Corporate Insolvency & Restructuring Introduction

As an entrepreneur in the Greater Toronto Area, you understand the daily pressures of running a business. With rising costs, inflation, high interest rates, and the need to repay loans, many businesses are struggling. It’s easy to feel overwhelmed when faced with financial challenges.

But you are not alone. Facing financial difficulty is not a failure; it’s an opportunity to find a path forward. There are clear corporate insolvency & restructuring solutions available to help Canadian businesses in Toronto and the wider GTA get back on track or close down in an orderly, dignified way.

This guide will clearly explain corporate insolvency & restructuring options under Canadian insolvency law, specifically for businesses in Ontario. My goal is to help you make informed decisions for a brighter future for your business and yourself. As a Licensed Insolvency Trustee or LIT, I am your trusted expert, here to provide clear, empathetic, and authoritative advice.

Corporate Insolvency & Restructuring Key Takeaways

- Insolvency is a financial state (when you can’t pay your debts when they come due), while bankruptcy is a legal outcome. Many options exist before bankruptcy.

- Acting early on warning signs is crucial. The sooner you seek help, the more corporate insolvency & restructuring options you have to save your business.

- Licensed Insolvency Trustees are the only federally regulated professionals in Canada who can help corporations through formal corporate insolvency & restructuring processes like Bankruptcy and Insolvency Act Division I Proposals, CCAA Plans of Arrangement and corporate bankruptcy.

- Formal options like a Division I Proposal can allow a viable business to restructure unmanageable debt and continue operating, protected from creditors.

- For incorporated businesses, personal assets are often protected unless personal guarantees were made.

1. Understanding Corporate Financial Distress: Warning Signs for GTA Businesses

Understanding corporate financial distress means recognizing when your business is having trouble paying its bills. Many businesses in the Greater Toronto Area face financial struggles due to economic shifts, high operating costs, and market competition. Recognizing the warning signs early is crucial because the sooner you act, the more corporate insolvency & restructuring choices you will have to help your business recover or close in an organized way. Ignoring these signs can lead to bigger problems and fewer solutions.

1.1 What is Corporate Insolvency?

Corporate insolvency is a financial state where your business cannot meet its money obligations. Simply put, a business is insolvent when it cannot pay its bills on time, or when its total debts are greater than the current value of its total assets. It’s important to remember that insolvency is a financial condition – it’s about being unable to manage your debts. Bankruptcy, on the other hand, is a legal process that can happen because a business is insolvent. It’s one of the options, but definitely the last option, you might consider when facing insolvency.

1.2 Key Warning Signs Your Business is in Trouble

Identifying these red flags early can make a big difference in the future of your Toronto-area business. Pay close attention to these signals:

- Cash Flow Problems: You are constantly struggling to pay your bills on time. This might mean late payments to suppliers, landlords, or employees. You might find yourself juggling payments, deciding which critical bill to pay each week.

- Government Arrears: Falling behind on important payments to the Canada Revenue Agency (CRA) is a serious warning sign. This includes unremitted HST, payroll deductions (like income tax, Canada Pension Plan, and Employment Insurance), or other government obligations. Directors of a corporation can be held personally responsible for these specific debts, even if the business is incorporated.

- Maxing Out Credit: Your business is always at its credit limit on lines of credit or credit cards, and you find it hard or impossible to get new loans or additional credit. This shows lenders no longer trust your business’s ability to repay.

- Selling Assets to Survive: You are forced to sell valuable business assets like equipment, vehicles, or property just to cover daily operating costs, not to grow the business. This is a sign you are using your business’s long-term value to pay for short-term needs.

- Creditor Pressure: You are receiving constant calls, demands for payment, threats of legal action, or demands for C.O.D. (cash on delivery) terms from your suppliers. This means your creditors are losing patience and trust.

- Lack of Financial Information: You don’t have clear, up-to-date financial statements, budgets, or a business plan. Without this information, you can’t truly understand your business’s financial health or make smart decisions.

