We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

If you would prefer to listen to this Brandon Blog’s audio version, please scroll to the very bottom of this page and click play on the podcast.

What Is Financial Wellness?

Financial wellness is the state of being free from financial stress or worry. By managing your financial health you can avoid the feelings of anxiety and despair that come from worrying about money. When you are financially well you have the ability to focus your energy on the things that really matter to you.

The phrase is everywhere these days. It’s a buzzword that’s getting a lot of attention. But what does it actually mean? When you boil it down, financial wellness is simply about being responsible with money. It’s about paying attention to how you spend, saving for the future, and making sure you can take care of yourself and your family.

Why is financial wellness important?

Financial wellness is important because it’s the first step to planning and achieving your goals. If you don’t know where your money goes, how can you ever be sure that there is enough for the things you want and need? Your ability to pay bills and avoid debt can determine whether or not you have a good credit score, and whether or not you can apply for a mortgage or a loan for a house or a car. This creates unnecessary financial stress.

In this Brandon Blog, I discuss the aspects of financial wellness and what it means for your overall enjoyment of life.

This blog is an expansion of a recent blog titled: “Take Care of Yourself, Take Care of Your Money” I wrote for our national association that we are a member of, the Canadian Association of Insolvency and Restructuring Professionals.

Financial wellness & stigma

It’s difficult to remember a time when the word “debt” didn’t have a negative connotation. Whether you’re talking about consumer debt, medical debt, or debt related to other services, the ominous word is never far from its less than attractive cousins “recession” and “bankruptcy“.

Yet even in the midst of a pandemic, in September 2020, credit reporting firm Equifax Canada stated increasing mortgage balances pressed average financial debt per Canadian consumer up to $73,532. This is up 2.2% from the prior year and despite the financial impact of the COVID-19 pandemic.

