Are you staring at a pile of bills you can’t pay? Is your phone ringing constantly with collection calls? You’re not alone. Many Canadians are struggling with debt right now, and if you’re reading this, you’re already taking the first step toward finding a solution.

Today, I want to talk honestly about consumer debt proposals in Canada. No complicated legal talk. No judgment. Just real information from someone who helps people with debt problems every single day.

My name is Brandon Smith, and I’m a Licensed Insolvency Trustee in the Greater Toronto Area. I’m also Senior Vice-President at Ira Smith Trustee & Receiver Inc. Over the years, I’ve helped many GTA residents in Toronto, Vaughan, Mississauga, Markham, Newmarket and Aurora find their way, or their company’s way, out of debt. I’ve seen the relief on people’s faces when they realize there’s a path forward. That’s what this guide is about—showing you that path.

Debt Proposal: The Reality of Debt in Canada Today

Let’s start with something you might see every day: expensive vehicles on the road. Drive around the GTA, and you’ll notice there’s no shortage of high-priced sedans, trucks and SUVs. These aren’t just luxury vehicles anymore. For many Canadians, a newer reliable vehicle is essential for getting to work, taking kids to school, and managing daily life.

But here’s the problem: these vehicles can come with massive loans that stretch 72 or even 84 months. That’s six to seven years of payments on a single vehicle. When you’re committing to a loan that long, you’re betting on your financial future staying stable. And as we all know, life doesn’t always cooperate.

Why Are Vehicle Loans Getting So Long?

Dealerships and lenders offer these extended loan terms to make monthly payments seem affordable. An expensive vehicle might look manageable at $650 per month over seven years. But when you add up the total cost with interest, you’re paying much more than the sticker price.

Here’s what often happens:

- People are still paying off their old vehicle when they trade it in

- The remaining debt gets rolled into the new loan

- The cycle continues, with debt piling on top of debt

- One financial setback—like a job loss or medical emergency—can make the whole thing collapse

I’m not saying expensive vehicles are bad. If you hold onto a vehicle for 10+ years and get a great interest rate (like those 0% manufacturer incentives), that loan might work perfectly for you. The problem is when the loan doesn’t match your situation. If you like getting a new vehicle every 3-4 years, or if you got stuck with a high interest rate and a closed loan with big penalties, that big purchase becomes a real financial burden.

Debt Proposal: Understanding Your Secured Debt vs. Unsecured Debt

Before we talk about a debt proposal, you need to understand one crucial difference: secured debts versus unsecured debts. This difference determines what options are available to you.

What Are Secured Debts?

Secured debts are attached to something you own. The two most common examples are:

- Car loans – The vehicle is the security

- Mortgages – Your home is the security

If you stop making payments on a secured debt, the lender can take back the item. They repossess your car or foreclose on your house. It’s that simple. And here’s something many people don’t realize: if the lender sells your car or house for less than you owe, you still owe the difference. That shortfall becomes an unsecured debt, and you’re also responsible for the costs the lender spent to seize and sell your property.

What Are Unsecured Debts?

Unsecured debts aren’t tied to any specific asset. These include:

- Credit card balances

- Personal loans

- Lines of credit

- Payday loans

- Income tax debt owed to Canada Revenue Agency

- Medical bills (if you have private services)

- Utility bills

If you stop paying these debts, creditors can’t immediately take your stuff. But they can sue you, get a judgment, and potentially garnish your wages or freeze your bank account.

Why This Matters for a Debt Proposal

Here’s the key point: a consumer debt proposal only deals with unsecured debts. Your car loan and mortgage aren’t included unless you decide to give up those assets.

So if you want to keep your truck and your home, you need to keep making those payments. The debt proposal helps you deal with everything else—the credit cards, lines of credit, and other unsecured debts that are drowning you.

Most Canadians I meet have a mix of both types of debt. Understanding which is which is the first step to finding the right solution.

What Is a Consumer Debt Proposal?