- Declining Profitability: Your business is regularly showing monthly losses, or your sales are consistently dropping without clear reasons or a plan to reverse the trend. This affects your ability to generate enough money to cover costs.

- Missed Opportunities: You can’t take advantage of new business opportunities because you lack funds or credit.

For businesses in the Greater Toronto Area, these signs can appear quickly due to the high operational costs and competitive markets. The urgency to identify and act on these issues early cannot be overstated. Waiting too long limits your corporate insolvency & restructuring choices and can make recovery much harder. If you see one or more of these signs, it’s time to seek professional advice.

2. Exploring Your Options: Corporate Insolvency & Restructuring Pathways in Ontario

When your business in Ontario faces financial distress, you have several pathways to explore, ranging from informal negotiations to formal legal corporate insolvency & restructuring processes. Understanding these options is key to making a strategic decision that best suits your company’s situation and objectives, whether you’re in Toronto, Vaughan, Markham, Mississauga, Brampton, or anywhere else in the GTA. These options represent the main ways a corporation can deal with insolvency and restructure its finances.

2.1 Informal Restructuring: The First Step Towards Recovery

Informal restructuring involves working directly with your creditors to make new payment arrangements or negotiate terms, often without formal legal proceedings. This approach is usually the first step for many businesses trying to fix financial problems.

- What it is: This can involve calling your suppliers or landlord to ask for more time to pay, negotiating lower interest rates with a bank, or working out a temporary payment plan directly with your creditors. It’s about finding common ground and trying to solve problems outside of court.

- Strategies: You might look at cutting unnecessary costs, improving how efficiently your business runs, finding new ways to generate income, or selling assets that aren’t essential to your core business operations. These steps aim to improve your cash flow and financial health.

- When it Works: Informal restructuring works best for businesses with fewer creditors, especially those with whom you have good, long-standing relationships. It’s most effective when your financial issues are likely temporary, and you believe you can recover with some breathing room.

- Limitations: The main limitation is that informal agreements may not stop legal action or prevent creditors from taking enforcement steps (like seizing assets or suing) if your problems are severe or widespread. Not all creditors may agree to new terms, and you have no legal protection from those who don’t.

2.2 Formal Restructuring under the Bankruptcy and Insolvency Act (BIA)

For many GTA businesses, informal efforts aren’t enough. That’s when formal corporate insolvency & restructuring options under federal law, specifically the Bankruptcy and Insolvency Act (BIA), become vital. These processes offer legal protection and a structured way to deal with debt.

Division I Proposals (Corporate Proposals): A Lifeline for Viable Businesses

A Division I Proposal, often called a Corporate Proposal, is a powerful tool for insolvent corporations in Ontario that have a chance to survive. The business may be financially sick, but it is still a viable business. It’s a formal, legally binding offer made by an insolvent corporation to its creditors. The offer can propose to pay back a percentage of what is owed, or extend the time to pay, or both. It is always and can only be administered by a Licensed Insolvency Trustee.

- Definition: This process allows your business to negotiate a new payment plan with your unsecured creditors under the protection of the law. Instead of paying all your debts in full, you propose a new plan that creditors vote on. If accepted, it becomes legally binding on all unsecured creditors, even those who voted no.

- Key Benefits:

- Immediate Protection: Once your LIT files the paperwork, a “stay of proceedings” legally comes into effect. This immediately stops all unsecured creditors from taking collection action, garnishments, lawsuits, or other enforcement steps against your business. This gives you vital breathing room.

- Business Continues: One of the biggest advantages is that your business can keep operating during the proposal process. This allows you to fix underlying issues, cut costs, or increase revenue, with the goal of returning to profitability.

- Debt Reduction: In many cases, the business only pays back a portion of its unsecured debts. This can provide significant financial relief and make debts manageable.

- Structured Plan: You work closely with an LIT to create a realistic and achievable payment plan that your business can afford based on its cash flow.

- The Process:

- Notice of Intention (NOI): The first step is often to file a Notice of Intention to Make a Proposal. This filing provides your business with immediate legal protection (the stay of proceedings) for an initial 30 days, which can be extended up to six months with the approval of the court. This time is used to prepare a detailed proposal.

