Early Warning Signals Of Financial Problems: Introduction

I wanted to write about the early warning signals of financial problems in companies. The reason is the one point I hate the most is seeing businesses marketing their products and services to others just not to be paid. The initiative you put into the sales funnel as well as the sales process is totally squandered if inevitably your customer cannot pay.

Currently the choice is usually to decide to take legal action against them or not. You want to see the value of recovering your unsettled billings. At the very least obtaining much more back than invested in battling the case.

To do this, it’s vital that you act earlier as opposed to later. So you must get on the continuous watch out for very early warning signs that your client or customer may be in financial trouble.

Right here are 5 very early indications to look out for as well as just what to do if you find any one of them.

Early Warning Signals Of Financial Problems: Irregular repayments

Among the first signs that your client is having economic difficulty is that their payments become unpredictable. This does not simply mean they pay later. You might find that you begin getting just a part repayment of your billings.

This is generally a clear indicator of cash flow troubles. Your client is possibly managing their distributors, paying only what they need to, when they can. Probably, they are just paying the vendor who is shouting the loudest for payment!

If you aren’t sure when payments are showing up, or if you get less than anticipated, you cannot budget to pay your own obligations on schedule. If you’re not mindful, your customer’s cash flow problems can cause troubles for your very own cash flow as well.

In this situation, the much more certainty you have the better. Try talking to your client and create a payment plan that they could adhere to.

Early Warning Signals Of Financial Problems: Weakening team morale

If you know exactly how your customer’s personnel feels about their work, you can commonly get a great sign of the general wellness of the business. If they’re miserable, it’s a sure sign of problem.

This is where the working partnership with your customers pays dividends. It’s amazing just what you could glean through small talk as you’re on the phone to them.

Undoubtedly, if you figure out that there are dangers of redundancies or that a reduction in your customer’s staff’s benefits is occurring for cost savings, you will recognize there are money problems. However, some issues are less clear. If the staff are whining that they are worked off their feet, it might additionally be indicating trouble.

While it could be, there is lots of work coming in, maybe your customer’s employees are overworked and stressed out because staff are leaving and are not being replaced. This will certainly make those that stay busy. Do not be afraid to delve a little deeper to learn what causes these troubles.

Early Warning Signals Of Financial Problems: Dropping revenues

No firm could endure long-term unless it’s profitable. So you need to be alert to a client’s dropping profits as early as possible. This can be a difficult measure to find, particularly for private companies. For public corporations, by the time you read their financial statements, it is already far too late.

You need to look for other hints about exactly what might be taking place behind the scenes. Try to work out just what the profit margin of your client’s organization is likely to be. Then look for various other pieces of evidence of what could be happening to revenues.

As an example, if market problems are tough, sales are most likely to be declining. If the price of basic materials is increasing, input prices are going to rise. Fluctuations in currency exchange rates due to political or financial uncertainty could additionally have a big effect on revenues if there’s a worldwide aspect to your client’s business.

Any of these scenarios could eat into a business’s revenues and tip the equilibrium to negative cash flow, leading to problems.

Early Warning Signals Of Financial Problems: Decreasing online reputation and market share

How many big names and long well established organizations have we seen vanish because they fail to adapt to a changing marketplace? It appears to be taking place all the time and it’s a real risk if you’re a supplier to these companies.

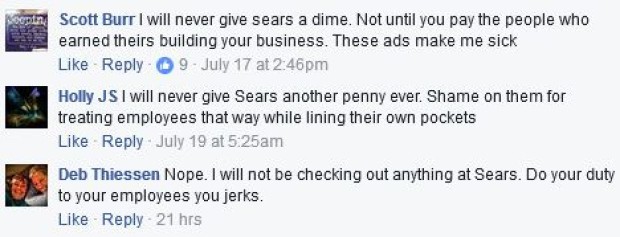

The larger the firm, the easier this is to find. In smaller sized business there are always indications too. Watch in mainstream and social media sites to see what people are stating about a company.

People can be very vocal on social networks if they’re miserable with a product or service, or if it’s no longer in style. Keep an eye out for these remarks. If you see comparisons such as “Company X doesn’t have the same product range as Company Y” it could be an indication business is losing touch with just what its consumers want.

Because of this, their track records as well as market share can decrease. This brings about economic problems and the enhanced danger that they will not pay you on schedule.

Early Warning Signals Of Financial Problems: Business becomes much more controversial

If a firm is struggling for its survival, it will certainly try to find any type of justification for not paying you. You might find your customer increasing spurious issues about your products or services or objecting to your invoices for no good reason at all. All they’re trying to do is postpone payment, get a discount rate and even avoid payment completely to ease their cashflow troubles.

If you take a hard position with these clients, they will typically pay up since they will certainly have ample on their plate to handle. They won’t want to get entailed with disputes they could not win and which will certainly cost them even more over time.

There are 3 key points I would like you to remember in all times:

- The earlier you find an issue, the easier it is to manage

If you find any one of these five warning signs, work as quickly as possible.

- Do not allow troubles to intensify

If you have outstanding billings, don’t allow your customers to get more into debt with you. If your client is paying late they will certainly stay in breach of contract so this could give you the right to suspend your services or stop the contract entirely.

- Maintain your feelings aside

Bear in mind, your top priority is to get paid as in full as promptly as you can. When a business is in financial difficulty, problems could intensify swiftly, so be realistic. Sometimes it may be more prudent for you to accept a reduced dollar figure now as a far better alternative than holding on for complete repayment later, which never ever shows up.

We have helped many businesses and people experiencing financial troubles restructure. Like the warning signs, the earlier a business or individual does something about it to fix their troubles, the more choices that are readily available to them to effectively reorganize and stay clear of bankruptcy.

Early Warning Signals Of Financial Problems: What to do if your customers are negatively affecting your company’s cash flow

If you’re trying to find means to reorganize your company’s financial debt, call Ira Smith Trustee & Receiver Inc. Our technique for every person is to develop an outcome where Starting Over, Starting Now happens, beginning the minute you stroll in the door. You’re just one call away from taking the essential action steps to get back to leading a healthy and balanced stress and anxiety free life.

UPDATE: CHECK OUT OUR NEW VLOG BY CLICKING ON:

Articles about debt help: Introduction

Articles about debt help: Introduction

Prenuptial agreements make families stronger: Introduction

Prenuptial agreements make families stronger: Introduction

How to Make Marriage Last Forever: Introduction

How to Make Marriage Last Forever: Introduction

Financial security planning process: Introduction

Financial security planning process: Introduction