Binge borrowing raises Canada’s household debt burden

Binge borrowing raises Canada’s household debt burdenWe worry about binge eating and binge drinking, but it appears that we are not paying enough attention to Canada’s latest problem – binge borrowing. Incredibly low interest rates and sky high house prices have contributed to this trend. The Bank of Canada, the federal government and many economists have long been concerned that consumers who have been binge borrowing are now exposed to risk in the event of an economic shock or significant downturn.

Just when we thought that Canada’s household debt burden was at its peak, in the third quarter of 2015 Canada’s household debt burden hit another record high. This means that Canadian’s debts grew faster than their incomes. According to Statistics Canada:

• The ratio of household credit-market debt to disposable income rose to 163.7% in the three months ended September 30, up from 162.7% in the second quarter (this means the average household had nearly $1.64 in debt for every dollar of disposable income)

• This was the highest ever reading in this key ratio for gauging consumer debt loads

• Debt rose 1.4% in the quarter, while disposable income increased by 0.8%

• Total credit-market debt reached $1.89-trillion in the third quarter, also a record

• Mortgage debt was $1.23-trillion

• Consumer credit – credit cards, car loans, personal lines of credit and other personal loans – totalled $572-billion

Unfortunately Canadians ended 2015 with more debt than they started off with and this is a trend that expected to continue into 2016. Are you ready to stop binge borrowing and get control of your finances before you are facing a financial crisis? Professional help is just a phone call away. Contact Ira Smith Trustee & Receiver Inc. As a firm of professional trustees we’re experts on dealing with debt. Our approach for every file is to create an outcome where Starting Over, Starting Now becomes a reality, beginning the moment you walk in the door. Call us today and take the first step towards living a debt free life.

[monkeytools msnip=”http://monkeyplayr.com/playr.php?u=5173&p=20577″]

We have previously written about surplus income in bankruptcy in our blogs:

On the list of items that generally seems to be difficult for many individuals to understand is how there can be surplus income in bankruptcy. The reason for the confusion is because it has nothing to do with the normal usage of the word “surplus”, being “more than what is needed or used; excess”.

Within a personal bankruptcy, the context is a measure of what a bankrupt has to pay to the Trustee month-to-month. It is one of the aims of the Canadian bankruptcy system to balance the discharge of one’s personal debt with the expectation of the creditors that they should be paid.

To allow Canadians to keep a basic standard of living during the personal bankruptcy procedure, the government features collection thresholds on income (after income tax as well as certain deductions) meant to enable the bankrupt to keep a basic standard of living while contributing an amount to the Trustee for the benefit of his or her creditors.

The surplus income payment is determined according to a prescribed surplus income calculation mandated by the federal government, without any distinction for the area somebody lives in. To learn exactly what your surplus income in bankruptcy obligation would be, if any, you need to speak to a Trustee.

Surplus income in bankruptcy thresholds are structured based on national “poverty line” stats and the thresholds are set regardless of what part of the country or city that you live in. Surplus income in bankruptcy has nothing to do with what you have left over in funds every month. It is a federal solution which takes your monthly after-tax wages or salary, allows for a specific number of non-discretionary expenses, and takes into account your family size. Your Trustee then inputs this information into the government mandated formula, to calculate your surplus income in bankruptcy obligation.

If you are an individual or company who needs to free themselves from the stress and strain of too much debt, and especially if you have been told your situation is hopeless, Ira Smith Trustee & Receiver Inc. can prepare and carry out the plan made just for you, to free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

If you’re experiencing serious debt issues with the CRA, or for any reason, contact a professional trustee for a free, no obligation consultation. The Ira Smith Team does not try to write new insolvency law or tax law. Rather, we will evaluate your situation within the existing statutes, and help you to arrive at the best possible solution for your problems, whether that solution is a bankruptcy alternative like credit counselling, debt consolidation or a consumer proposal. Starting Over, Starting Now you can be debt free with the help of a professional, licensed trustee in bankruptcy. Contact us today.

Which industries may require corporate bankruptcy services in 2016?

Which industries may require corporate bankruptcy services in 2016?