A consumer debt proposal (often just called a “consumer proposal”) is a legal process that lets you settle your unsecured debts for less than you owe. It’s managed by Licensed Insolvency Trustees—professionals like me who are licensed by the federal government to help Canadians with debt problems. It is a good alternative to bankruptcy.

Here’s how it works in plain language:

You make a formal offer to your creditors: “I can’t pay everything I owe, but I can pay this much.” Usually, you offer to pay back a portion of your unsecured debts over a period of up to five years. The amount you offer depends on what you can actually afford—not some imaginary number that would leave you broke every month.

What Makes a Debt Proposal Different?

Unlike regular debt payments, where you’re battling interest charges and making minimum payments that barely touch the principal, a debt proposal has real advantages:

- No more interest – Once you file, the interest clock stops on all included debts

- One monthly payment – Instead of juggling multiple bills, you make one affordable payment

- Legal protection – Creditors must stop calling and taking legal action

- You keep your assets – Your car, home, tax refunds, and other property stay with you (as long as you maintain secured debt payments)

- Credit recovery – You can start rebuilding your credit as soon as your proposal is filed

The Immediate Debt Proposal Relief: What Happens When You File

One of the most powerful benefits of a debt proposal happens immediately: all collection actions stop.

I mean it—the calls stop. The threatening letters stop. The stress of checking your mailbox or answering your phone finally ends. This protection is automatic and legally enforced. As soon as your proposal is filed, creditors can’t contact you anymore. They have to deal with me, your trustee.

Interest Freezes Instantly

Another immediate benefit: interest on all your unsecured debts freezes the day you file. If you have $50,000 in credit card debt at a high credit card interest rate and you are only making the minimum payment, interest continues to accrue and your payment is only making a dent in the interest charge. With a debt proposal that stops immediately. Every dollar you pay goes toward reducing what you actually owe, not feeding the interest monster.

For many people I’ve worked with, this moment—when the calls stop and the interest freezes—is when they finally exhale. Some people tell me it’s the first decent night’s sleep they’ve had in months.

Debt Proposal: How Much Will You Pay?

This is the question everyone asks: “How much will I have to pay back?”

The honest answer is: it depends on your situation. Consumer proposals in Canada typically reduce total unsecured debt by 30-70%. But your specific offer depends on several factors:

- Your income

- Your necessary living expenses

- Your assets

- What creditors would get if you filed for bankruptcy instead

That last point is important. Under the Canadian Bankruptcy and Insolvency Act, your offer in a consumer proposal process must be at least slightly better than what your creditors would receive if you went bankrupt. This is called the “bankruptcy floor.” Your Licensed Insolvency Trustee calculates this amount based on your circumstances.

