financial burdens

Financial Burdens: Introduction

Receiving a cancer diagnosis is a life-changing experience, In addition to the emotional challenges, many people face significant financial burdens. I recently came across an inspiring story about a financial adviser from Toronto who encountered this difficult situation after being diagnosed with head and neck cancer. His journey sheds light on the often-overlooked economic impact of cancer in Canada, reminding us of the importance of support and resources during such challenging times.

Financial Burdens: Signs of Financial Distress

Financial stress can show up in many different ways, and recognizing the signs early can help you take proactive steps to manage your situation. Here are some common indicators of stress created by financial burdens to keep an eye on:

- Late or missed payments: If you find yourself missing payments on bills, loans, or credit cards, it could lead to financial stress and negatively affect your credit score due to late fees.

- High credit utilization: Using more than 30% of your available credit can suggest financial strain and may also impact your credit score.

- Overdrafts or NSF fees: Frequently overdrawing your bank account or incurring non-sufficient funds (NSF) fees can indicate financial burdens.

- Collection agency calls: Receiving calls from collection agencies can be quite stressful and may signal that you are facing financial burdens.

- High-interest debt: Carrying a significant amount of high-interest debt, like credit card balances, can create financial burdens and make it tougher to pay off what you owe.

- Insufficient emergency fund: Lacking a sufficient emergency fund can lead to increased financial anxiety in times of unexpected expenses.

If you notice any of these signs, it’s important to take action quickly to help alleviate financial stress and avoid further complications. Seeking assistance from a credit counselor or a licensed insolvency trustee can be a great step towards creating a manageable financial plan to reduce your financial burdens. They can help guide you in reducing stress and finding a path forward. Remember, you’re not alone in this, and there are resources available to support you.

Recognizing the sandwich generation’s challenges

The term “sandwich generation” describes adults who find themselves balancing the responsibilities of caring for their aging parents while also supporting their own children. This group typically includes individuals in their 40s, 50s, and 60s, who may experience the pressures of managing the financial and emotional needs of multiple generations. It’s important to recognize that this situation can present unique challenges that may affect their financial stability, mental health, and overall well-being. Understanding these dynamics can help in finding effective strategies and support systems to navigate this complex phase of life.

Financial Burdens

One of the most significant challenges faced by the sandwich generation are the financial burdens of caring for multiple generations. They may be responsible for:

- Supporting their aging parents with living expenses, medical bills, and other costs

- Paying for their children’s education, extracurricular activities, and other expenses

- Managing their own household expenses, including mortgage or rent, utilities, and food

This financial burdens can lead to increased stress, anxiety, and feelings of overwhelm. The sandwich generation may need to make difficult decisions about how to allocate their resources, potentially sacrificing their own financial security and retirement savings.

Emotional Toll

Caring for aging parents and children can impose a considerable emotional burden on the sandwich generation, which encompasses individuals who simultaneously support both their elderly parents and their children. This group may experience a range of challenging emotions, including:

- Guilt: They may feel inadequate for not being able to provide sufficient support to their elderly parents or children.

- Overwhelm: The vast responsibility of managing caregiving duties for multiple generations can feel daunting.

- Isolation: They might experience a sense of disconnection from friends and social networks due to their caregiving commitments.

- Stress and Anxiety: The financial burdens and emotional demands of caregiving can lead to heightened stress levels and anxiety.

These emotional challenges can result in significant consequences, including burnout, depression, and anxiety, which can adversely affect mental health and overall well-being. It is essential to recognize and address these issues to support the sandwich generation in their caregiving roles.

Practical Solutions

The sandwich generation faces a unique set of challenges, but there are many practical solutions to help lighten the load. Here are some helpful strategies to consider:

- Create a Budget: Take some time to outline your expenses and prioritize them. This can help ensure that everyone’s needs—yours, your children’s, and your parents’—are being met.

- Seek Support: Don’t hesitate to reach out to family, friends, and community resources. Building a support network can make a significant difference in managing your responsibilities.

- Consider Professional Help: Hiring caregivers or home health aides can alleviate some caregiving duties, allowing you to focus on other important areas of your life.

- Practice Self-Care: Remember to take regular breaks and engage in activities that help you relax and recharge. Taking care of your own well-being is crucial for reducing stress and anxiety.

- Seek Counseling: If you’re feeling overwhelmed, consider talking to a professional counselor or therapist. They can provide valuable support in navigating emotional challenges.

By recognizing the pressures of being part of the sandwich generation and exploring these practical solutions, you can better manage the demands of caring for multiple generations while also prioritizing your own health and happiness. Remember, taking care of yourself is not only important for you but also for those you care for.

