The economy, much like a highway during rush hour, can move at different speeds. For some, it’s a smooth, open road. For others, it’s a gridlock of financial stress and mounting debt. As a Canada Trustee, I just read the new 2024-25 Annual Report from the Office of the Superintendent of Bankruptcy (OSB). It shows that Canada’s economy is looking more and more like this “two-speed” highway.

On one side, we have everyday Canadians and small businesses facing a significant increase in financial trouble requiring help with debt solutions. On the other hand, large corporations appear to be cruising along, handling economic bumps with ease. This striking difference is at the heart of the OSB’s 2024-25 Annual Report. It tells a powerful story about why more people are struggling and what the country’s official insolvency watchdog is doing about it.

This blog post will explore the key findings of the report, dive into the reasons behind this two-speed economy, and explain the important role of a Canada Trustee in helping people navigate these challenging times.

The Numbers Tell the Story: A Tale of Two Economies

The most surprising and important finding in the OSB’s report is the clear split between consumer and corporate financial health. The numbers don’t lie.

First, let’s look at the side of the road where most people are stuck: the world of consumer debt.

- The OSB accepted 143,864 insolvency filings in the 2024-25 fiscal year.

- This represents a notable increase of 7.6% from the year before.

To put this into perspective, an insolvency filing is when an individual or a small business officially asks for help with their debts, usually through a bankruptcy or a consumer proposal. Both these administrations occur under the Canadian Bankruptcy and Insolvency Act (BIA). A 7.6% jump in one year is a significant red flag. It points to a growing number of Canadians who are feeling the squeeze and can no longer keep up with their financial commitments.

Now, let’s look at the other side of the highway, where the big companies are. The OSB also tracks filings under the Companies’ Creditors Arrangement Act (CCAA). The CCAA is a law used by large corporations that need to restructure and reorganize their business when they are in serious financial trouble.

- There were only 70 CCAA filings in 2024-25.

- This is actually a decline of 2.8% from the previous year.

This is the core of the “two-speed” economy. The number of everyday people needing help is climbing fast, while the number of big companies in distress is going down. This trend suggests a Canada where financial stability depends heavily on your size. If you are a large, well-established company, you have been able to navigate recent economic challenges. But if you’re an individual, a family, or a small business, the ride has been much bumpier.

Why Are More Canadians Drowning in Debt?

