Help with debt

If you would prefer to listen to the audio version of this help with debt Brandon’s Blog, please scroll down to the bottom and click on the podcast.

Help with debt introduction

Many people need help with debt; especially credit card debt. They are stuck lugging around this debt. They only make the minimum monthly payment while a high rate of interest cost continues to accumulate. The net result is they never really make a dent in paying down the balance owing.

Canadian household help with debt

In March 2019, Equifax Canada reported that Canadian consumer debt delinquent accounts are increasing. Equifax also reported that the average Canadian household consumer debt is an average of $23,000, not counting mortgages. Bank of Canada Governor Stephen Poloz previously said that the typical Canadian owes about $1.70 for each dollar of income she or he earns each year, after taxes.

This, of course, is not a new story for Canadians. I have been writing about Canadians’ love affair with taking on more debt for several years now.

The Province of Quebec is trying to make a difference for help with debt

On November 15, 2017, Quebec’s Bill number 134, “An Act mainly to modernize rules relating to consumer credit and to regulate debt settlement service contracts, high-cost credit contracts and loyalty programs”, came into force. On August 1, 2019, certain aspects of this legislation, aimed at trying to curb credit card debt in Quebec, come into force.

Now in Quebec, brand-new charge card accounts opened up need the minimum monthly payment to be increased to 5% of the balance owing on those brand-new credit cards. For cards issued before August 1, 2019, cardholders will continue being required to pay a minimum of 2% of the outstanding balance. They have until 2025 to begin paying the new minimum of 5%. However, the minimum payment limit each month will be increased by half a percentage point annually after August 1, 2020, up until it gets to the five percent level.

Consumer advocates feel that other provinces will be viewing carefully what Quebec is doing. The Quebec government obviously believed that debt issues are an essential problem in Quebec that needed to be addressed.

Will this help with debt work?

Canadians have actually gone away from being a country of savers to a nation of borrowers. Therefore, if an unanticipated financial emergency hits, on average, Canadians do not have the resources to deal with it.