Canada and Canadians are facing serious economic challenges, and certain industries have been much harder hit than others. Oil and gas, automotive and construction have taken the biggest hit and there are no clear signs of recovery any time soon. They may very well require corporate bankruptcy services (sometimes misspelled corporate bancruptcy services) in 2016. And, according to Statistics Canada, accommodation and food services, transportation and warehousing, and information and cultural industries experienced the biggest increase in insolvencies.

Canadian consumers are the most indebted in the world according to Tom Bradley of Steadyhand funds, “Lines of credit, home-equity loans, car leases, credit cards, high-ratio mortgages—they’re well-versed in them all. The level of consumer debt will make it difficult to attain the growth and employment levels of previous cycles; past purchases were borrowed from the future. Extensive use of leverage will also make Canadian families and the overall economy vulnerable in the next economic slowdown”.

If you’re like many Canadians and Canadian corporations experiencing serious financial problems, now is the time to deal with them. The Ira Smith Team will tackle your financial issues head on and with immediate action and a solid plan you can be on your way to a debt free life Starting Over, Starting Now. Contact us today.

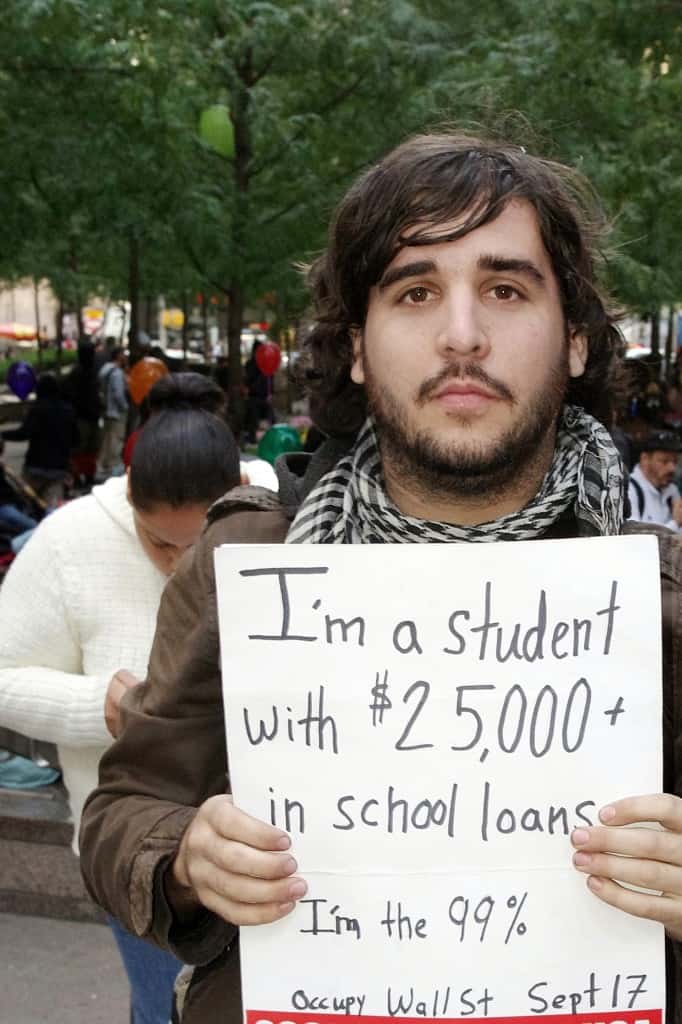

Average student loan debt is getting out of control. Post-secondary education is effectively a need for today’s labour market. According to the Canadian Federation of Students in its paper titled: “The Impact of Student Debt”, unfortunately, since the demand for education has inflated, public funding did not keep up. Public funding shortfalls have resulted in the increased cost of post-secondary education being borne by students.

From 1990 to 2014, the national average tuition fees have seen an inflation adjusted increase of over one hundred and fifty per cent (150%). In Ontario, tuition fees have grown over one hundred and eighty percent (180%). For most students—often having spent very little time active within the workforce, other than for part-time work—funding their education has become more and more troublesome.

Many students are now taking on increased levels of debt for their education. Students requiring a Canada Student Loan currently graduate with an average student loan debt of over $28,000. Keep in mind that this is an average, with the costs of graduate education resulting in higher debt levels. Relying on debt to finance education suggests that there is a delay in the full impact of high tuition fees till after graduation—when interest begins to be charged.

