A few months ago, I drove past something troubling. A house appeared to sit empty for weeks, then a realtor’s for-sale sign with the extra wording “Power of Sale” appeared on the lawn. As a Licensed Insolvency Trustee serving the Greater Toronto Area, I believed this wasn’t just a one-off situation. What I discovered when I looked into Ontario’s mortgage default numbers was far more concerning than I expected.

A few weeks ago, I wrote about the debt problems of normal GTA residents who invested in pre-construction Toronto condos, who cannot afford to complete the purchase when the condo was available to close on. This is a different problem – those who closed on the purchase of their GTA home but now cannot afford to pay the mortgage, creating a mortgage default in the GTA.

Understanding Mortgage Default in Ontario

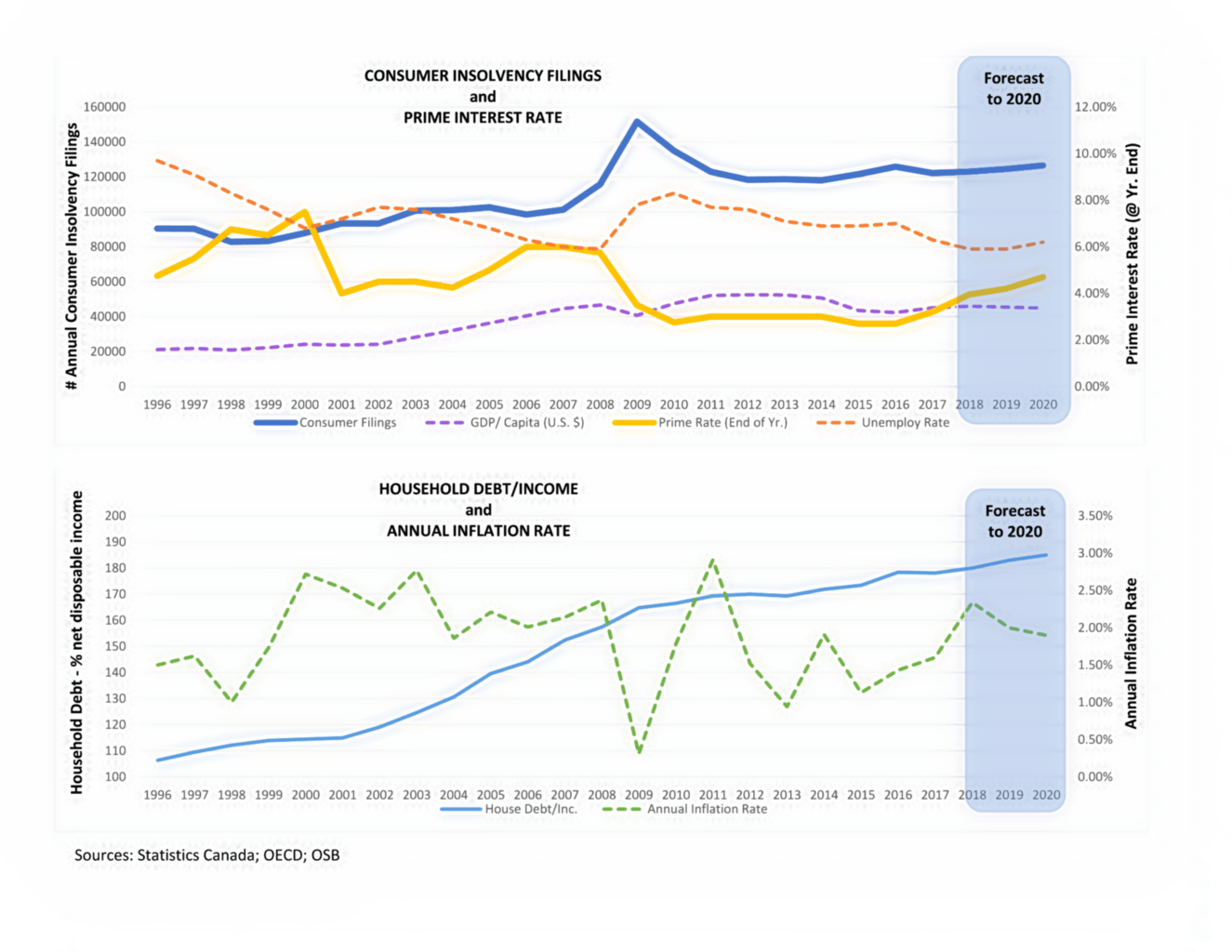

A mortgage default happens when a homeowner can’t make their mortgage payments for roughly 3 months or more. Global News has reported that in Ontario, we’re seeing mortgage default rates climb faster than at any time in recent years. The numbers tell a story that many homeowners and professionals need to understand.

That is the most common type of default. But in Ontario, mortgage default doesn’t just mean missing payments. You can also default if you stop paying your property taxes, let your home insurance lapse, or fail to maintain your property in reasonable condition. When any of these things happen, your lender has the legal right to start a Power of Sale process to sell your home and recover their money.

Here’s what’s important: if you’re struggling to make payments, call your lender right away. Many lenders will work with you by extending your mortgage term, temporarily reducing payments, or waiving late fees. The key is reaching out before you miss multiple payments—the earlier you ask for help, the more options you’ll have.

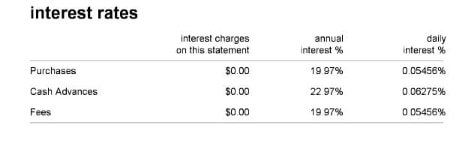

According to its August 18, 2025, Newsroom publication, Equifax Canada reported that Ontario’s 90-day mortgage default rate in Q2 2025 was 0.27% representing a year-over-year increase of 11 basis points. Even more striking: reporting indicates that defaults are now 50% higher than before the pandemic. Over 11,000 Ontario homeowners missed mortgage payments in late 2024 alone.

Why the Real Numbers Are Higher Than You Think

