We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

If you would like to listen to an audio version of this Companies’ Creditors Arrangement Act Brandon’s Blog, please scroll to the very bottom and click play on the podcast.

Companies’ Creditors Arrangement Act: Facing insolvency, Laurentian University files for creditor protection

Laurentian University’s filing under the Companies’ Creditors Arrangement Act has been reported in the media and I have written about it in previous Brandon Blogs. On February 1, 2021, Laurentian University filed for what the media calls the “bankruptcy protection process” under the Companies’ Creditors Arrangement Act. It is really a creditor protection process for a financial restructuring. A large amount of work and involving tough choices will definitely be required for Laurentian to emerge from this as a financially and operationally sound university.

This restructuring will call for difficult negotiations with its lenders, suppliers, faculty and labour unions. Laurentian will have to overhaul its academic programs and look for brand-new revenue generation opportunities to survive. As well it will require a re-evaluation of its federated colleges’ design (Laurentian is just one of 4 universities that make the Laurentian Federation; the others who are all part of the Laurentian Federation Agreement are: the University of Sudbury, the University of Thorneloe, and Huntington University).

The stay of proceedings provided by the Court gives Laurentian protection from creditors and prevents them from taking steps against Laurentian, without the prior leave of the Court. The Companies’ Creditors Arrangement Act filing means that Laurentian has concluded that it cannot fulfill its financial commitments as they end up being due and uses the protection supplied by this restructuring law to reduce its overall debt load without having to pay its debts in full.

FOR A FULL DESCRIPTION OF WHAT THE COMPANIES’ CREDITORS ARRANGEMENT ACT IS AND HOW IT WORKS, SEE OUR BLOG:

FAQ on the Companies’ Creditors Arrangement Act Insolvency Proceedings of Laurentian University

As I mentioned, I previously wrote three blogs so far on the Laurentian University Companies’ Creditors Arrangement Act insolvency process:

- LAURENTIAN UNIVERSITY FACING INSOLVENCY MAKES STARTLING CCAA NEWS FILING FOR CREDITOR PROTECTION – February 8, 2021

- LAURENTIAN UNIVERSITY INSOLVENCY RESTRUCTURING – OUR UPDATED GUIDE ON ITS MASSIVE CUTS TO GAIN FINANCIAL HEALTH – May 5, 2021

- LAURENTIAN UNIVERSITY IN SUDBURY: THE LAURENTIAN FEDERATED UNIVERSITIES SUFFERED A CRUSHING DEFEAT – May 17, 2021

Every time there has been a major event in this court-supervised restructuring, I have written about it. So far the topics I have covered are:

- The filing under the Companie’s Creditors Arrangement Act.

- What creditor protection is under the “Bankruptcy Protection Legislation“.

- What a stay period and a stay of proceedings are.

- What does CCAA mean?

- The Laurentian President affidavit upon filing and what it said about the university finances.

- What Laurentian has said about its day-to-day operations, the Federated University model and the need to get out of that agreement and general oversight of university affairs.

- The shock and the effect on Northern Ontario’s community over Laurentian’s filing.

- The potential effect on current students, both undergraduate and graduate students and the overall student experience.

- The initial list of creditors, both secured and unsecured creditors, in this restructuring process filing.

- The unions have lost the fight to unseal documents relating to Laurentian communications with the provincial government.

- Faculty and other staff terminations.

- The union represents faculty members on a new collective agreement reached by Laurentian Union Faculty Association or LUFA.

- Adjustments to the benefit pension plan and health benefit plan.

- The failure of the non-Laurentian parties to the Federated University agreement in appealing Laurentian’s disclaimer of the Federated University model agreement.

- The status of the interim financing DIP loan in the Companies’ Creditors Arrangement Act administration.

So as you can see, all the topics that I have covered in these 3 previous Brandon Blogs really are answers to a legal FAQ regarding Laurentian University’s CCAA filing.

Decisions about Laurentian University being made by creditors, insolvency specialists and the Ontario Court but not public

The National Union of Public and General Employees have stated that in a free and democratic society, choices regarding publicly financed institutions are expected to be made by elected officials or people who are responsible to them. That makes sure that when choices are made the demands of our communities who are funding these institutions through our tax dollars and donations are considered.

But when such organizations, like Laurentian University, are permitted to use a bankruptcy protection statute like the Companies’ Creditors Arrangement Act, that responsibility is lost. All that matters is what the creditors either desire or are willing to accept. They want the federal government to change bankruptcy protection legislation so that this cannot happen again.