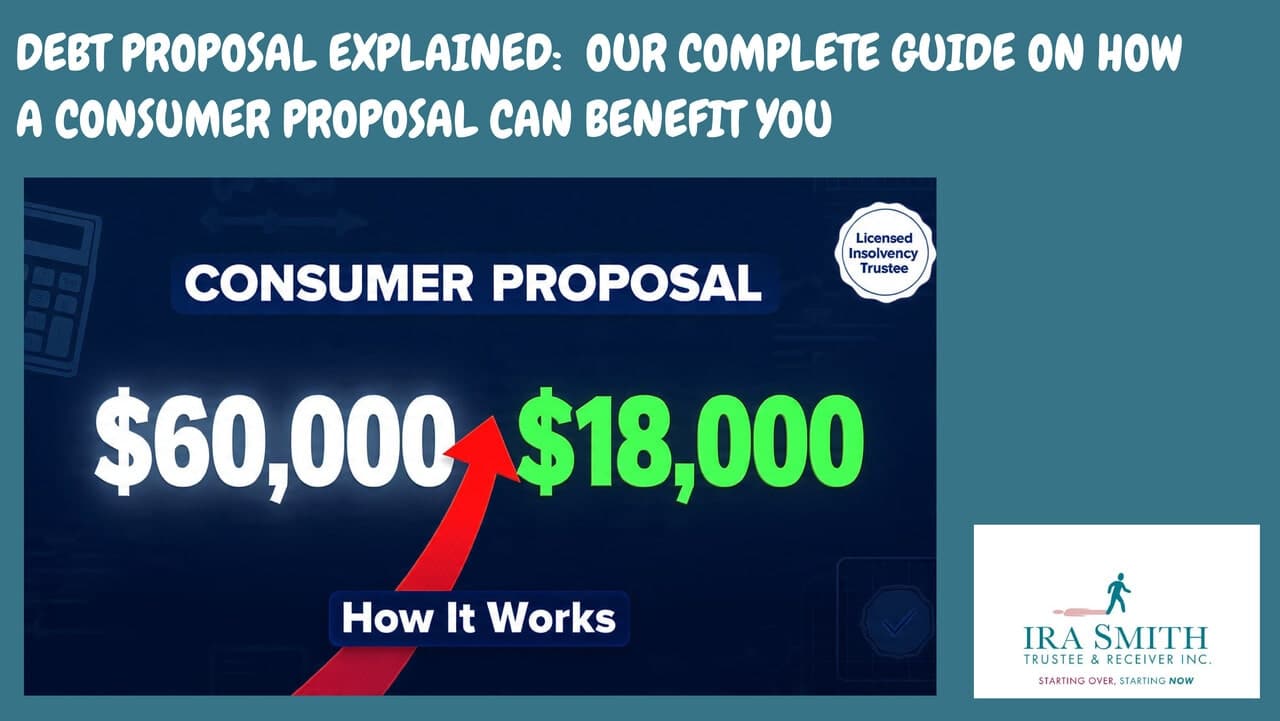

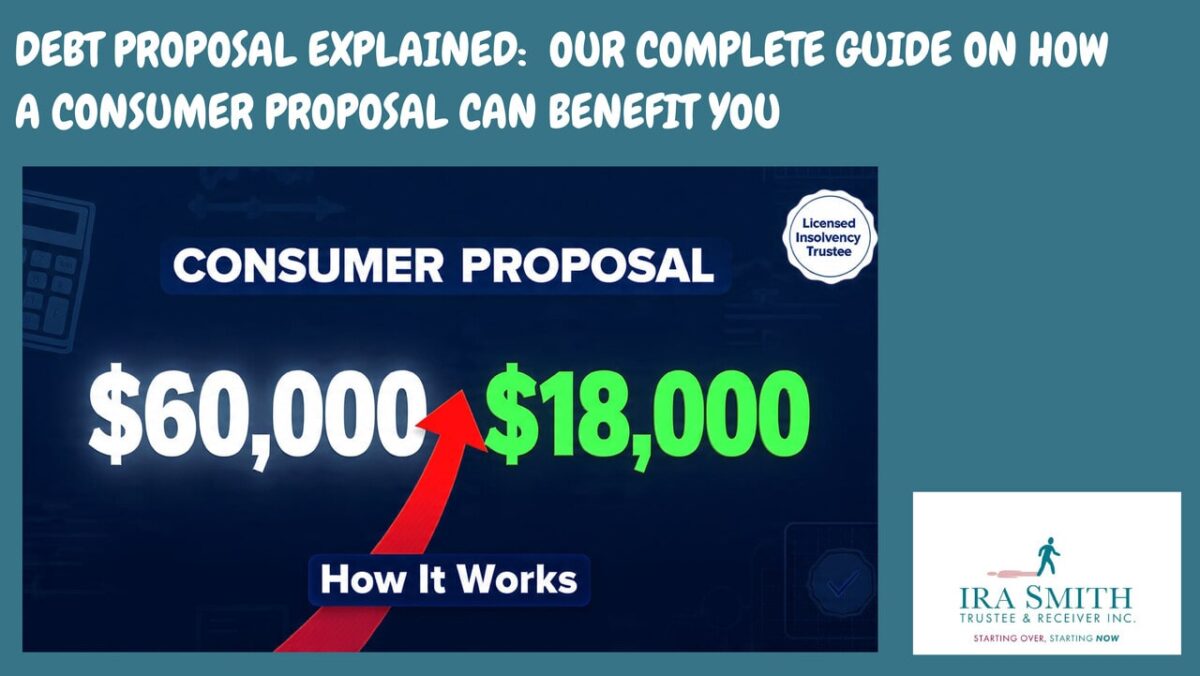

Real Examples (Numbers Changed for Privacy)

Example 1: Sarah’s Story

- Total unsecured debt: $60,000

- Monthly income: $3,200

- Proposal offer: $18,000 paid over 5 years ($300/month)

- Result: Creditors accepted, saving her $42,000

Example 2: James’s Situation

- Total unsecured debt: $85,000

- Monthly income: $5,500

- Owns a vehicle worth $15,000 (loan paid off)

- Proposal offer: $40,000 paid over 4 years ($833/month)

- Result: Accepted, saving him $45,000

Every situation is unique. The trustee works with you to determine what you can genuinely afford while meeting the legal requirements.

Who Qualifies for a Consumer Debt Proposal?

Not everyone qualifies for a consumer proposal. Here are the basic requirements:

- Debt amount: You must owe more than $1,000 but less than $250,000 in unsecured debts (not including your mortgage on your principal residence).

- Insolvency: You must be insolvent, which means you can’t pay your debts as they come due, or your debts exceed the value of your assets.

- Location: You must live in Canada or have property or business here.

- Income: You need enough regular income to make your proposal payments.

If you don’t qualify for a consumer proposal process, don’t worry. There are other options, including a different financial restructuring provision of Canadian bankruptcy law and if a restructuring is not possible, then bankruptcy. Licensed Insolvency Trustees can help you explore all possibilities.

The Consumer Debt Proposal Process: Step by Step

Let me walk you through exactly what happens when you pursue a debt proposal:

Step 1: Free Consultation

You meet with a Licensed Insolvency Trustee for a no-cost, no-obligation consultation. This can happen in person, over the phone, or through a video call. We’re available for anyone in the GTA or the surrounding region in Ontario.

During this meeting, we will:

- Review your complete financial situation