Here’s what concerns me as someone who works directly with struggling homeowners: the official numbers don’t show the complete picture. When you see mortgage default statistics in the news, they’re missing a huge piece of the puzzle—private mortgage lending. The Financial Services Regulatory Authority of Ontario (FSRA) reports that private mortgage lending defaults are not included in the reported numbers. The reported numbers only include data from commercial banks and other financial institution mortgage lenders offering conventional mortgage financing.

The Private Lending Blind Spot

Private mortgage lenders serve borrowers who can’t qualify with major banks. These include:

- Real estate investors

- People with credit challenges

- People requiring bridge financing

- Those who need quick financing

Private lenders don’t always report their defaults to Equifax or TransUnion Canada. This means the real mortgage default rate in Ontario could be significantly higher than what’s publicly reported.

I’ve seen this firsthand in my practice. Clients come to me after defaulting on private mortgages, normally second mortgages, often owing much more than their homes are worth. By the time they reach out, they’re facing Power of Sale proceedings and a judgment against them for the full loan amount, as the house has not been sold yet. When it does, it is certain to cause a shortfall to the lender. These people in financial distress have few options left.

What’s Driving Mortgage Defaults in Ontario?

Many people blame rising interest rates, and they’re partly right. The Bank of Canada has reported on the impact of higher mortgage rates. The Bank of Canada raised rates sharply after 2022, causing mortgage payments to jump for anyone who elected for a variable rate when pandemic interest rates made the money about as close to free as you can get. IG Wealth Management reports that mortgage variable interest rates saw a significant increase to a peak of around 5.95% in late 2024, from their lowest point of around 0.25% in March 2020. But that’s not the whole story.

The Real Causes Run Deeper

Unaffordable Housing: For years, home prices in Ontario climbed faster than incomes. Many families stretched their budgets for the home purchase, leaving no cushion for unexpected problems.

High Household Debt: TransUnion Canada reported that Canadians carry record levels of debt beyond their mortgages—credit cards, car loans, and lines of credit. When mortgage payments rise, these other debts become impossible to manage.