Liberal MP Paul Lefebvre introduced a bill in Parliament that aims to keep Laurentian University’s turmoil from happening at other schools. He and the Union believe that public institutions shouldn’t be allowed to use bankruptcy protection to force through cuts. I don’t believe that at this time, the bill has any traction to change bankruptcy legislation.

4 inspectors will be chosen to work with court monitor in the claims process

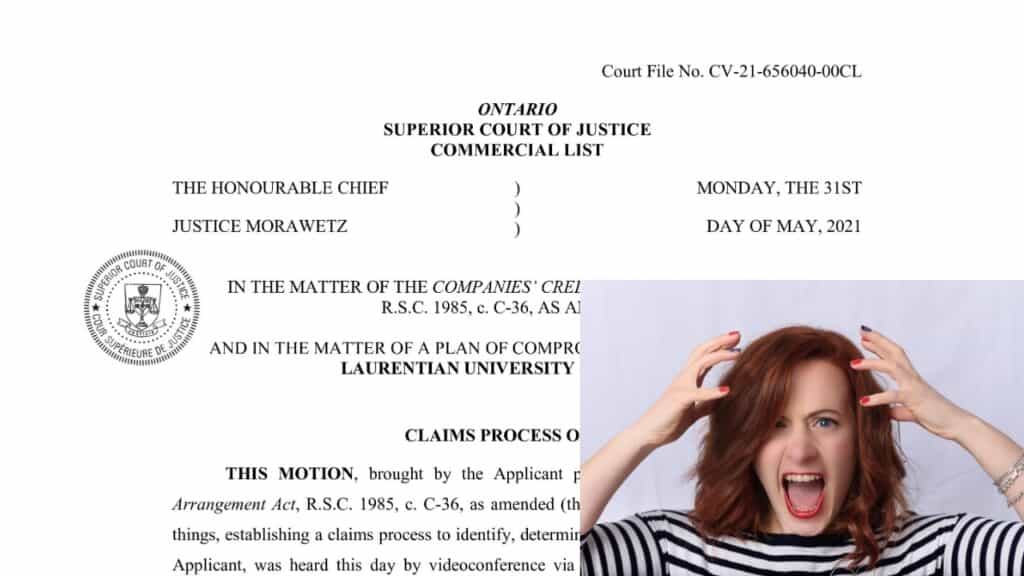

This now brings us current to the last attendance in the Ontario Superior Court of Justice Commercial List where Laurentian and its court monitor brought forward a claims process to be approved by the court in this Companies’ Creditors Arrangement Act process.

The lawyer for TD Bank advised the Court that TD supports the making of a Claims Process Order however feels that, in the circumstances, the procedure ought to contemplate that the Monitor will disclose its analysis of the claims filed with the Pre-filing Lenders. The Bank said that Laurentian and the Monitor have acknowledged that there may very well be material claims filed, some of which will be unliquidated and/or contingent. Some may be subject to a bona fide conflict – both relative to liability as well as quantum.

The Bank proposed a modification to the Monitor’s Claims Process where material cases should be discussed with the Pre-filing Lender group so that there could be a consensual resolution of such claims. The Bank said that it is reasonable as well as proper in this case to produce a reasonable and transparent process that enhances the goals of the Companies’ Creditors Arrangement Act.

Based upon information available to TD Bank at the time its factum was issued, the overall quantum of claims is unidentified, yet can sensibly be expected to include substantial claims representing: (a) the claims of the Pre-filing Lenders; (b) claims of current and also previous employees; (c) those of the federated colleges occurring from the termination and disclaimer of their contracts with Laurentian; (d) potential claims developing from the pension-related issues; as well as (e) claims of various other creditors with prefiling and also restructuring claims.

The Judge specified that he bore in mind the TD Bank submissions that it is extremely vital to move quickly, however not to rush. The Claims Process needs to be reasonable to all. He acknowledged that the Pre-filing Lenders should have some involvement in the Claims procedure. So the Judge borrowed from the provisions of the Bankruptcy and Insolvency Act (Canada) (BIA), as there were no specific rules for this in the Companies’ Creditors Arrangement Act. He ruled that there will be a bespoke process.

Laurentian and the Monitor should modify their proposed Claims Process by assigning 4 Inspectors; 2 of which will be representatives of the Pre-filing Lender group. The remaining 2 will be drawn from the creditors from those with a claim over $5 million.

The Inspectors will:

- Be selected by the Monitor who will devise an appointment process.