- Proposal Development: During this period, you and your LIT develop a formal offer to present to your creditors. This proposal outlines how much you will pay, over what period, and what terms will apply.

- Creditor Vote: Once the proposal is prepared, a meeting of creditors is called. Creditors vote on the proposal. For it to be accepted, a majority (by number) representing two-thirds (by dollar value) of the voting unsecured creditors must agree to it.

- Court Approval: If creditors accept the proposal, it must then be reviewed and approved by the court. Once approved, the proposal is legally binding on all unsecured creditors listed in the proposal, whether they voted for it or not.

- Eligibility: Any insolvent corporation in Ontario and the rest of Canada that owes at least $1,000 in debt can file a Division I Proposal if it has a viable business that can be saved.

The LIT needs to file all official documents with the Office of the Superintendent of Bankruptcy.

2.3 The Companies’ Creditors Arrangement Act (CCAA): For Larger Corporations

While a Division I Proposal is suitable for most businesses, the Companies’ Creditors Arrangement Act (CCAA) is another federal law designed for corporate insolvency & restructuring.

- Brief Explanation: CCAA proceedings are typically used for very large corporations with debts at or exceeding $5 million. It offers a more flexible and court-supervised restructuring process. The offer to the unsecured creditors to repay a portion of the debt is called a Plan of Arrangement.

- Key Difference from BIA Proposal: CCAA proceedings are generally more complex, more costly, and involve a higher degree of court oversight. For small to medium-sized businesses in the GTA, a Division I Proposal under the BIA is almost always the more appropriate and cost-effective option.

3. Corporate Bankruptcy: When a Fresh Start Means Closing the Doors

Corporate bankruptcy is a formal legal process under the Bankruptcy and Insolvency Act where an insolvent corporation’s assets are taken over by an LIT, sold off, and the money is used to pay its creditors. While a Division I Proposal aims to save the business, bankruptcy means the business will close permanently. This path is usually chosen when the business is no longer viable and cannot be saved through restructuring. It provides a formal, orderly way to shut down an unviable business and manage its remaining debts.

3.1 What is Corporate Bankruptcy?

Corporate bankruptcy is the legal end of a business. It’s a process where an insolvent company’s assets are gathered by a Licensed Insolvency Trustee, sold, and the funds are distributed among its creditors according to legal priorities. The main outcome is that the corporation ceases to exist. This decision is typically made when the business has no reasonable chance of recovery and restructuring isn’t possible or practical. It provides a definite end, allowing all stakeholders to move on.

3.2 The Bankruptcy Process for a Corporation in Ontario

The process for a corporation entering bankruptcy in Ontario is structured and managed by an LIT:

- Initiation: A corporation can voluntarily assign itself into bankruptcy by filing the necessary documents with an LIT. In some cases, creditors can petition the court to declare a corporation bankrupt, though this is less common for small and medium-sized businesses.

- Role of the LIT: Once bankruptcy is filed, a Licensed Insolvency Trustee is appointed to manage the bankruptcy estate. The LIT takes legal possession of all the corporation’s assets, such as inventory, equipment, accounts receivable, and real estate. The LIT’s role is to sell these assets for the best possible value and distribute the funds to the creditors according to a strict legal order of priority set out in the BIA. The interest in the assets of the LIT is subject to the rights of the secured creditors.

- No Personal Assets (Generally): For most incorporated businesses, the personal assets of the directors or owners are generally protected. This is because a corporation is a separate legal entity from its owners. However, there are very important exceptions, especially if personal guarantees were made or for specific government debts (see Section 5).

- Termination: Once all assets are liquidated (sold) and the funds are distributed to creditors, the bankruptcy administration is completed. The corporation ceases to exist. This provides a clean break for the business and its owners.

3.3 Priority of Creditors in Corporate Bankruptcy

Understanding the order in which creditors are paid is vital for business owners, especially those in the Greater Toronto Area, dealing with many different types of debt.

