in Title 11 of the United States Code and commonly called the “Bankruptcy Code” (“Code”), does not release the father from what is in reality student loans debt. The father is taking the lender to Court for a ruling that by virtue of his discharge, he is released from that debt like all his other debts. It has raised the question whether the same student loans debt rules should apply in that case.

The Canadian perspective

We are not qualified to express any opinion on the US legal case before the US Court, but we are qualified to discuss the issue from the Canadian perspective. We started thinking whether this same situation could arise in Canada for student loans.

Last week we discussed student debt bankruptcy from the perspective of the student. Previously, we have written blogs and created a vlog about student loan debt, including:

So this week, we’re discussing student loan debt and bankruptcy from a very different and interesting angle. Could a Canadian lender take the position against a Canadian parent borrower who on the loan application described the purpose of the loans for the funding of his or her child’s Canadian post-secondary education, that the loans qualify as student loans under the applicable Canadian statutes, including, the Bankruptcy and Insolvency Act (Canada) (BIA). Stated otherwise, are such loans the same as student loans under Canadian law and can bankruptcy cut such loans if you’re not the student?

Are student loans necessary?

Many young Canadians need student loans to get a post-secondary education. To qualify as Canadian student loan debt, the loans must be issued under a specific Canadian student loan statute: the (i) Canada Student Loans Act; (ii) Canada Student Financial Assistance Act; (iii) Apprentice Loans Act; or (iv) any enactment of a province that provides for loans or guarantees of loans to students.

All students need financial help to be full-time university students. The only real places that such assistance can come from is either the parents, if they are willing and able to do so, student loans, or both. Many Canadian parents pay a hefty part of students’ tuition fees, even if it means sacrificing their financial stability, to help their children avoid a post-graduation life burdened by tens of thousands of dollars of student debt. Others may wish to, but they cannot afford to do so.

So are student loans and the resultant debt necessary? In most cases, yes.

Can a parent co-sign for or guarantee their child’s student loans?

The short answer is no. As I have already stated, to qualify as a student loan, the loan has to be made under the provisions of one of the Federal loan statutes mentioned above, or any such similar Provincial legislation. Nowhere in those student loans statutes is there a place for either a guarantor or cosigner. In fact, the Federal statutes all have similar language stating that upon the death of the borrower, the Federal government will repay the outstanding part of the loan. In addition to there not being any sections that allow for a guarantor or cosigner, the specific section dealing with the death of the borrower does not limit the government’s guarantee by using words like “….and if the lender is unable to collect in full from any guarantor or cosigner”. The reason is simple, student loans cannot be guaranteed or otherwise borrowed by anyone other than the student.

Will bankruptcy eliminate student loans debt?

Student loans are nearly impossible to get rid of in bankruptcy. Section 178(1) of the BIA states:

“(g) any debt or obligation in respect of a loan made under the Canada Student Loans Act, the Canada Student Financial Assistance Act or any enactment of a province that provides for loans or guarantees of loans to students where the date of bankruptcy of the bankrupt occurred:

(i) before the date on which the bankrupt ceased to be a full- or part-time student, as the case may be, under the applicable Act or enactment, or

(ii) within seven years after the date on which the bankrupt ceased to be a full- or part-time student;

(g.1) any debt or obligation in respect of a loan made under the Apprentice Loans Act where the date of bankruptcy of the bankrupt occurred

(i) before the date on which the bankrupt ceased, under that Act, to be an eligible apprentice within the meaning of that Act, or

(ii) within seven years after the date on which the bankrupt ceased to be an eligible apprentice;”

So if you’re a student, bankruptcy will only end student loans if you’ve ceased to be a full or part-time student for more than seven years and either declare personal bankruptcy or make a debt proposal to your creditors, most likely through a consumer proposal. The only other option is to attempt to seek from the Court relief because of undue hardship, but this is very difficult, if not impossible.

What is required to meet the burden of undue hardship?

If the Court is satisfied that you meet the two-pronged test, you’ll be discharged from your student loans obligations in bankruptcy only if the :

- acted in good faith in connection with your obligation to repay your student loan debt; and (emphasis added)

- have experienced, and will continue to experience, financial difficulty that will prevent you from repaying this debt

It’s then up to the bankruptcy court to decide whether they forgive your loans, either in full or in part. One of the difficulties in trying to prove undue hardship is that there is no clear definition for what makes up hardship; each bankruptcy court across Canada may use a slightly different interpretation. The only thing that’s clear is that you must prove that having to continue to pay the student loans after bankruptcy would be a financial hardship for you. If you try this route, the Court will look at ALL of your income and expenses.

The Court may decide you are not trying hard enough, or, may look at things like your small car you use to get to work, which you purchased used (instead of taking public transit), your cell phone and your internet expenses, and decide that these are luxuries you do not need. If you are a smoker, the Court may very well decide that if you were not addicted to tobacco, you could start to repay some part of your student loans.

If you think my examples are picayune or silly, just look up the case of Fournier (Re), 2009 CanLII 31606 (ON SC).

Will bankruptcy eliminate student loan debt if you are not the student?

I don’t know what the eventual disposition of the US case which I mentioned at the beginning of this blog will be, but based on all the above, in my view in the Canadian context, a parent, relative or friend cannot guarantee, cosign or borrow for a loan that qualifies as a Canadian student loan. If you borrow to fund your child’s education, then you are borrowing under an ordinary commercial transaction and the applicable student loan sections of the BIA do not apply.

So if you have borrowed for this purpose, only the normal provisions of the BIA apply, and you will get a discharge from that and your other debts upon your discharge from bankruptcy. However, if you pledged any of your assets in support of such borrowings, such as your home, the lender does have the right to enforce its security against such assets if you cannot repay, whether you are bankrupt or not.

What should you do if you have too much debt?

If you’re drowning because of your finances, we know we can help you. Although many people believe that bankruptcy is the only way of out serious debt, that’s not always the case. Ira Smith Trustee & Receiver Inc.can discuss other bankruptcy alternatives with you which include credit counselling, debt consolidation and consumer proposals.

If we get to see you early enough, at the first sign of trouble, you can use and carry out one of the bankruptcy alternatives, to free you from the burden of your financial challenges to go on to be a productive, contributing member of society and not be plagued by debt problems.

Bankruptcy law is very complicated and requires the expertise of a professional licensed insolvency trustee. Ira Smith Trustee & Receiver Inc. is here to help. With a cumulative 50+ years of experience dealing with diverse issues and complex files, we can get you back on your feet Starting Over, Starting Now. We can help. Call us today.

People consider us bankruptcy experts because we wrote the eBook which is sold on Amazon.ca, explaining the Canadian personal insolvency and bankruptcy system, specifically directed to the person stressed out with too much debt.

Online payday loans Toronto – What was Google’s mistake?

Online payday loans Toronto – What was Google’s mistake?