Risky Lending Practices: Before rates went up, some lenders approved mortgages for people who could barely afford them. They assumed home prices would keep rising forever.

Change in employment conditions: When someone loses their job or has their hours cut, their income either drops or is completely lost. A mortgage default can then happen quickly—especially if they were already living paycheque to paycheque.

Warning Signs of Mortgage Default

As a Licensed Insolvency Trustee, I’ve worked with real estate investors who own several residential homes (including condos), including their matrimonial home, facing mortgage default. Here are the early warning signs I see most often:

- Juggling payments: Using credit cards to make normal food purchases, as all their cash is going to keep the properties propped up, or use a line of credit to make mortgage payments

- Missing other bills: Skipping utility or credit card payments to cover the mortgage

- Borrowing from family: Repeatedly asking relatives for money to stay afloat

- Avoiding mail: Not opening letters from your lender because you’re scared of what they say

- Losing sleep: Constant worry about money affecting your health and relationships

If you recognize these signs in your own life, you’re not alone—and there are options available to help.

What Happens During Mortgage Default

Understanding the mortgage default process can help you act before it’s too late.

The Timeline

Months 1-2: You miss one or two payments. Your lender will call and send letters asking you to catch up.

Month 3: After 90 days, you’re officially in mortgage default. Your lender may issue a demand letter requiring full payment within a specific timeframe.

Months 4-6: If you can’t pay, your lender will start Power of Sale proceedings (in Ontario). This legal process allows them to sell your home to recover their money. They will probably also sue you and get a judgment for the full mortgage debt. The amount of their claim will be reduced after they receive the net sale proceeds from the sale of your property. This final amount is called their shortfall claim. It will not only include their outstanding principal amount, but also their interest costs and legal fees.

In private mortgages, once the mortgage loan goes into default, under the mortgage agreement, the private lender can charge extra fees. There would also be additional fees incurred because of the default status. All these costs are added to the principal balance outstanding, which increases the shortfall.

Months 4-6+: Your home gets listed for sale. If it doesn’t sell, your lender may eventually take ownership.

The exact timeline varies based on your lender, your situation, and how quickly you respond to their communications.

Power of Sale vs. Foreclosure: Ontario’s System

Under Ontario real estate law, lenders use the Power of Sale process rather than foreclosure. This matters because it affects your options and timeline. Quebec, British Columbia, Alberta, Manitoba, Saskatchewan, Nova Scotia, and the three territories use a foreclosure process.

Power of Sale means your lender can sell your home without going through court (though they must follow strict legal procedures). You still own the home during this process, and you have rights—including the right to pay off the debt and stop the sale.

This is different from foreclosure, where the lender takes ownership of your property through the courts. Ontario’s system is generally faster, which means you have less time to find a solution.

What You Can Do If You’re Facing Mortgage Default

The worst thing you can do is ignore the problem. I’ve seen too many people wait until the Power of Sale notice arrives before seeking help. By then, their options are limited, and the stress is overwhelming.

Immediate Steps to Take

1. Contact Your Lender Right Away: Banks don’t want your house—they want their money. Many lenders will work with you on payment plans or temporary relief if you reach out early.

2. Review Your Budget Honestly: Look at every expense and see what you can cut. Even small changes can free up money for mortgage payments.

3. Consider All Your Options: Depending on your situation, you might be able to:

- Refinance to a lower rate or longer term

- Sell your at least list your home for sale, before the Power of Sale begins

- Rent out part of your home for extra income

- Work out a payment plan with your lender

4. Get Professional Help: Talk to a Licensed Insolvency Trustee. We can explain options like consumer proposals or bankruptcy, which might help you keep your home or exit your debt in an organized way.

When Keeping Your Home Isn’t Possible

Sometimes, despite your best efforts, keeping your home just isn’t realistic. If your mortgage is much larger than what your home is worth, or if your income has dropped permanently, selling might be your best option.

A Licensed Insolvency Trustee can help you understand:

- Whether you can sell before the Power of Sale begins

- How to handle any remaining debt after the sale

- What bankruptcy or a consumer proposal might mean for you

- How to protect any equity you have in your home

The Emotional Side of Mortgage Default

I want to address something that doesn’t show up in the statistics: the emotional toll of facing mortgage default.