- Trust Claimants: These are creditors given a trust claim under a provincial or federal law. The most common one found in a corporate bankruptcy is the CRA for unremitted payroll source deductions. They are paid first.

- Secured Creditors: These are creditors who have a registered claim against specific assets of the business (e.g., a bank with a loan secured by a mortgage on property, or a financing company with a lien on equipment). They are paid next from the sale of those specific assets. If the sale of the asset doesn’t cover their full debt, they become unsecured creditors for the remaining balance.

- Preferred Creditors: Certain types of unsecured creditors are given priority over general ordinary unsecured creditors. This includes the fees and expenses of the Licensed Insolvency Trustee for administering the bankruptcy. It also includes certain unpaid wages, salaries, commissions, and the claim of landlords for rent arrears, all up to certain legal limits.

- Unsecured Creditors: Most other creditors fall into this category. This includes suppliers, credit card companies, utility providers, and often the CRA for general income taxes (not source deductions). In a corporate bankruptcy, for unremitted HST, CRA is an unsecured creditor. These creditors share any remaining funds proportionally after trust claimants, secured and preferred creditors have been paid. In many corporate bankruptcies, unsecured creditors receive only a small percentage of what they are owed, or sometimes nothing at all.

Knowing this priority helps business owners understand what to expect and which debts might continue to be a concern if personal guarantees or director liabilities are involved.

4. Comparison Table: Division I Proposal vs. Corporate Bankruptcy in Ontario

When an Ontario business faces financial challenges, entrepreneurs in the Greater Toronto Area need to understand the key differences between a Division I Proposal and Corporate Bankruptcy. This table provides a clear overview to help you compare these two formal options.

Feature | Division I Proposal (corporate insolvency & restructuring) | Corporate Bankruptcy |

|---|---|---|

Primary Goal | To allow a viable business to keep operating, restructure its debts, and return to profitability. | To liquidate assets, formally close down the business, and legally discharge its corporate debts. |

Business Continues? | Yes, the business continues to operate under the terms of the approved proposal. | No, the corporation is dissolved and ceases to exist permanently. |

Debt Reduction? | Creditors typically accept a reduced amount (e.g., 20-50 cents on the dollar) or extended payment terms. The unpaid balance of corporate debts included in the Division I Proposal is legally discharged (after successful completion). | Unsecured corporate debts are legally discharged (after assets are liquidated). |

Creditor Protection? | An immediate “stay of proceedings” halts all unsecured creditor actions (lawsuits, garnishments, collection calls). | An immediate “stay of proceedings” halts all creditor actions against the corporation. |

Court Involvement? | Requires court approval after creditors vote to accept the proposal. | A court order often initiates (for involuntary) but not if the bankruptcy is voluntary. The LIT oversees the bankruptcy administration and applies to court at the end for approval of the Final Statement of Receipts and Disbursements and to obtain the LIT’s discharge. |

Public Record? | Yes, details are part of the public record maintained by the Office of the Superintendent of Bankruptcy (OSB). | Yes, details are part of the public record maintained by the Office of the Superintendent of Bankruptcy. |

Cost | Includes LIT fees, potentially higher overall costs due to ongoing operations and the complexity of the restructuring plan. | Primarily LIT fees; often lower overall as the focus is on liquidation, not ongoing operations. |

Impact on Directors/Owners | Directors continue to manage the business and can potentially protect personal assets (if no guarantees). | No direct personal liability for corporate debt (unless personal guarantees and director liabilities exist). |

Timeline | Flexible; preparation takes months, and payments can extend up to five years, but there is no statutory limit on length. | Typically, 9 to 36 months for assets to be sold and funds distributed, depending on complexity. |

This comparison highlights that a Division I Proposal is for businesses that can be saved, offering a path to recovery, while corporate bankruptcy is for businesses that need an orderly closure. Your choice depends on the viability of your business and your long-term goals.