Financial Burdens: The Financial Implications of Cancer Treatment

Cancer isn’t just a health issue; it’s a financial crisis for many. A recent report from the Canadian Cancer Society (CCS) reveals that the economic burden of cancer care in Canada is an astonishing $37.7 billion. This staggering figure encompasses both direct treatment costs and indirect losses that can devastate families.

Cancer impacts not only health but also finances for many individuals and families. According to a recent report from the Canadian Cancer Society (CCS), the economic burden of cancer care in Canada amounts to approximately $37.7 billion. This significant figure includes both direct costs associated with treatment and indirect costs that can have a profound effect on families.

The Financial Weight on Patients and Caregivers

Patients and their caregivers bear a significant part of this burden. They cover about 20%, which equates to approximately $7.5 billion. You might wonder, what does this mean in practical terms?

- Many patients face average costs nearing $33,000 each.

- Costs can include lost wages, which affects the entire family’s income.

- Travel expenses to treatment facilities can be unexpectedly high.

- Nutritional supplements and other out-of-pocket expenses add to the financial burdens.

As Dr. Jennifer Gillis notes,

“The financial toll of cancer can be as damaging as the disease itself.”

Think about it: cancer may take away your health, but it can also take away your financial security.

The Hidden Costs of Cancer Care

When discussing cancer, we often focus purely on treatments and outcomes. But what about the hidden costs? Each year, Canada sees 247,100 new cancer cases. The first year post-diagnosis is usually the most expensive for patients. Why? Because so many expenses pile up right away.

Furthermore, the complexities of the healthcare system can lead to different coverage across provinces. For instance, while hospital treatments are covered, many patients still face out-of-pocket costs for medications, especially crucial cancer drugs. Couples in lower-income households and those living in remote areas can suffer the most. Often, they must travel great distances for medical care, adding more financial burdens.

Understanding the Data

The report’s data paints a clear picture:

-

$37.7 billion– total economic burden -

$7.5 billion– financial responsibility of patients and caregivers -

$33,000– average cost incurred by cancer patients

Chart of Financial Impact

Category | Amount (in billions) |

|---|---|

Total Economic Burden | $37.7 |

Patients’ and Caregivers’ Contribution | $7.5 |

Average Cost Per Patient | $0.033 |

Ultimately, these numbers reflect painful realities. They underscore that cancer’s impact extends beyond the individual to families and communities. You might find yourself asking, how can we better support those affected? These stories illustrate the profound need for change in how society addresses cancer care and its associated costs.

Financial Burdens: The Personal Story Reality Behind the Numbers

Every story has a unique face, and in the realm of cancer care, that face can often be seen in individuals like this inspiring financial adviser. As a survivor, his journey goes beyond simply overcoming cancer; it reveals the deep and meaningful effects the disease has on real lives. His experiences can offer valuable insights and hope to others navigating similar challenges.

His Profile

This Toronto-based financial adviser was diagnosed with head and neck cancer in 2014. His struggle wasn’t merely against cancer itself; it was against the societal and financial concerns that came with it. Imagine juggling important business meetings while undergoing outpatient treatment for Stage 4 cancer. Each day was a balancing act as he wore a suit and makeup to conceal the effects of his treatment. He lost nearly two years of income. That’s time and money he can never recover.

The Impact of Income Loss

When families experience income loss, it can feel overwhelming, and many strive to stay afloat during tough times. Dependents, such as children and family members with special needs, can be particularly affected by these changes. For instance, in families like his, where there is a spouse and a child with autism, the challenges can be even more pronounced.

As financial burdens mount and savings are depleted, it’s important to recognize that this situation goes beyond just numbers—it profoundly impacts daily life. Understanding and addressing these challenges can help families navigate through this difficult period and find support when they need it most.

Struggles with Treatments

Managing a career while receiving treatment is a massive challenge. Treatments can leave individuals exhausted, even unable to perform everyday tasks. You might ask yourself, “How does one perform at work when battling something so overwhelmingly consuming?” He persevered. But many are not as fortunate.

Emotional Toll of Financial Stress

The financial burdens of healthcare can significantly impact overall health and well-being. The emotional weight of stress can often feel overwhelming. As one individual shared, “Being told you’re cancer-free doesn’t erase the struggles that follow.”

This perspective resonates with many and underscores the important connection between health and financial stability. It’s essential to recognize that treatments extend beyond just medical procedures; they also affect quality of life, daily routines, and overall wellness.

