Subprime Canada loans the introduction

Our vlog this week is on how subprime Canada loans are not hurting the GTA real estate market, or the Ontario economy at all. Last Tuesday, we published our blog titled PERSONAL INSOLVENCY: DROP IN OIL PRICES SERIOUSLY IMPACTING CANADIANS FINANCIALLY. One of our findings was that in Ontario, the rate of insolvency filings declined.

The reason is simple. The Ontario economy is not dependent on higher oil prices for its strength.

When I think of subprime lending, I think of the meltdown in the US economy in 2007 and 2008, and all the people who lost their homes. As can be seen in this year’s Presidential election, there is a lot of unhappiness in the US about many things, including jobs, wages and the economy. Globally everyone is looking for change; Canada’s Liberal party under Justin Trudeau and their sweep to power and the recent Brexit vote, are merely two recent examples of the global wish for change.

Recent TransUnion data on subprime Canada lending

Recent data shows that subprime Canada lending, is not having an effect on the Canadian economy and certainly is not hurting the hot GTA real estate market or Ontario. The data points out some interesting trends:

- subprime Canada lending is becoming a bigger part of Canada’s economy

- the average amount owed on Canadian credit cards rose by 1.8 per cent over the past year, but among subprime borrowers, it rose 5.7 per cent in a year

- among less risky borrowers with good credit ratings, credit card balances have been declining, by 1.5 to 4.7 per cent over the past year

“Average balances haven’t moved much, if you consider all Canadians together,” TransUnion director of research and analysis Jason Wang said in a statement.

“But once we segment by risk tiers, we find a gradual shift where subprime consumers are increasing their share of the debt load relative to the low-risk population.”

The TransUnion research included the following types of subprime lenders and subprime lending:

- subprime mortgage lenders

- subprime personal loans

- subprime auto lenders

- subprime credit cards

Subprime Canada delinquency rates

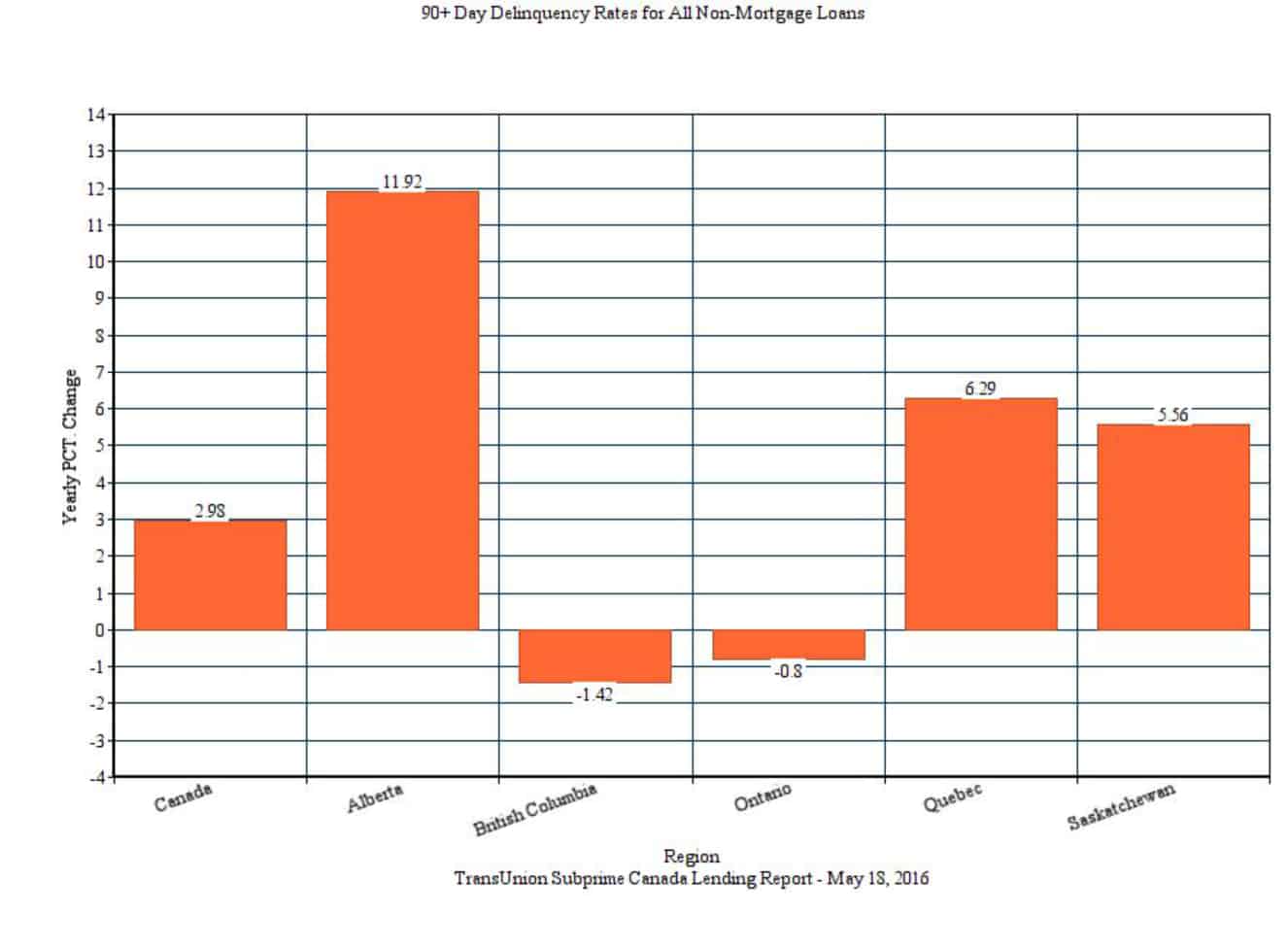

There are also regional differences in delinquency rates. The TransUnion data shows that delinquencies shot up in Alberta by almost 12 per cent, but declined in Ontario (and BC, who also has a hot Vancouver real estate market). Despite the growth in subprime Canada lending, TransUnion found that Canada has a generally healthy and well-functioning consumer credit marketplace, at least outside oil-exporting regions.

So what does this subprime Canada lending data mean

When you combine the catapulting delinquency and insolvency rates in the oil patch, and see that higher credit score people outside of the oil patch are reducing debt and their delinquency rates, it points out the regional disparities. It shows how the oil patch economy is suffering due to low oil prices. It shows me that sustained low oil prices will only keep the hurt going in the provinces that are dependent on higher oil prices for jobs and consumer spending.

What should you do if you have too much debt and can’t borrow more even in subprime Canada?

In our earlier blog titled SUBPRIME PERSONAL LOANS SECRETS REVEALED, I advised that if you can’t qualify for a traditional loan, a subprime loan is not the answer to your problems. High interest rate subprime personal loans are not an answer for being unable to repay your debts. Taking control of your debt with the help of a professional trustee is the answer.

Meet with one of our licensed insolvency trustees for a free consultation with Ira Smith Trustee & Receiver Inc.

We’ll discuss all your options. The options include bankruptcy alternatives – credit counselling, debt consolidation and consumer proposals. We will also tell you about bankruptcy if that’s the best option for you.

There is a way out of your financial problems. We can offer the right solution for you. We will do so without resorting to a subprime loan Starting Over, Starting Now.

THIS VLOG WAS INSPIRED IN PART BY OUR eBOOK – PERSONAL BANKRUPTCY CANADA: Not because you are a dummy, because you need to get your life back on track

What are subprime personal loans?

What are subprime personal loans?