Debt Relief Program vs Bankruptcy: Introduction

We keep hearing commercials about debt relief and their scare tactics of portraying the safety of a debt relief program vs bankruptcy. But, what is debt relief? And can some of these so-called debt relief companies actually put you deeper into debt?

Debt Relief Program vs Bankruptcy: Are They Legit?

As consumer debt continues to soar many Canadians are easy marks for unscrupulous companies who make false claims which are quite frankly just scams. The Financial Consumer Agency of Canada (FCAC) is warning Canadians to be very cautious about companies that claim they can negotiate a deal to cut the amount of debt you must repay to your creditors. This process is often called “debt reduction,” “debt settlement,” “debt relief” or “debt negotiation.” The truth is that there is no easy way out of debt. And, if you need help dealing with debt problems, run away from these companies and work only with a licensed insolvency trustee (the new name for a trustee in bankruptcy).

Heed the warning of FCAC Commissioner Ursula Menke. “Unfortunately, people do not always see the benefits that debt reduction companies lead them to expect—and some people wind up even deeper in debt than they were before,” says FCAC Commissioner Ursula Menke. “If an offer to reduce your debts seems too good to be true, it probably is.”

Debt Relief Program vs Bankruptcy: Debt relief tactics to beware of:

- Government approved: Companies will try to win your confidence by stating that they are government approved. Not true. A company’s business license or registration doesn’t mean that the government has approved or endorsed them.

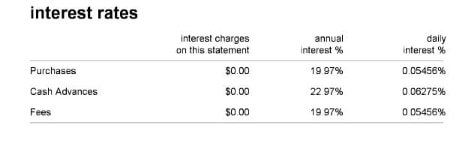

- We can reduce your debt by 60% or more: Not true. Your creditors are under no obligation to reduce your debts.

- High pressure sales tactics: Don’t ever be victimized by high pressure sales tactics. Always take your time. Do your due diligence. Check out the company thoroughly. Check with the government office that handles consumer affairs in your province or territory, as well as the Better Business Bureau.

- Upfront fees: These companies usually charge you hefty upfront fees and then don’t reduce your debt. Good luck getting a refund.

Debt Relief Program vs Bankruptcy: How Can You Get Debt Relief Safely And Reliably?

Contact a licensed insolvency trustee. We’re federally regulated, our fees are federally regulated, we’re subject to a strict code of ethics and we complete ongoing mandatory professional development each year.

A licensed insolvency trustee MUST first discuss all of your options with you in order for you to avoid bankruptcy, and attempt to find the best bankruptcy alternative solution for you. Many times the trustee can successfully carry out a debt restructuring proposal for you as an alternative to bankruptcy.

Don’t take chances with your financial future. Contact Ira Smith Trustee & Receiver Inc. We’ll evaluate your situation and help you to arrive at the best possible solution for your problems. Let us help restore you to financial health and give you back peace of mind Starting Over, Starting Now. Give us a call today. You’ll be happy you did.