This impact is now exacerbated by the effects of the most recent recession and the rising trend of precarious, and even unpaid, employment. The broader effects of high levels of student debt on both the person and the general economy are now resulting in various issues:

Starting out with huge debt and facing a weak labour market, this prevents graduates to fully take part within the Canadian economy. Student debt impacts career selections, even among professional school graduates in medicine and law. An estimate of unpaid internships is in the range of 300,000 graduates working with no pay.

If you are an individual or company who needs to free themselves from the stress and strain of too much debt, and especially if you have been told your situation is hopeless, Ira Smith Trustee & Receiver Inc. can prepare and carry out the plan made just for you, to free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

Student loan debt has its own set of unique rules and complexities within the Canadian insolvency scheme. If you’re experiencing serious debt issues, contact a professional trustee for a free, no obligation consultation. The Ira Smith Team does not try to write new insolvency law or tax law. Rather, we will evaluate your situation within the existing statutes, and help you to arrive at the best possible solution for your problems, whether that solution is a bankruptcy alternative like credit counselling, debt consolidation or a consumer proposal or bankruptcy. Starting Over, Starting Now you can be debt free with the help of a professional, licensed trustee in bankruptcy. Contact us today.

Sky high house prices are the delight of one generation and the doom of another. Baby boomers’ happiness directly correlates with the increase in house prices. They can cash out and live the retirement they dreamed of while the younger generations are handcuffed from creating the family life that they dreamed of.

The high cost of buying into the housing market is causing many couples to delay having a family. A new survey from RateSupermarket reports that:

> 56% of respondents said their ability to start or expand their family has been impacted by house prices in their region

> 72% of millennials said their ability to start or expand their family has been impacted by house prices in their region

> 52.8% of respondents said they couldn’t expand their family in their current home

> 49.4% said the costs involved have caused thesm to change their minds about the size of their family

The house prices in Toronto and Vancouver are not for the faint of heart, with the average single-family home in both cities currently above $1 million. It’s virtually impossible for a young couple to buy into the housing market today so with few options, condos are becoming more attractive to young couples and young families.

The study from the Canadian Centre for Policy Alternatives (CCPA) senior economist David Macdonald estimates that:

A 20% decline in house prices across Canada would put 169,000 families under age 40 “underwater” on their mortgages. That’s one in 10 families in that age group. If prices fell 30% – in line with the maximum by which the Bank of Canada says Canadian house prices are overvalued – there would be 294,000 underwater families under 40, or one in seven

It doesn’t seem right that young couples feel that they can’t start a family because they can’t afford to buy a house. Or even worse, they chase their dreams, buy a house that they really can’t afford and land up deep in debt. If you’re struggling financially, seek professional help as soon as possible. The Ira Smith Team approaches every file with the attitude that financial problems can be solved given immediate action and the right plan. Contact us today so that Starting Over, Starting Now you can put your financial problems behind you and plan your future.

Medical debts? Don’t we have free healthcare?

Medical debts? Don’t we have free healthcare?As Canadians we pride ourselves on our universal healthcare system, which we view as free healthcare. We therefore assume that medical debts cannot arise. However, when I read that Pamela Bowes, manager of the Money Matters and workplace programs at Wellspring in Toronto recently said, “I have had more people tell me they worry more about money than they worry about cancer”, I was quite frankly shocked. Clearly Canadians don’t understand that even though we have universal healthcare, we can get into serious financial problems due to medical debt.

Here’s the reality of healthcare debt in Canada. According to a 2014 BMO Wealth Institute Report:

Long-term care is another area where Canadians are totally unprepared. Stephen Frank, vice-president of policy development and health at Canadian Life and Health Insurance Association reports that 75% of Canadians have no long-term financial plan for long-term care if they need it. Long-term care isn’t covered under the Canada Health Act. Home care may be covered, partly covered or not covered at all depending on the province you reside in and our annual income. According to Statistics Canada there is about a:

A nursing home in Ontario can cost between $14,000 and $132,000 annually, while long-term care averages $20,800 to $29,300 (Senioropolis). Add to this the cost of certain medical treatment and the medical bills could pile up. Provincial plans cover most prescription drugs for seniors 65 years of age and older, but younger retirees have to pay for their medications unless they have an extended healthcare plan. And, then there are certain drugs that are not covered under the provincial plans, regardless of your age. This may leave a Canadian with thousands of dollars of medication debt.