With the average cancer patient facing costs of approximately $33,000, it’s vital to tackle these challenges head-on. Unfortunately, many individuals find themselves having to make tough choices, leading to missed appointments and unfilled prescriptions due to financial limitations. This ongoing struggle calls for greater awareness and proactive solutions.

As you reflect on this journey, consider the wider implications of cancer care in our society. It’s more than just an individual battle; it’s a shared challenge that we all need to address together. Your support and understanding can make a significant difference in the lives of those affected.

Financial Burdens: The Economic Disparities in Cancer Care

Cancer care in Canada reflects a troubling reality—economic disparities. It’s not just a health issue; it becomes financial burdens for many.

How Income Affects Access to Treatment

It’s important to recognize how income can impact the quality of medical care you receive. For those on a lower income, accessing necessary treatments can often feel out of reach, creating tough choices between essential expenses and crucial health procedures. This situation can seem quite unfair.

Many patients are on the lookout for resources to help. While about 60% of Canadians have private health insurance, this doesn’t always ensure complete coverage. If you find yourself in a lower-income bracket, you may encounter considerable out-of-pocket costs.

Challenges faced by lower-income households

Here are some challenges that lower-income households frequently face:

- Transportation Issues: Limited funds can make it difficult to travel to medical appointments.

- Time Off Work: Taking time off means losing wages, which can add to the financial burdens.

- Access to Specialized Care: Those in remote areas may struggle to find the specialized care they need, often having to travel long distances.

For individuals living in remote communities, the journey for treatment can be particularly challenging, turning travel into a financial strain. It’s understandable to feel overwhelmed by the demands of travelling for care, as it can be physically exhausting as well.

Remember, it’s okay to seek support and explore available resources that can make navigating these challenges a bit easier. You’re not alone in this, and there are avenues available to help you access the care you need.

Travel: A Hidden Cost

Every journey to a medical appointment can take a toll. You have to consider fuel costs, accommodation, and meals. Those add up quickly. For many, this is a critical issue. It turns into a vicious cycle—missing appointments because you can’t afford to go.

Financial Constraints and Health Outcomes

Financial burdens can significantly impact health outcomes, a reality underscored by troubling statistics. Patients who cannot afford treatments are more likely to delay or forgo necessary care.

“Financial constraints can lead to worse health outcomes, a gap we must bridge.” – Dr. Jennifer Gillis

This highlights the serious implications of missed appointments or ineffective treatments, which can have severe consequences for individuals’ health.The relationship between socioeconomic status and health is crucial to understand. Recognizing these challenges can enhance empathy for those affected, particularly in contexts like cancer treatment, where financial stability is often intertwined with the ability to receive adequate care. Engaging in this conversation is essential for addressing these critical issues.

Financial Burdens: The Complexity of Cancer Drug Coverage in Canada

The issue of cancer drug coverage in Canada is complex and can be quite confusing. While it might be assumed that hospital treatments are fully covered for patients, this is not entirely accurate. Although public funding generally supports hospital care, the coverage for cancer drugs varies significantly across provinces, which can lead to substantial financial burdens for many patients.

Understanding Public Funding and Drug Coverage

In Canada, the responsibility for drug coverage lies with provincial governments. While treatments provided in hospitals are typically covered by public funds, reimbursement for cancer medications is often contingent upon the province in which a patient resides. This disparity can create frustration, particularly for patients who find that their neighbors receive different levels of support. As a result, not all individuals have equal access to essential medications.

The Role of Private Health Insurance

Around 60% of Canadians have private health insurance, which may seem reassuring. However, even with such coverage, many individuals still encounter out-of-pocket expenses for medications. The costs associated with cancer drugs can be significant, leading to financial strain for patients and their families.

Financial Burdens and Advocating for Change: The CCS’s Call to Action

You may not realize the heavy burden cancer can be. It’s not just about the diagnosis. Consider the shocking financial strains that hit patients as they navigate their treatment journey. According to the CCS, the economic impact of cancer is staggering. A whopping $37.7 billion is expected to be incurred in Canada alone. Of that, patients and their caregivers are facing a heavy burden of around $7.5 billion—that’s almost 20% of the total costs.

So, what can be done? The answer lies in making systemic changes to light the path ahead. Here are some critical proposals:

- Systemic changes needed: To lessen patient financial burdens, strong reforms are needed in how cancer care is funded and managed.

- Plans for a refundable caregiver tax credit: This initiative could provide substantial relief to those supporting patients.

- Proposed better job protections: Ensuring that patients don’t have to choose between keeping their jobs and undergoing treatment is essential.

