Seniors debt relief introduction

Seniors debt relief introduction

The need for seniors debt relief is gaining more attention in Canada. Seniors in our country are having a very rough time. “A financially secure retirement is becoming the exception, not the norm”, says Lee Anne Davies, CEO of Agenomics, a consulting firm specializing in money management and ageing. We’ve spoken about the plight of our seniors in several blogs:

Seniors Acquiring More Debt Delays Retirement

What Do The Golden Years Really Look Like?

Help For Seniors In Debt

Senior Credit Card Debt Relief Or Declare Bankruptcy

Advice For Seniors With Credit Card Debt

Solve It Without Bankruptcy

However gray liabilities are on the rise and this problem is not going away any time soon. According to the Vanier Institute:

- Bankruptcy rates for those aged 55 to 64 have increased by more than 600% over the last twenty years.

Agenomics reports:

- The insolvency rate for those aged 65+ increased by 1,747% over the last twenty years.

- The elderly, in particular, were 17 times more likely to become insolvent in 2010 than they were in 1990.

These are only two sources of the many who have written on this issue.

Why are elderly liabilities on the rise?

Mortgages: People nearing retirement are taking on mortgages thinking that the property will appreciate substantially and quickly, providing them with a nest egg or retirement income when they sell. Others are mortgaging their homes to help out their kids.

There really isn’t any seniors debt relief available from a secured creditor, such as a mortgagee, who holds a valid charge against your property.

Lifestyle Debt: Many retirees are still living the same lifestyle as they were during their working years, but now they don’t have to money to fund it and as a result are falling into debt. Usually, the type of debt that signifies lifestyle debt would amount owing to numerous credit cards. This would be unsecured debt from which relief is available. However, the necessary lifestyle changes that seniors debt relief would require would be significant, as the credit card liabilities have risen from spending more than the seniors earn.

Payday Loans: The number of elderly taking out payday loans is on the rise. Now retired, they may not qualify for traditional loans so they are falling prey to payday loan companies. Relief is available for unsecured payday loans, but like credit cards, the solution will involve lifestyle and spending changes.

Are you struggling financially, you require seniors debt relief (or not so grey relief) and don’t know where to turn? Contact Ira Smith Trustee & Receiver Inc. today. Our approach for every file is to create an outcome where Starting Over, Starting Now becomes a reality, beginning the moment you walk in the door. Call us today and take the first step towards living a debt-free life.

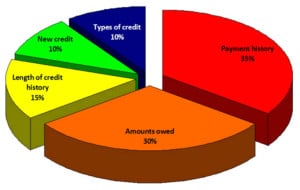

You probably have many bankruptcy questions if you’re experiencing serious debt problems and you are no doubt going through a very stressful time in your life and you may not know where to turn. Ira Smith Trustee & Receiver Inc. is here to tell you that there is help available, answers to your bankruptcy questions and there are solutions to your debt problems. The best thing that you can do is contact a Licensed Trustee as soon as possible. There is a popular misconception that Licensed Trustees only deal with bankruptcy, but that is only one of our many functions. We can and do help with debt problems considering various alternatives to bankruptcy also.

You probably have many bankruptcy questions if you’re experiencing serious debt problems and you are no doubt going through a very stressful time in your life and you may not know where to turn. Ira Smith Trustee & Receiver Inc. is here to tell you that there is help available, answers to your bankruptcy questions and there are solutions to your debt problems. The best thing that you can do is contact a Licensed Trustee as soon as possible. There is a popular misconception that Licensed Trustees only deal with bankruptcy, but that is only one of our many functions. We can and do help with debt problems considering various alternatives to bankruptcy also.