- Explain all your debt relief options (not just proposals)

- Answer your questions honestly

- Help you decide if a proposal is right for you

This consultation usually takes 30-60 minutes. Many people tell me they feel relief just from having this conversation—finally understanding their options clearly.

Step 2: Preparing Your Proposal

If you decide to move forward, we will gather detailed information about your finances and prepare the paperwork. This can happen quickly—sometimes within a day or two of your first meeting. Speed matters when you’re dealing with collection pressure.

Step 3: Filing Your Proposal

We file your consumer proposal officially. The moment this happens:

- Collection calls and legal actions stop immediately

- Interest on your unsecured debts freezes

- You’re protected by federal law

You’ll start making your agreed monthly payment to the trustee, and we’ll hold it in trust.

Step 4: Creditor Voting Period

Your creditors have 45 days after filing to accept or reject your proposal. They can also request a meeting to discuss it, though this is uncommon.

In my experience, most properly structured proposals are accepted. Why? Because creditors know that if you file bankruptcy instead, they’ll likely get less money. A reasonable proposal is better for everyone.

Step 5: Court Approval

If creditors accept your proposal (or if they don’t vote at all, which counts as acceptance), it needs court approval. If no one objects within 15 days after creditor acceptance, it’s automatically deemed approved. You don’t usually need to attend court.

Step 6: Making Your Payments

You make your single monthly payment for the term of your proposal (maximum five years). The trustee distributes the money to your creditors according to the plan.

You’ll also attend two financial counselling sessions with the trustee’s office. These sessions aren’t punishment—they’re designed to help you budget better and avoid debt problems in the future.