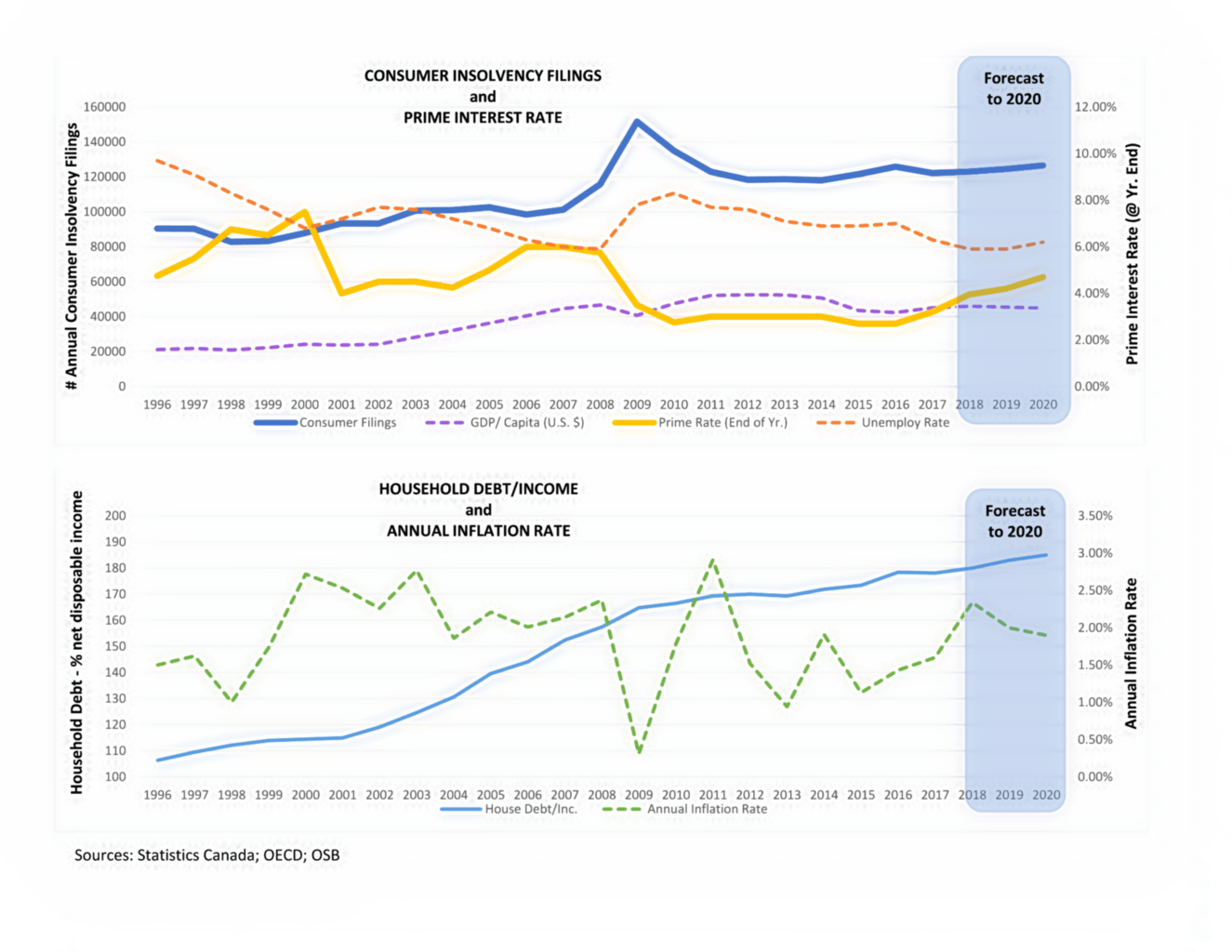

The OSB report doesn’t go into a deep analysis of the “why” behind these numbers, but it points to some key factors that are widely recognized as the main drivers of financial stress. These are not new headlines, but their combined effect has been felt more deeply this year.

- Inflation and the Rising Cost of Living: We’ve all felt it at the grocery store, the gas pump, and in our monthly bills. Inflation means that our money doesn’t go as far as it used to. For many families, this has made it harder and harder to afford the necessities of life. When prices for food, housing, and transportation keep climbing, it leaves less money for everything else, making it difficult to pay off existing debts.

- High Interest Rates: Over the past couple of years, central banks have raised interest rates to try and control inflation. While this is a necessary step for the economy, it has a direct and painful effect on anyone with a mortgage, car loan, or credit card debt. Higher interest rates mean that more of your money goes toward interest payments and less goes toward paying down the actual debt. This can turn a manageable debt load into an impossible one very quickly. A higher interest rate on a mortgage can add hundreds, or even thousands, of dollars to a person’s monthly expenses, putting immense pressure on their budget.

When you combine these two factors, you get the perfect storm for consumer financial distress. A family might be earning the same income, but their expenses are higher, and the cost of servicing their debt is higher. Something has to give, and for many, that “something” is their ability to stay on top of their financial obligations. It’s a situation where hard work and careful budgeting are simply not enough to keep up with the rising costs. This is often the point where people begin to look for solutions and seek the help of a Canada Trustee.

Why Are Big Companies Staying Afloat?

The other half of the story is why large corporations seem to be faring so much better. While the OSB report does not provide a detailed explanation for this, we can draw some logical conclusions based on the nature of a large business.

Large companies are often more resilient to economic headwinds than small businesses or individuals. They have some advantages that help them ride out the storm:

- Financial Resources: Large corporations typically have significant cash reserves and better access to credit. This means they can absorb higher costs and interest rates more easily. They can borrow money at lower rates and for longer terms than an individual.

- Diversification: Many big companies operate in multiple industries or regions. If one part of their business is struggling, another part might be thriving, helping to balance things out.

- Ability to Absorb Costs: Large companies have more power to pass along increased costs to their customers without losing them. They also have the resources to find ways to cut costs in their own operations, such as by streamlining processes or using new technology.

This creates a clear imbalance. While a single person might be overwhelmed by a credit card payment jump of $50, a large corporation can absorb an increase of millions of dollars in interest payments without having to file for protection. The system is designed to allow large corporations to handle big economic swings, but it leaves individuals and small businesses much more exposed. This is why the role of a Canada Trustee becomes so crucial.