Clients often tell me they feel ashamed, like they’ve failed their families. They lose sleep, avoid social situations, and feel overwhelmed by constant worry. Some have health problems from the stress.

Here’s what I tell everyone who walks through my door: Facing financial trouble doesn’t make you a failure. Economic forces beyond your control—rising rates, job losses, unexpected expenses—can push anyone to the breaking point. What matters is taking action to protect yourself and your family.

How Ontario’s Mortgage Default Crisis Affects Everyone

Even if you’re not personally facing mortgage default, this crisis matters. Here’s why:

Neighbourhood Property Values: When multiple homes in an area go into Power of Sale, it can drag down property values for everyone.

Community Stability: Families forced out of their homes disrupt schools, local businesses, and neighbourhood connections.

Economic Pressure: As more people struggle with mortgage payments, they cut spending elsewhere, affecting local economies.

Future Housing Affordability: If defaults lead to a crash in home prices, it could trigger broader economic problems that affect jobs and opportunities.

What Makes Ontario’s Situation Different

Working in the Greater Toronto Area, I see unique pressures that make Ontario’s mortgage default problem especially serious:

Extreme Housing Costs: Toronto and surrounding areas have some of the highest home prices in Canada. Even a small income disruption can trigger default.

Private Lending Concentration: The CBC reported that Ontario, particularly the GTA, has a large private lending market serving investors and those who can’t get traditional mortgages. These loans carry higher risk and aren’t fully tracked in official statistics.

Investor Activity: Many GTA properties are owned by investors who use leverage to buy multiple properties. When rental income drops or rates rise, these investors are often the first to default.

New Construction Pressures: Buyers of pre-construction condos who relied on getting financing to complete purchases are particularly vulnerable as projects take years to be completed for the purchaser to take possession. Although they bought the condo unit years ago, they cannot apply for financing until around 90 days before they have to complete the purchase. If either their income or the real estate market, or both, take a negative turn and they cannot qualify for the amount of financing they require, big problems arise.

Mortgage Default: Questions to Ask Before Getting Help

If you’re considering reaching out to a Licensed Insolvency Trustee or financial advisor, here are good questions to ask:

- What are all my options for dealing with a mortgage default?

- Can I keep my home if I file a consumer proposal?

- How long will each option take?

- What will happen to my credit rating?

- Are there any options I can pursue on my own first?

- What documents should I bring to our first meeting?

At Ira Smith Trustee & Receiver Inc., we answer these questions clearly and honestly. There’s no cost for an initial consultation, and our job is to help you understand your choices—not to pressure you into any particular decision.

Mortgage Default: Taking Action Before It’s Too Late

Here’s the bottom line: if you’re struggling with your mortgage payments, the time to act is now—not when you receive a Power of Sale notice.

The earlier you seek help, the more options you’ll have. Whether that means working with your lender, selling your home on your terms, or exploring debt relief options, taking action puts you back in control.

Your Next Steps

If you’re facing a mortgage default in the Greater Toronto Area:

- Don’t panic, but don’t wait: The situation won’t fix itself, but solutions exist.

- Gather your information: Get copies of your mortgage documents, recent statements, and a list of all your debts and income.

- Reach out for professional guidance: A Licensed Insolvency Trustee can review your situation confidentially and explain your options at no cost.

- Keep communicating: Stay in touch with your lender, even if you don’t have good news. Silence makes everything worse.

Frequently Asked Questions About Mortgage Default in Ontario

Understanding Mortgage Default

Q: What exactly is mortgage default?

A: Mortgage default happens when you can’t make your mortgage payments for about three months (90 days) or more. Once you hit that 90-day mark, your lender considers your mortgage officially in default and can start taking legal action.

Q: How quickly are mortgage default rates rising in Ontario right now?