If you are an individual or company who needs to free themselves from the stress and strain of too much debt, and especially if you have been told your situation is hopeless, Ira Smith Trustee & Receiver Inc. can prepare and carry out the plan made just for you, to free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

If you’re struggling with a mountain of unexpected medical debts and need medical debt help, or any serious debt issues, help is just a phone call away. Starting Over, Starting Now we can help you deal with what seems like insurmountable debt and breathe easy again. Contact the Ira Smith Team today.

Our blog about the CRA phone scam titled: CANADA REVENUE AGENCY SCAMS: IF YOU READ ONE ARTICLE, READ THIS ONE is one of our most viewed. Since it is so popular, we thought we would put together a short video on the topic as well.

There are many fraud types, including new ones invented daily. CRA’s website warns Canadians about the CRA phone scam, which is also sometimes called the India scam. The Toronto Star also published a story on this topic: Beware phony CRA tax owing calls. The problem is rampant.

Taxpayers must be vigilant when they receive, either by telephone (including voicemail), mail, text message or email, a fraudulent communication that claims to be from the Canada Revenue Agency (CRA) requesting personal information such as a social insurance number, credit card number, bank account number, or passport number.

These scams, increasingly a scam phone call, may insist that they need this personal information so that the taxpayer can receive a refund or a benefit payment. Cases of fraudulent communication could also involve threatening or coercive language, including threats of prosecution for tax evasion, to scare people into paying fictitious debt to the CRA. Other communications urge taxpayers to visit a fake CRA website where the taxpayer is then asked to verify their identity by entering personal information. These are scams and taxpayers should never respond to these fraudulent communications or click on any of the links provided.

To identify communications not from the CRA, be aware of CRA’s guidelines.

If you receive a call saying you owe money to the CRA, you can call the real CRA taxation office or check your CRA online “My Account” to be sure. If you have signed up for online mail (available through My Account, My Business Account, and Represent a Client), the CRA will do the following:

If you are an individual or company who needs to free themselves from the stress and strain of too much debt, and especially if you have been told your situation is hopeless, Ira Smith Trustee & Receiver Inc. can prepare and carry out the plan made just for you, to free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

If you’re experiencing serious debt issues with the CRA, or for any reason, contact a professional trustee for a free, no obligation consultation. The Ira Smith Team does not try to write new insolvency law or tax law. Rather, we will evaluate your situation within the existing statutes, and help you to arrive at the best possible solution for your problems, whether that solution is a bankruptcy alternative like credit counselling, debt consolidation or a consumer proposal or bankruptcy. Starting Over, Starting Now you can be debt free with the help of a professional, licensed trustee in bankruptcy. Contact us today.

Several months ago we first introduced you to Philippe DioGuardi, a Canadian tax lawyer – The Tax Lawyer; Even a High Profile Tax Fighting Tax Lawyer Has to Pay His Income Tax. He’s the high-profile tax lawyer of DioGuardi tax lawyers who portrays himself as a one-man bulldog lawyer crusader against the unfair tactics of the Canada Revenue Agency (CRA). Ironically, at that time, a Toronto Star investigation revealed that Philippe DioGuardi had his own tax problems with the CRA and he paid up; the DioGuardi tax law couldn’t create the DioGuardi tax amnesty magic or “change the game”, to quote his own radio ads.

Recently I noticed that Philippe DioGuardi, a prominently featured DioGuardi tax lawyer, was no longer featured in the radio ads. Instead, they are being voiced by his father Paul DioGuardi. The ads are now very low-key, with none of the old bluster and bravado. And, I wondered why DioGuardi tax law no longer featured Philippe DioGuardi, the tax lawyer in Toronto.

