We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic. Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

If you would prefer to listen to the audio version of this Brandon Blog, please scroll to the very bottom of the page and click play on the podcast.

Bad credit loans Toronto: How Canadians are dealing with higher rates

Low- and moderate-income people make up the membership of the Association of Community Organizations for Reform Now (ACORN) Canada. A report about high-interest loans was published by the organization in February 2021. The study found that instalment loans and high-interest online loans are becoming more popular. This loan type differs from payday loans in the category of bad credit loans Toronto.

According to the study:

- Loans with high-interest rates are growing in popularity.

- We need to protect consumers from unfair and deceptive practices.

- To stop unfair lending practices, the Federal Government needs to act.

Since the publication of the study, nothing has changed. The COVID-19 pandemic, the vaccination program, and the continuing stimulus to the Canadian economy have certainly taken the spotlight. I discuss these new high-interest loans in this Brandon Blog, which are akin to long-term payday loans for bad credit loans Toronto.

Bad credit loans Toronto: Forget payday loans, this is Canada’s new generation of high-interest loans

Provincial laws regulate payday loans, which usually have to be repaid within two weeks. These loans have very high-interest rates and are for relatively small amounts – enough to tide the person over until the next regular payday. In the event that a borrower cannot repay the loan on time, the payday lender rolls the amount owed, with more fees, into a new loan.

Typically, this results in annualized rates of interest between 400 percent and 500 percent. Canadians are struggling at a time when this form of legalized loan-sharking continues. Anti-poverty groups like ACORN have long targeted the industry, but it is being increasingly targeted by legislation.

In the midst of government efforts to rein in the payday loan industry, payday lenders as well as new online lenders offering an alternative to payday lenders are extending lines of credit and instalment loans to cash-strapped borrowers. At 47% annual interest, these lines of credit and instalment loans create debt traps.

Lack of regulation of high-interest personal loans has contributed to the growth of lenders offering bad credit Toronto instalment loans. According to ACORN’s report, nine out of 13 provinces have specific rules to regulate payday loans, but far fewer have rules to address other forms of high-cost lending, such as instalment loans.

Bad credit loans Toronto: Why Canadian borrowers are still taking on the high-interest loans steep commitment

