credit cards maxed out

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

How do credit cards maxed out affect your credit score?

Your credit score is one of the most important things you have to offer anyone who is seeking to lend you money, whether it’s from a bank, a different credit card issuer, or even a landlord. Your credit score is a sort of credit health report that measures how much you owe, how much you owe on different kinds of credit, and how likely you are to default on payments.

Credit cards can be a convenient and effective way to manage your finances. However, the best use of a credit card may not be the best use when it comes to your credit score. Lenders consider one or more credit cards maxed out as a reason for your credit score to decline.

Right now we have a very unique situation when it comes to consumer debt. The average Canadian’s monthly credit card balance is lower today than it was 2 years ago. People’s credit card balance for months has declined. So it is not the case right now that credit cards maxed out. Yet, a recent poll shows that Canadians’ stress levels about their potential insolvency are the highest ever.

In this Brandon Blog, I look at the issues and provide some tips as to what positive things you can do if you are concerned about insolvency. Let’s look at the issues.

Changing habits as pandemic adds to debt load

There has actually been a surge in total Canadian consumer debt. It came mainly from financial debt growth in home mortgage debt and also automobile loans. Home mortgage balance increases originated from both refinancings of existing home loan debt and brand-new mortgage applications.

The thinking with vehicle financings is that it arose from Canadians acquiring vehicles that they had actually intended to purchase earlier. Concerning home loans, the refinancings were to consolidate higher interest rate non-mortgage debt, for credit products such as credit cards, into a brand-new higher home mortgage amount, at greatly reduced rates of interest.

Throughout the last 18 months approximately of the COVID-19 pandemic, Canadians have actually partially paid for or totally repaid their high-interest-rate consumer debt by turning it into low-rate debt from bigger home mortgages along with residence equity credit lines. They have used their real estate to obtain a debt consolidation loan.

Now that the Canadians have in fact done that, the Ipsos survey discovered that 50% of Canadians are now more worried about not having the capability to repay their financial obligations than they used to. Yet one-third of respondents say they will spend more as the economy resumes.

As the economy slowly resumes, many Canadians are looking at a great amount of debt incurred during the pandemic and are stressed over making ends meet without taking on even more financial obligations. They have maxed out the possibility of getting even more cash from their homes.

The reasons are that either there is no more asset value to borrow from and/or their income cannot sustain any more financial obligations. So where is one of the most likely areas this brand-new financial debt is most likely to come from? Paid down credit cards are going to increase once more and many will sooner rather than later have credit cards maxed out from additional credit card debt.

Canada on verge of widespread insolvency and restructuring surge in COVID-19 new normal

Statistics Canada recently reported that overall household debt increased by 0.8% for the 2nd straight month to over $2.5 trillion. Mortgage debt and also home equity credit lines made up $1.98 trillion of that total amount. Over the initial 5 months of 2021, households had $57.5 billion in home mortgage financial obligations, compared to $34.3 billion over the exact same time period in 2020.

At the same time, non-mortgage debt climbed by 0.4% in May to $786.2 billion. Growth in credit card debt as well as other personal loans was the main driver. While charge card debt rose for the third month straight, it was still down by 3.3% from May 2020.

These statistics seem to bear out my thoughts that Canadian consumers now have no more room to borrow against their homes, so now, they will need to turn back to their credit cards and increase their credit card debt in order to fund their expenses. This will not turn out well in the long run. I foresee people having maxed out the amount they can borrow against their homes and then once again having their credit cards maxed out.

Lots of people do not understand how financial problems are created pushing individuals to seek out a remedy such as bankruptcy or a consumer proposal to restructure. The majority think that people get into financial trouble because they can’t properly handle their money. However, in most cases, it is because of an unforeseen trigger. Divorce, job loss, illness and the present pandemic are examples of triggers.

People in financial trouble feel shame and unfortunately, stop them from connecting with us early. Reaching out to a licensed insolvency trustee early is so important.

Credit cards maxed out Is a bad idea

By maxing out your credit cards you’re boosting your credit utilization ratio. This accounts for 30% of your credit score. As such, a maxed-out credit card can adversely impact your credit rating.

Theoretically, yes, you can pay off your credit card by just making the minimum payment. However, it can take you years to pay it off if you are only making the minimum payment. Your interest charges will be higher than your minimum monthly payments.