Introduction: Understanding the Role of a Trustee in Canada

The OSB’s report mentions that a Canada Trustee is a key figure in the country’s insolvency system. But what exactly are licensed insolvency trustees, and what do they do? The term “trustee” is used to describe a professional who holds property and acts on behalf of others. This role is a foundation of Canada’s legal and financial system.

What is a Canada Trustee? Defining the Core Concept

Licensed Insolvency Trustees are federally regulated professionals. They help people and businesses with serious debt problems. They are the only professionals allowed to handle insolvencies in Canada. The OSB report shows they play a key role during financial hardship. They act as a link between a person in debt and their creditors. The person who gives the property to the trustee is called in this case, a bankrupt.

The Foundation of Trust: Legal Framework and Fiduciary Duty

The most important part of being a Canada Trustee is the “fiduciary duty.” The word “fiduciary” comes from a Latin word that means “trust,” and this is the core of the relationship. A trustee has a legal and moral obligation to always act with honesty, loyalty, diligence, and prudence. They must put the interests of the beneficiaries or creditors ahead of their own. This means they must avoid any personal conflicts of interest and not try to profit from their role. The trustee must also be ready to account for everything they do, keeping accurate records of all financial transactions concerning the trust property.

Why Canada Trustees are Essential in the Canadian Landscape

Trustees are an essential part of the Canadian legal landscape because they provide a way for someone to manage important assets or affairs for another person, especially if that person is unable to do so themselves. A trustee can be appointed in a will, chosen through a separate trust document, or appointed by a court. For instance, a trustee can be appointed to manage an inheritance for a minor or to handle the finances of an adult who is no longer capable of making their own decisions and handling their financial situation on their own.

The Diverse Landscape of Trusteeship in Canada

While the blog focuses on the Licensed Insolvency Trustee, it’s important to know that the term “trustee” covers a wide range of roles in Canada.

Licensed Insolvency Trustees (LITs): Navigating Financial Hardship

This is the specific type of Canada Trustee that the OSB report focuses on. A Licensed Trustee is a professional who specializes in helping individuals and businesses with serious debt problems. They are the only professionals legally authorized to administer insolvencies in Canada. As the OSB report shows, they play a critical role in times of financial hardship, acting as a link between a person in debt and their creditors.

Estate Trustees (Executors): Stewarding Legacies

An Estate Trustee, often called an executor, is a person named in a will to manage and settle the affairs of someone who has died. Their duties are numerous, including making funeral arrangements, locating all of the deceased’s assets, paying off any debts and taxes, and finally, distributing what is left to the beneficiaries as directed by the will.[8, 9] It is a legally demanding role that requires careful attention to detail.

The Public Guardian and Trustee (PGT): Protecting Vulnerable Interests

Each province has a Public Guardian and Trustee, a government office created to protect the legal and financial interests of the most vulnerable people in society.[10, 11, 12, 13] The PGT acts as a trustee of last resort when there is no trusted family or friend available to do so.[10, 13] This includes protecting the interests of mentally incapable adults, children under a certain age, and deceased or missing persons when no one else can administer their estate.

Professional Trustees and Trust Companies: Specialized Asset Management

For those with large or complex estates, or when family conflicts are a concern, a professional trustee or trust company can be appointed to handle the trust property. These are professional fiduciaries—often a trust department of a bank or a private trust company—that are fully staffed with experts in law, taxes, and finance. They offer expertise and impartiality and can take on the day-to-day work of managing a trust.

Judicial Trustees: Court-Appointed Oversight

In some cases, a court may appoint a judicial trustee.] This happens when a person with mental or physical challenges needs help with their finances, and there is no one else to step in. A judicial trustee is authorized by the court to manage a person’s money and property, ensuring their bills are paid and their needs are met.

Core Responsibilities and Fiduciary Duties of a Trustee

Regardless of the type, every Canada Trustee is held to a high standard of conduct and has specific duties that are legally binding.

The Paramount Fiduciary Duty: Acting in the Best Interest of Beneficiaries/Creditors

An Estate Trustee, also called an executor, is named in a will to manage and settle a deceased person’s affairs. Their duties include making funeral arrangements, finding all assets, paying debts and taxes, and distributing what is left to beneficiaries as the will directs. This role requires careful attention to detail. The licensed trustee firm, Ira Smith Trustee & Receiver Inc., also acts as a court-appointed independent Estate Trustee.