- Support for treatment-related expenses: There should be enhanced assistance for travel, accommodation, and other costs that arise during medical care.

Community Involvement and Advocacy

The CCS is not just pointing out problems—they are actively pushing for solutions. You can get involved! Their ongoing petition efforts are essential to spark change on a larger scale. As Dr. Jennifer Gillis of CCS states,

“We must work together to confront these overwhelming financial pressures faced by cancer patients.”

This quote underscores the collaborative effort required to tackle this issue head-on.

Why should you care? Consider the numbers: With a projected 23% increase in societal costs over the next decade due to the aging population, the urgency for reforms becomes clearer. If this trend continues, how will it affect families like this Toronto financial adviser, who also experienced firsthand the devastating impact that cancer can impose on financial stability?

So, what will you do? Community support has the power to change lives. Whether you volunteer, donate, or simply spread the word, every effort counts. Engaging with advocacy initiatives can lay the groundwork for actionable solutions that alleviate financial burdens on cancer patients. Remember, your involvement could be the difference.

In conclusion, advocating for change is not just a lofty idea—it is a necessity. By supporting organizations like the Canadian Cancer Society and participating in their initiatives, you’re not just helping one person, but an entire community facing these challenges. Together, we can lighten the load for those battling cancer, fostering a society where financial burdens do not overshadow the fight for health.

Financial Burdens: Strategies for Managing Financial Distress

Tips for Managing Debt

- Create a Budget: Begin by tracking your income and expenses to gain a clear understanding of your financial flow. Develop a budget that includes all essential expenses, debt payments, and savings allocations.