Step 7: Completion

When you finish all your payments and complete the counselling sessions, you receive a Certificate of Full Performance. This legal document confirms you’ve completed your proposal. Your included debts are legally eliminated. You’re free. You need to safeguard the Certificate so that in future years, you can prove that you fully completed your consumer debt proposal.

Benefits of a Debt Proposal vs. Other Options

You might be wondering: why choose a consumer proposal over other debt solutions? Let me compare the main options:

Debt Proposal vs. Bankruptcy

Bankruptcy:

- Faster process (9 months for a 1st time bankrupt with no surplus income and who has fulfilled all their duties)

- May require you to surrender assets

- You lose your tax refund

- Potentially higher cost if you have significant income

- More impact on your credit score

Debt Proposal:

- Longer timeline (up to 5 years)

- You keep your assets and tax refunds

- Fixed payment regardless of income changes

- Less severe credit impact

- More socially acceptable (you can claim that you did not go bankrupt)

Debt Proposal vs. Debt Consolidation

Debt Consolidation:

- You pay back 100% of what you owe, plus interest

- Requires good enough credit to qualify for a consolidation loan

- One payment, but no debt reduction

- No legal protection from creditors

Debt Proposal:

- You pay back only a portion (typically 30-70%)

- No interest charges. The interest clock stops.

- Legal protection from creditors

- Available even with poor credit

Debt Proposal vs. Credit Counselling Sessions

Credit Counselling (Debt Management Plan

):

- Pay back 100% of debts

- Reduced or eliminated interest (but not always)

- Voluntary—creditors can still take legal action

- It can take 4-5 years to complete

Debt Proposal:

- Pay back a reduced amount

- Zero interest

- Legal protection—creditors can’t take action

- More flexibility in the fixed payment amount

Keeping Your Assets: What You Need to Know

One of the biggest misconceptions about consumer proposals is that you’ll lose everything. That’s not true.

Unlike bankruptcy, you keep control of your assets when you file a consumer proposal. This includes:

- Your vehicle (as long as you keep making the loan payments)

- Your home (as long as you keep making mortgage payments)

- Your furniture and personal belongings

- Your RRSPs (except contributions made in the last 12 months have to be taken into account when calculating the amount you offer)

- Your tax refunds

- Any other property you own

Important caveat: While you keep your assets, their value affects your proposal offer. If you own a paid-off vehicle worth $20,000, that value gets factored into what you offer creditors. The logic is simple: if you filed bankruptcy instead, creditors might get a share of that vehicle’s value. So your proposal needs to offer at least that much.

Also, remember: if you have secured debts against assets (like a car loan or mortgage), you must keep making those payments to keep the asset. The proposal doesn’t make your secured debts disappear.

Why Consumer Proposals Are More Popular

Consumer proposals have grown dramatically in Canada over the past 5-7 years. Why?

- People are more informed – Information about proposals is more readily available

- Less stigma – It’s becoming more socially acceptable to seek debt help

- Economic pressures – Rising costs, stagnant wages, and expensive housing are squeezing Canadians

- Asset protection – People want to keep their homes and vehicles

- Success rates – When properly structured, proposals work

In my practice, I’ve seen everyone from young adults with credit card debt to retirees struggling with unexpected costs. Debt doesn’t discriminate, and neither do solutions.

The Role of a Licensed Insolvency Trustee

Here’s something crucial: you can only file a consumer debt proposal through a Licensed Insolvency Trustee. We’re the only professionals in Canada authorized by the federal government through the Office of the Superintendent of Bankruptcy to administer consumer proposal services and bankruptcies.

Why This Matters

There are many companies and people online claiming to help with debt. Some are legitimate credit counsellors. Others are impostors and charge you fees for what a Licensed Insolvency Trustee would mostly do for you during a no-cost consultation. But when it comes to consumer proposals, only a Licensed Insolvency Trustee can help you.