Your credit utilization ratio and therefore your credit score will suffer. Many people try to solve this problem by just applying to the credit card issuer for an increased credit limit. This may work once, but it does not make any sense. You cannot eliminate debt by increasing it!

Furthermore, you’ll be carrying that debt and paying for it at a very high rate of interest. On the other hand, if you make your repayment by the due date, or make big routine payments to pay it off, you will certainly pay no or extremely little in interest.

Are your credit cards maxed out? Here’s some personalized tips for paying off credit card debt

What can you do trying to be credit card debt-free? My 4 step strategy can help you get there.

1. Credit cards maxed out: Take control

It isn’t simple or comfortable to take a hard look at your finances, but it is essential. Analyze your household expenses, as well as the interest rates linked to every resulting financial obligation. Track your monthly expenses to really understand what your credit card purchases get you on a monthly basis.

This is the first step in understanding your expenditures and cutting down on the ones that are not needed. To recognize where you are going, you need to recognize where you have in fact been.

2. Credit cards maxed out: Minimize interest rates

The normal rate of interest on a bank card is about 19 percent. That’s rather high, so you may wish to think of doing a balance transfer by moving your credit card debt to a card with a minimized or zero-interest offer to assist in paying it off a lot faster.

A word of care: you’ll probably require to pay a transfer fee in doing so. Likewise, you will need to repay the debt in full before that promotion price finishes. Otherwise, the remaining balance on your new balance transfer card will again attract a greater rate of interest, possibly the very same or higher than the card you moved the debt from.

Although I do not hold out a lot of hope, you can ask your credit card firms if they will lower your rate of interest.

3. Credit cards maxed out: Credit counselling as well as debt paydown approaches

If you merely cannot make sufficient earnings to fund your debt repayments, consider a non-profit credit counselling service. At no charge to you, they can get you into a Debt Settlement Plan. Bear in mind that as soon as you are in such a strategy, your charge cards will certainly be cut off.

Do not go to any one of the financial debt settlement services that market often on television or social media. All they do is charge you a fee to take down basic information that a certified non-profit credit counselling agency or a licensed insolvency trustee would certainly do for no cost. After that, they run you through their “program” charging you a lot more fees until you can pay no more. After that, they send you to a qualified bankruptcy trustee.