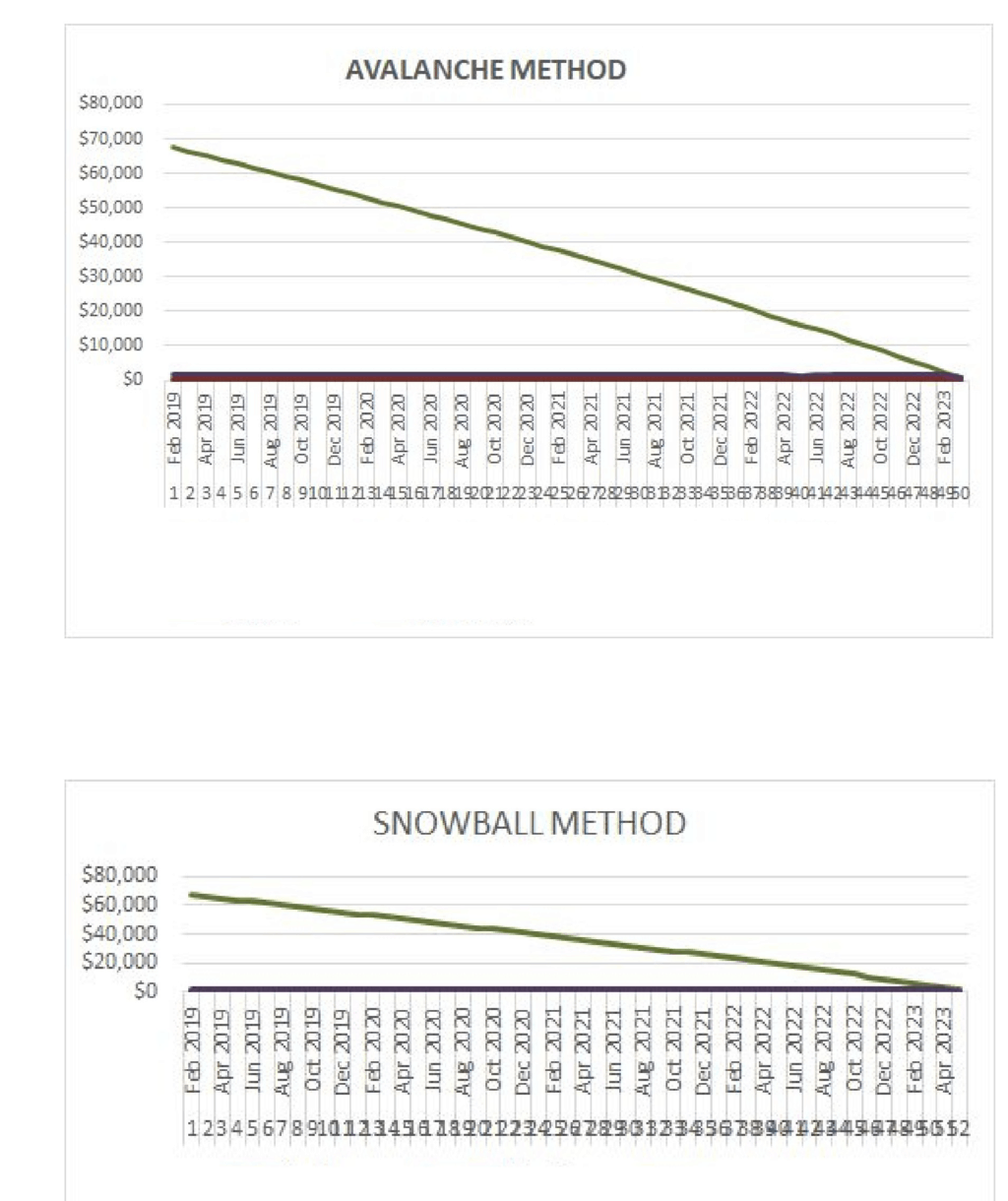

- Prioritize Debt: Concentrate on paying off high-interest debt first, such as credit card balances. It may also be beneficial to consider consolidating multiple debts into a single loan with a lower interest rate.

- Pay More Than the Minimum: Making only the minimum payments on debts can extend the payoff period and increase the total interest paid. Aim to pay more than the minimum to effectively reduce the principal balance.

- Consider Debt Consolidation: If you have various debts with high interest rates, consolidating them into one loan with a lower interest rate may simplify your payments and reduce overall costs.

- Cut Expenses: Review your spending habits to identify areas where you can reduce expenses. Redirect the savings towards debt repayment to expedite your journey to financial freedom.

Building a Stronger Financial Future

- Start Saving: Strive to save at least 10% to 20% of your monthly income. Setting up automatic transfers to your savings account can streamline the saving process and encourage consistent contributions.

FAQ: Financial Burdens of Medical Costs

- What are “pocket expenditures” in the context of healthcare?

Pocket expenditures refer to the out-of-pocket costs that individuals incur for medical care. This includes expenses such as deductibles, co-pays, and services not covered by insurance. These costs can have a significant impact on personal finances and may lead to financial burdens, particularly for individuals with chronic conditions or limited financial resources. - How do medical costs affect individuals and families?

Medical costs can impose a substantial financial burdens on both individuals and families, resulting in several key issues: - Financial stress and anxiety: The burden of medical bills can adversely affect mental health and overall quality of life.

- Debt accumulation: High medical expenses often necessitate the use of credit cards or loans, which can lead to increased debt and potential long-term financial instability.

- Difficult financial choices: Individuals may face tough decisions between covering essential expenses such as housing, food, and utilities versus managing medical expenses.

Financial Burdens: Conclusion

I hope you enjoyed this financial burdens Brandon’s Blog and how even with universal health care in Canada cancer patients must incur out of pocket medical costs. Do you or your company have too much debt because of medical costs or any other reason? Are you or your company in need of financial restructuring? The financial restructuring process is complex. The Ira Smith Team understands how to do a complex restructuring. However, more importantly, we understand the needs of the entrepreneur or someone with too much personal debt.

You are worried because you are facing significant financial challenges. It is not your fault that you are in this situation. You have been only shown the old ways that do not work anymore. The Ira Smith Team uses new modern ways to get you out of your debt troubles while avoiding the bankruptcy process. We can get you debt relief freedom using processes that are a bankruptcy alternative.

The stress placed upon you is huge. We understand your pain points. We look at your entire situation and devise a strategy that is as unique as you and your problems; financial and emotional. The way we take the load off of your shoulders and devise a plan, we know that we can help you.

We know that people facing financial problems need a realistic lifeline. There is no “one solution fits all” approach with the Ira Smith Team.

That is why we can develop a restructuring process as unique as the financial problems and pain you are facing. If any of this sounds familiar to you and you are serious about finding a solution, contact the Ira Smith Trustee & Receiver Inc. team today.

Call us now for a free consultation. We will get you or your company back on the road to healthy stress-free operations and recover from the pain points in your life, Starting Over, Starting Now.

The information provided in this Brandon’s Blog is intended for educational purposes only. It is not intended to constitute legal, financial, or professional advice. Readers are encouraged to seek professional advice regarding their specific situations. The content of this Brandon’s Blog should not be relied upon as a substitute for professional guidance or consultation. The author, Ira Smith Trustee & Receiver Inc. as well as any contributors to this Brandon’s Blog, do not assume any liability for any loss or damage resulting from reliance on the information provided herein.