Alternatives to bankruptcy

Alternatives to bankruptcy

Our insolvency clients, be they personal or corporate, usually want to start a consultation by asking us bankruptcy questions. However, I first start by obtaining a full understanding of the person’s or company’s financial challenges, so that we may consider all of the realistic options before discussing the topic of bankruptcy. I first wish to find the best alternative to bankruptcy.

I am finding now that many families, even high earners, are struggling in the “new economy”. We’ve spoken about their plight in our blogs:

There is yet another group that is now in great danger of bankruptcy – families whose previously very healthy income has taken a serious downturn and are now struggling to maintain a lifestyle they can no longer support. These families need to act fast and consider their alternatives to bankruptcy before it is too late to take remedial action. The natural inclination is to tough it out and hope for better times, but serious financial times demand serious financial decisions, not a hope and a prayer. As these families wait for better times to come they are burning through whatever savings they have, going further into debt by living off credit and will eventually run out of both money and credit.

This is not the best approach. At the first sign of financial trouble, these families should seek the advice of their legal counsel or accountant. These trusted professionals will be able to refer the families in financial trouble to a trustee in bankruptcy that they trust. With the trust factor bridge now in place with the trustee, that trustee can review the situation and provide the families with their realistic alternatives to bankruptcy.

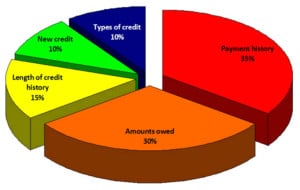

If you’re struggling to support a lifestyle you can no longer afford, take immediate action and contact a professional trustee and explore your alternatives to bankruptcy. There are alternatives to personal bankruptcy – credit counselling, debt consolidation and consumer proposals. However, regardless of the choice that’s right for you, a balanced budget is always part of the equation. As we’ve stressed before, a balanced budget is to financial health what a balanced diet is to physical health. You’ll have to take a realistic look at your lifestyle and a serious look at your big ticket items – luxury home(s), exotic vacations, luxury cars, designer clothes and expensive entertaining and start living within your budget in order to benefit from one of the alternatives to bankruptcy .

The Ira Smith team approaches every file with the attitude that corporate or personal financial problems can be solved given immediate action and the right plan. Contact us today and Starting Over, Starting Now you can be on the path to a debt free life.

http://youtu.be/qcr1ga9Jtw4

pingler