We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

What is in the Canadian Bankruptcy and Insolvency Act?

Canada’s bankruptcy and insolvency laws are governed by two major pieces of federal legislation: the Canadian Bankruptcy and Insolvency Act and the Companies’ Creditors Arrangement Act. Additionally, provincial legislation intersects with the Canadian Bankruptcy and Insolvency Act. During bankruptcy, a debtor can keep certain types of property based on provincial legislation. Details may differ amongst each Canadian province. Provincial governments and territories have their own laws regarding property exemptions, court orders, and debt collection.

The Canadian Bankruptcy and Insolvency Act (often referred to as the “BIA” or the “Bankruptcy Act“) is a federal government statute that sets out the rules and procedures governing insolvency proceedings in Canada. These rules and procedures will apply to all corporations, individuals and partnerships that are parties to an insolvency filing. The whole point of bankruptcy legislation is to allow the honest but unfortunate debtor to shed themselves of their debts and to allow for the sale of assets or reorganization and refinancing of insolvent persons so that there is also fairness for the different claims of creditors.

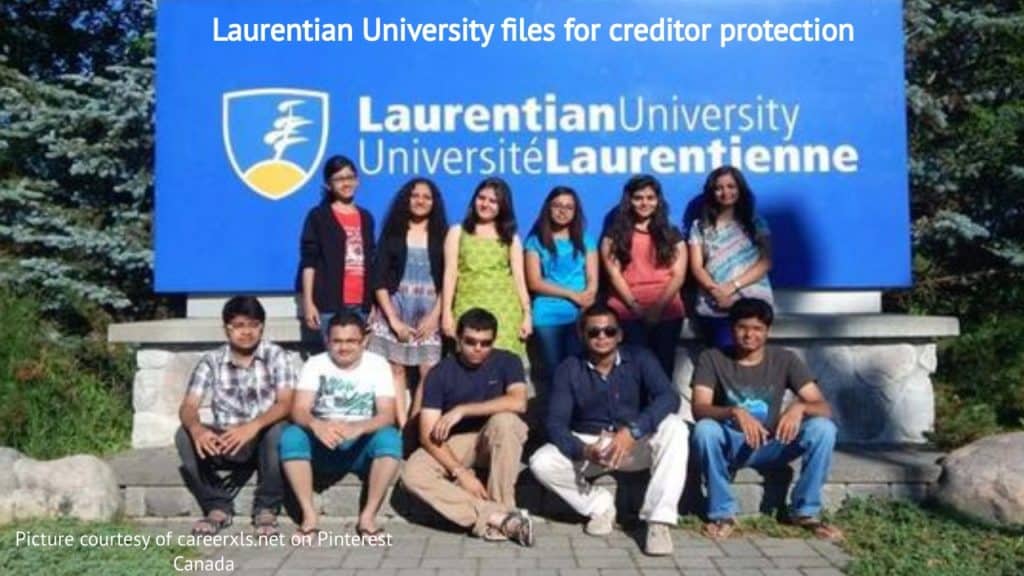

Under the Companies’ Creditors Arrangement Act (CCAA), financially troubled corporations are given the opportunity to restructure their affairs in order to avoid bankruptcy. A corporation must have debts of at least $5 million to qualify for the CCAA.

The Canadian insolvency landscape is a complex one, with many different insolvency proceedings being used to deal with many different types of debtors. In this Brandon Blog, I provide an easy beginner’s guide of the Canadian Bankruptcy and Insolvency Act, as a primer into Canadian insolvency legislation and the administration of estates.

This Brandon Blog is not about the nuts and bolts of filing for bankruptcy. Other blogs I have written cover that topic and more. You can use the search function above to search for those Brandon Blog topics.

What is the purpose of the Canadian Bankruptcy & Insolvency Act?

Everyone knows you should do your best to stay out of too much debt, but for many people, it’s an impossible feat. When you’re over your head in debt, you’re having to keep up just to pay the interest on your debt. When you are spending more than you are making, you can’t pay your bills on time, or your assets when liquidated are worth less than your total liabilities, you are insolvent. Insolvency is the main test to see if you, or insolvent companies, qualify to start a bankruptcy process or a formal restructuring process, either under the Canadian Bankruptcy and Insolvency Act or the CCAA.

The Bankruptcy Act was designed to help Canadians who find themselves in financial difficulty. It is the main piece of Canadian insolvency legislation that governs bankruptcy proceedings, receivership and personal and corporate restructuring proceedings through consumer proposals and commercial proposals. Commercial proposals are also available for those people with consumer debt levels greater than the amount allowed to qualify for a consumer proposal. All Canadian bankruptcies, proposals and receiverships are governed by the Act. It contains bankruptcy laws, rules and guidelines for all stakeholders: the Superintendent of Bankruptcy (which is part of Industry Canada) the Licensed Insolvency Trustee, the debtor, and the creditors.

What options are available under the Canadian Bankruptcy and Insolvency Act?