5. Protecting Your Personal Assets as a GTA Entrepreneur

As an entrepreneur in the Greater Toronto Area, understanding how your personal assets are protected or exposed when your business faces financial trouble is vital. Many business owners believe that incorporating their business fully shields them, but there are important exceptions.

The Power of Incorporation:

A key reason many entrepreneurs in Ontario choose to incorporate their business is to create a legal separation between the business and their personal finances. Generally, if your business is incorporated, you, as an owner or director, are not personally responsible for its debts. The corporation is a separate legal entity, meaning it is the business that owes the money, not you personally. This offers a valuable layer of protection for your home, savings, and other personal assets.

Personal Guarantees: Be Aware of the Risks

While incorporation offers protection, personal guarantees are a major exception. If you have personally guaranteed business loans, lines of credit, or leases (which is very common, especially with banks for small to medium-sized businesses in the GTA), your personal assets can be at risk if the business defaults. When you sign a personal guarantee, you are essentially promising to repay the business’s debt from your own pocket if the company cannot. This means that creditors can pursue your personal assets, such as your home, car, or personal savings, to recover the debt. It’s crucial to understand what you’ve signed and the potential personal liability involved.

Director Liabilities: Specific Debts You’re Responsible For

In Ontario (and the rest of Canada), even with an incorporated business, directors of corporations can be held personally liable for certain statutory debts. These are debts owed to the government or employees, and they are distinct from general business debts. The most common examples include:

- Unremitted Payroll Source Deductions: Income tax, Canada Pension Plan (CPP), and Employment Insurance (EI) amounts that you’ve deducted from your employees’ paycheques but haven’t sent to the Canada Revenue Agency. These funds are considered to be held “in trust” for the government, and directors have a duty to ensure they are remitted.

- Unremitted GST/HST: Goods and Services Tax / Harmonized Sales Tax (HST) that your business has collected but not sent to the CRA. This is also considered trust money.

- Unpaid Employee Wages: In some cases, directors can be personally liable for a limited amount of unpaid wages owed to employees.

Always ensure these specific types of debts are paid on time. Falling behind on them can put your personal finances at significant risk, even if your corporation goes through bankruptcy.

Smart Planning:

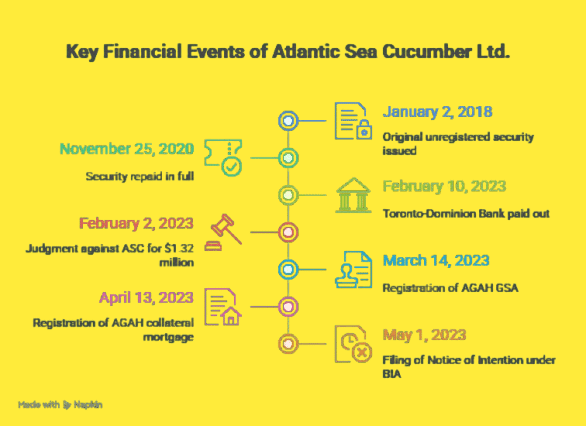

- Document Personal Loans: If you lend money to your business, properly document it with a loan agreement and ideally register a General Security Agreement (GSA) against the company’s assets. This could allow you to recover some of your investment in a formal insolvency.

- Consult an LIT: To truly understand how to best protect your personal finances during business difficulties, it’s essential to consult with a Licensed Insolvency Trustee. They can review your specific situation, including any personal guarantees, and advise you on the best course of action.

6. Choosing the Right Licensed Insolvency Trustee in the Greater Toronto Area

When your business in the Greater Toronto Area is facing financial distress, selecting the right professional to guide you through corporate insolvency & restructuring is one of the most important decisions you’ll make. A Licensed Insolvency Trustee is not just a consultant; we are the only federally licensed and regulated professionals in Canada legally authorized to administer formal insolvency processes like corporate proposals or corporate bankruptcies.

