If you would like to listen to the audio version of this Canada insolvency Brandon’s Blog, scroll to the bottom and click on the podcast

Introduction

On September 4, 2019, the Government of Canada department of Innovation, Science and Economic Development, issued a press release. They announced that there would be changes coming to the Canada insolvency legislation.

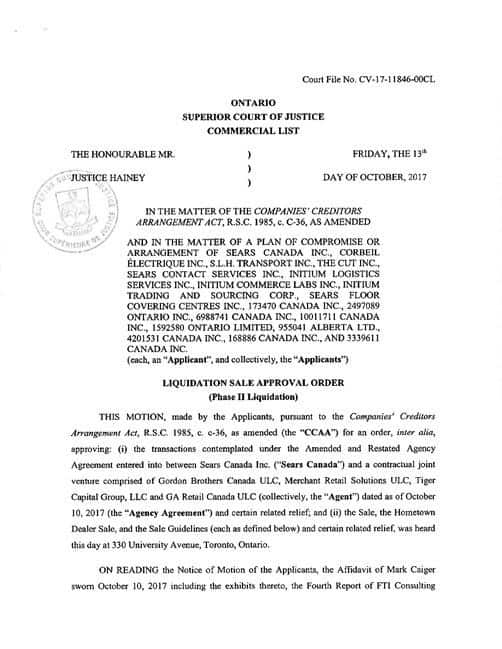

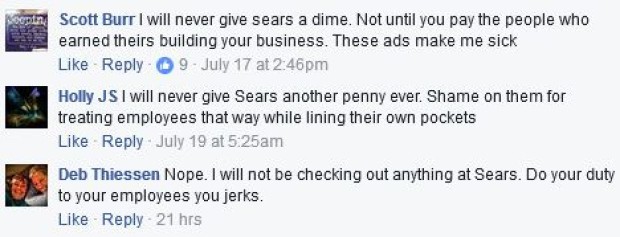

I have previously written about the fallout from the Sears Canada insolvency. Specifically, about the plight of retired employees seeing their medical benefits eliminated and their pension entitlement slashed. After that, there have been several private member bills trying to fix the Canada insolvency laws.

Budget 2019

As I have written in previous Brandon’s Blogs, the concern is for retired people (and present employees) when a company enters into an insolvency proceeding. Like in the Sears case, the worry is associated with the staff member’s health benefits plan which could be gutted for retirees. An equally important concern, are underfunded pension plans when a firm enters into bankruptcy protection.

Insolvent employers have placed a moratorium on reimbursements to workers and especially retirees on valid medical claims. Also, the staff member pension plan payments can be cut for retirees because the insolvent firm has not made the called for contributions. The retirees are in the weakest position as they can never make up for what they are now losing.

Pension payments are postponed income. In an insolvency filing, there is generally absolutely nothing left for current (other than perhaps their WEPPA claim in bankruptcy or receivership) and retired employees.

The reality is that all politicians currently acknowledge simply exactly how unsecure pension plans and health plans may be in the case of insolvency, restructuring or bankruptcy.

The Liberals acknowledge that this is a significant issue. Nonetheless, in this budget, they chose to ignore the problem.

What the press release said

The Government of Canada said that it is dedicated to far better safeguarding the rights of pensioners, employees and others during insolvency procedures. They say they can guarantee all Canadians can have satisfaction when it pertains to retirement. They say they can do this while maintaining laws that continue to support growth, advancement and also great jobs in Canada.

The Honourable Navdeep Bains, Minister of Innovation, Science and Economic Development Canada said, that beginning November 1, 2019, reforms to the Bankruptcy and Insolvency Act (BIA) and the Companies’ Creditors Arrangement Act (CCAA) announced in Budget 2019 will be enacted. He said that this will be done to enhance retired life security by making the insolvency procedure fairer, much more clear and also easily accessible.

So what is being planned?

The press release was consistent with the wording in Budget 2019. The press release went on to say that the BIA and CCAA modifications pertaining to boosting retirement protection will:

- call for participants in an insolvency process to act in good faith (isn’t that already enshrined in our legislation and enforced by our Courts?);

- offer the possibility of court-ordered disclosure of a creditor’s real financial interest in an insolvent business (how does this help retirees?);

- enforce director obligations in suitable cases for senior management compensation settlements in the lead-up to an insolvency proceeding (whatever appropriate means);

- limit the choices that can be taken initially in a CCAA administration to measures necessary to avoid the immediate liquidation of an insolvent company, thus boosting participation of all players (does this mean the government plans to outlaw a liquidating CCAA?);

- exclude assets held in registered disability savings plans from creditors’ claims in bankruptcy;

- reforms to the BIA and CCAA to guarantee the safeguarding of intellectual property user rights in insolvency, announced in Budget 2018, will also be enacted for November 1.

The devil is in the details

The Minister stated:

“It is unacceptable that some pensioners face hardship because of their employer’s insolvency and underfunded pension plans. Our government believes that after a lifetime of hard work, Canadians deserve a secure and dignified retirement. With these reforms, we are protecting Canadians’ retirement security and the ability of businesses to invest, grow and create more good jobs.”

This sounds great, but what does it mean? I don’t see anything in Budget 2019 or this recent press release that actually provides specifics on how retirees will be helped. There are no words talking about the super-priority of the amount of underfunding of pension plans. There is also no language on directors’ liability for such underfunding when the company continues to pay dividends to shareholders or bonuses to executives while the pension plan is underfunded.

We will have to wait to see how the proposed legislation actually reads. The other issue is our upcoming Federal election. Insolvency legislation is not a hot topic that gets votes. Perhaps real protection for retirees does. The government had a chance to really lay out how they will protect retirees, but they failed to do so. They talk about many issues in the press release. However, I don’t see anything directly related to retiree protection.

So I hope that the current federal government will follow through with legislation that has real teeth to protect retirees. But the 2019 Canadian federal election is scheduled to happen on or before October 21, 2019. That means that campaigning will have to begin very soon. So when will there be time to introduce the required legislation to be effective on November 1?

The federal government must have a plan otherwise they would not have put out the November 1 date in the press release. So let us wait and see and cross our fingers that retiree protection will be for real.

Canada insolvency summary

Are you nearing retirement with too much debt? Is your employer’s employee pension plan underfunded? Are you worried about how you will make ends meet in retirement?

The stress you are under because of your money challenges is huge. I understand your pain. At no cost to you, I will look at your whole set of circumstances and develop a plan that is as special as your issues. I know that I can help you through this.

There is no “one solution fits all” approach with the Ira Smith Team. That is why I can develop a debt settlement plan for you as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious in finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation. We will get your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

[monkeytools msnip=”http://monkeyplayr.com/playr.php?u=5173&p=21404″]