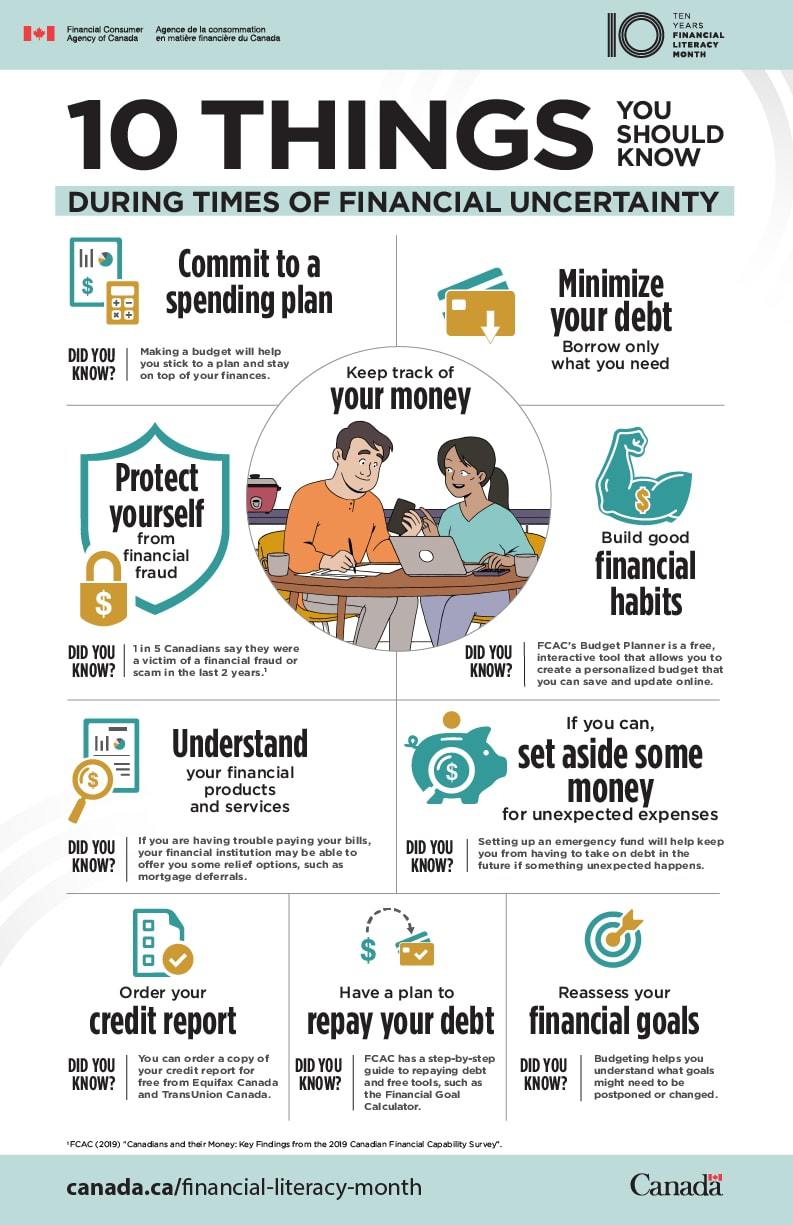

Financial health can be part of an overall health wellness program which will certainly aid in decreasing any kind of stigma. The Financial Consumer Agency of Canada stated that “mental, physical and financial wellness are three pillars of good health”. They say this with great certainty as almost fifty percent of Canadians have financial tension in their lives. Virtually as many, according to a 2018 survey carried out by the Canadian Payroll Association, would certainly have economic pressure and financial shock if a paycheque came late.

Financial wellness & productivity

The number one reason people will credit with helping them make and save money and make proper financial decisions is their parents. So why not make the home for your entire family the number one place to learn about money and manage it? Look for personal finance articles, books and courses that can teach you everything from general money management to specific techniques for saving money on groceries to investing. This is also known as improving your financial literacy.

Also, look for advice on your overall well-being so you can have a healthy relationship with money and your family that will last all of you a lifetime. Overall good health, taking the stressors out of your life as much as possible and financial well-being will lead to increased productivity and overall enjoyment of life.

The principles of physical health are well promoted through health institutions. It consists of a well-balanced diet regimen, exercise, and healthy life selections. The importance of psychological well-being in the form of self-care and mindfulness is obtaining awareness through networks beyond medical care specialists. Its value has been highlighted a lot more throughout the pandemic.

In my experience as a Licensed Insolvency Trustee (“Trustee”), the principles of financial well-being and financial wellness still challenge Canadians. I never see it included as a component of overall health in discussions over awareness of physical and mental health wellness. Perhaps because in our consumption-driven world, saving cash through excellent money management abilities isn’t as “awesome” a subject to brag about or to become a social media influencer in!

Nonetheless, establishing monetary objectives and achieving them is extremely rewarding. Self-control today will certainly pay dividends in the future. So just how do we get there to a nirvana state of financial well-being? The same way as we do with a physical health and wellness goal – with self-control and good habits, forming new behaviours.

I recommend that as a first step, draw up a checklist of financial planning objectives and a timeline. Take stock of your financial obligations, rates of interest you are paying, monthly payment amounts and days of the month that payments are due. Understand your assets, liabilities, income and all of your expenses.

Goals: Financial wellness programs need realistic goals

The biggest mistake people make when trying to establish financial wellness is setting financial goals they have no realistic chance of achieving. This is not an achievable goal if it is too high, or too grand. If necessary, break a larger objective into smaller-sized objectives that can be attained in a reasonable period of time to stay clear of discouragement. If you set out to lose 100 pounds, you might be scared off because of how much time that would certainly take. Going for a few pounds a week or month would certainly help keep you motivated.

If all you do is have the idea of being debt-free or have $100,000 in your bank account, that goal is probably unattainable. There is no roadmap of steps to take to get there and there is no timeline attached to such a goal. However, aiming to pay all your monthly bills on time, conserving 5% of every paycheque to have some emergency funds on hand or paying off your highest interest rate financial debts at the rate of $50 a week is reasonable and measurable.

Financial wellness: Nutrition

Barring any serious medical concerns, conventional weight loss wisdom focuses on calories. If you burn more calories than you ingest, you will certainly slim down. Budgeting takes the same approach. As long as your monthly spending is less than your monthly income, you will achieve your financial well-being monthly goals. In tracking your monthly spending you need to look at all the ways you spend in any month: cash, cheque, debit card and credit cards.

Don’t make the mistake that many people do in forgetting that the only amount you have to spend is your net monthly income, net of the income tax you need to pay to the Canada Revenue Agency. You need to look at your last year’s income tax return to see the total amount of income tax you paid, not just the amount deducted at source. If you received a refund, then you should not have to save extra to pay that income tax bill in April. If you had to pay more than what was deducted at source, you better plan to save that amount of money during the year so you will have it the following April.

Analyze every expenditure and determine just how well it aligns with your financial health goals for a better financial life. What is more important? The expenditure or the sensation of financial wellness that will be accomplished if you had that much more cash to put in the direction of paying down debt, building up an emergency savings fund or starting or adding to a retirement savings plan.

Financial wellness: Exercising

Running on a treadmill is excellent for your physical health and wellness. Yet unless that treadmill is powering your home, when it comes to your financial well-being you will require a different type of exercise. That is an exercise in discipline. Understanding just how a “need” is different from a “want”.