The Canadian Bankruptcy and Insolvency Act provides a number of ways to deal with a financially troubled company or person. Most involve a court-supervised process. The options for a person or business in financial trouble and not able to right themself or itself are:

Consumer proposal

It is an offer to your creditors to repay a portion of your unsecured debt obligations in exchange for their elimination (with certain limited exceptions as laid out in the Bankruptcy Act). You can qualify if you owe $250,000 or less, excluding any debts registered against your home, such as mortgage debt or secured home equity line of credit debt.

A person proposes a plan to make monthly payments to the Licensed Trustee acting as the consumer proposal Administrator. The total amount offered to your unsecured creditors must be agreed upon by them. Within 60 months, you must pay off the entire amount accepted. Creditors typically accept a total payment of 25% or less of your total unsecured debt. Individual situations vary, however.

A successfully completed consumer proposal allows the insolvent person to eliminate their debts and avoid an assignment into bankruptcy.

Commercial proposal

Commercial proposals are also known as Division I proposals. The reason for this is because it is provided under Canadian Bankruptcy and Insolvency Act, Part III, Division 1 (consumer proposals are found under Part III Division II). An insolvent corporation or person can use it for restructuring proceedings. When a consumer’s debt exceeds the limits of a consumer proposal, a “commercial proposal” would be filed. If a definitive commercial proposal cannot be immediately prepared but the debtor needs to file in order to invoke the stay of proceedings (discussed in the next section), they can get the immediate protection they need by first filing a Notice of Intention To Make A Proposal.

A commercial proposal works in a very similar way to a consumer proposal, except for some differences as follows:

- A commercial proposal may have various classes of creditors. A consumer proposal normally does not.

- Unlike for a person, there is no streamlined reorganization process for companies. Therefore, even if its debt is $250,000 or less, a company cannot file a consumer proposal.

- A meeting of creditors must be held as part of a commercial proposal. If the Official Receiver (being a representative of the Superintendent of Bankruptcy), doesn’t wish to chair the meeting, it can be delegated to the Trustee. A creditor who has filed a valid proof of claim has voting rights. They have the right to vote ahead of the creditors’ meeting by using a voting letter or in person. An official meeting of creditors is only held in a consumer proposal if 25% of the proven creditors’ claims request one.

- In a consumer proposal, if a meeting is not requested, the consumer proposal is deemed approved and there are no voting rights to be concerned about. If a meeting is requested, then the creditors who attend the meeting can vote by ordinary resolution for the acceptance of the consumer proposal. In a commercial proposal, it is a two-pronged test: 3/4 of the $ value voting AND a majority in the number of those voting.

- If the commercial proposal is voted down, the person or company is immediately deemed to have filed an assignment in bankruptcy. There is no such automatic bankruptcy if a consumer proposal is not accepted.

As soon as the commercial proposal is accepted by the creditors and approved by the court, the debtor starts making the payments promised in the proposal to the Insolvency Trustee. Once full payment has been made, the trustee in bankruptcy will issue to the person or company their Certificate of Full Performance. At this point, all provable claims, regardless of whether they filed a proof of claim or not.

As part of a successful restructuring process, the Trustee will run a claims process, vet every proof of claim to ensure that they are valid and that only an allowable claim is considered for distribution purposes. The Trustee will then comprise a scheme of distribution in order to distribute the funds promised to the creditors in the commercial proposal.

Restructuring under either the Canadian Bankruptcy and Insolvency Act or CCAA becomes possible for companies with debts greater than $5 million.

Receivers and Secured Creditors

Receiverships are remedies for lenders who have loaned money out and taken security over the debtor’s assets. It is most common in Canada for financial institutions to be lenders to Canadian businesses. As long as their loan documents, including the security agreement, allow for it in writing, a secured creditor may appoint a receiver when a debtor defaults on secured debt. Secured creditors and receivers are subject to certain requirements under the Canadian Bankruptcy and Insolvency Act.

Receivership relies both on provincial laws and federal legislation. The Bankruptcy Act specifies several main requirements for receivership, including:

- It is not permissible to enforce a security interest on the business assets of an insolvent person unless the secured creditor has given 10 days prior notice in the prescribed form and manner.

- Only a Licensed Insolvency Trustees (formerly called Trustees in Bankruptcy) can act as a receiver.

The secured creditor can appoint the receiver privately or with court approval.

A private receiver’s primary responsibility is to the secured creditor who appointed it. A court-appointed receiver is an officer of the court who protects the interests of all creditors of the debtor company.

Private receivers usually have from the security documents the power to run the debtor’s business and sell the debtor’s assets through auctions, tenders or private sales.

A court appointment is also preferred over a private appointment when there are significant claims against the debtor or its property as well as litigation or a threat of litigation. It is according to the provincial rules of court and s. 243 of the BIA (National Receiver) that a court may appoint a receiver.

The receivership order normally stays proceedings (discussed below in the next section) against the receiver, the debtor, and its property. In terms of its purpose, it gives the receiver authority to manage the assets of the debtor, to borrow money against the assets to repay a loan, to sell the assets of the debtor with the approval of the court, and to commence and defend litigation on behalf of the debtor. A privately-appointed receiver does not enjoy a stay of proceedings.