Prudent Management of Trust Property and Assets

A Canada Trustee has a duty to manage and invest the assets they control responsibly and prudently. This means they must make informed decisions and act as a careful person would in similar circumstances. They must avoid risky or speculative investments and must treat all beneficiaries fairly.

Legal Compliance and Regulatory Adherence

A trustee must always follow the law. This can be complex, as a Canada Trustee must comply with a range of federal and provincial laws, as well as the terms of any will or trust document. For example, an Estate Trustee must ensure that all debts and taxes are paid before distributing assets, or they could face personal liability. In Ontario, the Trustee Act comes into play.

Reporting, Disclosure, and Accountability

A trustee must keep detailed and accurate records of all transactions and be ready to show these to the beneficiaries at any time. This “duty to account” is a crucial part of their role, ensuring that they are transparent and accountable for their actions. If a trustee fails in their duties, they can be removed by the court and ordered to pay for any losses.

Trustee Remuneration: Compensation for Services Rendered

Trustees are entitled to be paid for their services.] How much they are paid is usually determined by the will or trust document, or if not specified, it is decided by provincial law or the court. For example, the Public Guardian and Trustee of British Columbia charges prescribed fees for their services, typically ranging from 3% to 5% of the estate’s value.

Navigating Financial Challenges: How Trustees Provide Debt Relief

As the OSB report highlights, the need for debt relief is growing. This is where the Licensed Insolvency Trustee becomes the most relevant kind of Canada Trustee for many people.

Understanding Financial Difficulties and Debt Problems

The first step in seeking help is acknowledging the problem. The OSB report shows that more Canadians are facing a financial gridlock due to factors like high interest rates and the rising cost of living. When you find yourself unable to pay your bills, a Licensed Insolvency Trustee is the professional to consult.

Options for Individuals: Consumer Proposals and Personal Bankruptcy

While consumer credit counselling can help many Canadians manage their debts, sometimes your financial situation requires more powerful legal solutions. When your debt load exceeds what you can realistically repay through traditional methods, consumer proposals and personal bankruptcy offer legal protection and genuine fresh starts.

As a Licensed Insolvency Trustee serving the Greater Toronto Area, I help people understand when these formal insolvency options become necessary alternatives to credit counselling. These government-regulated processes can eliminate or significantly reduce your debts while protecting you from creditor actions – something that consumer credit counselling services cannot legally provide.

If you’re facing overwhelming debt that exceeds 40% of your annual income, dealing with aggressive collection actions, or finding that minimum payments aren’t making a real dent in your balances, it may be time to explore these more comprehensive debt relief solutions that only Licensed Insolvency Trustees can administer:

- Consumer Proposals: A consumer proposal is a legally binding offer to your creditors to pay back a portion of what you owe over a set period (up to five years).

- Personal Bankruptcy: This is a legal process that allows you to be released from your debts and get a fresh financial start.

A Licensed Insolvency Trustee ensures that your rights are protected throughout these processes.

Corporate Insolvency and Restructuring

Beyond personal debt, a Licensed Insolvency Trustee also plays a key role in helping businesses that are in financial trouble. They can help companies reorganize and restructure their debt, which can save the business and its jobs. The OSB report’s mention of a decline in corporate filings suggests that this part of the economy is holding steady, but the service remains critical for businesses in distress.

Choosing the Right Canada Trustee for Your Specific Needs

The type of Canada Trustee you need depends entirely on your situation. Knowing who to turn to is the first step toward finding a solution.

When to Consult a Licensed Insolvency Trustee

You should consult a Licensed Insolvency Trustee when you are facing debt problems that you cannot solve on your own. They are the only ones who can legally help you with options like a consumer proposal or bankruptcy. A consultation with an LIT is free and will help you understand your situation and your legal options without any obligation.

When to Plan for an Estate Trustee/Executor

This is a step you should take when you are planning your will. Naming a trustworthy and competent person or company as your Estate Trustee is crucial for ensuring that your wishes are carried out and your beneficiaries are protected.

When the Public Guardian and Trustee May Be Involved

The PGT is an office of last resort. This means you should only expect them to be involved if there is no other suitable person to act as a trustee for a vulnerable individual or an estate. If you are worried about a family member who needs help, but no one is available to act, you can contact the PGT’s office.