Why an LIT is Essential:

An LIT plays a critical role as an impartial expert in Canadian insolvency law. We don’t represent just your creditors or just your interests; we are legally mandated to act fairly for all parties involved. This means we offer unbiased advice, explain all your available options (not just the ones that benefit us), and ensure that the process follows the strict rules set out in the Bankruptcy and Insolvency Act. We have the legal authority and expertise to provide the formal protection you need and to negotiate with your creditors on your behalf. Without an LIT, your business cannot access the legal protections and debt restructuring benefits of a formal proposal or bankruptcy.

What to Look For:

When choosing an LIT for your business in Toronto or the GTA, consider these factors:

- Corporate Insolvency Expertise: Ensure they specialize in business debt and corporate restructuring, not just personal insolvency. Corporate insolvency has its own complexities, and you need an expert who understands the nuances of business operations and director liabilities.

- Local Knowledge: A trustee familiar with the Greater Toronto Area market understands local economic factors, industry trends, and specific challenges that businesses in Ontario might face. This local insight can be invaluable in crafting practical solutions.

- Empathetic & Non-Judgmental: Facing business insolvency can be incredibly stressful and isolating. You need someone who listens without judgment, treats your situation with respect, and provides reassuring guidance. A good LIT acts as a trusted advisor, not just a legal administrator.

- Clear Communication: The world of insolvency law can be complex. Your LIT should be able to explain all your options, the processes involved, and potential outcomes in clear, simple language that you can easily understand, at a Grade 9 reading level.

- Free Consultation: A reputable LIT will always offer a confidential, no-obligation initial consultation. This allows you to explain your situation, understand your choices, and get a sense of their approach before committing to anything.

Ira Smith Trustee & Receiver Inc.:

At Ira Smith Trustee & Receiver Inc., we have extensive experience helping entrepreneurs across the GTA navigate complex corporate financial challenges and corporate insolvency & restructuring options. We understand the unique pressures of the Toronto business landscape. We approach every situation with professionalism, compassion, and a deep commitment to finding the most strategic path forward for your business and your peace of mind. We are here to ensure you get a fair, fresh start.

7. Corporate Insolvency & Restructuring Frequently Asked Questions (FAQs)

Entrepreneurs in the Greater Toronto Area often have many questions when considering corporate insolvency & restructuring. Here are answers to some common concerns, providing practical information to help you understand your options and the support available.

Q1: Can a small business in Toronto file a Consumer Proposal?

A: No, a Consumer Proposal is only for individuals who owe less than $250,000 (excluding a mortgage on their principal residence). Corporations are distinct legal entities. If a corporation wants to restructure its debts and avoid bankruptcy, it must file a Division I Proposal (often called a Corporate Proposal) under the Bankruptcy and Insolvency Act. This is a different process tailored to businesses.

Q2: What happens to employees when a company goes through corporate insolvency?

A: If the business files a Division I Proposal, the goal is to continue operations. Therefore, employees usually keep their jobs, and their employment continues under the restructured business. However, it is possible that one of the reasons for the employer’s insolvency is too high payroll costs and it may be necessary to shed some employees. In a corporate bankruptcy, the company closes, and employees are terminated by the bankruptcy. In this situation, the Wage Earner Protection Program Act (WEPPA) may offer some financial protection for unpaid wages, holiday pay, and severance owed to employees, up to a certain maximum amount. The LIT is obligated to provide details to the former employees of the bankrupt company.

Q3: How long does the corporate insolvency process take in Ontario?

A: The timeline varies depending on the chosen path. A Division I Proposal typically takes a few months to get approved by creditors and the court. The payment plan under a proposal usually involves payments over a period of up to five years, but there is no statutory maximum for its length. Corporate bankruptcy typically takes 9 to 36 months to complete, depending on how complex the assets are and how long it takes to sell them and distribute funds to creditors. The more complex business problems that exist, the longer the process generally will take.

Q4: Will my credit score be affected by corporate insolvency?

A: Yes, formal insolvency proceedings (either a Division I Proposal or corporate bankruptcy) will negatively affect the corporation’s credit history. This record is permanent. If you, as a director or owner, provided personal guarantees for the business’s debts (e.g., bank loans or credit lines), your personal credit score will also be impacted.

Q5: What is the difference between a “workout” and formal restructuring?