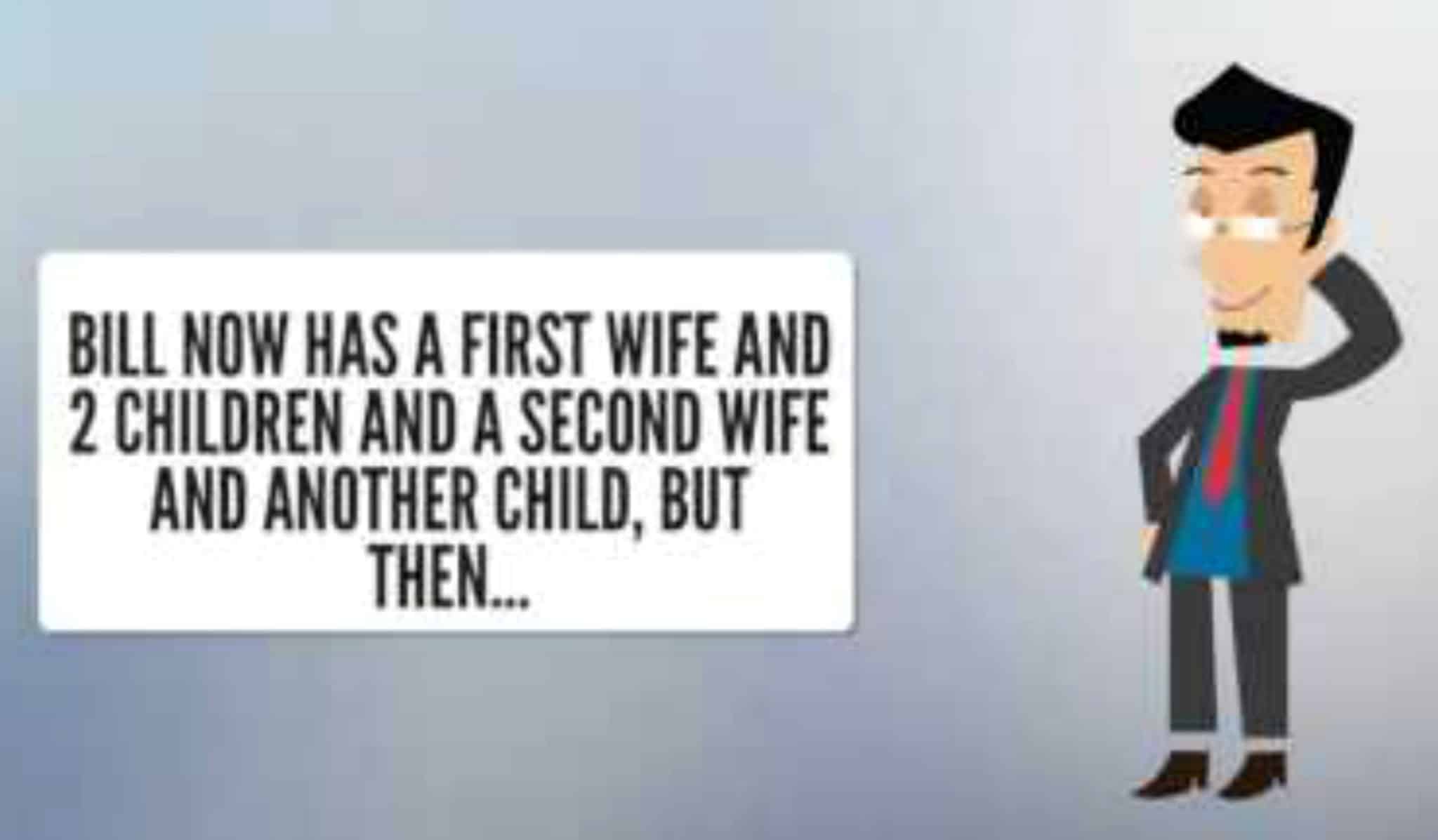

Due to a lack of regulation, these high-interest instalment loan lenders have grown at a rapid rate. Why do Canadian borrowers continue to take on debt when interest rates are so high? It is because they cannot avoid it. People who borrow this way often have no other option.

It was brought to light by the pandemic that there are essentially two classes in Canada: those with solid credit scores, savings, an emergency fund and collateral, and those without. The major banks and credit unions can lend to the former at a competitive interest rate but won’t to the latter. So many Canadians need this type of alternative lender.

Payday lenders are not the only players in the high-interest instalment loan industry in Canada. Equitable Bank and easyfinancial are also major players. The most common uses of the funds borrowed on these high-interest installment loans since the pandemic began are:

- Financing furniture and appliances purchases.

- Paying rent and other expenses both before and while receiving federal government COVID-19 support payments.

- Supporting other family members while unemployed.

- Buying Christmas presents.

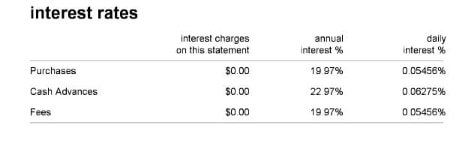

Let’s learn how installment loans work. Suppose you want to purchase a $1,500 piece of furniture for your apartment and the store offers you the option of an instalment loan financing. It costs almost $2,000 to borrow to pay for the furniture and the additional charges and administration fees. A 29.99 percent annual interest rate applies. In this example, the cost of borrowing is just over 39 percent annual percentage rate (APR), which includes interest and other charges.

The loan term will ultimately come to an end. The loan does not amortize so that there is nothing owed at the end of the term. They may refinance the loan for you if you are unable to repay the outstanding balance of the loan on time at the end of the term. If they do, it is at a higher interest rate than the original loan (with more fees and charges of course.) It becomes a never-ending circle debt trap. This is how high-interest instalment loans work.

Bad credit loans Toronto: Budget 2021 sets up a fight over high-interest loans

In order not to be guilty of charging a criminal rate of interest on those long-term loans, they need to adhere to the maximum annual interest limit of 60 percent. This rate, however, has been in effect for almost four decades already. Despite the fact that annual interest rates on these high-interest rate instalment loans are less than 60 percent, critics contend that they charge a criminal rate practically, if not legally. There are faint rumblings of some political will to try to rein in what many call predatory lending.

Bad credit loans Toronto summary

I hope you found this bad credit loans Toronto Brandon Blog post both informative and eye-opening. Are you worried because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option? If it is too much debt for any reason, call me. It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties while avoiding bankruptcy. We can get you the relief you need and so deserve.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Even though we are a licensed insolvency trustee, we have found that not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost consultation.

We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic. Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

Borrowing in retirement: Introduction

Borrowing in retirement: Introduction