A: The numbers are climbing faster than we’ve seen in years. In Q2 2025, Ontario’s 90-day mortgage default rate hit 0.27%—that’s an 11 basis point jump from the year before. Even more concerning, defaults are now much higher than they were before the pandemic.

Q: Do the official statistics tell the whole story?

A: Unfortunately, no. The official numbers miss a huge part of the problem—private mortgage lending. The statistics you see reported only include commercial banks and traditional financial institutions. Private lenders don’t necessarily report their defaults to Equifax Canada or TransUnion Canada, which means the real mortgage default rate in Ontario is likely much higher than what gets published.

Q: Who typically uses private mortgage lenders?

A: Private lenders serve people who can’t get approved by the big banks. This includes:

- Real estate investors buying multiple properties

- People who need money quickly (bridge financing)

- Those with credit problems or past bankruptcies

- Self-employed individuals who can’t prove traditional income

- Buyers of pre-construction properties

What Causes Mortgage Default?

Q: Why are so many people defaulting on their mortgages?

A: Everyone talks about rising interest rates, and yes, the Bank of Canada’s sharp rate hikes after 2022 made payments jump for people with variable-rate mortgages. But that’s only part of the story. The real causes include:

- Unaffordable housing: Home prices in Ontario shot up way faster than wages, forcing families to stretch every dollar just to buy

- Too much debt: Most Canadians are juggling mortgages plus credit cards, car loans, and lines of credit—when the mortgage payment goes up, something has to give

- Risky lending: Before rates went up, some lenders approved mortgages for people who could barely afford them, betting that prices would keep climbing forever

- Job loss: When someone loses their job or gets their hours cut, they can fall behind fast—especially if they were already living paycheque to paycheque

Q: What makes Ontario’s situation worse than other provinces?

A: Ontario, especially the Greater Toronto Area, faces unique pressures:

- Sky-high housing costs: Toronto has some of Canada’s most expensive homes, so even a small income drop can push people into default

- Heavy private lending: The GTA has a huge private lending market that serves risky borrowers, and these loans aren’t tracked properly

- Investor problems: Many Toronto properties are owned by investors who borrowed heavily to buy multiple homes—they’re often the first to default when rents drop or rates rise

- Pre-construction issues: Buyers of new condos can get stuck if their finances change before closing, leaving them unable to get the final mortgage they need

Q: What are the warning signs that I might be heading toward default?

A: From my years helping people in financial trouble, here are the red flags I see most often:

- You’re using your line of credit or credit cards to make mortgage payments

- You’re skipping other bills (utilities, credit cards) to keep up with your mortgage

- You’re constantly borrowing money from family or friends

- You’re afraid to open mail from your lender

- You’re losing sleep and feeling stressed about money all the time

If you recognize yourself in any of these, please reach out for help now—don’t wait.

The Default Process

Q: What actually happens when my mortgage goes into default?

A: Here’s the typical timeline:

Months 1-2: You miss one or two payments. Your lender starts calling and sending letters asking you to catch up.

Month 3 (90 days): You’re now officially in default. Your lender may send a demand letter requiring you to pay the full amount owed within a specific timeframe.

Months 4-6: If you can’t pay, your lender starts Power of Sale proceedings. They can also sue you for the full mortgage debt.

Months 4-6+: Your home gets listed for sale by the lender.

Q: What’s the difference between Power of Sale and foreclosure?

A: Ontario uses the Power of Sale, which is different from the foreclosure process used in provinces like BC, Alberta, and Quebec.

Power of Sale (Ontario’s system):

- Your lender can sell your home without going to court (though they must follow strict legal rules)

- You still own the home during this process

- You have the right to pay off the debt and stop the sale at any point before it’s sold

- It’s generally faster than foreclosure, giving you less time to find a solution

Foreclosure (other provinces):

- The lender actually takes ownership of your property through the courts

- It’s usually a slower process

Q: Are there extra costs if I default on a private mortgage?

A: Yes, and this is important. Private lenders can charge significant extra fees once you go into default—it’s usually written into your mortgage agreement. These fees get added to what you owe, making the shortfall even bigger. This is one reason why private mortgage defaults can spiral out of control so quickly.