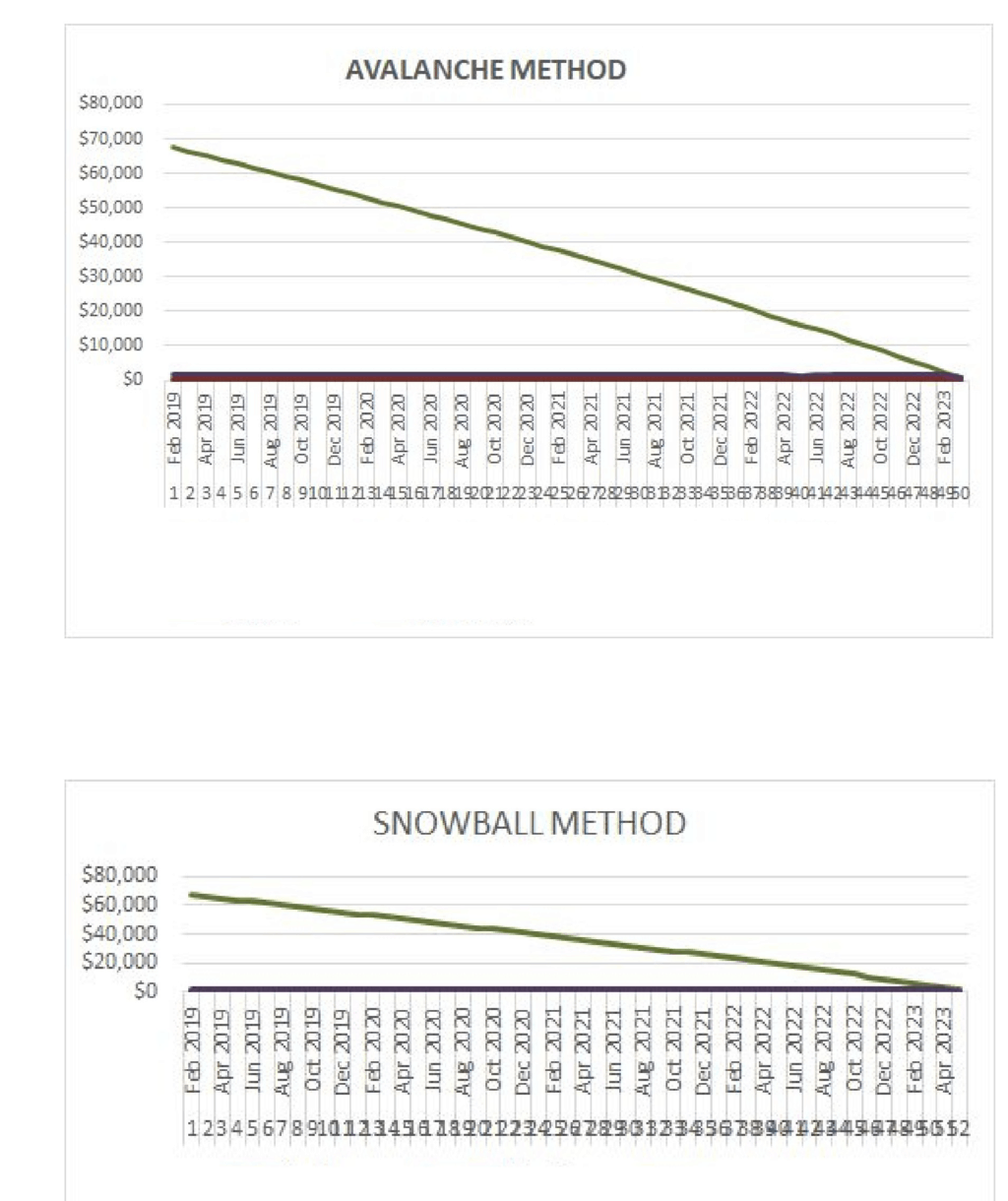

Many Canadians strung out on credit card debt need credit card debt help. A simple credit card debt calculator shows how problematic unpaid credit card debt is. Take a charge card with a balance owing of $1,000 with an annual 19.9% rate of interest and a two percent minimum monthly payment. It will take 26 years to pay off the balance. As well, it will cost $3,000 in interest. All this with an original balance of $1,000!

If the minimum monthly payment increases to 5%, that same credit card balance of $1,000 will take six years to pay off with $442 of interest. So you can see what the Province of Quebec is trying to achieve for its citizens.

The arithmetic of course works. However, the issue is not one of arithmetic. Better arithmetic won’t save Canadians who go into debt they cannot repay. If their budget does not allow them to pay more than a minimum of 2% each month, where will the extra money come from? Wage growth is stagnant and family expenses rise each year.

The Quebec government feels that having its people experience short-term pain for long-term gain will work.

As noble and well-intentioned this Quebec Bill 134 is, it does not appear that it has thought through what the real consequences will be. Will it help Quebeckers reduce their household debt faster? How will people who can only afford to pay a minimum monthly amount of 2% find the money to pay the higher amount. For Quebeckers in debt, it deserves asking if this sort of the change in policy will really help the people? Or, will it speed up the rate at which people in Quebec will have to make an insolvency filing, be it a consumer proposal or bankruptcy?

Has Quebec tackled the real help with debt issue?

High credit card debt is plainly a difficult situation for many. Time will tell exactly how effective a technique it is to raise the minimum monthly payment to 5% on a charge card will be. What Quebec is doing is a step in the right direction but it may not be one of the best high household debt solutions. But I am disappointed that it was not coupled with the requirement for better financial education and financial literacy.

In my opinion, it would have been much more impressive for Quebec to have at the same time developed simple online financial education tools for its citizens in trying to combat the problem of too much debt. What is really needed is to teach people that paying only the minimum monthly balance increases the cost of paying off the balance. Ideally, people need to adjust their household budget to be able to pay the full balance off every month.

Help with debt: Financial education was never on any curriculum

For many Canadians, proper money management and budgeting had not been a large subject in their house growing up. They get to college or university and they obtain that bank card. They just start spending and perhaps they also have student financial debt. They graduate and may or may not get a well-paying job to start off their new career. Then life takes place and living costs increase. Perhaps now a home with a home mortgage, children, automobile loan repayments and all other living costs take hold. Due to stagnant wage growth, or worse, corporate downsizing, there is not enough income in the family to keep up with all these debts. Now all you can do is make minimum payments.

To avoid this mess in the first place, people need to be taught basic budgeting skills. People need to understand that a household cannot spend more money than is earned, after income tax. This is the most basic concept for those in need of help with debt. The concept of having emergency savings funds is also necessary. People need to understand how fast credit card debt can grow and how hard it is to pay it off if the most you are able to pay is the minimum monthly payment.

Money management education and learning are so vital. People need to know that when they purchase things on a credit card, they do really need to have the money available to pay off that credit card at the end of the month. A credit card, unfortunately, is treated by many as an extra source of cash. In reality, it is a financial tool for convenience, but not an additional source of income.

Do you have too much debt?

Do you feel that you don’t have sufficient financial literacy? Do you believe that the lack of knowledge has led to you making financial mistakes? Have these mistakes caused you to now have too much debt? Is the pain and stress of too much debt now negatively affecting your health? Do you need help with debt?

If so, contact the Ira Smith Team today. We have decades and generations of helping people and companies in need of financial restructuring and counselling. As a licensed insolvency trustee (formerly known as a bankruptcy trustee), we are the only professionals licensed and supervised by the Federal government to provide debt settlement and financial restructuring services.

We offer free consultation to help you solve your problems. We understand your pain that debt causes. We can also end it right away from your life. This will allow you to begin a fresh start, Starting Over Starting Now. Call the Ira Smith Team today so that we can begin helping you and get you back into a healthy, stress-free life.

Canadian household debt crisis: Introduction

Canadian household debt crisis: Introduction

Toronto Credit Counseling: Introduction

Toronto Credit Counseling: Introduction