If you would prefer to listen to the audio version of this my bills Brandon’s Blog, please scroll to the bottom and click on the podcast

My bills are high: Introduction

It is very common when I sit down with a person who has come to my office for a free consultation to hear them say “my bills are high”. As a licensed insolvency trustee, my role is to first understand the person’s entire situation. It is quite possible that I can recommend a few alternatives to avoid bankruptcy.

The purpose of this Brandon’s Blog is to talk about the importance of budgeting and more things a person with financial problems can do before even considering the “B” word.

First thing – household budget

I will show you how to catch up when you are behind on your financial obligations by using a proper household budget plan process. I must warn you that there is no magic wand to wave to make things right. You will have to learn the budgeting technique and be willing to invest a great deal of effort, time and personal and family sacrifices. But it will be worth it. When you are back on track and living within your means, you will have a new stress-free outlook on life.

To start the monthly budget plan process, it does not matter if you use an electronic spreadsheet, a paper listing of income and expenses or a clean calendar. Whatever you are most comfortable using. The process will be the same.

The starting point is for you to list all your bills with their due dates. Don’t forget to make note of any special expenditures during any specific month, such as a spouse or child’s birthday present. Make sure you list all of your expenses regardless if you pay them by cheque, cash, credit card or online payment.

Next, list your monthly income by the date(s) during the month your wages or salary end up in your bank account. Make sure that you are listing your net take-home pay, net of income tax. That is the actual amount of income that you have to spend in any given month.

The 4 corners

Now that you know exactly how much money is coming in every month available for you to pay your expenses, you have to organize your expenses. You first need to know what I call your four corner expenses. These are the expenses that you will have to pay before anything else. This is true whether you continue working at the same place or you lose your job and are looking for new work. The expenses that I call the four corners are:

- Rent or mortgage payment.

- Food costs.

- Heat and electric bills.

- Clothing expenses.

These are your essentials. Nothing else can be considered before them. So fill in your regular monthly amount for each one. Total up the amount of your four corners expenses and deduct it from your take-home pay. The difference is what you have left over each month to spend on other expenses.

Now go down the list of the rest of your expenses. Car payments, gas and vehicle maintenance, insurance, cable, internet, credit card payments and anything else that you have listed. See what all those expenses total. If the total of those is more than you have leftover cash from the four corners exercise above, then you have to make adjustments. You either have to reduce your other expenses or you have to increase your income. Perhaps it may even be a combination of the two.

If you are behind on any of your payments, because your bills are too high right now, you are going to have to work into your budget increasing the amount of the monthly expenses that you are behind on. However, there is an exception. The exception is that you start with your four corners payments you are behind on.

It won’t help you to bring your credit cards current if the gas company is about to shut off your ability to heat your home. Bringing a life insurance payment current won’t help you if you are behind on your rent or mortgage payments. So again, your four corners payments have to be brought current first. Then you can focus on your other expenses.

Do not worry about anything else. You put it on hold due to the fact that at the end of the day, if you were to have lost your job, the four corners is what you require to make it through, not a credit card payment. You don’t need to fret about your credit rating decreasing since if you are starting this trip you are not looking to borrow more money that needs your credit score to be spot-on. That will come over time after you have your financial house in order.

You worry about taking care of your four corners first. That is a good mind trick to getting yourself out of the loop of being addicted to letting your bills go late. imagine if you would have lost your job you would have no other choice but to not pay the credit cards.

Balance the rest of your expenses

Now, normally when you’re behind on payments that mean that you don’t have enough money to cover all your bills and that is totally fine. I need to emphasize that is totally fine. You will be able to catch up eventually. Most people find ways to catch up by either:

- Further reducing expenses.

- Selling stuff.

- Using an annual bonus.

- Increasing income with overtime, a part-time job or side hustle.

You need to take care of business. That way you are treading water, not sinking in it!

Now, what about the non-four corners monthly payments that you are deferring. Yes, eventually the credit card company, such as, is going to start hounding you. You will have to explain your temporary problems, tell them what you are doing to correct things, and when you think you will really begin to resume payment. It doesn’t matter who the creditor is. The process of explaining the issues and getting a deferment or grace period is the same. Do not hide from your creditors. Explain the situation and show them that you have a solution for your common problem.