Getting Help

Q: What’s the worst mistake I can make if I’m struggling with my mortgage?

A: Ignoring the problem. Too many people stick their heads in the sand and wait until they get a Power of Sale notice before asking for help. By then, your options are much more limited, and your stress level is through the roof. The earlier you act, the more we can do to help.

Q: What should I do right now if I’m having trouble making payments?

A: Take these steps immediately:

- Call your lender: I know it’s scary, but banks would rather work out a payment plan than take your house. The sooner you contact them, the more willing they are to help.

- Look at your budget honestly: Go through every expense and see what you can cut. Even small savings add up.

- Know your options: You might be able to refinance, sell before the Power of Sale starts, rent out a room, or work out a payment arrangement.

- Talk to a Licensed Insolvency Trustee: We can explain all your options in a free, confidential meeting.

Q: How can a Licensed Insolvency Trustee help me?

A: As a Licensed Insolvency Trustee, I can help you:

- Understand every option available for dealing with your default

- Explain how a consumer proposal might let you keep your home while reducing your debt

- Figure out if you can sell your home before the Power of Sale begins

- Show you how to handle any money you still owe after your home is sold

- Protect any equity you have in your property

- Determine if bankruptcy might actually give you a fresh start

The initial consultation is always free and completely confidential. I’m here to explain your choices, not pressure you into anything.

Q: What should I bring to my first meeting with you?

A: Gather these documents before we meet:

- Your mortgage documents and statements

- Recent pay stubs or proof of income

- A list of all your debts (credit cards, loans, lines of credit)

- Your most recent property tax bill

- Any letters from your lender

Don’t worry if you don’t have everything—we can still talk through your situation and figure out next steps.

Q: How much does it cost to talk to a Licensed Insolvency Trustee?

A: The initial consultation is free. There’s no charge to sit down with me, explain your situation, and learn about your options. If you decide to move forward with a consumer proposal or bankruptcy, we’ll explain all the costs upfront—there are never any hidden fees.

Q: Will contacting a Licensed Insolvency Trustee hurt my credit even more?

A: Simply meeting with me and discussing your options has no impact on your credit score. Only if you decide to file a consumer proposal or bankruptcy will it affect your credit—but if you’re already facing mortgage default, your credit is likely already damaged. The question is: what’s the best path forward to rebuild your financial life?

Final Thoughts on Ontario’s Mortgage Default Crisis

Ontario’s rising mortgage default rates represent more than just numbers on a page. Behind every statistic is a family facing tough decisions, sleepless nights, and an uncertain future.

What worries me most isn’t just the official numbers—it’s what those numbers don’t show. The private lending defaults, the stressed investors, the families barely hanging on—these aren’t all captured in the reports, but they’re very real.

If you’re one of those families, please know that help is available. As a Licensed Insolvency Trustee with years of experience serving the Greater Toronto Area, we’ve helped many people navigate mortgage default and find a path forward.

The situation might feel hopeless right now, but you have more options than you think. The first step is simply reaching out.

From our Vaughan office, we provide:

- Free, confidential consultations

- Expert guidance on bankruptcy alternatives

- Consumer proposals that can reduce your debt

- Corporate restructuring solutions

- Court-supervised receiverships

Contact us today to discuss your situation. Let us help you understand your options and find the best solution for your financial future.

Brandon Smith, Licensed Insolvency Trustee

Senior Vice-President

Ira Smith Trustee & Receiver Inc.

167 Applewood Crescent, Suite 6

Vaughan, Ontario

Greater Toronto Area

905.738.4167

Toronto line: 647.799.3312

The information provided in this blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc., and any contributors do not assume any liability for any loss or damage.

About the Author: Brandon Smith is a Licensed Insolvency Trustee with Ira Smith Trustee & Receiver Inc., serving the Greater Toronto Area. With years of experience helping individuals and families navigate debt challenges, Brandon provides clear, compassionate guidance for those facing mortgage default and other financial difficulties. If you’re struggling with mortgage payments, contact our office for a free, confidential consultation.