Good and Bad credit loans: Introduction

I am always asked where can you get both good and bad credit loans. The first question I ask is how do you know you have a bad credit score? Have you checked it recently?

Last week we reviewed the new entrant to the Canadian financial marketplace, Credit Karma Canada and its service for checking your credit score for free. Right now Credit Karma Canada does not offer loan products, so it cannot help you with good and bad credit loans.

Good and Bad credit loans: First know your credit score, good or bad

This week we are reviewing another website where you can check your credit score for free, and if you wish, also use the site to get a loan product – Borrowell.com.

If you have a good credit score, you may very well qualify for a loan from Borrowell.com. If you have a bad credit score, being one below the Borrowell minimum credit score, Borrowell can’t give you a loan. In that case, they have partnered with a lender who may be able to. If you have a bad credit score, Borrowell will immediately tell you who to contact to apply for a bad credit score loan.

Good and Bad credit loans: About Borrowell

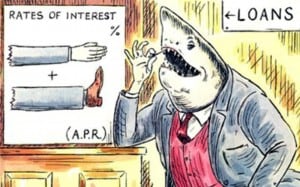

It’s never been so easy to swipe a credit card when you go shopping, but when people can’t control or manage their swiping, they will fall deep into debt. Then, they’ll have to go to their bank to borrow more money, but could face a big objection, depending on what their credit score is.

Borrowell is a Canadian company and a new breed of lender. Borrowell is in the growing group of fintech – defined as “computer programs and other technology used to support or enable banking and financial services”. Borrowell has teamed up with Equifax Canada, to allow anyone to check their credit score for free.

Checking your credit score this way, will not impact on your credit score, unlike when a lender, or potential lender, does an Equifax or TransUnion Canada credit check on you. Borrowell has also partnered up with third-party vendors, to offer financial products. Once you have checked your credit score, you can on a fairly seamless basis, apply for a personal loan for almost any purpose.

You can combine your debt, finance a purchase or borrow for your business. Borrowell has partnered with lenders for those with either good or bad credit scores.

Good and Bad credit loans: Hidden secret – Credit score, credit rating and credit report

The tool the banks use to measure creditworthiness is a person’s credit rating and credit report. But not everyone takes the time to check there’s out. You probably found out your credit rating the last time you applied for a mortgage or other loan, but have since forgotten what it was.

Regardless, time has passed and your credit rating has now changed. Here is the hidden secret. If you don’t know your credit score, you have no idea what needs improving. Once you know your credit score, you can drill down to work on what needs improving. Borrowell allows you to check your credit score for free.

“I would say anything above 650 is deemed to be a good rating” says Andrew Graham, the CEO of Borrowell.com. It’s the first lender in Canada to give free credit scores online. Proving that you are able to treat credit properly over an extended period is everyone’s goal. If you want to improve your credit score, the first and most important thing you can do is to check out where it is now at either Borrowell.com or Credit Karma Canada.

Good and Bad credit loans: Your credit score is an important number

Your credit score is an important number. One that can impact:

- your ability to borrow money in the first place;

- the rate of interest that you’re going to pay;

- your ability to find a rental if you don’t own;

- your ability to get a job;

- your home mortgage rate;

- your insurance policy charges; and

- even your job expectations.

We have written before on these issues, including:

- GOOD CREDIT SCORES HAVE SEX APPEAL

- THE RELATIONSHIP BETWEEN YOUR CREDIT SCORE AND INSURANCE RATES

- THE 10 MOST COMMON CREDIT SCORE MISTAKES

- A GREAT CREDIT SCORE DOESN’T MEAN YOU WILL GET THAT LOAN

- CREDIT REPORT: CHECK IT TO IMPROVE A POOR CREDIT SCORE OR A BAD CREDIT SCORE

- CREDIT SCORE RATING: YOU HAVE A GREAT ONE BUT YOU WERE STILL REJECTED

- CREDIT SCORE CHART MATCHMAKING SECRETS

- #VIDEO-CANADIAN CREDIT SCORE CALCULATOR: FREE SECRETS PROFESSIONALS USE REVEALED#

- CREDIT SCORES ONTARIO: USE YOURS TO SCORE THAT DREAM DATE!

- DIFFERENCE BETWEEN CREDIT REPORT AND CREDIT SCORE: KNOW YOUR CREDIT REPORT SCORE CARD?

Good and Bad credit loans: Don’t tense up!

Even if you think your credit rating is good, people tense up and they get really nervous and uneasy because they don’t know. People I see in our insolvency practice are always concerned about their credit rating, sometimes unnecessarily so. In fact, the people I see care more about their credit rating than the debt they can’t repay!

Whether you know or not it’s not going to change the result so I say it’s better to know than not know. You wouldn’t ignore going to the doctor if you thought something was wrong, so why ignore your finances?

Good and Bad credit loans: Hidden secret to demystify your credit score

To demystify your credit score a bit, it is on a scale from 300 to 900 and the higher the score the better. So you want to have a relatively high credit score to be assured that you get the best possible borrowing rates.

What would cause you to have a low credit score? Things such as not paying off your credit cards, if you’ve missed payments, and if you are late by 30, 60, or 90 days. That’s a big red flag, because again your credit score reflects how likely is this person to make their payments that they signed up to or not.

If you have a large unused credit ability, say you have five charge cards each with a $10,000 limit, but you pay it off every single month you’d think that would produce a good credit rating. However, the lenders will say, you can get into trouble really quickly. So if you have a lot of charge cards, you should focus on reducing the number you have open and reduce it to just a few.

Can I use a good credit rating to my advantage? Can I negotiate better interest rates? Yes, absolutely. They’ll know, so they’ll have an idea about your ratings and offer you pretty good terms, but you can certainly negotiate. If you’re a renter, you know when you’re dealing with potential landlords, if everything about you is the same as everyone else, except for your credit score, and yours is poor compared to another applicant, the rental will go to the other applicant.

Good and Bad credit loans: It doesn’t have to be like that forever

Does your credit rating stay with you eternally? If I was a broke student and racked up indebtedness, is that still going to affect me in my forties? Probably not. What happens is your rating will change as your circumstances change. So as long as you set up a record of responsible credit behavior, even if circumstances were really bad a very long time ago, you probably can still have a really good credit rating.

So it all starts with knowing your credit score and Borrowell.com can help you. Once you know the credit score, the secret to getting that loan you need at a reasonable price is to first do the things you need to do to improve your credit score. But even with a bad credit rating, Borrowell.com, through one of its partners, may still be able to get you that bad credit loan.

Good and Bad credit loans: Hidden secret to fix the problem without more debt

Our final hidden secret is to let you know that normally, more debt will not fix your problems. You need to find out why you have a bad credit score, why you cannot use your existing income to pay your bills and debts and why you need to borrow more money. We can help you unlock all those answers, and unlock the hidden secret for you to get your life back on track.

If so, contact Ira Smith Trustee & Receiver Inc. as quickly as possible. With immediate action and a solid financial plan for moving forward we can help you deal with debt and learn to manage it well in the future, Starting Over, Starting Now. We’re just a phone call away.