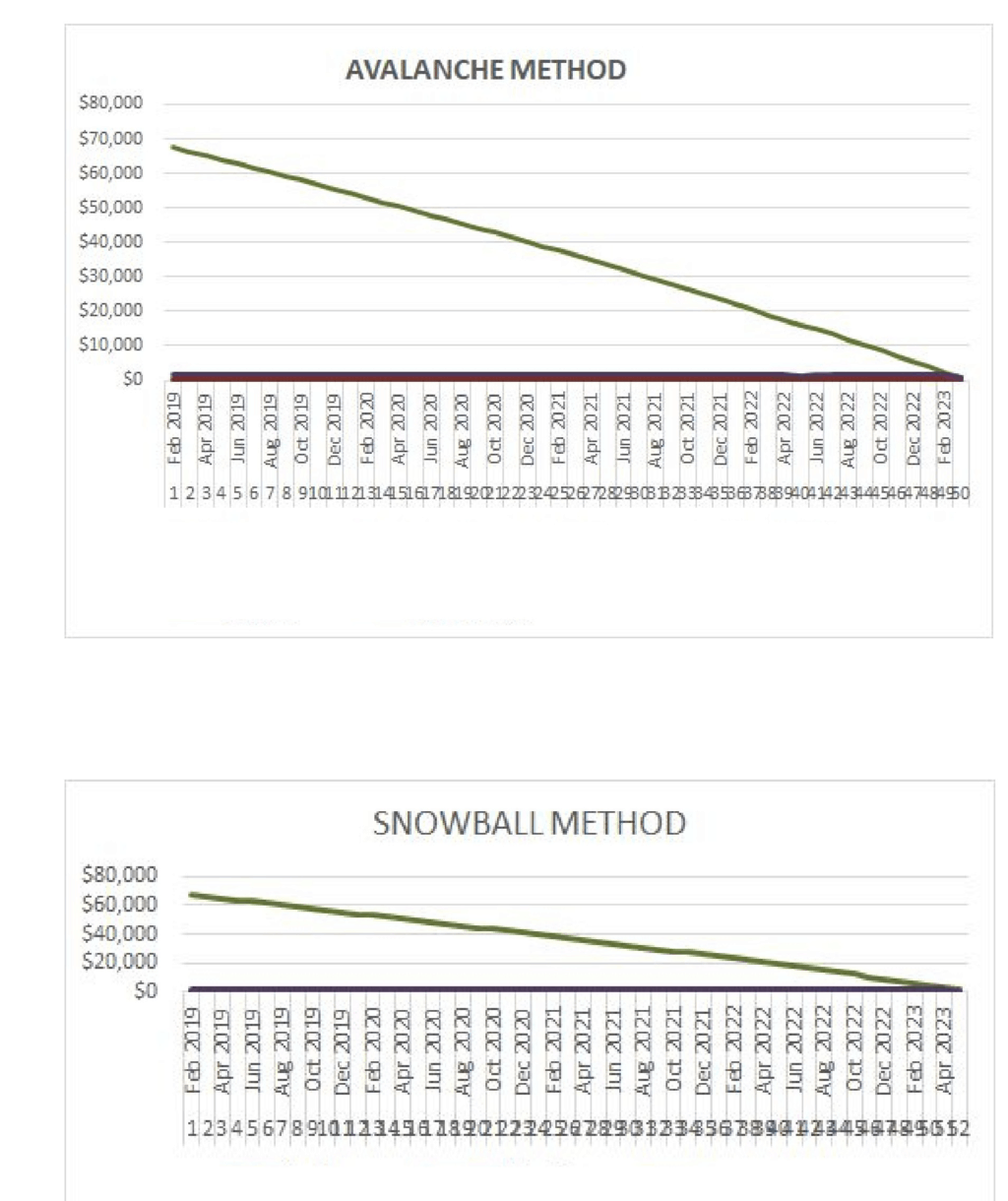

For additional ways to pay down your debt, take a look at my blog DEBT HELP NEAR ME: OUR TORONTO DEBT REPAYMENT CALCULATOR STRATEGY. In it I explain the two most common methods of paying down bills you are behind on; the debt snowball method and the debt avalanche technique.

If you budget properly and stick to your budget, you will get caught up and your credit will recover with time. Now that you actually have control over your expenses and you know to the day of every month what you earn and what you pay, you can then look at some alternatives if you cannot get current before a creditor stops waiting and is beginning to take action against you.

Once you have the budget process mastered and you are following your budget, you won’t have to say “my bills are high”.

Second thing – rebuilding credit

Rebuilding credit is essential. There are many points beyond your control that could have contributed to you’re getting behind on your bills and your resulting bad credit ranking – losing your job, an illness or a divorce. The most vital thing is to recognize what is within your control that got you into difficulty and ensure that you don’t repeat the same mistakes twice.

There are many strategies that you can use to restore your credit score. Here are a few suggestions:

- Continue with the budget plan I showed you above and continue to pay down your debt.

- Pay your expenses in a timely manner

- Contact a creditor instantly if you are having a problem making payments to advise them and work out a payment plan that you can honour.

If you do not qualify for any type of loan, apply for a secured credit card and stop using the normal credit cards that got you into trouble.

Third thing – credit counselling

The first two things I have mentioned are for those who can do it on their own. If you discover yourself experiencing money problems and feel that you need the help of an expert, credit counselling is a great place to start.

A certified credit counsellor professional, can look at your current situation and offer you many alternatives for taking care of the debt.