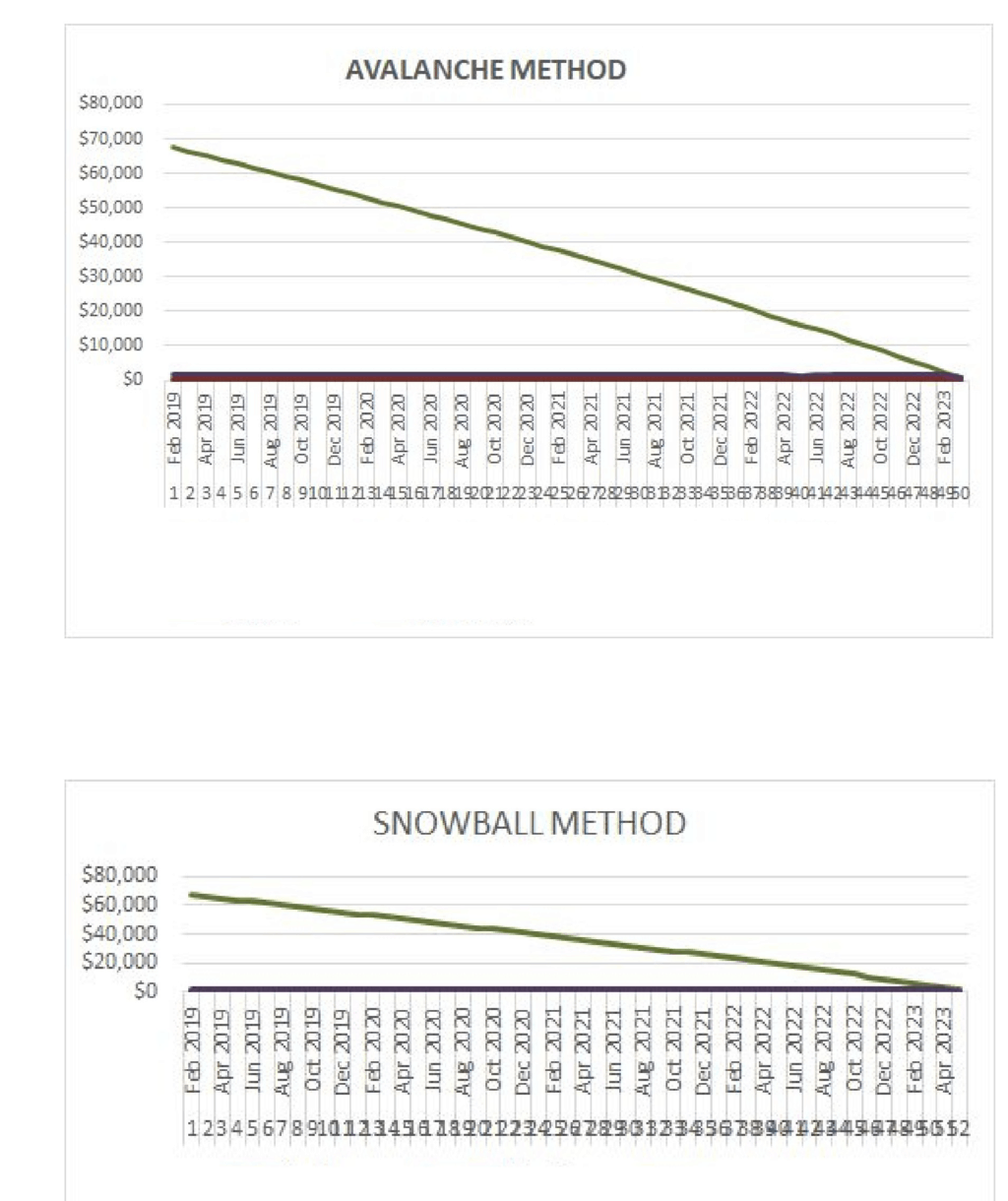

There are 2 regular financial debt settlement strategies– avalanche method and also snowball method. The avalanche technique of getting out of the credit card financial debt is you initially put all your available cash to pay down your highest interest rate debt. As soon as that’s cleaned up, you start settling the following most costly debt. You keep repeating this up until all your consumer debts are gone.

Sometimes, the snowball technique offers a great deal of extra motivation. With this method, you settle the tiniest financial debt initially, to improve your mood. You use that power to resolve what is the next tiniest debt and so on. You are grabbing steam like a snowball rolling downhill.

It does not matter which strategy you utilize. The vital thing is that you start now and stick with it.

4. Credit cards maxed out: Adhere to it.

Remember your single focus should be reducing debt, not new non-essential spending. So do not prepare any kind of sort of travel getaways or big purchases in the meantime. You could backslide or strike some road bumps yet do not let that distract you or depress you.

Now for the challenging part. When possible, save some money to assist with unpredicted expenses that you would typically place on your credit card. This will certainly minimize the amount you would have to borrow by paying with real cash.

It’s an incredibly lengthy as well as agonizing trip to fully pay off your credit cards maxed out. It also can be an extremely lonely one. People don’t get into the bank card debt trap overnight, so you can’t leave it without some effort.

Credit cards maxed out summary

I hope that you found this credit cards maxed out Brandon Blog interesting. I wrote this now because I fear the trend I see from both the Ipsos survey and the Statscan report shows that now that Canadians have done their debt consolidation and credit card balances are low, the credit cards are now being run up again. The end result will be higher debt than the average Canadian started with.

Problems will arise when you are cash-starved and in debt, especially with a maxed-out credit card. There are several insolvency processes available to a person or company with too much debt.

If you are concerned because you or your business are dealing with substantial debt challenges, you need debt help and you assume bankruptcy is your only option, call me.

It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties with debt relief options as alternatives to bankruptcy. We can get you the relief you need and so deserve. Our professional advice will create for you a personalized debt-free plan for you or your company during our no-cost initial consultation.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people with credit cards maxed out and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do as we know the alternatives to bankruptcy. We help many people and companies stay clear of filing an assignment in bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need to become debt-free, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost bankruptcy consultation.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.