Bankruptcy

If a personal or commercial restructuring is not possible, then the insolvent person or company has no choice but to file for bankruptcy. The first step in dealing with insolvency is to consult an insolvency trustee. You can learn about the bankruptcy administration process and your legal rights from Trustees in Bankruptcy so you can make an informed decision. A candid discussion about how much you earn, what assets you own, and what types of debts you have can help you decide if bankruptcy is the best choice for you.

Here is what the Canadian bankruptcy procedure is all about. After the bankruptcy assignment has been completed, the Trustee submits it to the Office of the Superintendent of Bankruptcy Canada. All legal obligations will be handled by the Trustee once the assignment has been filed. Your creditors will no longer receive payments directly from you.

The Trustee administers your bankruptcy. No more lawsuits or wage garnishments for you. Depending on your province’s law, some of your assets will certainly be exempt. The bankruptcy vests your non-exempt assets in the Trustee. The Trustee will sell them. According to the Canadian Bankruptcy and Insolvency Act, the proceeds will be for the benefit of the bankrupt estate and there could be a scheme of distribution among your preferred creditors and ordinary unsecured creditors.

In the administration of bankruptcy, the Trustee will send your creditors a notice of bankruptcy. You must attend a creditors’ meeting if one is called. Additionally, you will need to attend two counselling sessions. Canadian insolvency legislation in Canada includes rehabilitation programs to help individuals regain financial stability.

Finally, you may need to make payments toward your debt. “Surplus income payments” ensure that people who declare bankruptcy and have sufficient income contribute to paying back a portion of their debt. Your debts will eventually be discharged, relieving you from the obligation of repaying most of the debt you had on the day you filed for bankruptcy.

Despite the fact that most debts can be discharged, some cannot, namely:

- alimony and child support;

- court fines and penalties;

- debts related to fraud; and some

- student loans.

You will suffer credit damage for several years after filing for bankruptcy. After your debt is discharged, you can start rebuilding your credit. Although it’s not ideal, it will lift the burden from your shoulders and solve the debt problems you couldn’t resolve on your own.

Canadian Bankruptcy and Insolvency Act: Can bankruptcy protect you from creditors?

In addition to bankruptcy, any filing listed above under the Canadian Bankruptcy and Insolvency Act will protect you from creditors. In fairness to all stakeholders, the filing calls for a “time out” after which no claims for money, lawsuits, or collection efforts are permitted. In legal jargon, we call this a stay of proceedings.

By virtue of the individual’s bankruptcy or insolvency, you may not terminate, amend, or accelerated pay, or claim the term of any agreement. When an insolvent person files a notice of intention or a proposal, a similar provision is made.

Just like in bankruptcy, if you file a notice of intention or a Division I proposal or Division II proposal, all proceedings automatically stay and no creditor is entitled to take any action against the debtor or to pursue any execution or other proceeding for the recovery of a claim provable.

Commercial proposals are normally worded so that Directors of insolvent companies who have filed notices of intention or proposals enjoy similar protection.

A word on cross-border insolvencies

Many of the large CCAA reorganization filings in recent times have been cross-border insolvencies. Canadian courts prefer that cross-border insolvencies proceed as a single process with one jurisdiction acting as the primary entity. The Canadian court examines whether the Canadian case should be considered the main proceeding in order to determine whether it is significant and connected to Canada.

The other jurisdiction (most often the U.S.) usually recognizes the Canadian court’s authority when the court believes the insolvency action should be handled, for the most part, in Canada. Likewise, the opposite is also true.

Canadian Bankruptcy and Insolvency Act: Personal bankruptcy

Canadian Bankruptcy and Insolvency Act summary

I hope you found this Canadian Bankruptcy and Insolvency Act Brandon Blog informative. With too high household debt levels and not enough wealth, you are insolvent. You can choose from several insolvency processes to get the debt relief that you need and deserve. It may not be necessary for you to file for bankruptcy.

If you or your business are dealing with substantial debt challenges, you need debt help, and you assume bankruptcy is the only option, call me.

If you’re thinking about bankruptcy, you’re probably in a situation where you’re overwhelmed, frightened, and feel like you’re alone. That’s natural and it is not your fault.

It’s good that you’ve come to this site, where you’ll find answers to your questions, sort through your options, and discover that you can get help. You’re not alone, and the professionals at Ira Smith Trustee & Receiver Inc. are committed to helping you find a debt solution that’s best for you.

It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties with debt relief options as an alternative to bankruptcy. We can get you the relief you need and so deserve. Our professional advice will create for you a personalized debt-free plan for you or your company during our no-cost initial consultation.

You are under a lot of pressure. Our team knows how you feel. You and your financial and emotional problems will be the focus of a new approach designed specifically for you. With our help, you will be able to blow away the dark cloud over your head. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people with credit cards maxed out and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do as we know the alternatives to bankruptcy. We help many people and companies stay clear of filing an assignment in bankruptcy.

Because of this, we can develop a new method for paying down your debt that will be built specifically for you. It will be as unique as the economic problems and discomfort you are experiencing. If any one of these seems familiar to you and you are serious about getting the solution you need to become debt-free, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost consultation.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.