Credit counselling can solve debt problems. It will also give you the skills to properly budget, pay down your debt and then go on to live debt free. Credit counselling solutions consist of the budgeting process and credit repair that I have already talked about. It also will include lessons on how to use debt wisely. It may also include a proper debt administration program.

Debt administration programs are made to aid you to repay debt. You enlist willingly in a debt administration program; it is not court mandated. When you enlist, a debt counsellor will contact your creditors and ask for their participation in lowering your debt. Your lenders might agree to decrease the amount of debt owing or eliminating or reducing the interest owing. Not all financial debts are covered under a debt monitoring program. Secured debts are generally not included. This is because the creditor can repossess the house or car if you do not make your payments.

One word of caution. We have had cases where certain debt administration firms failed to provide any type of purposeful solution for the people. They charged costs and didn’t give any kind of results. We suggest that you contact what you believe to be a reputable credit counselling firm, you do not retain them until after getting and vetting a couple of references of people who have gone through the program you are considering and you receive positive reviews.

Fourth thing – debt consolidation

Debt consolidation is a loan that allows you to settle all your financial obligations to several or all of your lenders simultaneously, leaving you with just one loan payment. Your debt consolidation loan interest rate must be less than the average interest rate of the debts you are settling.

Not all debts can be included in a debt loan consolidation financing. Secured financial debts like your home mortgage or car loan cannot be included; however unsecured debt like credit card debt and other regular monthly bills that you are now behind on can be.

In order to qualify for a debt loan consolidation, you will require to have an acceptable credit score and sufficient income to show to the lender that you can make your new month-to-month payment in addition to your other regular monthly expenses. Debt consolidation is something you ought to consider before you are in more significant financial troubles. If you have a poor credit score you will certainly not qualify.

There are many benefits to a debt loan consolidation financing that include yet are not limited to:

- Interest rates are less than the rates of interest on credit cards

- Your unsecured creditors will be paid in full

- You will have the benefit of making only one monthly payment

- You ought to be able to keep a good credit report rating

Fifth thing – consumer proposal

Your financial problems may have gotten to the point where you just don’t have enough time to get current using one or a combination of the 4 things I have already explained. Worse, you may have gotten breathing room and accommodation from your creditors. However, you were not able to keep current on your new payment plan. If this is the case, do not fret because there is a solution.

By using a licensed insolvency trustee (formerly called a bankruptcy trustee) (Trustee), you can reach a binding deal with your creditors to settle your debts at less than the amount you owe in total. The process for this debt settlement plan is called a consumer proposal.

Consumer proposals are options to avoid bankruptcy. A consumer proposal is available to people whose total financial debts do not go beyond $250,000. This limit is not including financial obligations for mortgage or line of credit loans registered against your principal home.

Consumer proposals have formal rules governed by the Bankruptcy and Insolvency Act (BIA). Dealing with a Trustee you make a proposal to:

- Pay your creditors a percentage of what you owe them over a specific time period (not more than 5 years).

- Extend the time you need to pay off the debt.

- It could be a combination of both.

Payments are made to the Trustee who is the administrator of your consumer proposal. The Trustee then uses that money to pay each of your creditors their part of the payments.

The advantages of a consumer proposal are:

- You maintain all of your possessions

- Collection actions against you by unsecured creditors, such as garnishments are stopped

- Unlike informal debt settlement, the consumer proposal is a legal process where every one of your creditors must heed your restructuring

- You do not have to claim bankruptcy

Sixth thing – bankruptcy

If you have left things too late, or other reasons why none of the 5 things I have already described will work for your situation, then the sixth thing is bankruptcy. Personal bankruptcy is meant to allow the honest but unfortunate person shed themselves of their debt. That way you can start over fresh and new.

Our goal as a Trustee is to ensure that you understand the bankruptcy process and how it can be used to get your life back on track.

We will first help you understand the 5 things I have already described that might be available to you to avoid bankruptcy. If bankruptcy is the only solution, we will guide you back on the roadway to financial health and wellness. We design solutions to ease the stress you meet and bring you:

- Relief from bothering calls from debt collectors.

- Freedom by extricating you from garnishments.

- Provide you the ability to live better than just hanging on one paycheque to the next.

- Improve your credit scores.

- Give you an improved and enhanced wellness and well-being.

My bills are high: Do you have too much debt and need help?

If so, call the Ira Smith Team today. We have years as well as generations of experience aiding individuals and companies needing financial restructuring. As a licensed insolvency trustee, we are the only professionals accredited and followed by the Federal government to provide debt restructuring options.

You can have a no-cost appointment for us to gather the necessary information to advise you on how to fix your debt difficulties. We can end your pain so that you will begin your clean fresh start, Starting Over Starting Now.

[monkeytools msnip=”http://monkeyplayr.com/playr.php?u=5173&p=20444″]