That is until I read the latest Toronto Star article about him stating, “Self-styled tax fighter Philippe DioGuardi has been given a six-week suspension, a $5,000 fine and an order to pay $75,000 in legal costs after being found guilty of professional misconduct by the Law Society of Upper Canada” (LSUC). So LSUC found law society misconduct charges were proven and assessed a tribunal penalty and didn’t buy into the DioGuardi tax law concept of income tax law, as written by Philippe, and so he has a brief rest from the practice of law – a twist on DioGuardi tax amnesty!

The law society lawyer was successful in proving, according to the Order Summary of the Law Society Tribunal Philippe Joseph Mario DioGuardi (1990), of the City of Mississauga was found to have engaged in professional misconduct for:

DioGuardi tax law, as written by Philippe, is an interesting experiment. It may not be right, but it has certainly garnered a lot of attention.

Do you or your company have unpayable tax debts? Are you looking for unpayable tax debt solutions? If you are an individual or company who needs to free themselves from the stress and strain of too much debt, and especially if you have been told your situation is hopeless, Ira Smith Trustee & Receiver Inc. can prepare and implement the plan made just for you, to free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life. This plan includes resolving unpayable tax debt solutions. We have vast experience in helping people and companies with a variety of financial challenges.

If you’re experiencing serious debt issues with the CRA, or for any reason, contact a professional trustee for a free, no-obligation consultation. The Ira Smith Team does not try to write new insolvency law or tax law. Rather, we will evaluate your situation within the existing statutes, and help you to arrive at the best possible solution for your problems, whether that solution is a bankruptcy alternative like credit counselling, debt consolidation or a consumer proposal or bankruptcy. Starting Over, Starting Now you can be debt-free with the help of a professional, licensed trustee in bankruptcy.

Contact us today.

If you are an individual or company who needs to free themselves from the stress and strain of too much debt, and especially if you have been told your situation is hopeless, Ira Smith Trustee & Receiver Inc. can prepare and implement the plan made just for you, to free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

HHoliday spending for the holiday shopping season has started. We have been inundated with commercials, advertisements and emails about Black Friday and Cyber Monday sales. We are all thinking about buying those Chanukah and Christmas gifts. It is natural for all of us to want to buy something special and of high quality for our loved ones. Something special and high quality usually means expensive, but it doesn’t have to be.

We previously wrote about holiday spending and holiday debt:

Below are our 5 tools everyone who wants a holiday spending calculator should be using in order for holiday spending not to turn into holiday debt that we cannot afford to repay:

Impulse buying can get anyone into a lot of trouble. It is difficult not to buy on impulse if we do not have a plan to follow. Before buying anything, make a list of what you need to buy for each person. Usually, a gift that a lot of thought has been put into will be one that the recipient cherishes, and it is not necessarily the most expensive item. Emotions don’t know price tags, and the best heartfelt gift geared perfectly for your loved one will steer you away from impulses.

Figure out how much in total you can afford to spend, and then allocate the funds amongst the things you need to buy. If you will be travelling to friends and family over the holidays, don’t forget to include the cost of travel, lodging and food as part of your overall budget. Then stick to it. Use your ordinary calculator as a holiday spending calculator.

You should have your total budget figured out early in the year, and then start saving. That way you can afford to purchase either for cash or if on credit card, you will be able to pay it off in the following month. It is hard to put your hands on a lot of money all at once, but it may be no problem for you to save a little bit each month, ending up with the total you need for when you need to make your purchases.

If you set your list and budget early, then you can be looking for the non-perishable items on your list throughout the whole year. This will let you cash in on special sales, thereby saving you money. This will keep your holiday spending total as low as possible.

Have you ever heard the expression “pay yourself first”? That is the best gift you can give to yourself. Make sure that your year in year out obligations for bill paying and a normal savings program is intact and on budget, before you add more expenses into your budget. Don’t rationalize a break in your normal bill paying and savings program by saying you will play catch up next month. It rarely happens and then you just fall further behind. Use your holiday spending calculator to help you figure out what you need to save.

Now it’s time to deal with the sobering reality of holiday spending and there is no time to waste. If you are experiencing serious debt issues contact Ira Smith Trustee & Receiver Inc. today for advice and a plan to tackle your financial difficulties so that you can be Starting Over, Starting Now.