What We Do

As your trustee, I act as an intermediary between you and your creditors. I’m licensed to:

- Assess your financial situation

- Prepare and file your proposal

- Negotiate with creditors on your behalf

- Distribute payments to creditors

- Provide credit counselling sessions

- Issue your completion certificate

The Human Element

Yes, there are online calculators and forums where you can get rough estimates. But debt isn’t just about numbers. It’s about your life, your family, and your future.

When you sit down with a Licensed Insolvency Trustee, you’re talking to someone who understands both the legal requirements and the human reality. I’ve had consultations where people come in expecting to file bankruptcy but leave with a plan that doesn’t require any insolvency filing at all. Other times, a consumer proposal is clearly the best path forward.

The point is: personalized advice from a licensed professional beats internet guesswork every time.

Common Frequently Asked Questions (FAQ) About Debt Proposals

“Will a debt proposal ruin my credit?”

A consumer proposal does appear on your credit report. It’s noted as an R7 rating, which stays on your report for three years after you complete the proposal (or six years from filing, whichever comes first).

Yes, this affects your credit. But here’s the reality: if you’re considering a proposal, your credit is probably already damaged from missed payments and high utilization. A proposal gives you a clear path to rebuild. Many people I’ve worked with have better credit two years after completing their proposal than they did before filing, because they’re no longer drowning in debt.

“Can I get credit during my proposal?”

Technically, yes. Legally, nothing prevents you from getting credit while in a proposal. However, most lenders will be hesitant to extend significant credit until your proposal is complete. You can usually get a secured credit card to start rebuilding.

The counselling sessions you attend during your debt proposal help you develop better spending habits so you don’t need to rely on credit as much.

“What if my financial situation changes?”

Life happens. Your income might go up or down during your proposal. Here’s how different scenarios work:

If your income increases: Your payment stays the same. Unlike bankruptcy, where increased income can increase your payments, a consumer proposal locks in your payment amount.

If your income decreases: You can potentially ask creditors to modify the proposal terms, though this isn’t guaranteed. Alternatively, if your situation becomes truly dire, you might need to consider bankruptcy. You need to consider if the decrease is temporary or permanent.

This is especially true for people on commission income.

If you get a lump sum (inheritance, lottery, etc.): You can pay off your proposal early with no penalty. This gets you out of the proposal faster. In bankruptcy, the lump sum payment must be paid over to your trustee for the benefit of your unsecured creditors.

“Will my employer find out?”

Generally, no. Employers aren’t notified about consumer proposals unless you owe them money. The only exception is if a creditor has already established wage garnishment against you—your employer would be notified to stop the garnishment and told why.

“Can I include all my debts?”

Not only can you, but you MUST include all your unsecured debts in a proposal. You can’t pick and choose. This ensures fairness to all creditors. However, you’re not required to include secured debts unless you want to surrender the asset.

“What if creditors reject my proposal?”

If creditors representing an ordinary majority of your debt value vote to reject your proposal, you have options:

- Negotiate with the creditors and revise the proposal with a better offer at a meeting of creditors before the actual vote is held. This assumes that the required number of creditors voting against the consumer proposal also requests that a meeting be held.

- Pursue bankruptcy

- Continue dealing with debts outside of insolvency proceedings

In practice, rejections are uncommon when proposals are properly structured. As a Licensed Insolvency Trustee, I help ensure your offer is reasonable and likely to be accepted.

What Happens After You Complete Your Debt Proposal

Completing your consumer debt proposal is a significant achievement. Here’s what happens next:

- Certificate of Full Performance: You receive an official document confirming you’ve completed your obligations.

- Debts are eliminated: All included unsecured debts are legally gone. Creditors can’t come after you for them anymore.

- Credit rebuilding continues: With your debts cleared and your proposal complete, you can focus on rebuilding your credit.

- Financial fresh start: You have the tools and knowledge (from counselling) to manage money better going forward.

