The debt counselling ON process

We are licensed to practice in the Province of Ontario, so when we do debt counselling, that is where the “ON” comes from. We have previously written on various debt settlement issues, including:

- #VIDEO – HOUSEHOLD DEBT IN CANADA CRISIS#

- WANT TO STEP UP YOUR NEW YEAR’S CREDIT CARD DEBT SETTLEMENT? YOU NEED TO READ THIS FIRST

- 407 ETR DEBT SETTLEMENT: OUR NEWEST GUILT FREE WAY TO DO IT

- DEBT SETTLEMENT COMPANIES FINALLY TAKEN TO TASK IN ONTARIO

In terms of our Debt Counselling ON process you contact us to discuss your bankruptcy alternatives debt relief if you are unable to meet your financial commitments under credit agreements on a monthly basis. Our debt counselling ON process assesses if you are over-indebted, as follows:

Step 1

Complete our Debt Relief Worksheet, in full, with complete backup where requested, providing details of your income, monthly budget and debt commitments. Examples of the backup documentation you will need is a copy of your pay slip, ID, the latest statements of all your debts and your last year’s filed income tax return and notice of assessment from Canada Revenue Agency (CRA).

We can email the Debt Relief Worksheet to you and then you can submit it to us with the backup. That way, we save you an initial trip to our office. Our clients appreciate this, so they don’t have to take time off work just to obtain the worksheet.

Step 2

We will review your completed Debt Relief Worksheet to do an initial assessment to check if you are over-indebted, determine the debt counselling ON options available to you and then arrange for a consultation with you. This could either be a face to face or a telephone consultation. We want to make it as easy as we can on you. You are already under enough stress from your debts!

Step 3

During the consultation, we will verify your budget and your existing debt commitments. A new budget will be agreed upon to determine the amount available for debt repayment. At this stage we will also provide you with details of all the costs involved, as well as an interim debt settlement plan. Until now, our service is free. It is at this point that we will discuss costs with you to enter our debt counselling ON program to supervise your debt settlement plan.

Step 4

We will contact all your creditors to verify your debts. You WILL also be listed on the Credit Bureaus as being under our debt counselling ON program and the listing will stay there for a few years AFTER you have successfully completed the debt settlement program. We will, if necessary, further negotiate the proposed debt repayment plan with your creditors. We will do the negotiations, but we cannot settle on anything on your behalf until we have your approval.

Step 5

If your creditors accept the proposed debt settlement plan, it will be made an order of the court. This makes our debt counselling ON program binding on both you and your creditors.

Step 6

We will obtain from you post-dated cheques to cover the monthly payments you promised in your debt settlement plan. The aim of this is to collect the monthly payments from you and ensure that the correct amount in terms of the final debt repayment plan is paid by us to your creditors. This will continue until the amount you promised to pay under your debt settlement plan is paid in full.

Our debt counselling ON program works best for individuals that owe a maximum of $250,000, not including any mortgages or lines of credit secured against your home. If you owe more than $250,000, we can also assist you in a different plan tailored for those that owe larger amounts.

So how can I obtain debt counselling ON – NOW!

If you’re trapped in a high interest debt cycle, I could tell you that you need to pay off high interest debt, but how would you do it? You need a professional trustee to help you manage debt before it reaches a critical stage where bankruptcy is your only option. We have been able to help many individuals carry out a successful debt settlement program. Successful completion of such a program, will free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

Contact the Ira Smith Team today. Before considering declaring bankruptcy, there are other bankruptcy alternatives which include our debt counselling on program. Contact us today so that we can help and Starting Over, Starting Now you can be restored to financial health.

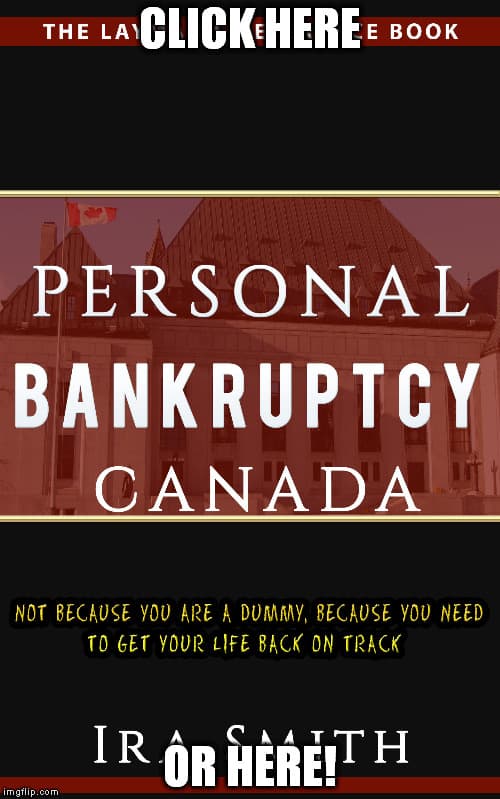

THIS VLOG WAS INSPIRED IN PART BY OUR eBOOK – PERSONAL BANKRUPTCY CANADA: Not because you are a dummy, because you need to get your life back on track