When to Engage a Professional Trustee or Trust Company

A professional trustee is a good choice if you have a large and complex estate, or if you anticipate conflicts between family members after your death. They can provide professional expertise and impartiality, which can save a lot of stress and family disputes in the long run.

Key Factors in Trustee Selection

When choosing any type of Canada Trustee, remember to consider factors beyond just a personal relationship. Trustworthiness is a given, but you should also look for someone with the right skills, knowledge of tax and legal requirements, and the ability to act prudently and impartially.

Regulatory Oversight and Professional Standards for Canadian Trustees

The different types of trustees in Canada are held accountable by various regulatory bodies and legal frameworks, ensuring they maintain high professional standards.

- Licensed Insolvency Trustees (LITs): As the OSB report makes clear, LITs are strictly regulated by the Office of the Superintendent of Bankruptcy. The OSB conducts office visits, initiates compliance actions, and launches professional conduct investigations to ensure that LITs are following all the rules.

- Estate Trustees: The duties of an Estate Trustee are regulated by provincial laws and overseen by the courts. If a trustee fails in their duties or mismanages an estate, the courts can remove them and hold them personally responsible for any losses.

- Public Guardian and Trustee (PGT): These are government-appointed roles, and their authority and duties are set out in provincial laws.] They are held to the highest ethical and legal standards.

- Trust Companies: Trust companies, which are often a part of a bank, are highly regulated entities.[16] They are regulated at the federal level by organizations like the Financial Consumer Agency of Canada (FCAC) and the Office of the Superintendent of Financial Institutions (OSFI).

Canada Trustee Conclusion

The OSB’s 2024-25 Annual Report shows that Canada’s economic reality is difficult for a growing number of people. In this “two-speed” economy, the role of a trusted professional like a Canada Trustee is more important than ever. Whether you need help with debt, are planning your will, or are a family member of a vulnerable person, knowing who these professionals are and how they can help is the first step toward securing your financial future.

The path to financial freedom in Canada’s current economic climate may be challenging, but it is not impossible. With the right information, a clear plan, and professional guidance, you can overcome your cost-of-living and debt challenges and move towards a more secure and hopeful financial future.

You’re not alone in this. There’s a path forward, and it starts with reaching out for the right kind of help. Take that step—you deserve it. If you’re a GTA resident dealing with overwhelming debt, don’t wait for your credit situation to get worse. As a licensed insolvency trustee serving Toronto, Mississauga, Brampton, Markham, and surrounding areas, I’m here to help you understand your debt relief options.

Free consultation available:

- No obligation to proceed

- Complete review of your debt and credit situation

- Clear explanation of how debt relief options affect your Equifax credit score

- Practical next steps you can take immediately

Remember: Your current financial situation doesn’t define your future. With the right help and information, you can overcome both debt challenges and credit score problems.

As a licensed insolvency trustee serving the Greater Toronto Area, I encourage consumers and business owners to view financial difficulties not as failures but as challenges that can be addressed with proper guidance. By understanding the warning signs of insolvency and seeking professional advice early, many people and businesses can find a path forward – whether through restructuring, strategic changes, or in some cases, an orderly wind-down that protects their future opportunities.

Remember: The earlier you seek help for company insolvency concerns, the more options you’ll have.

If you or someone you know is struggling with too much debt, remember that the financial restructuring process, while complex, offers viable solutions with the right guidance. As a licensed insolvency trustee serving the Greater Toronto Area, I help entrepreneurs understand their options and find a path forward during financial challenges.

At the Ira Smith Team, we understand the financial and emotional components of debt struggles. We’ve seen how traditional approaches often fall short in today’s economic environment, so we focus on modern debt relief options that can help you avoid bankruptcy while still achieving financial freedom.

The stress of financial challenges can be overwhelming. We take the time to understand your unique situation and develop customized strategies that address both your financial needs and emotional well-being. There’s no “one-size-fits-all” approach here—your financial solution should be as unique as the challenges you’re facing.

If any of this sounds familiar and you’re serious about finding a solution, reach out to the Ira Smith Trustee & Receiver Inc. team today for a free consultation. We’re committed to helping you or your company get back on the road to healthy, stress-free operations and recover from financial difficulties. Starting Over, Starting Now.

The information provided in this blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc., and any contributors do not assume any liability for any loss or damage.