Many people I’ve worked with tell me that completing their proposal feels like lifting a weight off their shoulders. One client told me, “I forgot what it felt like to not worry about money every single day.”

Is a Debt Proposal Right for You?

A consumer proposal isn’t the right solution for everyone. It makes the most sense when:

- You have significant unsecured debts you can’t repay in full

- You have a regular income to make monthly payments

- You want to avoid bankruptcy

- You want to keep your assets

- You want legal protection from creditors

It might not be the best choice if:

- You can realistically pay off your debts within 1-2 years on your own

- You qualify for a low-interest debt consolidation loan

- Your only debts are secured (like a car loan or mortgage)

- You don’t have a regular income

The only way to know for sure is to speak with a Licensed Insolvency Trustee who can review your specific situation.

Debt Proposal: Taking the First Step

If you’re struggling with debt, the hardest part is often just starting the conversation. I understand—money is stressful, and admitting you need help can feel uncomfortable.

But here’s what I tell everyone who reaches out: asking for help is smart, not weak. You’re taking control of your situation instead of letting it control you.

What to Expect in Your First Consultation

When you book a consultation with a Licensed Insolvency Trustee, here’s what typically happens:

- We talk about your debts—how much you owe, to whom, and what types of debt

- We review your income and necessary expenses

- We discuss your assets

- We explain your options clearly, including the pros and cons of each

- We answer all your questions

- We recommend the best path forward for your situation

This consultation is free. There’s no obligation. And it’s confidential—what you share stays between us.

Many people tell me they wish they’d reached out sooner. The relief of finally understanding your options and having a plan is worth that initial nervousness. Check out our Google reviews – that is the best evidence.

Debt Proposal Final Thoughts: You’re Not Alone

Debt is incredibly common in Canada. Rising living costs, expensive housing, long vehicle loans, unexpected emergencies—these things affect real people every day. If you’re struggling, you’re not alone, and there’s no shame in seeking help.

A consumer debt proposal isn’t a magic solution, but for many Canadians, it’s an effective tool to get out of debt, protect assets, and start fresh. The key is getting proper advice from a Licensed Insolvency Trustee who can evaluate your unique situation.

Whether you ultimately file a proposal, pursue another option, or find you don’t need insolvency proceedings at all, the important thing is taking that first step. Understanding your options is empowering.

If you’re in the Greater Toronto Area and want to discuss your situation, I’m here to help. At Ira Smith Trustee & Receiver Inc., we’ve been helping GTA consumers, entrepreneurs and their companies with debt problems for years. Our consultations are free, confidential, and pressure-free.

You don’t have to figure this out alone. Reach out today and let’s talk about your path to financial freedom, Starting Over, Starting Now.

The time to act is now.

Contact Ira Smith Trustee & Receiver Inc. today:

905.738.4167

Toronto line: 647.799.3312

brandon@irasmithinc.com or ira@irasmithinc.com

https://irasmithinc.com/

Disclaimer: This analysis is for educational purposes only and is based on the cited legal decisions (Cameron Stephens Mortgage Capital Ltd. v. Conacher Kingston Holdings Inc., 2025 ONCA 732, and the other identified cases) and my professional expertise as a licensed insolvency trustee. The information provided does not constitute legal or financial advice for your specific circumstances.

Every situation is unique and involves complex legal and factual considerations. The outcomes discussed in this article may not apply to your particular situation. Court decisions are fact-specific and depend on the particular circumstances of each case.

Please contact Ira Smith Trustee & Receiver Inc. or consult with qualified legal or financial professionals regarding your specific matter before making any decisions.

About the Author: Brandon Smith is a Licensed Insolvency Trustee and Senior Vice-President at Ira Smith Trustee & Receiver Inc., serving the Greater Toronto Area. With years of experience helping Canadians overcome debt challenges, Brandon provides practical, compassionate guidance for people seeking financial relief. For a free consultation, visit irasmithinc.com.