Many Canadians must not follow a household budget. Canada has a lot to be proud of, but not the dubious honour of being a world leader in household debt among G7 nations. The G7 nations are Canada, United States, United Kingdom, France, Germany, Italy and Japan and together the gross domestic product of these seven member nations makes up approximately 50% of the global economy. Unfortunately we are leading our member nations in household debt.

Many Canadians must not follow a household budget. Canada has a lot to be proud of, but not the dubious honour of being a world leader in household debt among G7 nations. The G7 nations are Canada, United States, United Kingdom, France, Germany, Italy and Japan and together the gross domestic product of these seven member nations makes up approximately 50% of the global economy. Unfortunately we are leading our member nations in household debt.

Canada’s household budget watchdog says household debt continues to reach new highs!

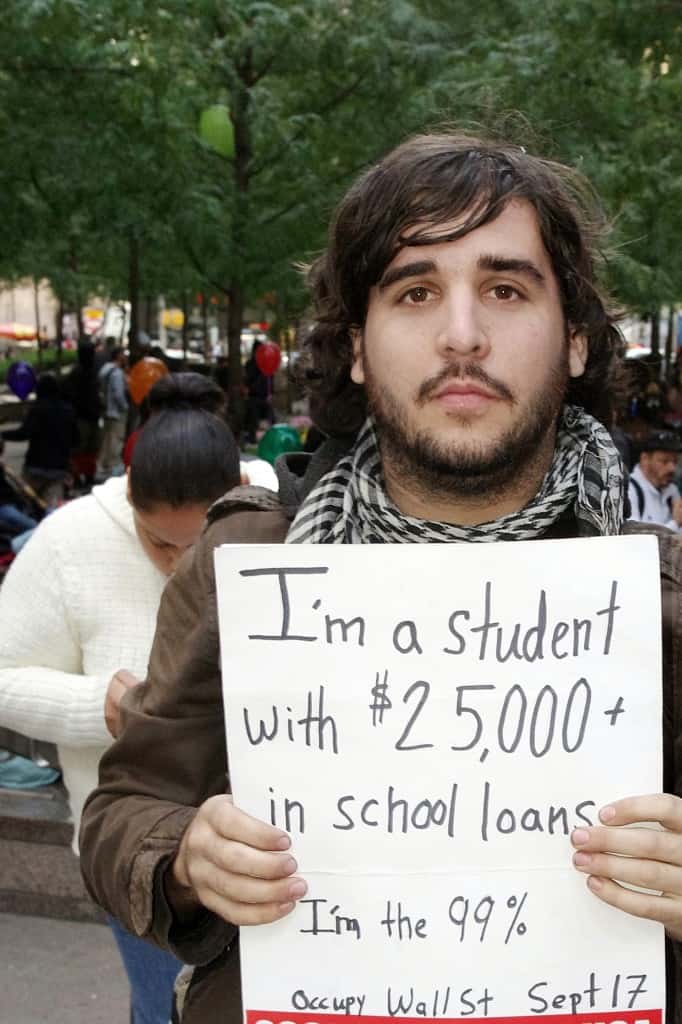

According to the Parliamentary Budget Office (PBO), Canada’s budget watchdog, Canadian households could soon be carrying the heaviest debt-to-income loads in history, reaching 174% later this year. Who is the household budget watchdog in your home? If you are the average Canadian, the answer is nobody!

Any sudden economic change can spell financial disaster for your household budget.

The danger is not so much the level of the debt relative to income, but whether we can meet our debt service obligations. Do we have enough disposable income to pay our debts? In increasing numbers Canadians do not have enough disposable income to pay their debts. And, even if they do now, many Canadians are in an extremely vulnerable state.

Any sudden economic changes like a job loss or higher interest rates can spell economic disaster. According to the PBO, our household debt servicing capacity will become stretched further as interest rates rise to normal levels over the next five years. Canadians have been binge borrowing as a result of historically low interest rates and these low interest rates are in large part responsible for the hot housing market.

If you are following a household budget, have you left any room in it for an increase in interest rates, and therefore debt service costs? Canadians are getting in over their heads and could face financial crises when the housing market cools down or interest rates rise.

What will you do if the housing market cools down and/or the interest rates rise? What will it do to your household budget?

The economic warning signs are out there. If you’re trapped in high household debt, you need a professional trustee to help you manage the situation before it reaches a critical stage where bankruptcy is your only option. We have been able to help many individuals carry out a successful debt settlement program. The first step is a realistic household budget. Successful completion of such a program, will free you from the burden of your financial challenges to go on to live a productive, stress-free, financially sound life.

If you’re like many Canadians on the brink of a financial crisis, you need the help of a professional trustee today while you have options. The Ira Smith Team can help before disaster strikes. There is a way to manage debt Starting Over, Starting Now. Contact us today.

What defines the middle class in Canada?

What defines the middle class in Canada?