A: A “workout” is an informal agreement made directly between a business and its creditors, outside of any legal framework. It relies on voluntary cooperation. Formal restructuring, such as a Division I Proposal or a filing under the CCAA, is a legal process under federal law. It provides specific legal protections (like a stay of proceedings) from creditors and results in a legally binding scheme of arrangement that applies to all unsecured creditors once approved. Formal restructuring offers greater certainty and protection than an informal workout.

Formal corporate restructuring in Canada is the equivalent of Chapter 11 bankruptcy protection in the United States.

Q6: What if my business debts include money owed to the Canada Revenue Agency?

A: Debts owed to the CRA, including unremitted HST and payroll source deductions, are definitely considered in both Division I Proposals and corporate bankruptcies. However, it’s crucial to understand that directors can be held personally liable for these types of corporate debts, even if the corporation enters bankruptcy or files a proposal. Addressing these critical liabilities early with your LIT is essential, as they often require special attention in any restructuring or liquidation plan.

Brandon’s Take (Expert Authority) on Corporate Insolvency & Restructuring

As a Licensed Insolvency Trustee and active insolvency practitioner serving the Greater Toronto Area, I’ve had the privilege of guiding countless entrepreneurs through their most challenging corporate insolvency & restructuring business moments.

What I’ve learned is that seeking help is never a sign of failure; it’s a profound act of leadership and courage. The landscape of business debt and insolvency can feel overwhelming, especially for dedicated business owners in Toronto and across Ontario. But you don’t have to navigate it alone. My team and I are here to provide clear, empathetic, and authoritative advice, helping you understand your unique situation and find the most strategic path forward for your business and your peace of mind. Your business deserves a chance at a fresh start.

Corporate Insolvency & Restructuring Conclusion

Facing corporate financial challenges in the Greater Toronto Area can be daunting, but there are proven legal pathways, from informal restructuring to formal proposals and bankruptcy, that offer a solution. The most important step you can take is to act early and seek professional guidance. Delaying action can significantly limit your options and increase stress.

Remember, the goal is not just to resolve debt, but to pave the way for a more stable future, whether that’s through a revitalized business or a dignified and orderly closure.

Don’t let uncertainty or fear prevent you from exploring your options. If your business in Toronto, Vaughan, Markham, Mississauga, Brampton, or anywhere in the wider GTA is experiencing financial difficulty, contact the insolvency practice of Ira Smith Trustee & Receiver Inc. today for a confidential, no-obligation consultation. We are here to listen, assess your situation, and help you chart the best course forward, Starting Over Starting Now.

Ira Smith Trustee & Receiver Inc. is licensed by the Office of the Superintendent of Bankruptcy and is a member of the Canadian Association of Insolvency and Restructuring Professionals.

Contact Ira Smith Trustee & Receiver Inc. Today:

- Phone: 905.738.4167

- Toronto line: 647.799.3312

- Website: https://irasmithinc.com/

- Email: brandon@irasmithinc.com

Disclaimer: This analysis is for educational purposes only and is based on the cited sources and my professional expertise as a licensed insolvency trustee. The information provided does not constitute legal or financial advice for your specific circumstances.

Every situation is unique and involves complex legal and factual considerations. The outcomes discussed in this article may not apply to your particular situation. Situations are fact-specific and depend on the particular circumstances of each case.

Please contact Ira Smith Trustee & Receiver Inc. or consult with qualified legal or financial professionals regarding your specific matter before making any decisions.

About the Author:

Brandon Smith is a Senior Vice-President at Ira Smith Trustee & Receiver Inc. and a licensed insolvency trustee serving clients across Ontario. With extensive experience in complex court-ordered receivership administration and corporate insolvency & restructuring proceedings, Brandon helps businesses, creditors, and professionals navigate challenging financial situations to achieve optimal outcomes.

Brandon stays current with landmark developments in Canadian insolvency law. He brings this cutting-edge knowledge to every client engagement, ensuring his clients benefit from the most current understanding of their rights and options.