- Act in the interests of all creditors.

- Stand in a fiduciary capacity on behalf of all creditors.

- Need to accomplish their duties on an impartial basis.

- Are entitled to payment by following the payment structure for Inspectors set out in the BIA.

- Help the Monitor in evaluating and admitting material claims.

Companies’ Creditors Arrangement Act

Laurentian expecting about 15 claims of more than $5M from creditors, court documents show

Laurentian reported that upon filing under the Companies’ Creditors Arrangement Act, it estimated its liabilities at $322 million. The categories of creditor groups are properly summarized by legal counsel for TD Bank recently in Court, indicated above.

The “bespoke” Claims Process approved by the Court is now underway. It is for all claims against Laurentian, but not including any form of compensation claim by any current or former employee. That type of claim has been defined by Laurentian and its Monitor as “Compensation Claims“. The Monitor advised the Court that it would soon come back to Court to get approval for a special process to establish the Compensation Claims.

The current Claims Process, not including any Compensation Claims, works like this:

- Any creditor who has not received a Claims Package and who believes that he or

she has a Claim against Laurentian, under the Claims Process Order must contact the Monitor

in order to obtain a Proof of Claim form or visit the Monitor’s website. - Employees (and Former Employees) will not be receiving a Claims Package and do not need to complete a Proof of Claim at this time. Compensation Claims of Employees and Former Employees will be determined by a Court Approved Compensation Claims Methodology at a later date.

- Three types of Claims qualify for this Claims Process: (i) Claims for amounts owing as at the date of Laurentian filing under the Companies’ Creditors Arrangement Act (Pre-filing Claims), February 1, 2021; (ii) Claims which arose as a result of the restructuring itself (Restructuring Claims); and (iii) Claims against senior management, Directors and Officers, the Board (D&O Claims).

- In order to for Claims to be considered in the Claims Process, the fully completed Proof of Claim must be received by the Monitor no later than:

- For Pre-filing Claims, 5:00 PM Toronto time on July 30, 2021 (Pre-Filing Claims Bar Date).

- For Restructuring Claims, 5:00 p.m. (Toronto Time) on, whichever is later: (i) July 30, 2021, or (ii) the date that is 30 days after the date on which the Monitor sends a Proof of Claim Document Package to the Creditor with respect to such Restructuring Claim (Restructuring Claims Bar Date).

- For D&O Claims, 5:00 PM Toronto time on July 30, 2021 (D&O Claims Bar Date).

No doubt the Monitor, the Inspector Group and Laurentian will be very busy sorting out all the Claims.

Public institutions shouldn’t be allowed to use bankruptcy protection to force through cuts

There has been an outcry from the public service community that public institutions should not be allowed to make use of Canadian insolvency laws like any other person or company that qualifies. I doubt that movement will get much traction.

I hope that you found this Companies’ Creditors Arrangement Act Brandon Blog interesting. If you are concerned because you or your business are dealing with substantial debt challenges and you assume bankruptcy is your only option, call me.

It is not your fault that you remain in this way. You have actually been only shown the old ways to try to deal with financial issues. These old ways do not work anymore.

The Ira Smith Team utilizes new modern-day ways to get you out of your debt difficulties while avoiding bankruptcy. We can get you the relief you need and so deserve. Our professional advice will create for you a personalized debt-free plan for you or your company during our no-cost initial consultation.

The tension put upon you is big. We know your discomfort factors. We will check out your entire situation and design a new approach that is as unique as you and your problems; financial and emotional. We will take the weight off of your shoulders and blow away the dark cloud hanging over you. We will design a debt settlement strategy for you. We know that we can help you now.

We understand that people and businesses facing financial issues need a realistic lifeline. There is no “one solution fits all” method with the Ira Smith Team. Not everyone has to file bankruptcy in Canada. The majority of our clients never do. We help many people and companies stay clear of bankruptcy.

That is why we can establish a new restructuring procedure for paying down debt that will be built just for you. It will be as one-of-a-kind as the economic issues and discomfort you are encountering. If any one of these seems familiar to you and you are serious about getting the solution you need to become debt-free, contact the Ira Smith Trustee & Receiver Inc. group today.

Call us now for a no-cost consultation.

We hope that you and your family are safe, healthy and secure during this COVID-19 pandemic.

Ira Smith Trustee & Receiver Inc. is absolutely operational and Ira, in addition to Brandon Smith, is readily available for a telephone consultation or video meeting.

Companies’ Creditors Arrangement Act