After covering the requirements of life, you need to focus on what spending will certainly get you closer to attaining your goals, and which do the opposite. I am not recommending that you lead a reclusive life yet search for financial savings and effectiveness to get you closer to the financial well-being you are striving for. Is there a less costly cafe? Can I get that same fashion look for much less? Don’t deny yourself, but at the same time do not overreach.

My grandfather’s depression-era wisdom is still appropriate today: if you pinch pennies hard, you will get nickels.

Financial wellness in the workplace

Most people have financial stress in their lives, whether they realize it or not. For some, the stress may be simply a question of meeting their bills. For others, it may be more complex such as how to:

- reduce the stress of dealing with creditors;

- set up a savings account to handle an unexpected financial blow; or

- achieve financial security.

Regardless of the type of financial stress people face, a financial wellness program can help them find solutions and create a plan to reduce their stress over money. Employees that have their stress reduced will be more productive. So it is in the employer’s best interests to institute a financial wellness program in the workplace.

It all starts with a financial wellness assessment

The idea of a financial wellness assessment might seem a bit like financial group therapy. A professional looks at your situation, from your income to your debts, and asks questions about your financial goals. It can be stressful to open up about your financial situation, but it’s an important step toward taking control of your money. It’s also an opportunity to learn about products and services that may help you achieve your financial goals.

The result of the financial wellness survey will be written up in a financial wellness report. A financial wellness report is a tool that helps you identify the state of your finances, your level of financial distress and the main source of stress. It is a tool that you can use, which provides you with objective information about your financial situation and what steps you can take to improve it.

Measure the success of your financial wellness program

If you’re a company concerned about the financial wellness of your employees, don’t just rely on gut feeling to measure your program’s effectiveness. Instead, use a quantitative approach to measuring the success of your financial wellness program, as this will help you better understand where your employees are at financially and what works and what doesn’t in your program.

If you’re seeking a successful financial wellness program, you need to assess yours. You may feel as if your program is successful, but have you measured it to be sure? Any employee financial wellness program aims to improve each employee’s financial position and to reduce the amount of financial stress in their lives. The best way to measure your financial wellness program’s success would be to measure how your employees have advanced in achieving their financial goals established in the financial wellness assessment.

After an appropriate length of time, depending on each unique set of goals, another financial wellness assessment should be conducted and the results of the newer one compared to the prior one. What an employee has achieved and how they feel about it is an extremely important measure. New goals can be set, old goals can continue to be worked on or recalibrated. All this is intending to keep your employees on track to achieve their financial goals, improve the level of financial wellness peers experience and reduce the stress in their lives.

Financial wellness guide information for employees

This listing is not meant to be exhaustive. Some of the things that your employees might need to learn about in financial wellness workshops to improve their every day finances might be how to:

- Track your finances

- best manage assets, liabilities, income and expenses

- Improve your relationship with money

- Create, track and adjust your personal budget

- Money management skills

- Have control over day to day spending

- Set up and maintain positive money habits to reduce your money worries

- Understand the key elements behind your spending habits and how to fix what needs fixing

- Know how much life insurance you may need and how to choose the best for you from the different types of insurance

- Maintain a good credit score

- Fix your credit

- Deal with Canada Revenue Agency and income taxes

- Create goals for when you have extra money

- Deal with unexpected expenses

- Create the financial resources to meet your household’s needs

What are the financial consequences of debt?

I hope you enjoyed this financial wellness Brandon Blog post. Sometimes financial literacy and financial education have to take a back seat to fix an immediate financial problem. Education can come both as part of the solution as well as continuing after debt problems have been solved. Student debt, bad debt, Canada Revenue Agency income tax debt, other personal debt and corporate debt, credit card debt and an unmanageable debt load are all examples of financial problems we have solved for other individuals and entrepreneurs and their companies.

If you are concerned because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option, call me. It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties while avoiding bankruptcy. We can get you the relief you need and so deserve.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need, contact the Ira Smith Trustee & Receiver Inc. group today

Call us now for a no-cost consultation. We will get you or your business back up driving to healthy and balanced trouble-free operations and get rid of the discomfort factors in your life, Starting Over, Starting Now.

We hope that you and your family are safe, healthy and secure during this coronavirus pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

If you would prefer to listen to the audio version of this financial literacy Brandon’s Blog, please scroll to the bottom and click on the podcast

If you would prefer to listen to the audio version of this financial literacy Brandon’s Blog, please scroll to the bottom and click on the podcast